Cosmetic Shea Butter Market Size

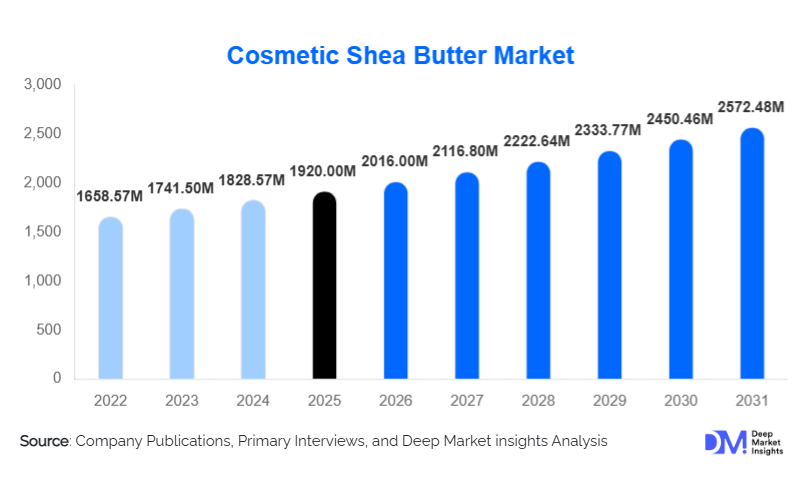

According to Deep Market Insights, the global cosmetic shea butter market size was valued at USD 1920 million in 2025 and is projected to grow from USD 2016.0 million in 2026 to reach USD 2572.48 million by 2031, expanding at a CAGR of 5.0% during the forecast period (2026–2031). The cosmetic shea butter market growth is primarily driven by rising consumer demand for natural and clean-label cosmetic ingredients, increasing penetration of shea butter in premium skincare formulations, and the growing influence of sustainability and ethical sourcing initiatives across the global beauty industry.

Key Market Insights

- Refined and ultra-refined shea butter dominate cosmetic formulations, driven by better stability, neutral odor, and enhanced compatibility with skincare and haircare products.

- Skin care applications account for the largest share, supported by strong demand for moisturizers, anti-aging creams, and dermatological products.

- Europe leads global consumption, fueled by stringent clean beauty regulations and high adoption of organic and sustainable cosmetic ingredients.

- North America remains a high-value market, driven by premium beauty brands and rising cosmeceutical demand.

- Asia-Pacific is the fastest-growing region, supported by expanding middle-class populations and increasing beauty product consumption in China and India.

- Ethical sourcing and fair-trade certifications are becoming key differentiators for suppliers and brands.

What are the latest trends in the cosmetic shea butter market?

Shift Toward Clean Beauty and Natural Ingredients

The cosmetic shea butter market is increasingly aligned with the global clean beauty movement. Consumers are actively seeking plant-based, chemical-free ingredients, driving cosmetic brands to replace synthetic emollients with naturally derived shea butter. This trend is particularly strong in Europe and North America, where regulatory scrutiny and consumer awareness are high. Shea butter’s multifunctional properties, hydration, anti-inflammatory action, and skin barrier repair make it a preferred ingredient in clean-label formulations. As a result, demand for refined and deodorized shea butter grades is rising, ensuring consistent quality without compromising natural positioning.

Rising Demand for Organic and Ethically Sourced Shea Butter

Organic-certified and ethically sourced shea butter is gaining strong traction, especially among premium and natural cosmetic brands. Companies are increasingly investing in traceable supply chains, women-led cooperatives in West Africa, and sustainability certifications. These initiatives not only enhance brand credibility but also allow suppliers to command premium pricing. Fair-trade shea butter is increasingly used as a marketing differentiator, reinforcing ethical consumption trends within the global cosmetics industry.

What are the key drivers in the cosmetic shea butter market?

