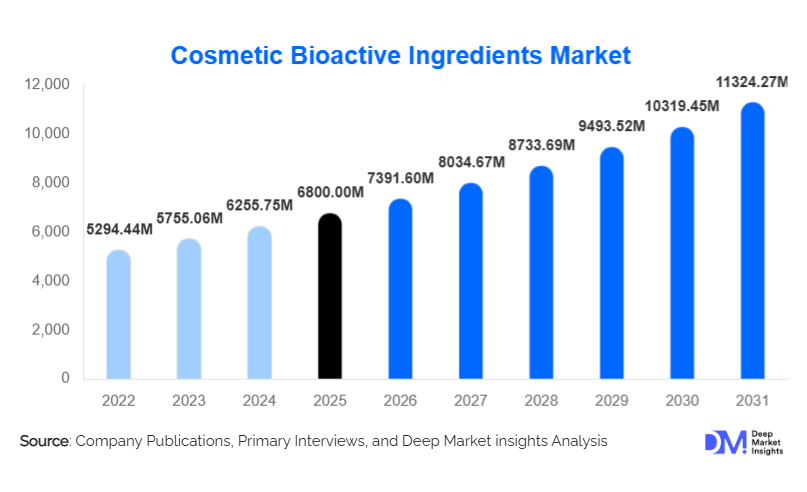

Cosmetic Bioactive Ingredients Market Size

According to Deep Market Insights, the global cosmetic bioactive ingredients market size was valued at USD 6800 million in 2025 and is projected to grow from USD 7391.6 million in 2026 to reach USD 11324.27 million by 2031, expanding at a CAGR of 8.7% during the forecast period (2026–2031). Market growth is primarily driven by the rising demand for high-efficacy skincare and haircare products, increasing adoption of clean-label and sustainable beauty formulations, and rapid advancements in biotechnology, fermentation, and encapsulation technologies used in cosmetic actives.

Key Market Insights

- Bioactive ingredients are becoming central to product differentiation, as cosmetic brands increasingly compete on proven efficacy rather than aesthetics alone.

- Anti-aging and skin longevity actives dominate demand, supported by aging populations and rising preventative skincare adoption globally.

- Asia-Pacific leads global volume growth, driven by China, South Korea, and India, while North America and Europe dominate premium-value consumption.

- Fermentation-derived and bio-identical actives are the fastest-growing categories, offering consistency, sustainability, and regulatory compliance.

- Encapsulation and controlled-release technologies are reshaping formulation strategies by improving stability and ingredient performance.

- Premium and luxury cosmetic brands account for the largest share of bioactive spending, reflecting higher tolerance for advanced ingredient costs.

What are the latest trends in the cosmetic bioactive ingredients market?

Rapid Growth of Fermentation-Based and Bio-Identical Actives

Fermentation-derived cosmetic bioactives are gaining strong traction due to their high purity, batch-to-batch consistency, and reduced environmental footprint. Ingredients such as fermented peptides, probiotics, enzymes, and postbiotics are increasingly replacing animal-derived or agriculturally volatile sources. Bio-identical actives produced through precision biotechnology offer improved safety profiles and regulatory acceptance, making them highly attractive to global cosmetic manufacturers focused on long-term scalability and sustainability.

Advanced Delivery Systems Enhancing Ingredient Performance

Encapsulation, liposomal delivery, and controlled-release technologies are transforming the effectiveness of cosmetic bioactives. These systems improve ingredient stability, skin penetration, and targeted release, allowing brands to deliver visible results at lower concentrations. This trend is particularly prominent in anti-aging serums, sunscreens, and dermatological skincare products, where performance claims must be substantiated through measurable outcomes.

What are the key drivers in the cosmetic bioactive ingredients market?

Growing Consumer Demand for Efficacy-Driven Beauty Products

Consumers are increasingly prioritizing visible and clinically validated results when selecting cosmetic products. Bioactive ingredients such as peptides, retinoids, antioxidants, and ceramides provide targeted biological functions that support claims related to wrinkle reduction, skin barrier repair, pigmentation control, and hair growth. This shift toward performance-based beauty is a key driver supporting sustained market growth.

Expansion of Clean Beauty and Ingredient Transparency

Regulatory pressure and consumer awareness are accelerating the transition away from controversial synthetic additives toward safer, natural, and bio-identical alternatives. Cosmetic bioactives align well with clean beauty principles by offering multifunctionality, reduced formulation complexity, and compatibility with natural and organic certifications. This trend is especially strong in Europe and North America, where regulatory standards are most stringent.

