Contact Lenses Solutions Market Size

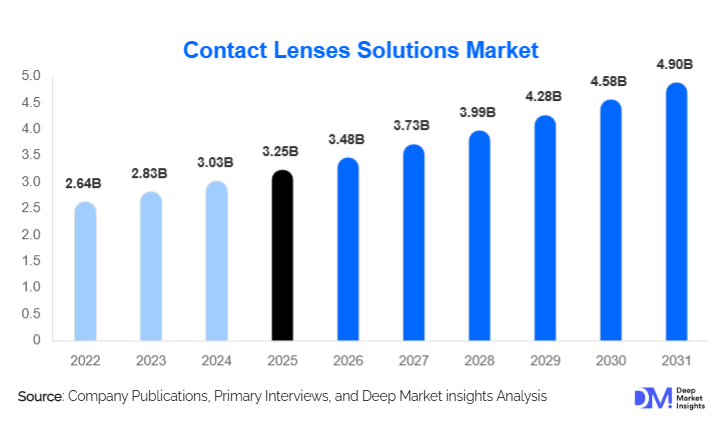

According to Deep Market Insights, the global contact lenses solutions market size was valued at USD 3.25 billion in 2025 and is projected to grow from USD 3.48 billion in 2026 to reach USD 4.90 billion by 2031, expanding at a CAGR of 7.1% during the forecast period (2026–2031). The market growth is primarily driven by the rising prevalence of refractive errors, increasing adoption of contact lenses across age groups, and growing awareness regarding proper lens hygiene and eye health.

Key Market Insights

- Multipurpose contact lens solutions dominate the market due to convenience, cost efficiency, and wide compatibility with soft lenses.

- Preservative-free and hydrogen peroxide-based solutions are gaining traction, driven by rising cases of dry eye syndrome and sensitivity concerns.

- North America leads global demand, supported by high contact lens penetration, strong compliance, and premium product adoption.

- Asia-Pacific is the fastest-growing region, fueled by rising myopia prevalence, urbanization, and expanding middle-class populations.

- E-commerce and direct-to-consumer channels are reshaping distribution, enabling recurring purchases and subscription-based models.

- Product innovation focused on comfort and biocompatibility is driving premiumization and value growth.

What are the latest trends in the contact lenses solutions market?

Shift Toward Preservative-Free and Advanced Disinfection Systems

One of the most prominent trends in the contact lenses solutions market is the growing shift toward preservative-free and hydrogen peroxide-based cleaning systems. Consumers are increasingly aware of preservative-related eye irritation, especially among long-term users and patients with dry eye conditions. Hydrogen peroxide solutions offer superior disinfection and reduced chemical exposure, making them particularly popular among sensitive users. Manufacturers are investing heavily in neutralization technologies and improved packaging systems to enhance safety and ease of use, accelerating adoption across developed and emerging markets.

Digital Commerce and Subscription-Based Models

The increasing penetration of e-commerce platforms is transforming how contact lens solutions are purchased. Online pharmacies, brand-owned websites, and optical retail platforms now offer subscription-based replenishment models, ensuring consistent product availability and improving consumer compliance. These digital channels also enable brands to bundle solutions with contact lenses and accessories, enhancing customer retention. Younger consumers, in particular, prefer the convenience, pricing transparency, and personalized recommendations enabled by digital platforms.

What are the key drivers in the contact lenses solutions market?

Rising Global Burden of Refractive Errors

The growing prevalence of myopia, hyperopia, and astigmatism is a major driver of contact lens adoption, directly fueling demand for lens care solutions. Increased screen exposure, sedentary lifestyles, and reduced outdoor activity have significantly raised vision correction needs, particularly among younger populations. As reusable contact lenses remain widely used, recurring consumption of cleaning and disinfecting solutions continues to support stable market growth.

