Cosmetic Lasers Market Size

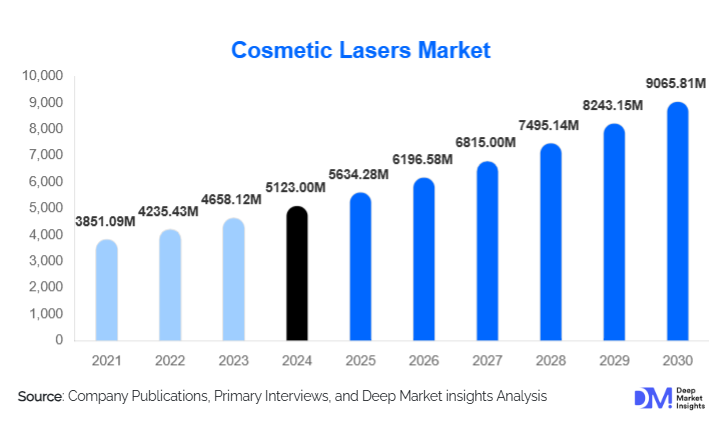

According to Deep Market Insights, the global cosmetic lasers market size was valued at USD 5,123.00 million in 2024 and is projected to grow from USD 5,634.28 million in 2025 to reach USD 9,065.81 million by 2030, expanding at a CAGR of 9.98% during the forecast period (2025–2030). The cosmetic lasers market growth is primarily driven by rising demand for non-invasive aesthetic procedures, increasing awareness of appearance-related treatments, and continuous technological advancements in laser platforms used across dermatology and aesthetic medicine.

Key Market Insights

- Non-invasive aesthetic procedures are becoming the preferred choice, driving sustained demand for cosmetic laser systems globally.

- Hair removal remains the largest application segment, accounting for over 40% of total cosmetic laser procedures worldwide.

- North America dominates the global market, supported by high procedure volumes, strong purchasing power, and early technology adoption.

- Asia-Pacific is the fastest-growing region, driven by rising medical tourism, expanding middle-class populations, and increasing aesthetic awareness.

- Multi-application laser platforms are gaining traction, as clinics seek higher return on investment and operational efficiency.

- Male aesthetic treatments are growing rapidly, contributing to double-digit growth in select application segments.

What are the latest trends in the cosmetic lasers market?

Shift Toward Multi-Application and AI-Enabled Laser Platforms

The cosmetic lasers market is witnessing a strong shift toward multi-application platforms capable of addressing hair removal, pigmentation, acne, vascular lesions, and skin rejuvenation using a single system. These platforms reduce capital expenditure for clinics while increasing treatment flexibility. In parallel, AI-enabled systems are emerging that automatically adjust energy delivery based on skin type, pigmentation, and treatment area. This trend improves safety, minimizes operator error, and enhances patient outcomes, making advanced laser platforms increasingly attractive to high-volume dermatology clinics and medical spas.

Rising Popularity of Portable and Compact Laser Devices

Portable and compact cosmetic laser devices are gaining popularity, particularly in emerging markets and among smaller aesthetic practices. These systems offer lower upfront costs, easier installation, and flexibility for outpatient and mobile aesthetic services. Technological improvements have significantly enhanced the performance of portable devices, enabling them to deliver results comparable to traditional standalone systems for selected applications such as hair removal and acne treatment.

What are the key drivers in the cosmetic lasers market?

Growing Demand for Non-Invasive Aesthetic Treatments

Consumers increasingly prefer non-invasive and minimally invasive cosmetic treatments due to shorter recovery times, lower risk, and reduced discomfort compared to surgical alternatives. Cosmetic lasers meet these preferences by offering effective solutions for skin rejuvenation, pigmentation correction, and hair removal. The growing working population and aging demographics are further accelerating demand for such procedures, supporting long-term market growth.

Technological Advancements in Laser Systems

Continuous innovation in laser wavelengths, cooling mechanisms, and precision targeting has significantly expanded the range of treatable conditions. Modern cosmetic lasers offer improved safety profiles and enhanced efficacy, encouraging clinics to upgrade existing equipment. The introduction of combination laser systems that integrate multiple wavelengths into a single platform is further driving adoption across dermatology and aesthetic centers.

What are the restraints for the global market?

High Capital and Maintenance Costs

Advanced cosmetic laser systems require significant upfront investment, often ranging into hundreds of thousands of dollars per unit. Maintenance, consumables, and staff training further increase total ownership costs. These factors limit adoption among small clinics and independent practitioners, particularly in cost-sensitive regions.

Regulatory and Safety Compliance Challenges

Cosmetic lasers are regulated as medical devices in most regions, requiring compliance with stringent safety and performance standards. Lengthy approval processes, varying regional regulations, and the need for certified operators can delay product launches and restrict market entry, especially for new manufacturers.

What are the key opportunities in the cosmetic lasers industry?

Expansion in Emerging Markets and Medical Tourism

Emerging economies such as India, China, Brazil, and Southeast Asian countries present significant growth opportunities due to rising disposable incomes and expanding medical tourism sectors. International patients increasingly seek affordable cosmetic treatments in these regions, driving demand for advanced laser systems in private clinics and hospitals.

