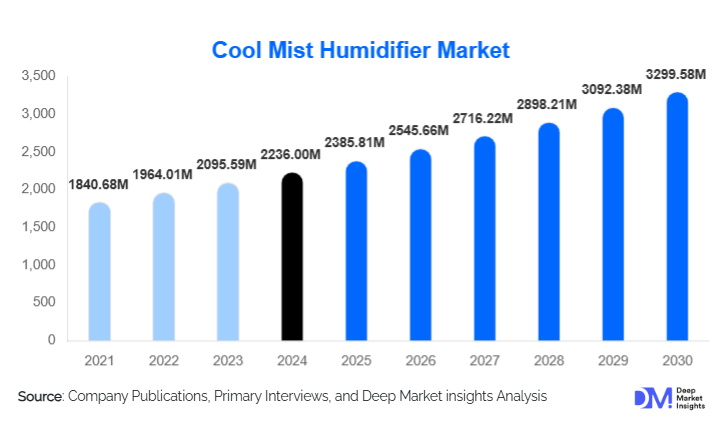

Cool Mist Humidifier Market Size

According to Deep Market Insights, the global cool mist humidifier market size was valued at USD 2236.00 million in 2024 and is projected to grow from USD 2385.81 million in 2025 to reach USD 3299.58 million by 2030, expanding at a CAGR of 6.70% during the forecast period (2025–2030). Market growth is primarily driven by rising consumer awareness of indoor air quality, increasing respiratory health concerns, rapid expansion of smart home ecosystems, and heightened demand for energy-efficient and contact-safe humidification systems across residential and commercial environments.

Key Market Insights

- Indoor air quality has become a global priority, accelerating the adoption of cool mist humidifiers for respiratory relief, improved sleep quality, and healthier living conditions.

- Smart humidifiers with IoT connectivity are rapidly gaining share, offering remote control, automation, and humidity-sensing capabilities.

- Ultrasonic cool mist humidifiers dominate the market due to quiet operation, compact size, and energy efficiency.

- Online retail channels lead global distribution, supported by product variety, competitive pricing, and consumer shift toward digital purchasing.

- Asia-Pacific is the fastest-growing region thanks to rapid urbanization, pollution concerns, and rising middle-class health consciousness.

- Healthcare and institutional demand are rising as humidifiers gain importance in respiratory therapy, patient comfort, and controlled-environment settings.

What are the latest trends in the Cool Mist Humidifier Market?

Smart and Connected Humidifiers Accelerating Adoption

Cool mist humidifiers are undergoing rapid technological transformation. Smart models equipped with Wi-Fi/Bluetooth connectivity, auto-humidity adjustment, voice assistant integration, and mobile app dashboards are becoming mainstream. These features allow users to monitor humidity levels, schedule mist cycles, and automate operations, creating a seamless smart-home experience. Younger consumers, especially in urban centers, prefer dual-function devices that combine air purification, aromatherapy, and micron-level mist control. As sensor prices decline and home-automation ecosystems expand, smart humidifiers are expected to capture an increasingly large market share. Manufacturers are also integrating advanced filtration systems and UV-C sterilization to improve water hygiene and mist purity.

Health and Wellness Integration

The cool mist humidifier market is benefiting from the broader global wellness movement. Consumers increasingly use humidifiers for sleep improvement, skin hydration, allergy relief, and respiratory comfort. This trend is especially strong in colder regions and polluted metropolitan areas, where indoor dryness exacerbates health issues. Wellness-oriented product designs, quiet operation, aromatherapy compatibility, and child-safe cool mist systems are attracting households, nurseries, and care centers. Marketing narratives are shifting from “comfort appliance” to “wellbeing enhancer,” deepening consumer engagement and product loyalty.

What are the key drivers in the Cool Mist Humidifier Market?

Growing Awareness of Respiratory Health and Indoor Air Quality

Global consumers increasingly recognize the harmful effects of dry indoor air, particularly its association with sinus irritation, allergies, asthma, and reduced sleep quality. As people spend more time indoors, due to remote work, climate shifts, and urban living, the need for comfortable, healthy indoor environments grows. Medical professionals and wellness experts commonly recommend cool mist humidifiers, further reinforcing demand across age groups, especially infants and the elderly.

Rise of Smart Home Ecosystems

The proliferation of connected home devices is driving strong demand for smart cool mist humidifiers. Wi-Fi-enabled models that integrate with Amazon Alexa, Google Home, and Apple HomeKit offer users frictionless control and automated humidity management. This shift toward intelligent climate solutions positions cool mist humidifiers as essential components of modern living spaces. Manufacturers are leveraging AI algorithms, improved sensors, and mobile-first experiences to differentiate offerings and increase average selling prices (ASPs).

What are the restraints for the global market?

Seasonality of Demand and Market Volatility

Demand for cool mist humidifiers spikes during winter and dry seasons but declines in humid months, creating strong seasonality that affects revenue predictability for manufacturers. Retailers face inventory challenges, while brands often reduce margins during off-season periods to maintain sales flow. This cyclical demand pattern limits uniform year-round growth and complicates forecasting in emerging regions with variable climates.

Price Sensitivity in Developing Markets

While developed economies readily adopt premium smart humidifiers, many consumers in Asia, Africa, and Latin America remain highly price sensitive. The presence of low-cost, unbranded humidifiers poses competitive pressure on global manufacturers. Cost barriers also slow the adoption of advanced features like UV-C sanitization and IoT modules. As a result, premium brands must balance innovation and affordability to penetrate high-growth regions.

