Converted Paper Market Size

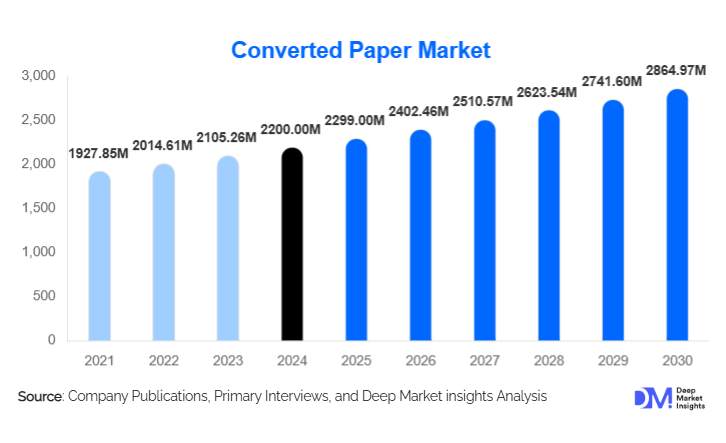

According to Deep Market Insights, the global converted paper market size was valued at USD 2,200.00 million in 2024 and is projected to grow from USD 2,299.00 million in 2025 to reach USD 2,864.97 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The converted paper market growth is primarily driven by the rapid substitution of plastic-based materials, rising demand for sustainable packaging solutions, expanding tissue and hygiene consumption, and increasing use of specialty and functional paper across industrial and commercial applications.

Key Market Insights

- Packaging converted paper remains the dominant segment, accounting for nearly half of global demand due to food, beverage, and e-commerce growth.

- Sustainability regulations are accelerating fiber-based material adoption, particularly in Europe and North America.

- Asia-Pacific leads global production and consumption, supported by strong manufacturing bases in China and India.

- Tissue and hygiene paper demand continues to rise structurally, driven by urbanization and post-pandemic hygiene awareness.

- Technological advancements in coating and barrier treatments are expanding paper’s application into areas traditionally dominated by plastics.

- The market remains moderately fragmented, with the top five players accounting for roughly one-third of global revenues.

What are the latest trends in the converted paper market?

Shift Toward Plastic-Substitute Packaging

One of the most prominent trends in the converted paper market is the accelerated shift toward plastic replacement in packaging applications. Governments worldwide are enforcing bans and restrictions on single-use plastics, driving brand owners to adopt paper-based cartons, bags, wraps, and coated packaging solutions. Converted paper with advanced barrier properties—such as grease resistance, moisture control, and oxygen barriers—is increasingly used in food service, ready-to-eat meals, and takeaway packaging. This trend is strengthening investments in coated and laminated paper technologies and driving innovation in recyclable and compostable paper grades.

Rising Demand for Functional & Specialty Papers

Beyond traditional packaging and printing, demand for specialty converted papers such as thermal paper, release liners, medical-grade paper, and electrical insulation paper is growing steadily. These products benefit from higher margins and long-term contracts with industrial and healthcare customers. Digitally enabled converting, precision coating, and silicone treatment technologies are increasingly adopted to meet stringent performance requirements. The expansion of logistics tracking, labeling, and pharmaceutical packaging is further reinforcing this trend globally.

What are the key drivers in the converted paper market?

Growing Sustainability & ESG Compliance

Corporate sustainability goals and ESG compliance are major drivers for the converted paper market. Large FMCG, retail, and food service brands are committing to recyclable and renewable packaging targets, directly boosting demand for paper-based alternatives. Governments are also incentivizing sustainable materials through regulations, procurement policies, and waste reduction mandates, ensuring long-term structural demand for converted paper products.

Expansion of E-commerce and Organized Retail

The rapid growth of e-commerce and organized retail is significantly increasing demand for corrugated boxes, folding cartons, protective paper, and branded packaging. Converted paper plays a critical role in last-mile delivery, product protection, and brand differentiation. Emerging markets are witnessing especially strong growth as digital commerce penetration rises, supporting sustained demand for packaging-grade converted paper.

What are the restraints for the global market?

