Consumer Shopping Cart Market Size

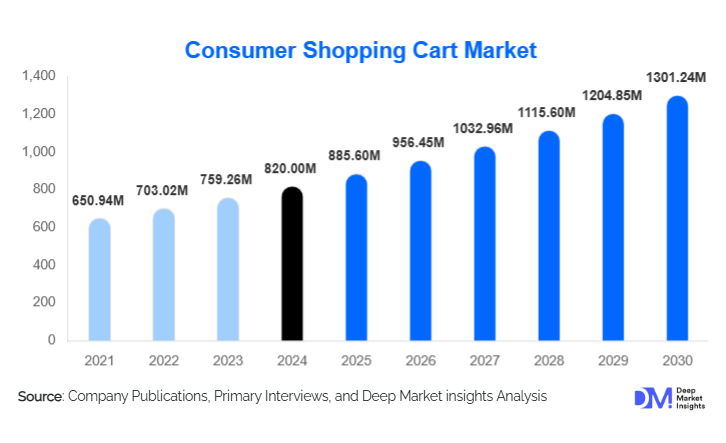

According to Deep Market Insights, the global consumer shopping cart market size was valued at USD 820.00 million in 2024 and is projected to grow from USD 885.60 million in 2025 to reach USD 1,301.24 million by 2030, expanding at a CAGR of 8.00% during the forecast period (2025–2030). Growth is primarily driven by the expansion of organised retail worldwide, rising demand for durable plastic/composite carts, and a gradual shift toward smart, technology-enabled carts equipped with sensors, digital displays, and self-checkout functionalities.

Key Market Insights

- Standard manual carts remain dominant, accounting for 60–65% of global demand due to long lifespans, low cost, and widespread use in supermarkets and hypermarkets.

- Plastic and composite carts are gaining popularity for their corrosion resistance, lighter weight, and reduced maintenance requirements.

- Asia-Pacific leads global demand, driven by the rapid expansion of supermarkets, hypermarkets, and convenience store chains.

- Smart carts represent the fastest-growing segment, supported by increasing retail automation and self-checkout initiatives.

- North America and Europe show strong replacement demand due to frequent store revamping and the adoption of tech-enabled retail solutions.

- Retail digitisation trends, including RFID, IoT, mobile payments, and AI-driven cart systems, are shaping the next generation of consumer shopping carts.

What are the latest trends in the consumer shopping cart market?

Smart, Connected, and Self-Checkout Carts

The rapid digital transformation of retail environments is fueling the adoption of smart carts equipped with barcode scanners, weight sensors, digital navigation screens, and in-cart payment modules. These carts improve in-store convenience by eliminating the checkout queue, enhancing customer satisfaction, and enabling retailers to track real-time inventory. AI-enabled features such as smart recommendations and route optimization are being explored by advanced retailers. These innovations are especially popular in North America and parts of Europe, where consumers value frictionless shopping and contactless interactions.

Sustainable and Composite Material Carts

Retailers worldwide are transitioning to plastic, polymer, and hybrid shopping carts to reduce maintenance and operational costs. Composite carts offer improved durability, rust resistance, and enhanced ergonomics, making them ideal for humid or coastal regions. Many retailers are also adopting recycled-plastic carts to meet sustainability goals and comply with stricter environmental guidelines. These trends have boosted demand for lightweight, eco-friendly carts that lower long-term ownership costs while contributing to corporate sustainability commitments.

What are the key drivers in the consumer shopping cart market?

Growth of Organized Retail Formats

The expansion of supermarkets, hypermarkets, discount stores, and big-box retailers, especially across Asia-Pacific, Latin America, and Africa, remains the primary driver of cart demand. Each new store requires dozens to hundreds of carts, creating recurring bulk procurement opportunities. Rising disposable incomes and rapid urbanization further accelerate store openings, boosting demand for both standard and customized carts globally.

Rising Interest in Retail Automation and Smart Store Concepts

Retailers are increasingly integrating automation systems such as self-checkout kiosks, RFID-enabled tracking, and AI-powered store analytics. Smart shopping carts play a crucial role in these ecosystems by reducing labor costs, optimizing customer flow, and enabling seamless checkout. Developed economies are leading the adoption of next-generation carts, while emerging markets show growing interest as retail digitization accelerates.

Shift Toward Lightweight, Low-Maintenance Materials

Plastic and composite carts are growing in popularity due to their durability, low maintenance, and lighter construction, which enhances shopper comfort. Retailers also benefit from reduced repair costs and longer product lifespans. This shift toward advanced materials supports global demand, especially in regions with high humidity, coastal climates, or high cart turnover.

What are the restraints for the global market?

Low Replacement Rates in Traditional Carts

Conventional metal and plastic carts are highly durable and can last for years, resulting in infrequent replacement cycles. This limits recurring demand, especially in saturated retail markets across North America and Europe. Retailers often delay cart replacement due to cost considerations, further slowing market expansion.

High Cost of Smart Cart Integration

Tech-enabled carts involve significant upfront investment in sensors, displays, IoT connectivity, and system integration. Retailers must also invest in supporting infrastructure, software updates, and maintenance. These high costs restrict adoption in cost-sensitive markets, limiting the scale of smart-cart deployment to large-format retailers with strong technology budgets.

