Coverall Market Size

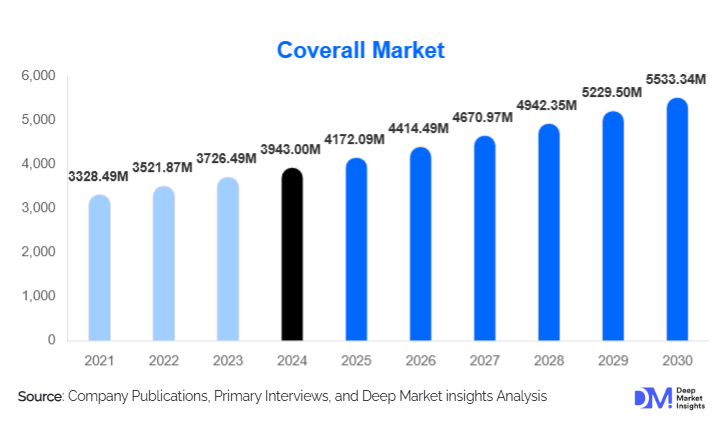

According to Deep Market Insights, the global coverall market size was valued at USD 3,943.00 million in 2024 and is projected to grow from USD 4,172.09 million in 2025 to reach USD 5,533.34 million by 2030, expanding at a CAGR of 5.81% during the forecast period (2025–2030). The coverall market growth is primarily driven by rising industrialization, stringent workplace safety regulations, and increasing demand for contamination control in healthcare and pharmaceutical sectors globally.

Key Market Insights

- Reusable coveralls dominate industrial and construction sectors, offering durability, cost-efficiency, and compliance with occupational safety standards.

- Disposable coveralls are widely adopted in healthcare and life sciences, ensuring contamination control and meeting strict hygiene regulations.

- North America and Europe collectively hold over 50% of the market, led by high industrial adoption and stringent regulatory frameworks.

- Asia-Pacific is the fastest-growing region, driven by rapid industrialization, infrastructure development, and rising safety awareness among emerging economies.

- Technological innovations in fabrics, including flame-resistant, chemical-resistant, anti-static, and smart textiles, are enhancing product differentiation.

- Export opportunities are expanding as manufacturers in China, India, and Germany supply protective coveralls to global industrial and healthcare markets.

What are the latest trends in the coverall market?

Shift Toward Reusable and Specialty Coveralls

Industries are increasingly favoring reusable and specialty coveralls due to their long-term cost benefits and superior protective features. Reusable polyester/cotton blend coveralls dominate industrial usage, while specialty garments with flame resistance, chemical protection, or anti-static properties are gaining traction in hazardous environments. The trend reflects a shift from purely disposable solutions to long-lasting, performance-oriented garments, supporting sustainability and reducing operational waste in industrial sectors.

Integration of Advanced and Smart Materials

Innovations in protective textiles are reshaping the coverall market. High-performance fabrics such as Tyvek®, Nomex®, and nanofiber-coated materials are increasingly used for chemical, fire, and contamination protection. Smart textiles equipped with temperature regulation, moisture-wicking, and wearable sensors are gaining adoption, particularly in high-risk industries. These advancements not only enhance worker safety but also improve comfort and productivity, positioning technologically advanced coveralls as a preferred choice for modern industrial operations.

What are the key drivers in the coverall market?

Strict Workplace Safety Regulations

Global safety standards and regulations, including OSHA in the U.S., the EU PPE Directive, and ISO certifications, mandate protective clothing across industrial and healthcare sectors. Compliance-driven procurement ensures consistent demand for high-quality coveralls, especially in chemical, oil & gas, construction, and pharmaceutical industries. Over 55% of industrial buyers prioritize regulatory-compliant coveralls as part of their safety strategy.

Rising Industrialization and Healthcare Demand

Rapid infrastructure development and industrialization in Asia-Pacific and Latin America have expanded the workforce in hazardous environments, driving demand for durable and protective coveralls. Simultaneously, the healthcare and pharmaceutical sectors continue to adopt disposable coveralls to prevent contamination, especially in laboratories, hospitals, and manufacturing facilities. These trends collectively support steady market growth and volume expansion.

