Copiers Market Size

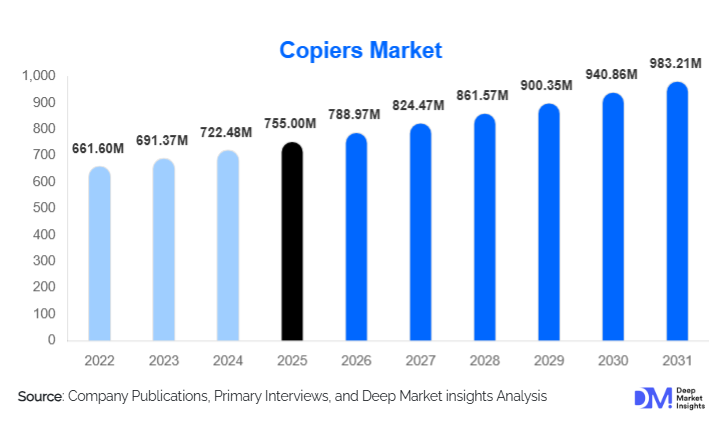

According to Deep Market Insights, the global copiers market size was valued at USD 755.00 million in 2024 and is projected to grow from USD 788.97 million in 2025 to reach USD 983.21 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The copiers market growth is primarily driven by the increasing adoption of multifunction copiers (MFPs), rising penetration of managed print services (MPS), and sustained replacement demand from corporate offices, government institutions, and education sectors, despite gradual digitization trends.

Key Market Insights

- Multifunction copiers dominate global demand, as organizations consolidate printing, scanning, copying, and faxing into single networked devices.

- Managed print services are reshaping procurement models, shifting spending from upfront CapEx to subscription-based and leasing models.

- Asia-Pacific leads global growth, supported by expanding SME bases, government digitization, and office infrastructure investments.

- North America remains the largest value market, driven by high adoption of premium copiers and long-term service contracts.

- Sustainability and energy efficiency are key purchasing criteria, influencing fleet replacement decisions across enterprises.

- Software and workflow integration, including cloud scanning and document security, is becoming a core differentiator among OEMs.

What are the latest trends in the copiers market?

Shift Toward Managed Print Services and Subscription Models

The copiers market is increasingly moving away from outright equipment purchases toward managed print services and leasing models. Enterprises are prioritizing predictable operating costs, centralized fleet management, and reduced administrative complexity. Under MPS contracts, vendors provide hardware, consumables, maintenance, and analytics as bundled offerings, enabling higher lifetime value per customer. This trend is particularly strong in North America and Europe, while Asia-Pacific and the Middle East present significant untapped potential for MPS expansion among SMEs and public institutions.

Integration of Smart and Cloud-Connected Copiers

Modern copiers are evolving into intelligent document hubs integrated with enterprise IT systems. Features such as cloud-based scanning, secure print release, AI-powered document classification, and direct integration with ERP and ECM platforms are becoming standard. These capabilities improve productivity, enhance data security, and position copiers as workflow automation tools rather than standalone hardware. Vendors offering software ecosystems alongside devices are gaininga competitive advantage and commanding higher average selling prices.

What are the key drivers in the copiers market?

Enterprise Digitization and Hybrid Work Environments

While digital documentation reduces print volumes, hybrid work models still require secure, centralized document handling. Copiers equipped with cloud access, user authentication, and remote fleet monitoring support distributed workforces and sustain replacement demand. Organizations continue to upgrade fleets to meet evolving security and compliance requirements.

Premiumization and Technological Advancements

Demand for high-speed, energy-efficient, and production-grade digital copiers is driving value growth. A3-format, mid-to-high speed laser copiers remain essential for corporate, government, and commercial print environments. Advanced features, including touchscreen interfaces and workflow automation, enable vendors to maintain margins despite pricing pressure in entry-level segments.

What are the restraints for the global market?

Acceleration of Paperless Initiatives

Digital transformation initiatives, e-signatures, and cloud-based collaboration tools continue to reduce overall printing and copying volumes, particularly in developed markets. This trend limits unit shipment growth and forces vendors to rely more heavily on services and software to sustain revenues.

High Initial Costs and Extended Replacement Cycles

Advanced copiers involve higher upfront investments, prompting organizations to extend equipment lifecycles. Longer replacement cycles slow new equipment demand, especially among cost-sensitive SMEs and public sector buyers.

What are the key opportunities in the copiers industry?

Expansion in Emerging Markets

Rapid office infrastructure development in India, Southeast Asia, the Middle East, and parts of Africa presents strong growth opportunities. Government digitization, education expansion, and SME formalization are driving first-time copier installations, particularly in A3 multifunction segments.

Software-Led Differentiation and Security Solutions

Copiers integrated with document management software, cybersecurity features, and compliance tools offer significant upselling potential. Vendors that position copiers as part of secure information governance frameworks can access enterprise IT budgets and improve customer retention.

Product Type Insights

Color copiers dominate the global market, accounting for approximately 58% of revenue in 2024. This dominance is driven by higher average selling prices (ASPs) and the growing need for professional-quality output in corporate, commercial, and creative industries. Color copiers are increasingly preferred in environments requiring marketing materials, reports, and design-related documentation, which command higher value per page and contribute significantly to vendor revenues. Monochrome copiers continue to retain relevance in cost-sensitive environments such as government offices, education institutions, and small businesses, where high-volume black-and-white printing remains the priority due to lower operational costs.

