Cosmetics OEM & ODM Market Size

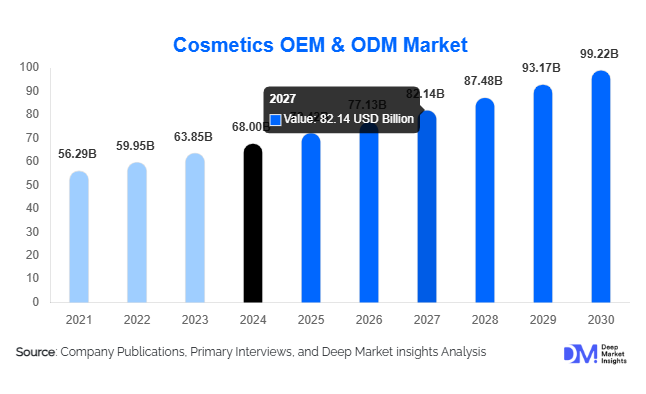

According to Deep Market Insights, the global Cosmetics OEM & ODM Market was valued at USD 68.0 billion in 2024 and is projected to grow from USD 72.42 billion in 2025 to reach USD 99.22 billion by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is driven by increasing outsourcing by beauty brands, demand for rapid product innovation, and the expansion of regional manufacturing hubs in the Asia-Pacific. OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) companies are emerging as strategic partners for brands that prioritize speed-to-market, sustainability, and technological integration.

Key Market Insights

- OEM services dominate with nearly 60% market share, as global beauty brands rely heavily on outsourcing for cost efficiency and scalability.

- Skincare remains the largest application segment, accounting for approximately 48% of market revenue in 2024, driven by strong consumer demand for clean, sustainable, and dermocosmetic formulations.

- Asia-Pacific leads the global market, contributing about 40% of total revenue, with China, South Korea, and Japan serving as major manufacturing hubs.

- Rising demand from indie, D2C, and influencer-led brands is accelerating ODM and turnkey service adoption.

- Technological integration in formulation and packaging, including AI-based R&D and eco-friendly packaging materials, is enhancing competitiveness.

- Government initiatives such as “Make in India” and “Made in China 2025” are fueling new manufacturing capacity and investments in local cosmetics production.

Latest Market Trends

Sustainable and Clean-Label Manufacturing

The cosmetics OEM & ODM market is rapidly shifting toward sustainable, vegan, and cruelty-free production. Brands increasingly demand eco-certified formulations, recyclable or biodegradable packaging, and transparent supply chains. Manufacturers are responding by investing in green chemistry, renewable energy facilities, and waste-reduction technologies. This trend is particularly strong in Europe and North America, where regulatory and consumer pressure for sustainability is reshaping the manufacturing landscape. Sustainable formulations are now positioned not just as ethical choices but as key differentiators in premium segments.

Rise of Indie and D2C Brand Partnerships

The proliferation of direct-to-consumer and influencer-led cosmetic brands has created a major shift in contract manufacturing demand. ODM and hybrid turnkey services enable smaller brands to launch quickly without capital investment in facilities. OEM/ODM partners now offer low-MOQ flexible production lines, rapid prototyping, and white-label catalogs for skincare and makeup. These agile services empower new brands to compete with legacy players, while driving higher margins for manufacturers capable of quick trend adaptation and regulatory compliance across multiple markets.

Cosmetics OEM & ODM Market Drivers

Increasing Brand Outsourcing to Optimize CAPEX

Beauty brands are focusing resources on marketing and digital engagement while outsourcing production to specialized OEM/ODM partners. This model significantly reduces capital expenditure and accelerates product rollout timelines. The scalability of outsourced production allows brands to test new SKUs, seasonal launches, and limited editions efficiently, supporting a dynamic market environment.

Growing Demand for Innovative and Functional Formulations

Consumers are increasingly prioritizing performance-driven formulations with active ingredients like peptides, probiotics, and botanical extracts. OEM/ODM providers with strong R&D capabilities are capturing demand from both legacy and indie brands seeking innovative product lines. The shift toward functional skincare, anti-aging, and dermocosmetic products further strengthens this trend.

Expansion of E-commerce and Private Label Brands

Digital beauty retail has led to a surge in private label and D2C cosmetics brands. Online platforms and marketplace models encourage niche brand launches, most of which depend on outsourced manufacturing. This has broadened the OEM/ODM client base globally and increased the need for turnkey solutions that include formulation, packaging, and fulfillment.

Market Restraints

Regulatory Complexity and Compliance Burden

OEM/ODM manufacturers face stringent regional regulations, such as EU Cosmetics Regulation 1223/2009, U.S. FDA standards, and China’s NMPA filing system. Compliance requires extensive documentation, testing, and product safety verification, which lengthens product cycles and raises operational costs. Smaller ODM providers often struggle to maintain multi-region compliance, limiting global scalability.

Volatile Raw Material and Packaging Costs

Price fluctuations in natural ingredients, specialty actives, and sustainable packaging materials create margin pressure for contract manufacturers. The global supply-chain disruptions of recent years have intensified these challenges, increasing lead times and production costs, especially for OEMs dependent on imported raw materials.