What are the restraints for the global market?

High Cost of Advanced Materials

Specialty coveralls with flame resistance, chemical protection, or smart textile integration have higher production costs, limiting adoption among small and medium enterprises in emerging regions. High-priced materials and manufacturing investments restrict penetration in cost-sensitive segments.

Limited Awareness in Developing Regions

Lack of awareness about workplace safety and protective standards in certain countries restricts market expansion. Companies need to invest in training and education to improve adoption rates and ensure compliance with safety regulations.

What are the key opportunities in the coverall industry?

Expansion into Emerging Markets

Rapid industrialization in Asia-Pacific, Latin America, and Africa creates substantial growth opportunities. Countries like India, China, Brazil, and South Africa are investing in manufacturing, mining, and construction, increasing demand for reusable and disposable coveralls. Local partnerships and regional production facilities can help companies reduce costs and expand market reach effectively.

Technological Integration and Smart Fabrics

Advanced materials and smart textiles offer superior protection while maintaining comfort. Wearable sensors, temperature-regulating fabrics, and nanofiber coatings enhance worker safety and productivity. Early adoption of these technologies provides competitive differentiation, enabling premium pricing and stronger market positioning.

Regulatory Compliance and Workplace Safety Initiatives

Strict safety regulations globally, including OSHA, EU PPE Directive, and national labor laws, drive continuous demand for certified protective coveralls. Companies can also offer value-added services such as employee safety training, compliance certification, and on-site consulting to strengthen client relationships and revenue streams.

Product Type Insights

Reusable coveralls dominate the global coverall market, accounting for approximately 60% of total demand in 2024, primarily due to their durability, reusability, and long-term cost efficiency in industrial, construction, and manufacturing environments. These coveralls are widely adopted in sectors where workers are exposed to mechanical, thermal, or particulate hazards over extended periods, making reusable garments a preferred choice for compliance with occupational safety standards and cost control strategies. The increasing focus on sustainability and reduction of disposable PPE waste has further strengthened demand for reusable coveralls, particularly in developed markets.

Specialty coveralls, including flame-resistant, chemical-resistant, anti-static, and high-visibility variants, are steadily gaining market share as industries adopt higher safety benchmarks for hazardous and regulated environments. The leading driver for this segment is the expansion of oil & gas, chemical processing, utilities, and mining industries, where exposure to extreme heat, chemicals, and electrical hazards necessitates advanced protective apparel. Regulatory enforcement and increased employer liability concerns are accelerating the adoption of specialty coveralls globally.

Material Insights

Polyester/cotton blends held the largest material share at approximately 42% in 2024, favored for their balance of durability, breathability, comfort, and affordability. These materials are widely used in industrial and construction applications where workers require extended wear protection without compromising mobility or comfort. The leading growth driver for polyester/cotton blends is their adaptability to repeated washing cycles and compatibility with safety enhancements such as reflective strips and reinforced stitching.

High-density polyethylene (HDPE) materials, including Tyvek®, are extensively used in disposable coveralls for healthcare, pharmaceutical, and chemical applications due to their superior barrier protection against liquids, aerosols, and particulates. Demand for HDPE-based coveralls is driven by infection prevention protocols, cleanroom requirements, and regulatory mandates in life sciences industries. Aramid fibers such as Nomex® dominate flame-resistant coverall applications, particularly in oil & gas, electrical utilities, and firefighting environments. These materials offer inherent heat and flame resistance, long service life, and compliance with stringent safety certifications. Increasing investment in high-risk industrial operations and stricter fire safety regulations continue to drive the adoption of aramid-based coveralls. Overall, advanced material integration is increasingly influencing purchasing decisions as end users prioritize performance, compliance, and lifecycle cost benefits.

