Contemporary Height Adjustable Desk Market Size

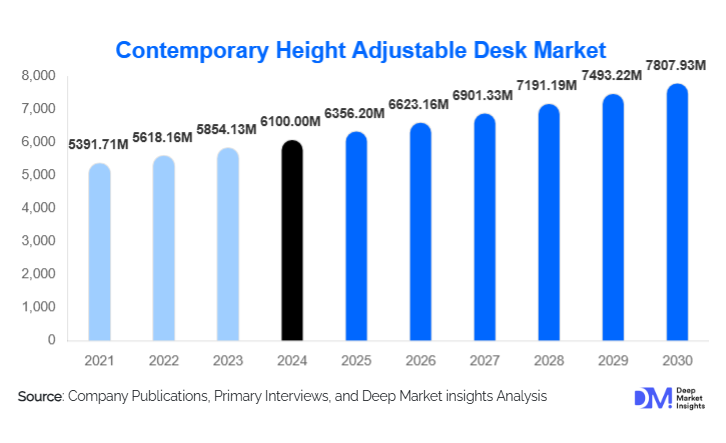

According to Deep Market Insights, the global contemporary height-adjustable desk market size was valued at USD 6,100.00 million in 2024 and is projected to grow from USD 6,356.20 million in 2025 to reach USD 7,807.93 million by 2030, expanding at a CAGR of 4.2% during the forecast period (2025–2030). The market growth is primarily driven by rising ergonomic awareness, widespread adoption of hybrid work models, increasing employer focus on employee wellness, and continuous innovation in electric and smart desk technologies.

Key Market Insights

- Electric height-adjustable desks dominate the market, accounting for over 70% of global revenue due to ease of use, programmability, and compatibility with modern office ecosystems.

- Corporate offices remain the largest end-use segment, supported by workplace wellness programs and office modernization initiatives.

- Home office demand is the fastest-growing segment, fueled by permanent remote and hybrid work adoption.

- North America leads global demand, driven by strong ergonomic regulations and high per-employee spending on furniture.

- The Asia-Pacific region is the fastest-growing, supported by the expansion of the IT sector, rising middle-class income, and manufacturing scale advantages.

- Smart and connected desks, featuring app controls, memory presets, and posture tracking, are accelerating premiumization trends.

What are the latest trends in the contemporary height-adjustable desk market?

Smart and Technology-Integrated Desks

Technology integration is reshaping the contemporary height-adjustable desk market. Manufacturers are increasingly embedding features such as Bluetooth connectivity, mobile app controls, posture reminders, usage analytics, and IoT-enabled height synchronization. These innovations are particularly attractive to large enterprises and co-working space operators seeking to improve productivity and employee wellness outcomes. Anti-collision sensors, quiet motor systems, and programmable memory controls are becoming standard even in mid-range desks, raising average selling prices while improving user experience.

Sustainable and Eco-Friendly Desk Design

Sustainability has emerged as a key purchasing criterion, especially among corporate buyers in Europe and North America. Desk manufacturers are adopting FSC-certified wood, recycled steel frames, low-VOC finishes, and carbon-neutral manufacturing processes. Circular economy practices, including modular components, repairable motors, and recycling programs, are gaining traction. These sustainability-driven designs not only meet regulatory expectations but also enhance brand differentiation and long-term procurement contracts.

What are the key drivers in the contemporary height-adjustable desk market?

Rising Ergonomic Awareness and Workplace Wellness

Growing awareness of the health risks associated with prolonged sitting has positioned height-adjustable desks as essential ergonomic solutions. Employers are increasingly investing in sit-stand desks to reduce musculoskeletal disorders, absenteeism, and long-term healthcare costs. Occupational health guidelines and ergonomic standards across developed markets are further reinforcing adoption, particularly in corporate and institutional environments.

