Cooler Bags Market Size

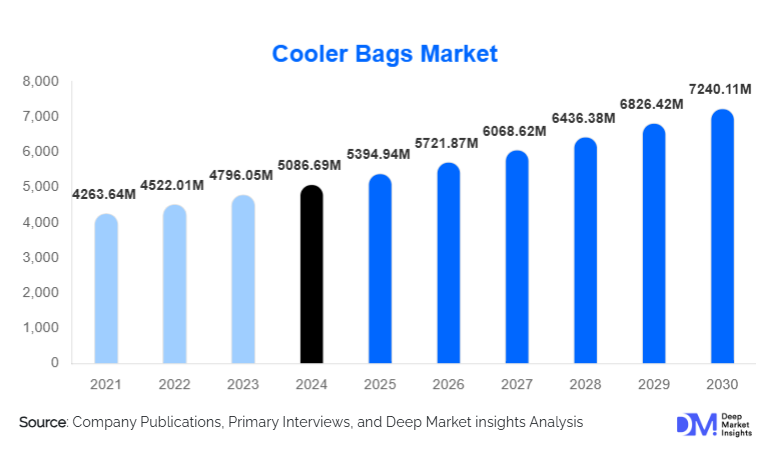

According to Deep Market Insights, the global cooler bags market size was valued at USD 5,086.69 million in 2024 and is projected to grow from USD 5,394.94 million in 2025 to reach USD 7,240.11 million by 2030, expanding at a CAGR of 6.06% during the forecast period (2025–2030). The cooler bags market growth is primarily driven by the rapid expansion of food delivery services, rising demand for portable cold storage solutions, increasing outdoor and recreational activities, and growing pharmaceutical cold-chain requirements across both developed and emerging economies.

Key Market Insights

- Food & beverage applications dominate global demand, supported by grocery delivery, catering, and on-the-go consumption trends.

- Soft-sided cooler bags remain the most preferred product type, owing to their lightweight design, affordability, and versatility.

- North America leads the global market, driven by a strong outdoor recreation culture and advanced last-mile logistics.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and expanding cold-chain infrastructure.

- Sustainability-focused materials, such as recycled fabrics and bio-based insulation, are gaining rapid adoption.

- Technological advancements, including vacuum insulation panels and hybrid electric-assisted cooling, are enhancing product performance.

What are the latest trends in the cooler bags market?

Sustainable and Eco-Friendly Cooler Bags

Sustainability is emerging as a defining trend in the cooler bags market. Manufacturers are increasingly adopting recycled PET fabrics, solvent-free laminations, and bio-based insulation materials to align with global environmental regulations and consumer preferences. Retailers and institutional buyers are prioritizing eco-certified products, particularly in Europe and North America, where sustainability compliance influences procurement decisions. This trend is also enabling premium pricing, as environmentally responsible cooler bags are perceived as higher-value products.

Advanced Insulation and Smart Cooling Technologies

Innovation in insulation technology is reshaping the market landscape. Vacuum-insulated panels (VIPs), phase-change materials, and multi-layer reflective foils are being integrated into premium cooler bags to extend thermal retention durations. Hybrid electric-assisted cooler bags, though still niche, are gaining traction in pharmaceutical and long-haul food transport applications. These advancements are expanding the functional scope of cooler bags beyond traditional recreational use.

What are the key drivers in the cooler bags market?

Growth of Food Delivery and Last-Mile Logistics

The rapid expansion of online food delivery, meal kits, and grocery platforms is a major driver for the cooler bags market. Cooler bags provide an efficient and flexible solution for maintaining food freshness during short-distance transport, making them indispensable in last-mile logistics. Rising urban populations and changing consumption patterns continue to support sustained demand from this segment.

Rising Outdoor Recreation and Travel Activities

Increasing participation in camping, hiking, beach tourism, sports events, and recreational travel is significantly boosting demand for portable cooling solutions. Backpacks and soft-sided cooler bags are particularly popular among consumers seeking convenience and portability. Post-pandemic lifestyle shifts toward outdoor experiences have further strengthened this driver.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in prices of petroleum-based foams, synthetic fabrics, and aluminum foils pose a challenge for manufacturers. Rising input costs directly impact margins, especially for small and mid-sized players that lack pricing power or long-term supply contracts.

Limited Thermal Performance for Long-Duration Use

Compared to rigid refrigeration systems, cooler bags offer limited cooling duration, restricting their use in long-haul or extended cold storage applications. This limits adoption in certain industrial and logistics use cases, requiring continuous technological innovation to overcome performance constraints.

What are the key opportunities in the cooler bags industry?

Pharmaceutical and Medical Cold-Chain Expansion

The growing distribution of vaccines, biologics, and temperature-sensitive medicines presents a significant opportunity for high-performance cooler bags. Demand is increasing for validated, portable cooling solutions that meet regulatory temperature compliance, particularly in emerging markets and remote healthcare delivery.

Emerging Market Urbanization and Local Manufacturing

Rapid urbanization in Asia-Pacific, Latin America, and the Middle East is driving demand for affordable cooler bags for food transport and recreational use. Localized manufacturing and region-specific product customization present strong opportunities for market expansion and cost optimization.

Product Type Insights

Soft-sided cooler bags dominate the global cooler bags market, accounting for the largest revenue share due to their lightweight construction, flexibility, and cost-effectiveness. Their widespread adoption across food delivery, travel, picnics, and recreational activities makes them the preferred choice for both consumers and commercial users. The leading growth driver for this segment is the rapid expansion of last-mile food and grocery delivery services, where portability and ease of handling are critical.