End-Use Industry Insights

The industrial and manufacturing sector accounts for approximately 40% of global coverall demand, driven by construction, oil & gas, chemical processing, heavy manufacturing, and utilities. Growth in this segment is supported by infrastructure development, industrial automation, and stricter enforcement of worker safety regulations. Reusable and specialty coveralls are the leading product categories within this segment due to prolonged exposure risks and regulatory compliance requirements.

Healthcare and life sciences represent around 35% of the market, with disposable coveralls playing a critical role in hospitals, laboratories, pharmaceutical manufacturing, and biotechnology research. Growth is driven by rising healthcare expenditure, expansion of pharmaceutical production capacity, and heightened focus on infection prevention and contamination control. Emerging applications in electronics manufacturing, semiconductor fabrication, and biotech cleanrooms are creating incremental demand, particularly for anti-static and contamination-resistant coveralls. Additionally, export-driven procurement from manufacturing hubs such as China, India, and Germany to North America and Europe supports sustained growth, as global industries align with standardized safety and hygiene protocols.

Distribution Channel Insights

Direct B2B sales dominate the global coverall market, accounting for approximately 55% of total revenue, supported by long-term supply contracts with large industrial, healthcare, and construction clients. This channel benefits from bulk purchasing, customization options, and compliance-driven procurement processes. Distributors and dealers contribute nearly 30% of market revenue, playing a critical role in supplying small and medium enterprises (SMEs) and regional industries. Their strength lies in localized distribution networks, inventory availability, and customer support services.

Online platforms and e-commerce channels account for roughly 15% of sales and are gaining traction among smaller buyers, healthcare facilities, and independent contractors. The leading driver for online growth is convenience, transparent pricing, and faster procurement cycles, particularly in urban and semi-industrial regions.

| By Product Type | By Material | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 28% of the global coverall market in 2024, led by the United States and Canada. Regional growth is driven by stringent OSHA regulations, high industrial safety awareness, and strong demand from chemical processing, manufacturing, construction, and oil & gas industries. The region also benefits from advanced healthcare infrastructure and consistent adoption of disposable coveralls in medical and pharmaceutical settings. Specialty and reusable coveralls dominate demand due to regulatory compliance requirements and employers' focus on long-term worker protection.

Europe

Europe represents around 25% of global demand, with Germany, France, and the U.K. leading the market. Growth is supported by strict PPE regulations under EU directives, high workplace safety standards, and a strong industrial base. Flame-resistant and chemical-protective coveralls see consistent uptake in chemical, pharmaceutical, and energy sectors. Additionally, Europe’s emphasis on sustainability and reusable PPE solutions is accelerating demand for high-quality reusable coveralls.

Asia-Pacific

Asia-Pacific is the fastest-growing region, registering a CAGR of approximately 8.5%, driven by rapid industrialization, large-scale infrastructure projects, and expanding manufacturing bases in China and India. Rising awareness of occupational safety, coupled with government enforcement of labor protection laws, is accelerating coverall adoption. ASEAN countries are emerging as secondary growth markets, supported by expanding healthcare infrastructure, electronics manufacturing, and foreign direct investment in industrial zones.

Latin America

Latin America is witnessing steady growth, led by Brazil and Mexico. Demand is driven by construction, oil & gas, mining, and industrial manufacturing activities. Increasing regulatory focus on worker safety and gradual alignment with international PPE standards are supporting greater adoption of reusable and specialty coveralls, particularly in hazardous industrial environments.

Middle East & Africa

The Middle East & Africa region is driven by strong demand from oil & gas, mining, and large-scale construction projects, particularly in Saudi Arabia, the UAE, and South Africa. Government-led infrastructure development, industrial diversification initiatives, and increased enforcement of workplace safety standards are accelerating the adoption of protective coveralls. Specialty and flame-resistant garments are especially critical in high-risk operational environments across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Coverall Market

- DuPont

- 3M

- Honeywell

- Lakeland Industries

- Ansell

- Alpha Pro Tech

- Kimberly-Clark

- Delta Plus

- Cardinal Health

- Uvex Safety Group

- Radians

- JSP Ltd.

- Globus Group

- Portwest

- Ansell Protective Solutions