Cosmetics OEM & ODM Market Opportunities

Expansion into Clean and Sustainable Manufacturing

As environmental awareness grows, OEM/ODM companies investing in eco-friendly production stand to capture a larger market share. Developing carbon-neutral factories, implementing biodegradable packaging solutions, and achieving vegan/cruelty-free certifications can unlock premium brand partnerships and government incentives. Sustainability-oriented differentiation is rapidly becoming a competitive necessity.

Emerging Market Manufacturing and Localization

Developing regions such as India, Indonesia, and Brazil are witnessing a surge in local beauty consumption and brand creation. Establishing regional manufacturing hubs offers OEM/ODM firms advantages in cost efficiency, logistics, and regulatory alignment. In addition, growing demand for halal, Ayurvedic, and natural cosmetic formulations opens lucrative submarkets for manufacturers with adaptive R&D capabilities.

Integration of Digital and Smart Manufacturing Technologies

Automation, AI-driven formulation design, and IoT-enabled production monitoring are transforming the efficiency of cosmetic manufacturing. Smart factories equipped with robotics and predictive analytics can significantly reduce waste, accelerate customization, and improve quality control. Digital twins and cloud-based PLM (Product Lifecycle Management) are enhancing collaboration between brands and contract manufacturers, streamlining product development cycles.

Product Type Insights

Skincare dominates the global Cosmetics OEM & ODM Market, accounting for nearly 48% of total revenue in 2024. Strong consumer inclination toward anti-aging, sun protection, and wellness skincare drives demand. Haircare ranks second, supported by growth in scalp-care and plant-based hair treatments, while color cosmetics continue to grow through fashion and social-media trends. Fragrances and niche categories like men’s grooming and baby-care are expanding but remain smaller in volume share.

Service Type Insights

OEM manufacturing leads with around 60% share in 2024, attributed to the preference of established brands for maintaining proprietary formulations. The ODM segment, however, is expected to register the fastest growth, as indie and digital-first brands increasingly leverage pre-formulated and ready-to-brand solutions to speed up market entry.

End-Use Insights

Demand from indie and D2C beauty brands represents the fastest-growing end-use category, expanding at a double-digit rate. These brands rely on ODM and hybrid turnkey services to launch quickly. Mass-market and premium brands continue to anchor the OEM segment, outsourcing large-batch production to maintain cost efficiency. Meanwhile, private-label retail chains in North America and Europe are increasingly sourcing white-label cosmetics from ODM partners to expand in-store offerings.

| By Product Type | By Service Type | By End Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 22–25% of the global market share in 2024. Demand is primarily concentrated in the U.S., where leading brands outsource manufacturing to ensure regulatory compliance and operational flexibility. The growing emphasis on clean beauty and cruelty-free certifications is also stimulating ODM partnerships with sustainable producers.

Europe

Europe holds about 25–26% of global revenue. The region’s OEM/ODM market benefits from its strong base of luxury beauty brands and strict sustainability mandates. Germany, France, Italy, and the U.K. are key outsourcing centers, while Eastern Europe is emerging as a cost-effective production zone for EU brands. Clean-label and vegan certification trends are particularly influential here.

Asia-Pacific

Asia-Pacific leads globally, representing around 40% of the total market in 2024. China, South Korea, and Japan dominate as manufacturing hubs, exporting large volumes of private-label and branded cosmetics worldwide. India and Southeast Asia are among the fastest-growing subregions, supported by rising middle-class income, government manufacturing incentives, and increasing demand for localized products such as herbal and halal cosmetics.

Latin America

Latin America contributes 6–8% of global revenue, led by Brazil and Mexico. Local brands are rapidly expanding and outsourcing production to meet regional demand for natural and affordable beauty products. The market is supported by growing consumer awareness and domestic manufacturing initiatives.

Middle East & Africa

This region holds 5–7% of market share, with GCC countries and South Africa showing the most activity. Demand for halal-certified cosmetics and men’s grooming lines is fueling ODM expansion. The UAE and Saudi Arabia are emerging as trade and distribution hubs for international beauty products manufactured under OEM agreements.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetics OEM & ODM Market

- COSMAX Inc. (South Korea)

- Intercos Group (Italy)

- Kolmar Korea Co., Ltd. (South Korea)

- KDC/One (United States)

- Nihon Kolmar Co., Ltd. (Japan)

- Cosmo Beauty Co., Ltd.

- Mana Products Inc.

- Nox Bellow Cosmetics

- Cosmecca Korea

- PICASO Cosmetic Co., Ltd.

- Toyo Beauty Co., Ltd.

- Chromavis S.p.A.

- Opal Cosmetics

- Bawei Biotechnology

- Ridgepole (China)

Recent Developments

- In June 2025, COSMAX announced the expansion of its sustainable manufacturing plant in Suwon, South Korea, integrating solar-powered operations and eco-friendly packaging lines.

- In April 2025, Intercos Group introduced a new biotech formulation center in Italy, focusing on bio-fermented actives and personalized skincare technologies.

- In February 2025, KDC/One acquired a specialty packaging manufacturer in the U.S. to strengthen its turnkey beauty solutions and digital design capabilities.

- In January 2025, Kolmar Korea partnered with an Indian cosmetics producer under the “Make in India” initiative to establish a local OEM facility focused on Ayurvedic formulations.