Increasing Awareness of Eye Health and Hygiene

Heightened awareness regarding eye infections and lens-related complications has strengthened adherence to recommended cleaning routines. Eye care professionals and public health initiatives emphasize proper lens hygiene to prevent conditions such as microbial keratitis, boosting demand for high-quality disinfecting solutions. This awareness has led consumers to trade up from basic saline products to advanced multipurpose and peroxide-based systems.

What are the restraints for the global market?

Rising Adoption of Daily Disposable Contact Lenses

The increasing popularity of daily disposable contact lenses poses a structural restraint to the contact lenses solutions market, as these lenses eliminate the need for cleaning and storage solutions. This trend is particularly pronounced in North America and Western Europe, where convenience-oriented consumers and new lens users favor disposables, limiting volume growth in mature markets.

Price Sensitivity in Emerging Economies

In price-sensitive regions, particularly parts of Asia, Latin America, and Africa, affordability constraints limit the adoption of premium lens care solutions. Some consumers resort to suboptimal cleaning practices or low-cost, unbranded products, which can restrict market value growth and pose safety concerns for established brands.

What are the key opportunities in the contact lenses solutions industry?

Expansion in Emerging Asia-Pacific Markets

Asia-Pacific represents a major growth opportunity, driven by rising urban myopia rates, expanding access to vision care, and improving disposable incomes. Countries such as China, India, and Southeast Asian nations are witnessing rapid increases in first-time contact lens users. Manufacturers that invest in localized production, affordable product formats, and educational marketing campaigns can significantly expand their market footprint.

Technological Innovation and Smart Packaging

Innovation in formulation chemistry, moisture-retention agents, and biocompatible surfactants offers opportunities for differentiation. Additionally, smart packaging features such as QR codes for usage guidance and compliance reminders can enhance user engagement and brand loyalty. These advancements support premium pricing and long-term customer retention.

Product Type Insights

Multipurpose solutions (MPS) continue to dominate the contact lenses solutions market, accounting for approximately 52% of the global market share in 2025. Their leadership is driven by their all-in-one capabilities, combining cleaning, disinfecting, rinsing, and storage in a single product, which appeals to the majority of soft lens users seeking convenience and safety. The segment’s growth is further fueled by increased consumer awareness of eye hygiene and the rise in reusable soft contact lens adoption globally. Hydrogen peroxide-based solutions represent a premium and fast-growing segment, preferred by consumers with sensitive eyes and those seeking superior disinfection efficacy, particularly in developed markets with high disposable incomes. Saline solutions remain essential for rinsing and storing lenses, while enzymatic cleaners and rewetting drops address niche needs, such as protein removal and comfort enhancement, and are often adopted in specialty clinical applications or by frequent lens users. Overall, the product type landscape reflects a balance between volume-driven multipurpose solutions and value-driven premium offerings, with innovation in comfort, safety, and user convenience serving as a key driver for continued adoption.

Lens Compatibility Insights

Solutions formulated for soft contact lenses lead the market, accounting for nearly 68% of total demand. This dominance is supported by the global prevalence of soft lenses, which offer comfort, affordability, and cosmetic versatility, making them the lens type of choice for both first-time and long-term users. Rigid gas permeable (RGP) and specialty lens solutions occupy smaller market shares but show steady growth, driven by increasing use of scleral lenses, orthokeratology lenses, and specialty lenses for therapeutic applications. Growth in these segments is underpinned by rising awareness of advanced vision correction options, higher adoption of post-surgical lenses, and expanding clinical recommendations for customized lens care routines. As lens technology evolves, specialized solutions are increasingly recognized as necessary for maintaining lens longevity and ocular health, which in turn is fueling segment growth.

Distribution Channel Insights

Optical retail stores remain the primary distribution channel, accounting for approximately 38% of global sales. This dominance is attributable to the influence of professional recommendations, as optometrists and eye care specialists strongly guide purchasing decisions for lens care products. Pharmacies and drug stores maintain steady demand due to their accessibility and trustworthiness, particularly for routine lens solutions. However, e-commerce channels are the fastest-growing segment, capturing over 21% of the market and expanding at double-digit rates. Growth in online channels is fueled by convenience, subscription-based delivery models, bundled product offerings, and targeted digital marketing. Younger, tech-savvy consumers increasingly prefer the ease of online replenishment, while established players leverage e-commerce platforms to enhance brand loyalty and capture recurring revenue streams.