Expansion of Hybrid and Remote Work Models

The structural shift toward hybrid and remote work has permanently increased demand for ergonomic home office furniture. Employees are investing in professional-grade adjustable desks to replicate office comfort at home, driving strong growth through e-commerce and direct-to-consumer channels. This driver has significantly expanded the addressable market beyond traditional corporate procurement.

What are the restraints for the global market?

High Initial Cost Compared to Conventional Desks

Height-adjustable desks carry a higher upfront cost than fixed desks, particularly electric and premium models. This limits adoption among price-sensitive small businesses, educational institutions, and consumers in emerging markets. While long-term health benefits are well documented, budget constraints remain a key barrier to mass penetration.

Raw Material Price Volatility

Fluctuations in steel, aluminum, engineered wood, and electric motor costs directly impact manufacturing margins and pricing strategies. Supply chain disruptions and rising material prices can constrain profitability or lead to higher end-user prices, potentially slowing demand growth.

What are the key opportunities in the contemporary height-adjustable desk industry?

Government and Institutional Ergonomic Mandates

Government-backed workplace health initiatives and ergonomic compliance regulations present strong opportunities for market expansion. Public sector offices, educational institutions, and healthcare facilities are increasingly upgrading furniture to meet ergonomic standards, creating large-volume, long-term procurement opportunities for manufacturers.

Emerging Market and Local Manufacturing Expansion

Rapid urbanization, IT sector growth, and outsourcing-driven employment in Asia-Pacific and Latin America are driving demand for affordable, compact adjustable desks. Localized manufacturing supported by initiatives such as “Make in India” and “Made in China 2025” offers cost advantages and faster market penetration for global and regional players.

Product Type Insights

Electric height-adjustable desks account for approximately 72% of the global market in 2024, driven by superior usability, higher load capacity, and smart feature integration. Manual desks serve niche price-sensitive segments, while hybrid desks are gaining limited traction in specialized applications. Dual-motor electric desks lead within the electric category due to improved stability and durability, particularly in corporate environments.

End-Use Insights

Corporate offices represent the largest end-use segment, contributing nearly 41% of global demand in 2024. Home offices are the fastest-growing segment, expanding at a CAGR exceeding 14%, supported by remote work adoption. Educational institutions, healthcare facilities, and R&D centers are emerging end uses, integrating adjustable desks into labs, classrooms, and rehabilitation environments.

Distribution Channel Insights

Direct B2B sales dominate the market with around 38% share, driven by enterprise contracts and bulk procurement. E-commerce platforms are the fastest-growing channel, accounting for over 22% of sales, supported by home office demand and improved online customization tools. Specialty furniture retailers and office integrators continue to play a critical role in premium and institutional sales.

| By Product Type | By Desk Configuration | By Material Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market share in 2024, led by the United States. High ergonomic awareness, strong corporate spending, and mature office infrastructure support sustained demand. Canada contributes through institutional and government procurement programs.

Europe

Europe holds nearly 28% of the market, driven by Germany, the U.K., and France. Strict workplace health regulations and sustainability mandates are key growth drivers, with strong adoption in both corporate and public sectors.

Asia-Pacific

Asia-Pacific represents around 24% of global demand and is the fastest-growing region, with a CAGR above 13%. China leads manufacturing and domestic consumption, while India and Southeast Asia are emerging demand hubs.

Latin America

Latin America accounts for roughly 8% of the market, led by Brazil and Mexico. Growth is supported by multinational office expansion and increasing awareness of ergonomic solutions.

Middle East & Africa

The Middle East & Africa region contributes about 6% of global demand, driven by office infrastructure development in the UAE and Saudi Arabia, along with gradual adoption across Africa’s commercial hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Contemporary Height Adjustable Desk Market

- Herman Miller

- Steelcase

- Haworth

- IKEA

- HNI Corporation

- Okamura Corporation

- Kinnarps

- Humanscale

- Vitra

- FlexiSpot

- Vari

- Teknion

- Kimball International

- Fully (Jarvis)

- Ergonofis