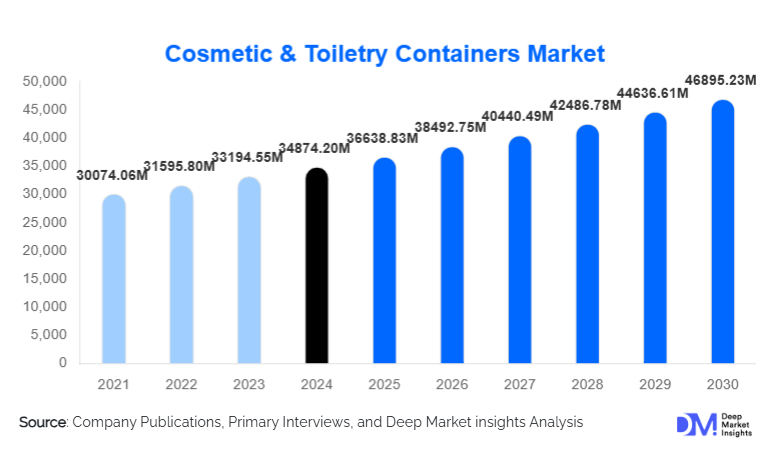

Cosmetic & Toiletry Containers Market Size

According to Deep Market Insights, the global cosmetic & toiletry containers market size was valued at USD 34,874.20 million in 2024 and is projected to grow from USD 36,638.83 million in 2025 to reach USD 46,895.23 million by 2030, expanding at a CAGR of 5.06% during the forecast period (2025–2030). Market growth is primarily driven by rising global consumption of beauty and personal care products, increasing premiumization of cosmetic packaging, and strong demand for sustainable, lightweight, and aesthetically differentiated containers across both developed and emerging economies.

Key Market Insights

- Plastic containers remain the dominant material category, accounting for over 60% of global demand due to cost efficiency, lightweight properties, and design flexibility.

- Skincare applications represent the largest demand segment, supported by rapid growth in anti-aging, dermaceutical, and sun-care products.

- Asia-Pacific leads global consumption, driven by China, India, South Korea, and Japan, supported by large-scale cosmetic manufacturing and export-oriented production.

- Sustainability regulations in Europe and North America are accelerating the adoption of PCR plastics, refillable packaging, and mono-material designs.

- Premium and luxury cosmetic brands are driving innovation in glass, metal, and airless container formats.

- E-commerce expansion is reshaping container design priorities, emphasizing durability, lightweighting, and leakage prevention.

What are the latest trends in the cosmetic & toiletry containers market?

Sustainable and Circular Packaging Solutions

Sustainability has become the most influential trend shaping the cosmetic & toiletry containers market. Brand owners are increasingly demanding packaging solutions that incorporate post-consumer recycled (PCR) content, are fully recyclable, or enable reuse through refillable systems. Governments across Europe and North America are enforcing extended producer responsibility (EPR) regulations, pushing manufacturers to redesign containers with lower environmental impact. As a result, mono-material plastic bottles, refill pods, and lightweight container structures are rapidly replacing complex multi-layer designs. Sustainability is no longer limited to premium brands and is now expanding into mass-market cosmetics, significantly increasing the addressable market for eco-friendly container solutions.

Functional and Smart Packaging Adoption

Functional innovation is another major trend, particularly in skincare and cosmeceuticals. Airless pumps, anti-contamination dispensers, UV-protective containers, and precision dosing systems are increasingly adopted to preserve formulation efficacy and improve user experience. Smart packaging features such as QR codes, tamper-evident closures, and traceability markers are being integrated to support product authentication and consumer engagement. These innovations allow container manufacturers to command higher margins and strengthen long-term partnerships with premium cosmetic brands.

What are the key drivers in the cosmetic & toiletry containers market?

Expansion of the Global Cosmetics and Personal Care Industry

Continuous growth in the global beauty and personal care industry remains the primary driver for cosmetic and toiletry container demand. Rising disposable incomes, urbanization, and evolving grooming habits have increased per-capita consumption of skincare, haircare, and hygiene products. Emerging markets are witnessing particularly strong volume growth, directly translating into higher demand for bottles, tubes, jars, and dispensers.