What are the key opportunities in the Cool Mist Humidifier Market?

Expansion of Healthcare and Institutional Applications

Hospitals, clinics, eldercare facilities, and rehabilitation centers are increasingly integrating cool mist humidifiers to enhance patient comfort, improve respiratory therapy outcomes, and maintain optimal humidity in controlled environments. The aging global population and rise in chronic respiratory conditions present robust long-term institutional demand. Purpose-built medical humidifiers with filtration and sterilization features represent a high-value subsegment for manufacturers.

Emerging Demand in Asia-Pacific and Latin America

Rapid urbanization, higher pollution levels, rising middle-class affluence, and increasing health awareness are fueling demand in China, India, Brazil, and Mexico. These markets offer substantial volume opportunities for mid-priced humidifiers. Localization strategies, including region-specific product design, local assembly, and targeted e-commerce campaigns, can unlock significant new revenue pools for global brands. The growing popularity of wellness devices in APAC further strengthens this opportunity.

Product Type Insights

Ultrasonic cool mist humidifiers dominate the global market, accounting for approximately 45–50% of total 2024 revenue. Their whisper-quiet operation, energy efficiency, small footprint, and ability to produce ultra-fine mist make them ideal for bedrooms, nurseries, and personal spaces. Evaporative humidifiers appeal to consumers seeking natural moisture dispersion and filtration, while impeller models remain cost-effective alternatives in budget segments. Smart humidifiers are the fastest-growing product category, supported by integration with connected-home ecosystems and demand for automated climate control.

Application Insights

The residential segment holds the largest share of the cool mist humidifier market, driven by heightened household adoption for comfort, sleep improvement, and children's health. Commercial applications, including offices, retail spaces, and hospitality, are expanding as employers emphasize worker wellbeing and indoor environmental standards. Healthcare remains a high-value application segment, offering opportunities for specialized, sterilization-enabled humidification systems. Industrial usage is niche but growing in sectors where humidity influences material stability, such as electronics and printing.

Distribution Channel Insights

Online retail is the leading distribution channel, commanding roughly 40–45% of global sales due to ease of comparison, extensive product variety, competitive pricing, and fast delivery options. Marketplaces like Amazon, JD.com, and Flipkart are key growth facilitators. Offline retail, including specialty appliance stores and hypermarkets, remains significant in regions where consumers prefer hands-on product evaluation. Direct-to-consumer (D2C) channels are also rising as brands enhance digital presence through branded websites, influencer marketing, and subscription replenishment models for filters and accessories.

End-User Insights

Households represent the dominant end-user group, accounting for nearly 60% of the market in 2024. Telecommuting trends and rising wellness lifestyles boost residential demand. Corporate offices are adopting humidifiers to improve employee comfort and productivity. Educational institutions and hospitality venues are integrating humidifiers to enhance indoor ambiance and reduce pathogen spread. Healthcare settings remain an essential growth avenue due to patient-care applications and controlled environment requirements.

| By Product Technology | By Application | By Distribution Channel | By Tank Capacity | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global cool mist humidifier market (30–33%). High consumer awareness, strong purchasing power, and widespread adoption of smart home devices drive regional demand. The U.S. leads consumption, supported by dry winter climates and advanced retail infrastructure. Commercial and healthcare applications are rapidly expanding with increased focus on indoor air quality standards.

Europe

Europe accounts for 25–28% of global revenue, driven by demand from Germany, the U.K., France, and the Nordics. The region's cold climate and stringent energy efficiency regulations favor the adoption of low-power, eco-friendly cool mist systems. Increasing preference for wellness devices and indoor comfort technologies strengthens long-term demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a projected CAGR of 10–12%. Rapid urbanization, pollution challenges, and rising middle-class wealth in China and India are driving mass-market adoption. Japan and South Korea represent high-value segments for advanced smart humidifiers, while China remains both a manufacturing hub and a major consumer market.

Latin America

Latin America shows growing adoption, particularly in Brazil, Mexico, and Argentina. Health awareness campaigns and increased e-commerce penetration are boosting sales. Budget and mid-range models dominate due to regional price sensitivity.

Middle East & Africa

MEA adoption is rising, led by GCC countries, where desert climates and high indoor AC usage create environments conducive to humidifier use. The hospitality sector in the UAE and Saudi Arabia is increasingly adopting commercial humidifiers to enhance guest comfort.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cool Mist Humidifier Market

- Honeywell International Inc.

- Dyson Ltd.

- Newell Brands

- De’Longhi Appliances

- Condair Group AG

- Carel Industries

- Crane USA

- BONECO AG

- Pure Enrichment

- Levoit

- Panasonic Corporation

- Sharp Corporation

- Electrolux AB

- Temtop

- Vornado Air LLC

Recent Developments

- In March 2025, Dyson announced a new generation of purifying humidifiers integrating AI-driven moisture sensing and anti-bacterial water treatment.

- In January 2025, Honeywell expanded its smart home appliance portfolio with a low-noise ultrasonic humidifier line targeting the premium residential segment.

- In April 2025, Crane USA introduced eco-friendly humidifier models using recyclable materials and low-energy ultrasonic modules.