Growing Demand for Premium and Dermaceutical Products

The expansion of premium skincare and dermaceutical products is a key growth driver. Shea butter is widely used in formulations targeting sensitive skin, eczema, and post-procedure care due to its proven efficacy. Dermatologist-recommended brands increasingly incorporate refined shea butter for its high skin tolerance and nourishing properties. This trend is boosting demand for high-purity and standardized cosmetic-grade shea butter globally.

Increasing Focus on Sustainability and Ethical Beauty

Sustainability has become a core purchasing criterion for cosmetic brands and consumers alike. Shea butter sourcing supports rural economies in Africa, particularly women-led cooperatives, aligning well with corporate ESG goals. Governments and NGOs are supporting sustainable harvesting and local processing, improving supply chain reliability while reinforcing the ethical positioning of shea butter-based cosmetic products.

What are the restraints for the global market?

Raw Material Price Volatility

Shea nut production is highly dependent on climatic conditions, leading to fluctuations in raw material availability and pricing. This volatility can affect cost structures for cosmetic manufacturers, particularly those operating on fixed-price contracts. Smaller suppliers often face margin pressure during supply shortages, limiting scalability.

Quality Standardization Challenges

Variability in fatty acid composition, odor, and contamination risks, especially in unrefined shea butter, poses challenges for cosmetic manufacturers requiring consistent ingredient quality. Additional refining and quality control processes increase costs, acting as a restraint for broader adoption among cost-sensitive brands.

What are the key opportunities in the cosmetic shea butter industry?

Expansion in Asia-Pacific Beauty Markets

Asia-Pacific presents a significant growth opportunity, driven by increasing cosmetic consumption in China, India, South Korea, and Southeast Asia. Rising disposable incomes, urbanization, and growing awareness of natural skincare are accelerating shea butter adoption. Localization of formulations and partnerships with regional beauty brands can unlock substantial demand growth.

Innovation in Fractionated and Customized Shea Butter Grades

Technological advancements in fractionation and deodorization are enabling customized shea butter grades with tailored melting points and textures. These innovations expand usage into lightweight facial creams, color cosmetics, and hair styling products, allowing suppliers to move up the value chain and increase margins.

Product Type Insights

Refined shea butter dominates the cosmetic shea butter market, accounting for approximately 46% of the 2025 market share. Its leadership is primarily driven by superior formulation stability, extended shelf life, and neutral color and odor, which make it highly compatible with mass-market, premium, and dermaceutical cosmetic formulations. Refined shea butter allows manufacturers to maintain consistent product performance while meeting stringent quality and regulatory standards, particularly in Europe and North America.

Unrefined shea butter continues to hold a meaningful share, especially among artisanal, natural, and organic beauty brands that emphasize minimal processing and traditional sourcing methods. This segment benefits from strong consumer perception around authenticity and nutrient retention. Meanwhile, ultra-refined and fractionated shea butter variants are gaining traction at a faster pace within premium skincare, dermatological products, and color cosmetics. These advanced grades offer customized melting points, improved spreadability, and enhanced absorption, enabling their use in lightweight facial creams, serums, and makeup products. The growing preference for high-performance natural ingredients is expected to further accelerate demand for fractionated and specialty shea butter grades over the forecast period.

Application Insights

Skin care applications lead the cosmetic shea butter market with an estimated 58% share in 2025, driven by widespread use in body lotions, facial creams, lip balms, hand creams, and anti-aging products. Shea butter’s exceptional emollient properties, ability to restore the skin barrier, and anti-inflammatory benefits make it a core ingredient in both mass-market moisturizers and premium skin repair formulations. Rising consumer concerns around dry skin, sensitivity, and premature aging are reinforcing its dominance in skincare applications.

Hair care represents the second-largest application segment, supported by shea butter’s effectiveness in moisturizing dry hair, repairing damage, and enhancing curl definition. Demand is particularly strong in conditioners, hair masks, and leave-in treatments formulated for textured and chemically treated hair. Color cosmetics and personal hygiene products are emerging application areas, driven by the growing popularity of natural makeup, sulfate-free soaps, and gentle cleansing products. Shea butter’s role as a natural alternative to synthetic emollients is expanding its usage across multifunctional personal care formulations.