What are the restraints for the global market?

High Production Costs and Complex Manufacturing Processes

Cosmetic bioactive ingredients often require advanced extraction, fermentation, purification, and testing processes, resulting in higher production costs compared to conventional cosmetic ingredients. These costs can limit adoption among mass-market manufacturers and smaller brands with restricted formulation budgets.

Regulatory and Claim Substantiation Challenges

Bioactive ingredients frequently operate at the boundary between cosmetic and pharmaceutical classifications, requiring extensive safety assessments and efficacy validation. Inconsistent global regulatory frameworks and strict claim substantiation requirements can delay product launches and increase compliance costs for ingredient suppliers and cosmetic brands.

What are the key opportunities in the cosmetic bioactive ingredients industry?

Rising Demand from Asia-Pacific and Emerging Markets

Asia-Pacific represents the most significant growth opportunity, driven by expanding middle-class populations, increasing beauty awareness, and strong innovation ecosystems in countries such as China, South Korea, Japan, and India. Localized bioactive ingredient development tailored to regional skin types, climate conditions, and beauty preferences offers suppliers a strong competitive advantage.

Integration of Biotechnology and Sustainable Manufacturing

Precision fermentation, green chemistry, and sustainable sourcing technologies are creating opportunities for next-generation cosmetic bioactives with lower environmental impact. Companies investing in biotechnology platforms and sustainable production models are well positioned to capture premium contracts with global cosmetic majors and clean-label brands

Ingredient Type Insights

Plant-derived bioactives represent the largest ingredient category, accounting for approximately 38% of the 2025 market, driven by strong consumer acceptance and compatibility with clean beauty positioning. Microbial and fermentation-derived bioactives are the fastest-growing segment, supported by advances in biotechnology and rising demand for vegan and sustainable ingredients. Synthetic and bio-identical actives continue to play a critical role in high-performance formulations, particularly in anti-aging and dermatological products.

Functional Benefit Insights

Anti-aging and skin longevity bioactives dominate the market with an estimated 42% share in 2025, reflecting strong demand for collagen-boosting, antioxidant, and cellular renewal ingredients. Moisturization and barrier repair actives follow closely, supported by growing awareness of skin microbiome health and sensitivity. Hair growth, scalp health, and anti-inflammatory actives are emerging as high-growth functional categories.

Application Insights

Skincare products account for nearly 56% of global cosmetic bioactive ingredient consumption, driven by facial creams, serums, sunscreens, and dermatological products. Haircare applications represent a growing segment as consumers increasingly seek clinically backed solutions for hair thinning, scalp health, and damage repair. Oral beauty and nutricosmetics are emerging as a niche but fast-expanding application area.

End-Use Industry Insights

Premium and luxury cosmetic brands dominate bioactive ingredient demand, accounting for approximately 41% of total market spending due to their emphasis on performance, innovation, and scientific validation. Professional dermatology and aesthetic clinics represent the fastest-growing end-use segment, driven by medical-grade skincare and post-procedure product demand. Indie and clean-label beauty brands are also accelerating adoption of multifunctional bioactives to differentiate their offerings.

| By Ingredient Type | By Functional Benefit | By Application | By Form | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific holds approximately 34% of the global market share in 2025, led by China, South Korea, Japan, and India. South Korea remains the fastest-growing country due to strong K-beauty exports and innovation in cosmetic biotechnology.

North America

North America accounts for around 28% of the market, driven by high R&D investment, strong clean beauty adoption, and demand for dermatologically validated skincare products in the United States and Canada.

Europe

Europe represents nearly 26% of global demand, with France, Germany, and the United Kingdom leading consumption. Stringent cosmetic regulations favor high-quality, compliant bioactive ingredients.

Latin America

Latin America is an emerging market, led by Brazil and Mexico, with growing premium beauty consumption and increasing adoption of advanced skincare formulations.

Middle East & Africa

The Middle East and Africa show steady growth, supported by rising luxury beauty demand in the UAE and Saudi Arabia, along with expanding local manufacturing capabilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Companies in the Cosmetic Bioactive Ingredients Industry

- BASF SE

- DSM-Firmenich

- Evonik Industries

- Croda International

- Givaudan Active Beauty

- Ashland Global

- Symrise

- Clariant

- Solvay

- Lonza

- Kobo Products

- Lucas Meyer Cosmetics

- Seppic

- Provital Group

- Alban Muller International