Multifunction copiers (MFPs) represent the largest functionality segment, contributing nearly 72% of total market value. The growth of MFPs is fueled by organizations’ desire to consolidate office equipment, reduce device redundancy, and optimize space and IT infrastructure. The multifunctionality trend also supports energy efficiency, lowers maintenance overheads, and integrates digital workflow capabilities, particularly scanning, cloud connectivity, and secure printing, which are increasingly critical in hybrid and remote work environments. Vendors are focusing on value-added features such as AI-driven document routing, automated workflow optimization, and user-based access control to maintain premium pricing and enhance differentiation in enterprise environments.

Technology Insights

Laser and electrophotographic copiers remain the backbone of the market, accounting for approximately 81% of total revenue. Their leading position is due to superior speed, reliability, longevity, and lower cost per page, making them ideal for high-volume corporate and government applications. Laser technology continues to evolve with lower energy consumption, faster warm-up times, and integration with MPS solutions, which further strengthens adoption in enterprise settings.

Inkjet copiers are gaining traction in smaller offices and home-office setups, particularly where low-volume, high-quality color output is needed without significant upfront investment. Digital production copiers are increasingly adopted by commercial print shops, in-house print departments, and on-demand print services, where flexibility, fast turnaround, and the ability to handle short-run high-quality prints drive growth. These segments are particularly influenced by marketing, retail, and education applications, where print personalization and customization are key.

End-Use Insights

Corporate offices and SMEs represent the largest end-use segment, contributing roughly 41% of global demand. The demand is driven by hybrid work models requiring secure and efficient document handling, cost optimization through fleet management, and consolidation of devices via MFP adoption. Government and education sectors are the fastest-growing segments due to increased administrative workloads, digitization of services, and examination-related printing requirements. In healthcare, copiers are essential for patient records, regulatory compliance documentation, and operational efficiency, driving steady adoption. Commercial print shops are increasingly investing in production-grade copiers to diversify their offerings, with demand fueled by short-run marketing materials, on-demand printing, and personalized print campaigns.

Distribution Channel Insights

Authorized dealers and value-added resellers dominate global distribution, accounting for approximately 57% of the market. Their strong local presence, service capabilities, and ability to provide integrated solutions make them preferred partners for corporate and government clients. Direct OEM sales remain important for large enterprises and institutional buyers seeking customized solutions, bulk contracts, and MPS agreements. Online B2B platforms are gradually expanding among SMEs, providing transparent pricing, faster procurement, and easier access to consumables and service support. Channel expansion, particularly digital platforms, is emerging as a key growth driver for small and mid-sized businesses in developing regions.

| By Product Type | By Functionality | By Technology | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 38% of the global copiers market in 2024, with China and Japan dominating in terms of market value. India is the fastest-growing major market, experiencing a CAGR exceeding 5%. Regional growth is driven by SME expansion, rapid digitization of government and educational institutions, and increasing adoption of MFPs to streamline office workflows. Urbanization, the proliferation of start-ups, and rising office infrastructure investments are key enablers. Additionally, supportive government initiatives, such as India’s push for local manufacturing and Japan’s focus on energy-efficient office equipment, further stimulate demand for modern copiers.

North America

North America holds approximately 27% of the global market share, led by the United States. The region benefits from high penetration of managed print services (MPS), frequent fleet upgrades, and strong demand for premium and multifunction copiers. Key growth drivers include enterprise digital workflow adoption, regulatory compliance requirements for secure document handling, and a trend toward integrating AI-driven document management solutions. North American buyers increasingly focus on sustainability and energy-efficient devices, which also contributes to the adoption of next-generation copiers with low power consumption and eco-friendly toner technologies.

Europe

Europe shows steady, replacement-driven demand, with Germany, the U.K., and France serving as major markets. Growth is fueled by strict sustainability and energy-efficiency regulations, frequent fleet refresh cycles in corporate and public institutions, and increased MFP adoption for workflow optimization. European enterprises are also integrating copiers with document security and digital compliance solutions, which support the adoption of premium devices. The growing emphasis on environmentally responsible procurement and green IT initiatives is encouraging manufacturers to provide energy-efficient, certified products, thereby sustaining market expansion.

Middle East & Africa

Growth in the Middle East & Africa is supported by robust office infrastructure development in GCC countries and rising public sector investments in South Africa and other select African economies. Drivers include modernization of government offices, digitization of administrative processes, and SME expansion in urban centers. Additionally, regional incentives for technology adoption and import-friendly policies encourage organizations to invest in multifunction, energy-efficient copiers. Corporate and government demand for high-quality color and multifunction devices is particularly strong in countries like the UAE, Saudi Arabia, and South Africa.

Latin America

Brazil and Mexico lead regional demand, supported by a gradual recovery in office investments, corporate modernization, and growing awareness of managed print services. Leasing and subscription models are increasingly preferred due to cost efficiency, especially among SMEs and public institutions. Additional drivers include urban office expansion, adoption of color and multifunction devices to meet marketing and operational needs, and increasing digitization initiatives in government and educational institutions. Brazil’s corporate sector, in particular, is investing in production-grade copiers for internal marketing, printing, and document management.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Copiers Market

- Canon Inc.

- Ricoh Company, Ltd.

- Xerox Holdings Corporation

- Konica Minolta, Inc.

- Sharp Corporation

- Kyocera Corporation

- HP Inc.

- Toshiba Corporation

- Fujifilm Business Innovation

- Lexmark International