Growth of Male Aesthetic Procedures

The male grooming and aesthetics segment is expanding rapidly, with increasing acceptance of cosmetic treatments among men. Procedures such as laser hair removal, acne treatment, and skin tightening are witnessing strong uptake. Manufacturers that tailor marketing strategies and device ergonomics to male consumers can unlock incremental revenue growth.

Laser Type Insights

Semiconductor (diode) lasers dominate the global cosmetic lasers market, accounting for approximately 34% of total revenue in 2024. Their leadership is primarily driven by their high electrical-to-optical efficiency, compact system architecture, lower maintenance requirements, and cost-effectiveness compared to other laser technologies. Diode lasers are extensively used in hair removal procedures due to their optimal penetration depth and compatibility with a wide range of skin types, making them the preferred choice for high-volume dermatology clinics and medical spas. The increasing demand for repeat hair removal sessions further reinforces the dominance of diode-based systems.

Solid-state lasers represent the second-largest laser type segment, supported by their strong clinical efficacy in skin resurfacing, pigmentation correction, and vascular lesion treatment. These lasers offer higher peak power and precision, enabling advanced aesthetic treatments with improved outcomes. Gas lasers and dye lasers account for a smaller share of the market and are primarily used in niche or specialized dermatological applications. Their limited adoption is attributed to higher operational complexity and the availability of more versatile solid-state and semiconductor alternatives.

Application Insights

Hair removal remains the leading application segment in the cosmetic lasers market, contributing approximately 42% of the total market value in 2024. The segment’s dominance is driven by high procedure frequency, recurring treatment cycles, and growing acceptance of laser hair removal among both female and male consumers. Increasing demand for long-term hair reduction solutions, coupled with rising grooming awareness across urban populations, continues to fuel this segment’s growth globally.

Skin rejuvenation and resurfacing represent the second-largest application segment, supported by strong anti-aging trends, increasing incidence of photoaging, and rising consumer spending on appearance-enhancing procedures. This segment benefits significantly from technological advancements in fractional and non-ablative laser systems, which offer effective results with minimal downtime. Meanwhile, tattoo removal and acne treatment are among the fastest-growing application segments. Changing lifestyle preferences, increasing tattoo adoption followed by removal demand, and rising prevalence of acne-related skin conditions, particularly among younger demographics, are driving accelerated growth in these categories.

End-Use Insights

Dermatology clinics account for the largest share of end-use demand, representing approximately 46% of the global cosmetic lasers market in 2024. Their leadership is attributed to high patient volumes, specialized expertise, and continuous investment in advanced laser platforms to expand service offerings. Dermatology clinics are also early adopters of multi-application laser systems, which improve operational efficiency and return on investment.

Medical spas constitute the fastest-growing end-use segment, driven by the increasing popularity of outpatient aesthetic services, wellness-oriented cosmetic treatments, and rising consumer preference for non-hospital settings. The expansion of chain-based medical spas in urban centers is further accelerating demand for compact and versatile cosmetic laser systems. Hospitals and ambulatory surgical centers contribute steadily to market demand, particularly for high-end, multi-application platforms used in advanced dermatological and reconstructive procedures. Their role remains important in complex cases and regulated treatment environments.

| By Laser Type | By Application | By End Use | By Modality | By Gender Target |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the cosmetic lasers market, accounting for approximately 38% of global revenue in 2024. The United States dominates regional demand due to high procedure volumes, strong consumer spending on aesthetic treatments, and rapid adoption of technologically advanced laser systems. A well-established network of dermatology clinics, favorable reimbursement scenarios for select dermatological procedures, and early adoption of AI-enabled laser platforms further support market leadership. In addition, growing demand for male aesthetic procedures and minimally invasive anti-aging treatments continues to drive regional growth.

Europe

Europe accounts for around 27% of the global cosmetic lasers market, with Germany, the U.K., and France serving as key demand centers. Regional growth is driven by strong aesthetic awareness, an aging population seeking anti-aging treatments, and increasing acceptance of non-invasive cosmetic procedures. Regulatory harmonization across the European Union enhances market stability and facilitates cross-border product adoption. Additionally, the growing popularity of medically supervised aesthetic treatments supports consistent demand for advanced laser platforms.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the cosmetic lasers market and is expected to register a CAGR exceeding 14% through 2030. China, South Korea, Japan, and India are key contributors, driven by rapid urbanization, rising disposable incomes, expanding medical tourism, and strong cultural emphasis on skincare and appearance. South Korea and Japan lead in technological adoption and aesthetic innovation, while India and China are witnessing the rapid expansion of private dermatology clinics and medical spas. Favorable government initiatives supporting healthcare infrastructure and local manufacturing further accelerate regional growth.

Latin America

Latin America holds nearly 8% of the global cosmetic lasers market, led by Brazil and Mexico. Growth in the region is supported by increasing acceptance of aesthetic procedures, rising middle-class income levels, and expanding private healthcare infrastructure. Brazil, in particular, remains a key hub for cosmetic procedures, driving steady demand for laser-based aesthetic technologies.

Middle East & Africa

The Middle East & Africa region contributes approximately 5% of global market demand. The UAE and Saudi Arabia lead adoption due to high-income populations, strong demand for premium aesthetic services, and the rapid expansion of luxury cosmetic clinics. Increasing investments in healthcare infrastructure, coupled with the region’s growing medical tourism sector, continue to support market growth. In Africa, South Africa remains a key contributor, driven by rising urbanization and growing awareness of aesthetic treatments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|