Raw Material & Energy Price Volatility

Fluctuations in pulp prices, recovered paper availability, and energy costs pose challenges for converted paper manufacturers. These factors impact production costs and profit margins, particularly for commodity-grade products. Passing cost increases downstream remains challenging in highly competitive markets.

High Capital Intensity

Modern paper converting requires significant investment in coating, laminating, printing, and automation equipment. High capital requirements limit entry for small players and slow capacity expansion in developing regions, potentially constraining short-term supply growth.

What are the key opportunities in the converted paper industry?

Advanced Barrier & Functional Paper Innovation

There is a significant opportunity in developing high-performance barrier papers that can replace multi-layer plastic packaging. Innovations in water-based coatings, bio-based barriers, and recyclable laminates allow converted paper to enter premium food, pharmaceutical, and industrial packaging segments, offering higher margins and differentiation.

Emerging Market Manufacturing Expansion

Rapid urbanization and consumption growth in Asia-Pacific, Latin America, and parts of Africa present strong opportunities for local manufacturing expansion. Government initiatives such as “Make in India” and industrial modernization programs in Southeast Asia are encouraging investments in domestic paper converting capacity, reducing import dependence, and improving supply chain resilience.

Product Type Insights

Packaging converted paper dominates the market with an estimated 46% share of global revenue in 2024, supported by strong demand from food, beverage, and logistics sectors. Tissue and hygiene converted paper represents approximately 22% of the market, driven by rising per capita consumption and expanding healthcare use. Label and release paper accounts for around 12%, supported by growth in retail labeling and logistics tracking. Printing and writing converted paper continues to decline gradually in mature markets but remains relevant in emerging economies, while specialty and functional papers contribute nearly 10%, offering higher-margin growth opportunities.

End-Use Industry Insights

Food and beverage remains the largest end-use segment, accounting for approximately 34% of total demand, driven by packaged food consumption and regulatory shifts toward paper-based packaging. Healthcare and pharmaceuticals are among the fastest-growing end uses, supported by demand for medical-grade, sterile, and labeling papers. Retail and e-commerce logistics represent a rapidly expanding segment, while industrial applications such as filtration, insulation, and electrical components are emerging as niche but high-value uses for converted paper.

Distribution Channel Insights

Direct B2B supply contracts dominate the market, accounting for nearly 55% of total distribution, as large brand owners prefer long-term sourcing agreements. Converter-to-brand-owner supply chains remain critical, while institutional and government procurement supports steady demand for hygiene and packaging paper. Digital procurement platforms and contract-based sourcing models are gradually improving pricing transparency and supplier integration.

| By Product Type | By Raw Material Source | By Processing Technology | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global converted paper market with approximately 42% share in 2024. China and India dominate regional demand due to large packaging, tissue, and manufacturing sectors. Southeast Asian countries such as Vietnam and Indonesia are emerging as high-growth markets, supported by expanding FMCG production and export-oriented packaging demand.

North America

North America accounts for around 23% of global market share, driven by strong sustainability adoption, advanced packaging technologies, and high tissue consumption. The United States remains the largest national market, supported by food service, healthcare, and logistics demand.

Europe

Europe represents approximately 21% of global demand, with Germany, France, Italy, and the UK leading consumption. Stringent environmental regulations and circular economy initiatives continue to accelerate the adoption of recycled and fiber-based converted paper products.

Latin America

Latin America is experiencing steady growth, led by Brazil and Mexico. Expanding food processing industries and retail modernization are key drivers, while local capacity expansion is reducing reliance on imports.

Middle East & Africa

Demand in the Middle East & Africa is supported by food packaging, hygiene products, and infrastructure development. The UAE and Saudi Arabia lead regional consumption, while South Africa remains the primary African manufacturing hub.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Converted Paper Market

- International Paper

- Smurfit Kappa

- WestRock

- Mondi Group

- Stora Enso

- DS Smith

- Oji Holdings

- UPM-Kymmene

- Nippon Paper Industries

- Sappi

- Georgia-Pacific

- Nine Dragons Paper

- Metsä Group

- Packaging Corporation of America

- Lee & Man Paper