Backpack cooler bags are witnessing strong growth, supported by rising outdoor recreation, hiking, camping, and sports participation, particularly among younger demographics. Ergonomic designs, hands-free portability, and improved weight distribution are driving adoption in adventure and lifestyle applications. Hard-structured cooler bags continue to retain steady demand in commercial, industrial, and event-based applications where durability, higher load capacity, and rugged performance are essential. Meanwhile, hybrid electric-assisted cooler bags represent a high-growth niche segment, primarily catering to pharmaceutical distribution, specialty food logistics, and premium commercial use cases that require extended cooling duration and temperature stability.

Insulation Material Insights

Foam-based insulation materials account for the largest share of the cooler bags market due to their cost efficiency, scalability, and ease of mass production. These materials are widely used in soft-sided and mid-range cooler bags, making them suitable for high-volume consumer markets. The primary driver for foam-based insulation dominance is its favorable cost-to-performance ratio, particularly in price-sensitive regions.

Reflective foil and multilayer insulation solutions are commonly used in mid-range products, offering improved thermal efficiency without significant cost escalation. Vacuum insulated panels (VIPs), while currently holding a smaller market share, are gaining momentum in premium and professional-grade cooler bags. The key driver for VIP adoption is the growing demand for longer cooling durations in pharmaceutical, medical, and specialty food applications, where thermal performance directly impacts product safety and regulatory compliance.

Capacity Insights

Medium-capacity cooler bags (10–30 liters) represent the largest share of global demand, as they strike an optimal balance between portability and storage capacity. These products are extensively used for daily food transport, grocery delivery, short trips, and outdoor recreational activities. The leading driver for this segment is its versatility across multiple end-use applications, making it suitable for both individual consumers and small commercial users.

Small-capacity cooler bags (up to 10 liters) remain popular for personal use, office meals, and short-duration travel, particularly in urban environments. Large and extra-large cooler bags (above 30 liters) are primarily used in catering, events, group travel, and commercial cold transport, where higher volume handling is required. Growth in these segments is supported by rising event catering, outdoor gatherings, and small-scale food businesses.

Distribution Channel Insights

Offline retail channels, including hypermarkets, supermarkets, and specialty outdoor and sports stores, continue to dominate global sales due to strong product visibility, immediate product availability, and impulse purchasing behavior. The leading driver for offline dominance is consumer preference to physically evaluate product size, insulation thickness, and build quality before purchase.

However, online direct-to-consumer (D2C) and e-commerce platforms are growing at a faster pace, supported by expanding digital retail infrastructure, increasing smartphone penetration, and aggressive online discounting strategies. Brand-owned websites and marketplace platforms enable manufacturers to offer wider product assortments, customization options, and competitive pricing. Institutional and B2B sales channels play a critical role in pharmaceutical, healthcare, and commercial logistics segments, where bulk procurement and long-term supply contracts drive stable demand.

End-Use Application Insights

The food and beverage segment leads the cooler bags market, driven by the rapid growth of grocery delivery, catering services, meal kits, and outdoor food consumption. The key driver for this segment is the increasing reliance on short-distance cold transport solutions that maintain food freshness during transit.

Pharmaceutical and medical logistics represent the fastest-growing end-use segment, supported by vaccine distribution programs, biologics transport, home healthcare services, and emergency medical response requirements. Outdoor recreation and sports applications continue to expand steadily, driven by rising participation in camping, picnics, beach activities, and sports events. Industrial and commercial cold transport contributes stable demand, particularly in small-scale food processing, floral logistics, and specialty chemical handling.

| By Product Type | By Insulation Material | By Capacity | By Distribution Channel | By End-Use Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global cooler bags market, led by the United States. High participation in outdoor recreation, strong penetration of food delivery and meal-kit services, and widespread adoption of premium lifestyle products are key drivers of regional growth. Additionally, replacement demand and product premiumization, including the adoption of high-performance and branded cooler bags, support market maturity in the region.

Europe

Europe represents a significant share of the global market, with Germany, the United Kingdom, and France leading demand. Stringent sustainability regulations, strong consumer preference for eco-friendly and recyclable products, and well-developed cold-chain infrastructure are key growth drivers. Increasing outdoor leisure activities and rising demand for reusable food transport solutions further support market expansion across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by China and India. Rapid urbanization, expanding middle-class populations, rising disposable incomes, and the growth of online food delivery platforms are major drivers of demand. Additionally, increasing investments in pharmaceutical cold-chain logistics and local manufacturing capabilities are accelerating the adoption of both consumer and commercial cooler bags.

Latin America

Latin America is witnessing gradual but steady growth, supported by increasing food delivery adoption, expanding urban populations, and rising outdoor recreational activities in countries such as Brazil and Mexico. Improving retail infrastructure and growing awareness of portable cooling solutions are further contributing to regional market development.

Middle East & Africa

In the Middle East, hot climatic conditions, expanding food logistics networks, and rising tourism and outdoor dining culture are driving demand for cooler bags. In Africa, growth is supported by increasing use of cooler bags in healthcare delivery, vaccine distribution, and informal cold transport, particularly in regions with limited access to fixed refrigeration infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Cooler Bags Market

- YETI Holdings, Inc.

- Igloo Products Corp.

- The Coleman Company, Inc.

- Thermos L.L.C.

- Pelican Products, Inc.

- AO Coolers

- ENGEL Coolers

- RTIC Outdoors

- ORCA Coolers

- Stanley (PMI Worldwide)