End-Use Insights

Individual consumers dominate demand in the contact lenses solutions market, accounting for approximately 82% of total consumption. Daily use, recurring purchasing behavior, and increasing penetration of soft lenses drive this segment. Hospitals, eye clinics, and other institutional buyers represent a smaller but high-value segment, primarily focused on specialty solutions, post-surgical lens care, and therapeutic lenses. Growing adoption of specialty lenses such as scleral and orthokeratology lenses is creating opportunities for institutions to procure premium solutions for clinical and corrective applications. Overall, end-user dynamics highlight a dual strategy: volume-driven growth from individual consumers and value-driven growth from clinical and institutional adoption.

| By Product Type | By Lens Compatibility | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global contact lenses solutions market in 2025, led by the United States. The region benefits from high contact lens penetration, well-established optical retail chains, and strong regulatory standards ensuring product quality and safety. Premium solution adoption, particularly hydrogen peroxide-based and preservative-free formulations, is robust due to heightened consumer awareness of ocular health and the prevalence of sensitive eyes. Market growth is supported by drivers such as rising disposable incomes, widespread adoption of reusable lenses, and growing focus on eye hygiene education by healthcare professionals. Furthermore, increasing awareness of eye infections and the importance of lens hygiene encourages repeat purchases, reinforcing stable market value growth.

Europe

Europe holds nearly 27% of global demand, with Germany, the U.K., and France serving as key markets. Growth in this region is driven by stringent regulatory standards, consumer preference for preservative-free and advanced disinfection solutions, and the adoption of multipurpose cleaning systems for soft lenses. Increased healthcare spending, aging populations with a higher incidence of refractive errors, and growing adoption of premium and specialty lenses contribute to market expansion. Awareness campaigns by ophthalmic associations, along with guidance from eye care professionals, have strengthened compliance, making Europe a stable and mature market with moderate growth prospects, particularly in premium segments.

Asia-Pacific

Asia-Pacific represents approximately 24% of the market and is the fastest-growing region, with China leading at over 9% CAGR. The primary growth drivers include rising myopia prevalence due to digital device usage, expanding urban populations, increasing awareness of eye hygiene, and growing disposable incomes. Countries such as India, Japan, South Korea, and Southeast Asian nations are witnessing significant increases in first-time contact lens users, driving recurring demand for multipurpose and preservative-free solutions. Expanding optical retail networks and the rise of online platforms further enhance accessibility, while local manufacturing and government-led health initiatives encourage adoption. Premium segments, including hydrogen peroxide-based solutions, are growing rapidly among affluent consumers in metropolitan areas.

Latin America

Latin America shows moderate growth, led by Brazil and Mexico. Market expansion is driven by improving access to vision care services, increasing urbanization, and the gradual adoption of reusable contact lenses. Rising awareness of eye hygiene, partnerships with optometrists, and government initiatives to improve vision correction accessibility are key contributors. Premium solution adoption remains limited compared to North America and Europe, but multipurpose solutions dominate due to cost-effectiveness and ease of use. E-commerce growth in urban centers is beginning to influence purchasing behavior, particularly among younger consumers.

Middle East & Africa

The Middle East & Africa market is expanding steadily, supported by rising disposable incomes in Gulf countries, improving healthcare infrastructure, and increasing awareness of vision correction solutions. Premium solutions, particularly preservative-free and peroxide-based formulations, are gaining traction among affluent populations in countries such as the UAE, Saudi Arabia, and Qatar. Market growth is further supported by government investment in eye care programs, expanding optical retail networks, and increasing penetration of international lens care brands. In Africa, the demand is emerging, driven by urban population growth and initiatives to improve access to corrective eye care, presenting long-term opportunities for both multipurpose and specialty solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|