Distribution Channel Insights

Direct B2B supply contracts dominate the cosmetic shea butter market, accounting for nearly 61% of global sales. Large cosmetic manufacturers prefer long-term sourcing agreements to ensure consistent quality, traceability, price stability, and compliance with sustainability commitments. These contracts are especially critical for premium and dermaceutical brands that require standardized cosmetic-grade shea butter with strict quality specifications.

Ingredient distributors play a vital role in servicing small- and mid-sized cosmetic brands by offering flexible order volumes, technical support, and access to multiple shea butter grades. Meanwhile, online ingredient platforms are gaining momentum, particularly among indie beauty brands and startups. These platforms enable faster sourcing, transparent pricing, and easier access to certified organic and specialty shea butter variants, supporting innovation and rapid product development cycles in the independent beauty segment.

End-Use Industry Insights

Mass-market cosmetic manufacturers account for the largest share of volume demand, driven by high production volumes of lotions, creams, and personal care products targeting daily-use consumers. These manufacturers primarily rely on refined shea butter to balance cost efficiency, scalability, and formulation performance.

Premium and luxury beauty brands, while smaller in volume, generate significantly higher value consumption due to their preference for organic-certified, fair-trade, and customized shea butter grades. Natural and organic beauty brands represent the fastest-growing end-use segment, supported by clean beauty positioning, sustainability-driven branding, and increasing consumer willingness to pay premium prices for ethically sourced ingredients. This segment is expected to play a key role in shaping innovation and sourcing practices across the cosmetic shea butter value chain.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe leads the cosmetic shea butter market with an estimated 34% share in 2025, driven by strong demand from France, Germany, and the U.K. The region’s dominance is supported by strict cosmetic regulations, widespread adoption of clean-label formulations, and a strong consumer preference for organic and sustainably sourced ingredients. European beauty brands are early adopters of fair-trade and traceable shea butter, reinforcing long-term demand. Additionally, the region’s well-established premium skincare and dermaceutical industries continue to drive consistent consumption of high-quality refined and organic shea butter.

North America

North America accounts for approximately 28% of global demand, led by the U.S. Growth in the region is driven by strong premium skincare consumption, a rapidly expanding cosmeceutical segment, and high awareness of ethical and sustainable sourcing. The popularity of dermatologist-recommended skincare, combined with rising consumer demand for plant-based and hypoallergenic ingredients, continues to support shea butter adoption across both mass-market and premium beauty brands.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 9% CAGR. China and India are key growth markets, supported by rising disposable incomes, increasing beauty awareness, and the rapid expansion of e-commerce and digital beauty platforms. Growing demand for natural and herbal personal care products, particularly in India and Southeast Asia, is accelerating shea butter adoption. In China, premium skincare growth and cross-border e-commerce are driving demand for imported cosmetic ingredients, including refined and fractionated shea butter.

Latin America

Latin America exhibits steady growth, led by Brazil and Mexico. Rising consumer interest in natural cosmetics, increasing local beauty manufacturing, and growing penetration of international cosmetic brands are key growth drivers. Regional demand is further supported by a strong hair care market, where shea butter is widely used in products targeting dry and textured hair types.

Middle East & Africa

Africa remains the primary production hub for shea butter, while regional cosmetic consumption is gradually increasing. Government initiatives aimed at value-added processing and export diversification are strengthening local industries. The Middle East is emerging as a premium demand center, driven by luxury beauty brands, high disposable incomes, and a strong preference for high-quality skincare products. Direct trade links between African producers and Middle Eastern cosmetic manufacturers are also improving supply chain efficiency and regional market growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetic Shea Butter Market

- BASF

- Bunge

- AAK

- Wilmar International

- Fuji Oil Holdings

- Croda International

- IOI Corporation

- Cargill

- Barry Callebaut

- OLVEA Group

- Ghana Nuts Company

- 3F Industries

- Star Shea Ltd

- Timiniya Tuma

- Akoma Cooperative