Dermocosmetics Market Size

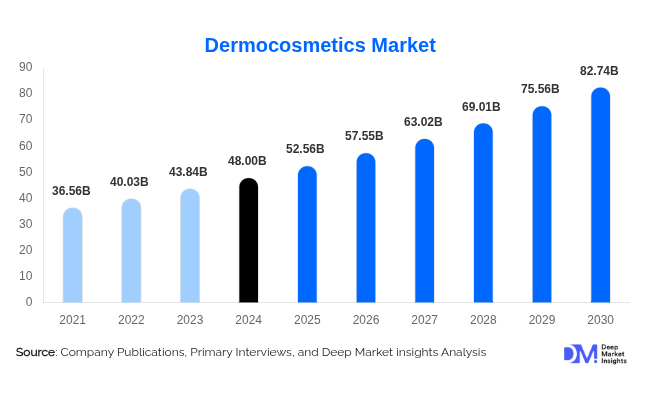

According to Deep Market Insights, the global dermocosmetics market size was valued at USD 48.0 billion in 2024 and is projected to grow to approximately USD 52.56 billion in 2025. From there, it is expected to reach around USD 82.74 billion by 2030, expanding at an estimated CAGR of 9.5 % (2025–2030). The growth is being driven by increasing consumer demand for skin-health solutions that bridge cosmetics and dermatology, growing awareness of dermatological conditions, and rapid expansion of online and clinical channels.

Key Market Insights

- Skin care remains the dominant segment, supported by high demand for anti-aging, sun-protection, and sensitive-skin formulations globally.

- Pharmacy and drug-store distribution channels continue to lead, as consumers seek trust, clinical-grade endorsement, and therapeutic-style retail environments.

- Retail at-home use vastly outpaces professional/clinic use, as consumer self-care and direct-to-consumer brands gain traction.

- Europe and North America hold large shares of the market today, thanks to mature markets, established dermatology infrastructure, and high per-capita spending.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urbanization, and growing penetration of dermocosmetic brands in China, India, and Southeast Asia.

- Technological innovation and personalization are reshaping the category with brands deploying AI-driven diagnostics, microbiome-friendly actives, tele-dermatology, and clean-clinical positioning to command premium pricing.

Latest Market Trends

Clinically-Validated and Performance-Driven Formulations

Consumers are increasingly seeking products with proven efficacy, backed by dermatological trials, active ingredients (e.g., ceramides, peptides, microbiome-friendly actives), and dermatologist endorsement. This is pushing dermocosmetic brands to elevate their R&D, highlight clinical data, and differentiate from mass cosmetics. The result: higher price points, brand trust, loyalty, and a shift from “beauty only” to “skin health plus appearance”.

Digital Transformation and D2C Growth

The dermocosmetics market is rapidly being shaped by online channels, social media, and tele-dermatology. Brands are leveraging digital skin diagnostics, subscription models, virtual consults, and e-commerce to reach consumers directly. Especially in emerging markets, online penetration is empowering new entrants and enabling established players to scale globally faster. The shift is also enabling personalized marketing, data-driven product development, and omnichannel integration.

Market Drivers

Growing Prevalence of Skin & Scalp Conditions

Issues such as acne, hyper-pigmentation, rosacea, hair loss, and scalp sensitivity are becoming more common owing to aging populations, pollution, lifestyle stressors, and men’s grooming expansion. This drives demand for targeted dermocosmetic solutions that go beyond generic beauty products, catalyzing the market.

Consumer Shift Towards Clinical Grade & Premiumization

As consumer awareness increases, more shoppers are willing to pay a premium for products that promise visible results, dermatological endorsement, and clean or advanced ingredients. This premiumization trend lifts average selling prices and margins in the dermocosmetics category, contributing to market expansion.

Expansion of Online & Omnichannel Distribution

Distribution innovations such as online D2C, social-commerce, tele-dermatology link-ups, and pharmacy e-commerce are helping brands reach new consumer segments (especially younger and emerging-market buyers). This increased accessibility is supporting faster growth, especially outside traditional retail geographies.

