Costume Jewelry Market Size

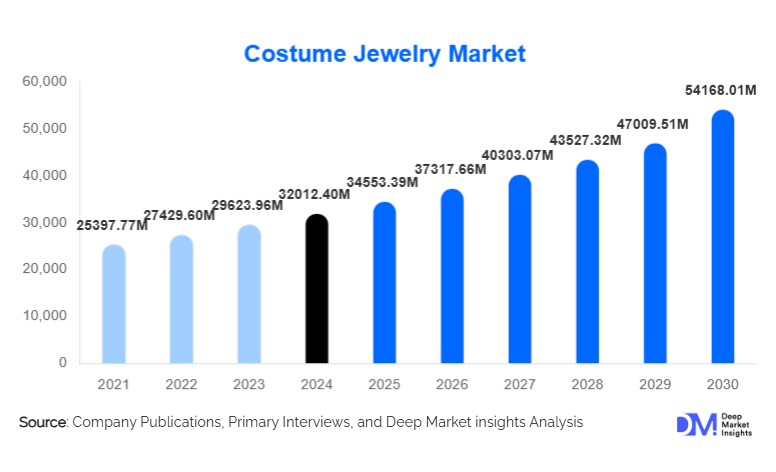

According to Deep Market Insights, the global costume jewelry market size was valued at USD 32,012.40 Million in 2024 and is projected to grow from USD 34,553.39 Million in 2025 to reach USD 54,168.01 Million by 2030, expanding at a CAGR of 8.00% during the forecast period (2025–2030). The market is fueled by rising fashion consciousness, fast-fashion retail expansion, social media influence, and increased demand for affordable accessories across emerging and developed economies. Growing adoption of e-commerce, rising disposable incomes, particularly in Asia-Pacific, and the surge in trend-based consumer purchasing cycles are further accelerating market advancement.

Key Market Insights

- Affordable, trend-driven fashion accessories are rapidly gaining mainstream adoption, driven by fast-fashion cycles and higher purchase frequency among younger consumers.

- Asia-Pacific leads global consumption with strong demand from India, China, and Southeast Asia, supported by a rising middle class and deep-rooted cultural affinity for jewelry.

- Offline retail remains dominant, accounting for nearly 80% of global sales in 2024, driven by consumers’ preference to physically evaluate jewelry quality and aesthetics.

- E-commerce and social commerce are the fastest-growing channels, propelled by influencer marketing, virtual product try-ons, and rapid product turnaround.

- Sustainable and ethically produced costume jewelry is emerging as a major purchasing criterion among millennials and Gen Z buyers.

- Base metal and metal-plated jewelry dominate the material share, driven by low-cost manufacturing and high-volume global demand.

What are the latest trends in the costume jewelry market?

Sustainable & Eco-Friendly Costume Jewelry on the Rise

Consumers are increasingly demanding environmentally responsible materials and ethical manufacturing processes. This has pushed brands to adopt recycled metals, lead-free alloys, non-toxic plating technologies, and transparent labor practices. Manufacturers are integrating eco-friendly packaging, sustainable supply-chain models, and compliance with global chemical-safety standards. The rise of “green fashion” has led to new product lines made from upcycled components, bio-resins, and lab-created stones. This trend is further reinforced by regulatory scrutiny surrounding harmful metals such as nickel and lead, prompting brands to shift toward safer alternatives. As sustainability becomes a defining factor in brand loyalty, companies investing in responsible production are gaining a competitive advantage.

Technology-Driven Personalization & Virtual Try-On Experiences

Emerging technologies such as AR-based virtual try-ons, AI-assisted design customization, and 3D-printed prototypes are transforming how consumers shop for costume jewelry. Online shoppers can now visualize jewelry pieces in real-time, compare color/material variations, and receive AI-curated style suggestions. These innovations appeal strongly to Gen Z and millennial consumers who value personalization and convenience. Social commerce platforms like Instagram, TikTok, and Pinterest are also integrating direct-purchase capabilities, turning trending styles into instant purchase opportunities. Digital design tools reduce lead times, enabling brands to align collections with fast-moving fashion cycles.

What are the key drivers in the costume jewelry market?

Rising Fashion Consciousness & Rapid Trend Cycles

Global fashion culture has shifted toward high-frequency accessory purchasing driven by social media, celebrity influence, and fast-fashion retail. Consumers increasingly buy jewelry to complement specific outfits, seasons, or cultural events. Costume jewelry fills this need due to its affordability and diversity. Frequent product drops by fashion brands and online stores further stimulate demand. Younger consumers, in particular, adopt jewelry as a form of self-expression, fueling robust market expansion.

Increasing Disposable Income in Emerging Markets

Growth in per-capita income across India, China, Southeast Asia, and parts of the Middle East has broadened access to affordable fashion jewelry. A rising female workforce, urbanization, and changing lifestyle aspirations contribute to higher discretionary spending on fashion accessories. In culturally rich markets, festive and ceremonial wear also supports recurring demand. Manufacturers in low-cost production hubs benefit from both robust domestic consumption and strong export demand.

E-Commerce Expansion & Social Media Influence

Online marketplaces, influencer-led marketing, and digital storefronts have drastically widened the reach of costume jewelry brands. Platforms such as Amazon, Shein, Etsy, and brand-owned D2C websites drive high-volume sales. Viral trends, fashion influencers, and short-form video content (TikTok, Instagram Reels) accelerate product discovery, often triggering global demand spikes for specific styles. The convenience of fast delivery and easy returns has strengthened online buying behavior.

What are the restraints for the global market?