What are the key opportunities in the consumer shopping cart industry?

Smart Cart Ecosystem Expansion

As retailers transition toward digital-first operations, smart carts offer vast opportunities for software providers, hardware manufacturers, and retail technology integrators. AI-driven navigation, personalized promotions, real-time inventory visibility, and autonomous checkout open new revenue streams. Vendors can also implement subscription-based service models for software updates, analytics dashboards, and maintenance, transforming the traditional one-time cart sale into a long-term service partnership.

Emerging Market Retail Expansion

Rapid growth in organized retail across India, China, Southeast Asia, Brazil, and parts of Africa presents major opportunities for cart manufacturers. Retail infrastructure investment is increasing, with new malls, hypermarkets, and convenience store chains emerging in urban and semi-urban regions. Offering region-specific, cost-effective carts tailored to local use conditions, such as compact carts for dense cities, can help vendors secure early market dominance.

Product Type Insights

Standard manual carts dominate the market with a 60–65% share in 2024, as they remain the preferred option for supermarkets, hypermarkets, and mass retailers. Plastic and composite carts continue to rise in adoption, driven by maintenance benefits and improved ergonomics. Smart carts, though representing only 5–10% of current demand, are the fastest-growing category thanks to retail digitization and self-checkout innovations.

Application Insights

Large-format retail, including supermarkets, hypermarkets, and big-box chains, accounts for 55–60% of cart demand worldwide. Convenience stores and small-format retailers are driving demand for compact and foldable carts, especially in dense urban markets. The rise of click-and-collect and omni-channel retail strategies is creating a new niche for specialized carts used for order picking, curbside delivery, and in-store fulfillment. Institutional buyers such as hospitals, schools, and facility operators also contribute to incremental but steady demand growth.

Distribution Channel Insights

Direct procurement from manufacturers dominates the shopping cart market, especially for large retail chains seeking high-volume purchases and customized designs. Regional distributors play a key role in serving small and medium-sized retailers. Increasingly, manufacturers are strengthening their digital sales channels, offering configuration tools, online catalogs, and virtual demonstrations for composite and smart cart solutions. E-procurement adoption among retail chains is also rising as part of broader digital transformation initiatives.

End-User Insights

Supermarkets and hypermarkets remain the largest end-users, followed by convenience stores and warehouse clubs. E-commerce-driven retail formats are increasingly purchasing specialized carts for order picking and in-store fulfillment. Household utility carts, used for small shopping trips, laundry, or storage, represent an emerging niche driven by urban living trends, though this segment remains smaller compared with commercial demand. Rapid expansion of organized retail across Asia-Pacific and Latin America will continue to shape end-user buying patterns through 2030.

| By Product Type | By Material Type | By Application | By Technology Level | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 25–30% of the market, supported by a mature retail ecosystem and high replacement demand. Adoption of smart carts is strongest in this region, driven by technology-forward retailers, rising labor costs, and the push for automated checkout solutions. The U.S. is the region’s largest market, followed by Canada, where plastic and composite carts are increasingly preferred.

Europe

Europe holds around 20–25% of the global market share, driven by established hypermarket chains and stringent quality standards. Retailers in Germany, France, and the U.K. are investing in composite carts and ergonomic designs to improve the shopper experience. Smart cart pilots are expanding across Western Europe, supported by strong consumer acceptance of digital retail technologies.

Asia-Pacific

APAC leads global demand with 30–35% market share in 2024. China and India drive much of the region’s car purchases, powered by rising urban incomes, rapid mall construction, and nationwide expansion of big-box retail. Southeast Asian markets, including Indonesia, Thailand, Vietnam, and the Philippines, are emerging as high-growth markets for both standard and compact carts.

Latin America

Latin America contributes 8–12% of market value, with Brazil and Mexico being the largest contributors. Growth is driven by supermarket expansion into tier-2 and tier-3 cities, as well as demand for durable carts suited to high-traffic stores. Composite carts are increasingly popular as they reduce long-term operating costs for regional retailers.

Middle East & Africa

MEA accounts for around 5–8% of demand but offers high growth potential. Gulf countries such as the UAE and Saudi Arabia are investing heavily in modern retail formats, fueling premium cart purchases and early adoption of smart carts. Africa’s demand is driven by supermarket expansion in South Africa, Kenya, and Nigeria, supported by growing middle-class populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Consumer Shopping Cart Market

- Wanzl

- Unarco

- Guangdong Winleader

- CADDIE

- Creaciones Marsanz

- Sambo Corp

- Versacart

- R.W. Rogers

- Kailiou

- Suzhou Hongyuan

- Advancecarts

- Guangzhou Shuang Tao

- Damix

- Rolser

- Rabtrolley

Recent Developments

- In March 2025, Wanzl announced a new line of hybrid smart carts integrating IoT sensors and cloud-based analytics for European hypermarket chains.

- In January 2025, Unarco introduced a lightweight composite cart platform designed for high-traffic retailers in North America.

- In April 2025, Guangdong Winleader expanded manufacturing facilities in Southeast Asia to meet rising demand from emerging retail chains.