Restraints

High Cost of Advanced Formulations and Regulatory Complexity

The development of dermatological-grade formulas, clinical testing, advanced packaging, and regulatory compliance increases manufacturing cost and may limit affordability in price-sensitive markets. This can slow adoption among lower-income consumer segments.

Market Saturation and Differentiation Challenge

With increasing numbers of brands entering the dermocosmetics space, including mass brands with premium lines, differentiation is becoming harder. Consumers are more skeptical about claims, making brand trust and effective marketing critical. In saturated markets, growth may plateau unless innovation accelerates.

Market Opportunities

Personalized Dermatological-Grade Skincare at Scale

Brands that invest in skin diagnostics, AI personalization, microbiome profiling, and tailored formulations have an opportunity to capture premium consumers seeking “skin-health meets beauty”. This is especially relevant in developed markets, where consumers expect high sophistication, and in emerging markets, as middle-income consumers upgrade. By offering customized product sets, subscriptions, and clinically-tested solutions, companies can build deeper loyalty and premium pricing.

Emerging Market Penetration & Export-Driven Growth

While North America and Europe remain large, growth is faster in Asia-Pacific, Latin America, and the Middle East & Africa. Brands can tap rising skin-care awareness, rising incomes, and expanding pharmacy/e-commerce infrastructure in countries like India, China, Brazil, and GCC nations. Moreover, exporters in Europe/North America can target underserved markets and benefit from international brand perception. Localizing formulations (e.g., for sun damage in the Middle East, pigmentation in India) presents further upside.

Sustainable & Ingredient-Innovative Formulations

Consumer demand for “clean-clinical” formulations combining dermatologically effective actives with sustainability (eco‐packaging, botanical / microbiome actives, transparency) is rapidly increasing. Brands that innovate in eco-friendly packaging, ethical sourcing, natural/derm verified actives, and transparent labeling can command premium valuations and differentiate in a crowded field. This also aligns with regulatory and retail trends favoring sustainable beauty.

Product Type Insights

Skincare products dominate the global dermocosmetics market, accounting for the largest share due to growing demand for anti-aging, acne control, pigmentation correction, and sun protection formulations. These products are increasingly preferred by consumers seeking dermatologist-recommended solutions that combine cosmetic appeal with clinical efficacy. Anti-aging and hydration serums are particularly popular among women aged 25–50, while men’s skincare and post-procedure care lines are emerging as high-growth segments. Hair and scalp care products, including anti-hair fall and sensitive scalp treatments, are witnessing steady growth driven by increased awareness of scalp health and rising cases of stress-related hair loss. Lip and body care lines are also expanding, supported by consumer preferences for all-season dermo-protection and barrier-repair formulations that complement facial care routines.

Application Insights

Dermocosmetics find applications across a range of skin concerns and therapeutic categories. The acne treatment segment leads in volume, propelled by the rising prevalence of hormonal and lifestyle-induced skin conditions among younger demographics. Anti-aging products follow closely, with demand driven by consumers seeking prevention-based skincare using retinoids, peptides, and antioxidants. Pigmentation management and photoprotection products are gaining traction in markets such as Asia-Pacific and the Middle East, where sun exposure and uneven skin tone are major concerns. Post-procedure care applications, including recovery creams and barrier-repair products recommended after laser or chemical treatments, are emerging as a fast-growing category as aesthetic procedures become more common worldwide.

Distribution Channel Insights

Pharmacies and drugstores remain the dominant distribution channel for dermocosmetic products, contributing to over 40% of global sales in 2024, owing to strong consumer trust and dermatologist referrals. However, online retail and e-commerce platforms are rapidly expanding, accounting for approximately 30% of global market revenue. E-commerce growth is being fueled by social media marketing, digital dermatology consultations, and direct-to-consumer brand strategies that offer personalization through AI-driven skin diagnostics. Dermatology clinics serve as premium retail points for professional-grade dermocosmetic products, particularly in Europe and North America. Specialty stores and supermarket chains continue to expand their dermocosmetic sections, driven by premiumization trends and increased consumer access to hybrid skincare-cosmetic products.

