Consumer Electronics Sensors Market Size

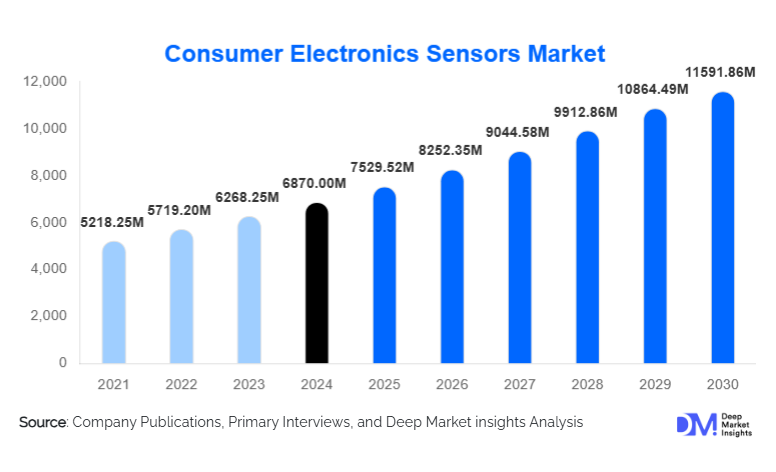

According to Deep Market Insights, the global consumer electronics sensors market size was valued at USD 6,870.00 million in 2024 and is projected to grow from USD 7,529.52 million in 2025 to reach USD 11,591.86 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025–2030). Market growth is primarily driven by rising sensor integration across smartphones, wearables, smart home devices, and emerging AR/VR platforms, along with continuous advancements in MEMS technology, sensor miniaturization, and AI-enabled sensing capabilities.

Key Market Insights

- Motion and optical sensors dominate demand due to their widespread use in smartphones, wearables, and gaming devices.

- Asia-Pacific accounts for the largest share of global production and consumption, led by China, South Korea, Japan, and Taiwan.

- Wearable devices represent the fastest-growing application segment, supported by rising health monitoring and fitness tracking adoption.

- Integrated sensor modules are increasingly preferred as OEMs prioritize compact device designs and lower assembly complexity.

- AI and sensor fusion technologies are reshaping product differentiation, enabling smarter, low-power, and context-aware consumer devices.

- Government semiconductor initiatives are accelerating local sensor manufacturing and supply chain resilience.

What are the latest trends in the consumer electronics sensors market?

AI-Enabled and Smart Sensor Integration

One of the most significant trends in the consumer electronics sensors market is the integration of artificial intelligence at the sensor level. AI-enabled sensors can preprocess data locally, reducing latency, power consumption, and reliance on cloud computing. This trend is particularly prominent in image sensors, biometric sensors, and motion sensors used in smartphones, smart home devices, and AR/VR systems. Sensor fusion, combining data from multiple sensors, has become a standard design approach, enhancing accuracy and contextual awareness. As consumer electronics increasingly adopt edge AI, demand for intelligent, low-power sensors continues to accelerate.

Miniaturization and Multi-Function Sensors

Advancements in MEMS fabrication and semiconductor packaging are enabling smaller, lighter, and more energy-efficient sensors. Multi-function sensors capable of performing multiple measurements within a single module are gaining traction, particularly in wearables and compact devices such as wireless earbuds and smart rings. This trend supports higher sensor density per device while maintaining battery efficiency and form-factor constraints, reinforcing long-term market growth.

What are the key drivers in the consumer electronics sensors market?

Rising Smart Device Penetration

The rapid global adoption of smartphones, wearables, and smart home devices remains the primary driver of sensor demand. Smartphones alone account for over 40% of total sensor revenues, as each device integrates accelerometers, gyroscopes, proximity sensors, ambient light sensors, image sensors, and biometric sensors. Continuous replacement cycles and increasing sensor counts per device sustain high shipment volumes.

Growth of IoT and Connected Ecosystems

The convergence of consumer electronics with IoT ecosystems is driving demand for environmental, motion, and proximity sensors. Smart homes, in particular, rely heavily on sensors for automation, security, and energy management. Expanding adoption of voice assistants and connected appliances further amplifies sensor requirements.

What are the restraints for the global market?

Semiconductor Supply Chain Volatility

The consumer electronics sensors market remains exposed to semiconductor supply disruptions, geopolitical tensions, and wafer capacity constraints. Shortages of advanced nodes and specialty materials can delay production schedules and increase costs, particularly for CMOS image sensors and advanced MEMS devices.

Pricing Pressure from OEMs

Intense competition among consumer electronics OEMs places sustained pricing pressure on sensor suppliers. Large-volume buyers demand continuous cost reductions, forcing manufacturers to balance innovation investments with margin preservation, which can limit profitability for smaller players.