Premiumization and Brand Differentiation Through Packaging

Cosmetic brands increasingly view packaging as a strategic branding tool rather than a cost component. Unique shapes, tactile finishes, high-clarity materials, and luxury aesthetics are driving demand for glass and metal containers, particularly in skincare and fragrance categories. This premiumization trend has increased the average selling price of cosmetic containers globally and supported higher value growth than volume growth.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in prices of petrochemical-based plastics, aluminum, and glass raw materials pose a significant challenge for container manufacturers. Volatile input costs can compress margins, particularly when long-term supply contracts limit the ability to pass cost increases to cosmetic brand owners.

Regulatory Pressure on Single-Use Plastics

Increasing restrictions on plastic packaging, especially single-use formats, create compliance challenges for manufacturers. Redesigning containers to meet recyclability and sustainability standards often requires additional capital investment, which can slow adoption and expansion, particularly for small and mid-sized players.

What are the key opportunities in the cosmetic & toiletry containers industry?

Refillable and Reusable Packaging Systems

Refillable packaging models present a major growth opportunity as brands shift toward circular economy strategies. Containers designed for multiple reuse cycles, supported by refill pods or cartridges, are gaining traction in skincare, haircare, and personal hygiene products. This model increases customer retention while creating recurring revenue streams for container suppliers.

Emerging Market Manufacturing Expansion

Rapid growth in cosmetic consumption across Asia-Pacific, Latin America, and parts of Africa presents strong opportunities for capacity expansion. Establishing localized manufacturing facilities closer to end markets reduces logistics costs, improves customization, and enables suppliers to better serve regional cosmetic brands and contract manufacturers.

Material Type Insights

Plastic containers dominate the market, accounting for approximately 62% of global revenue in 2024 due to their versatility, low cost, and suitability for mass-market applications. Glass containers hold a significant share in premium skincare and fragrance packaging, supported by their aesthetic appeal and chemical inertness. Metal containers, primarily aluminum, are gaining traction in deodorants and luxury cosmetics due to recyclability and durability. Paperboard and molded fiber containers remain niche but are expanding rapidly as secondary and eco-conscious packaging solutions.

Product Type Insights

Bottles represent the largest product category, accounting for nearly 34% of total demand, driven by extensive use in haircare, skincare, and hygiene products. Tubes are widely used in creams and gels, particularly in oral care and skincare. Jars dominate premium skincare applications, while pumps and dispensers are increasingly preferred for hygiene, serums, and liquid cosmetics due to controlled dispensing and contamination prevention.

End-Use Insights

Skincare is the largest and fastest-growing end-use segment, contributing nearly 29% of total market revenue in 2024, supported by high product turnover and premium packaging demand. Haircare remains volume-driven, particularly in emerging markets. Color cosmetics and fragrances generate higher value per unit due to premium container requirements, while oral care and personal hygiene provide stable, recurring demand.

| By Material Type | By Product Type | By Capacity | By Application | By End-Use Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 41% of the global cosmetic & toiletry containers market in 2024, led by China, India, South Korea, and Japan. Strong domestic cosmetic brands, export-oriented manufacturing, and rising consumer spending drive sustained growth. India is the fastest-growing country, supported by expanding local brands and contract manufacturing.

Europe

Europe holds around 27% of global demand, driven by France, Germany, Italy, and the UK. The region leads in sustainable packaging innovation due to strict environmental regulations and strong luxury cosmetic manufacturing.

North America

North America accounts for approximately 22% of market share, with the U.S. dominating due to high per-capita cosmetic spending, strong indie brand growth, and advanced packaging innovation.

Latin America

Latin America is an emerging growth region, led by Brazil and Mexico, supported by rising middle-class consumption and expanding local cosmetic brands.

Middle East & Africa

The Middle East & Africa region shows steady growth, driven by premium cosmetic demand in the UAE and Saudi Arabia, along with expanding hygiene product consumption across Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cosmetic & Toiletry Containers Market

- AptarGroup

- Albéa Group

- Berry Global

- Amcor

- Silgan Holdings

- Gerresheimer

- HCP Packaging

- Quadpack

- Libo Cosmetics

- Graham Packaging