End-User Insights

The retail consumer segment represents the largest end-user base for dermocosmetic products, driven by increasing self-care awareness and at-home skincare routines. This segment benefits from a growing preference for clinically tested, non-prescription products that offer visible results without medical supervision. Professional and clinical use is expanding, especially across dermatology practices and aesthetic clinics that integrate dermocosmetic brands into treatment protocols. These settings favor prescription-grade formulations designed to complement medical treatments such as microdermabrasion, laser resurfacing, and chemical peels. As clinical skincare continues to converge with consumer beauty, demand from both end-user categories is expected to rise steadily through 2030.

Age Group Insights

Consumers aged 25–44 years account for the largest share of the dermocosmetics market, representing the core audience for preventive skincare and anti-aging products. This demographic drives premiumization trends through spending on serums, sunscreens, and active-ingredient-rich formulations. The 18–24 age group contributes significantly to acne and blemish-control product sales, supported by digital awareness campaigns and influencer marketing on platforms like TikTok and Instagram. Consumers aged 45–60 years increasingly prefer advanced anti-aging and dermo-restorative solutions that address elasticity, wrinkles, and pigmentation, particularly in Europe and Japan. Meanwhile, the 60+ demographic is emerging as a niche but valuable segment, demanding gentle, fragrance-free, and sensitive-skin formulations aligned with age-related skin physiology.

| By Product Type | By Distribution Channel | By End-Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America (U.S. & Canada) remains a major mature market with high per-capita spending on dermocosmetics. In 2024, it held about one-fifth (20-25 %) of the global market. The strong dermatology infrastructure, high consumer awareness of skin health, and well-developed pharmacy and online channels underpin demand. Growth is steady but below the fastest emerging regions.

Europe

Europe (including Germany, France, UK) represents the largest regional share estimated at 30-35 % in 2024. European consumers place a high value on trust, clinical validation, and pharmacy distribution, making the region an important base for dermocosmetic brands. Growth is moderate but stable.

Asia-Pacific (APAC)

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and South Korea. Strong consumer aspiration for skincare, rising incomes, urbanization, and e-commerce expansion support growth. APAC’s share is rising from a smaller base toward parity with mature markets.

Latin America (LATAM)

In Latin America (Brazil, Mexico), dermocosmetic uptake is increasing thanks to higher awareness of skin conditions (pigmentation, sensitivity) and expanding pharmacy/online retail networks. While the current share is smaller (under 10 %), growth rates are above mature markets.

Middle East & Africa (MEA)

MEA (GCC nations, South Africa) is emerging. While the total share is single-digit today, demand is growing thanks to climate-driven skin concerns (sun damage, pigmentation), rising disposable incomes, and medical-tourism spill-ins. Brands that customize to local skin types and sun/UV exposure patterns can capture incremental gains.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Dermocosmetics Market

- L’Oréal S.A.

- Johnson & Johnson Services, Inc.

- Unilever PLC

- Procter & Gamble Co.

- Beiersdorf AG

- Shiseido Company, Ltd.

- Coty Inc.

- Colgate-Palmolive Company

- Galderma S.A.

- Amorepacific Corporation

- Natura & Co.

- Kanebo Cosmetics Inc.

- Sebapharma GmbH & Co. KG

- Pierre Fabre Group

- Himalaya Global Holdings Ltd.

Recent Developments

- In recent months, major firms have increased acquisitions in the dermocosmetics space, for example, L'Oréal S.A.’s acquisition of a stake in premium skincare brands to strengthen its dermocosmetic portfolio, highlighting industry consolidation and innovation investment.

- Companies are increasingly investing in AI-enabled skin diagnostics, teledermatology integration, and microbiome-friendly actives, shifting the competitive battleground from traditional cosmetics to high-performance skincare.

- Emerging-market expansion is accelerating, and brands are scaling operations and distribution in India, China, and Southeast Asia to capture the fast-growing consumer base and export-driven demand.