Raw Material Price Volatility & Quality Concerns

Although costume jewelry uses low-cost metals, fluctuations in brass, copper, and alloy prices can impact manufacturing costs. Inexpensive plating may also cause tarnishing or skin irritation, leading to consumer dissatisfaction. Maintaining quality consistency across mass production, especially for exporters, poses operational challenges. Brands must invest in higher-grade materials and improved coatings to meet consumer expectations.

Counterfeiting & Regulatory Compliance Issues

The market faces challenges from counterfeit products, poor-quality replicas, and unregulated materials entering global supply chains. Several regions enforce strict rules regarding nickel release, allergen safety, and chemical coatings; non-compliant products face import rejections and penalties. Smaller manufacturers often struggle with the cost of adhering to these regulations. Counterfeit goods further dilute brand value and undermine pricing structures.

What are the key opportunities in the costume jewelry industry?

Emerging Markets with Expanding Middle-Class Populations

Asia-Pacific, Latin America, and the Middle East present major growth opportunities for brands targeting aspirational consumers seeking affordable fashion accessories. With rising urbanization, growing female employment, and strong cultural ties to jewelry, these regions offer high-volume, long-term potential. Brands entering with region-specific designs, cultural motifs, and localized pricing strategies can unlock substantial scale.

Digital-First Brands & Omnichannel Integration

The shift toward online retail provides space for digitally native brands that leverage influencer marketing, social commerce, and AI-driven product recommendations. Virtual try-on tools, customized subscription boxes, and rapid logistics capabilities enhance the consumer experience. Combining online convenience with selective offline presence (pop-ups, boutique stores) can create a premium brand perception while controlling inventory costs.

Product Type Insights

Necklaces, chains, and pendants dominate the global product landscape, accounting for nearly 25–30% of the total market share in 2024. Their universal appeal to both men and women, versatility across casual and formal wear, and strong presence in gifting categories drive consistent demand. Earrings and bracelets also represent substantial market shares, particularly in trend-driven segments influenced by fast-fashion retailers. Rings and brooches continue to cater to niche fashion styles, while anklets and toe rings remain regionally concentrated in markets with strong cultural adoption.

Application Insights

Everyday fashion wear leads the application segment due to the growing habit of accessorizing for workplace, social, and casual occasions. Festive and cultural wear remains strong in Asia-Pacific and Middle Eastern markets, where costume jewelry is frequently purchased for weddings and religious events. Trend-based and seasonal wear is rapidly expanding as consumers adopt fast-fashion cycles, often purchasing multiple low-cost pieces to complement changing wardrobe styles. Gifting applications continue to grow, especially during holiday seasons, Valentine’s Day, Mother’s Day, and regional festivals.

Distribution Channel Insights

Offline retail, comprising department stores, specialty boutiques, and traditional local jewelry shops, accounted for around 80% of sales in 2024, reflecting consumers’ desire to inspect craftsmanship and finish before purchase. However, online platforms are the fastest-growing channel, fueled by influencer culture, convenience, and access to diverse global designs. Direct-to-consumer (D2C) brands, marketplace sellers, and social media shops contribute heavily to this surge. Seamless returns, competitive pricing, and the rise of dynamic online catalogs accelerate digital penetration.

Consumer Demographic Insights

Women represent the largest consumer demographic, commanding 65–70% of the market share due to the broad range of product types tailored to female styling needs. Gen Z and millennials drive high purchase frequency, particularly through online channels. Men’s costume jewelry, spanning chains, rings, and bracelets, is emerging rapidly as gender-neutral fashion gains mainstream acceptance. Kids and teens represent a growing niche, especially in the low-priced, trend-based segment.

| By Product Type | By Material Type | By Distribution Channel | By End Use / Application | By Consumer Demographic |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market share, driven by strong fashion culture, high disposable income, and widespread acceptance of costume jewelry as an everyday accessory. The U.S. leads regional consumption, with robust online retail adoption and frequent trend cycles influenced by celebrities and social media. Premium costume jewelry, influencer-led brands, and specialty retailers thrive in this region.

Europe

Europe remains a mature yet steadily growing market, with high interest in sustainable and ethically sourced fashion accessories. Western Europe, particularly the U.K., Germany, France, and Italy, shows strong demand for premium costume jewelry, while Eastern Europe contributes growing volume. Regional consumers often prioritize design sophistication, quality plating, and durability.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, representing 30–35% of global demand. India and China dominate consumption due to large populations, rising incomes, and the cultural relevance of jewelry in weddings and festivals. Southeast Asian markets such as Indonesia, Thailand, and the Philippines also contribute substantial growth. Manufacturing concentration in APAC boosts both domestic consumption and global exports.

Latin America

Latin America is emerging as a promising market, led by Brazil and Mexico. Youth-driven fashion culture, increasing urbanization, and the adoption of Western fashion trends are key growth drivers. Domestic production and imports from Asia support rising demand for affordable jewelry styles.

Middle East & Africa

MEA showcases rising demand for ornate and culturally inspired pieces, particularly in GCC nations such as the UAE and Saudi Arabia. Africa’s demand is supported by the cultural usage of jewelry during ceremonies and celebrations. Regional e-commerce growth and rising fashion awareness contribute to expanding market opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Costume Jewelry Market

- Swarovski

- Pandora

- Guess

- Michael Kors

- Kate Spade

- BaubleBar

- Avon Products Inc.

- The Colibri Group

- Chico’s FAS

- H&M Accessories Division

- Zara Fashion Accessories

- Accessoirize

- Claire’s Stores

- Aldo Accessories

- Bling Jewelry

Recent Developments

- In 2024, multiple global brands launched sustainable collections using recycled metals and eco-friendly plating technologies to align with environmental regulations.

- In early 2025, several D2C jewelry brands introduced AI-driven customization and virtual try-on features, enhancing consumer engagement and reducing return rates.

- In 2025, major Asian manufacturers expanded production facilities to meet rising export demand from North America and Europe.