What are the key opportunities in the consumer electronics sensors industry?

Expansion of Wearable and Health Monitoring Devices

Wearables represent one of the most attractive growth opportunities, driven by consumer demand for health, fitness, and wellness monitoring. Advanced biometric sensors such as heart rate, SpO₂, and skin temperature sensors are increasingly integrated into smartwatches and fitness bands. Aging populations and preventive healthcare trends further support long-term demand.

Government-Led Manufacturing and Localization Initiatives

Government programs such as “Make in India,” “Made in China 2025,” and semiconductor incentive schemes in the U.S. and Europe are encouraging domestic sensor production. These initiatives create opportunities for new entrants and existing players to expand manufacturing capacity, reduce supply chain risks, and access financial incentives.

Sensor Type Insights

Motion sensors remain the leading sensor category in the consumer electronics sensors market, accounting for approximately 28% of total market revenue in 2024. Their dominance is driven by near-universal integration across smartphones, wearables, gaming consoles, and AR/VR devices. Accelerometers and gyroscopes are essential for screen orientation, motion tracking, gesture recognition, and gaming controls, making them foundational components in both mass-market and premium devices. Continuous innovation in MEMS-based motion sensors, focused on lower power consumption, improved accuracy, and multi-axis functionality, has further reinforced their leadership position.

Optical sensors represent the second-largest segment, supported by strong demand for CMOS image sensors, proximity sensors, and ambient light sensors. The rapid evolution of smartphone camera systems, facial recognition features, and augmented reality applications has significantly increased optical sensor content per device. Meanwhile, biometric sensors are among the fastest-growing sensor types, fueled by heightened emphasis on device security, seamless authentication, and personalized user experiences. Fingerprint and facial recognition sensors are increasingly embedded across smartphones, laptops, and smart home access systems, with adoption accelerating in mid-range devices due to declining component costs and improved reliability.

Product Category Insights

Smartphones and tablets dominate the consumer electronics sensors market, contributing nearly 42% of total sensor revenues in 2024. This leadership is driven by high global shipment volumes and the increasing number of sensors integrated per device. Modern smartphones typically incorporate motion, optical, biometric, environmental, and proximity sensors, creating sustained, high-volume demand. Frequent replacement cycles and ongoing feature upgrades, such as advanced camera systems and biometric security, continue to support this segment’s market leadership.

Wearable devices represent the fastest-growing product category, expanding at a CAGR exceeding 12% during the forecast period. Growth is fueled by rising health awareness, preventive healthcare trends, and increasing adoption of smartwatches and fitness trackers with advanced biometric sensing capabilities. Smart home devices are emerging as another high-growth category, supported by expanding adoption of connected security systems, smart lighting, thermostats, and energy management solutions. These devices rely heavily on environmental, motion, and proximity sensors to enable automation, safety, and energy efficiency.

Integration Type Insights

Integrated sensor modules account for approximately 47% of total market share, reflecting OEM preference for compact, pre-calibrated, and highly reliable sensor solutions. Integrated modules simplify device design, reduce assembly complexity, and improve time-to-market, making them particularly attractive for smartphones, wearables, and smart home products where space constraints are critical. The growing trend toward sensor fusion, combining multiple sensing functions into a single module, has further accelerated adoption of integrated solutions.

Discrete sensors continue to play a role in cost-sensitive and modular device designs, particularly in entry-level consumer electronics and aftermarket replacements. System-on-chip (SoC) embedded sensors are gaining traction in premium and AI-enabled devices, where tight integration with processing units enables faster data processing, lower power consumption, and enhanced real-time performance.

End-Use Insights

Smartphones remain the largest end-use segment, with sensor-related revenues estimated at approximately USD 19.5 billion in 2024. Their dominance is driven by large-scale production volumes and continuous innovation in camera, motion, and biometric sensing technologies. Wearables represent the fastest-growing end-use segment, supported by expanding applications in health monitoring, fitness tracking, and lifestyle management. Advanced biometric and motion sensors are increasingly central to wearable functionality, driving strong demand growth.

Smart home devices and emerging AR/VR platforms are creating new growth avenues for the consumer electronics sensors market. Smart home applications rely on sensors to enable automation, safety, and energy optimization, while AR/VR systems demand highly precise motion, position, and optical sensors to deliver immersive user experiences. These emerging applications are expected to significantly increase sensor content per device over the forecast period.

| By Sensor Type | By Product Category | By Integration Type | By Connectivity | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global consumer electronics sensors market with approximately 48% share in 2024, led by China, South Korea, Japan, and Taiwan. The region’s leadership is underpinned by its strong semiconductor and electronics manufacturing ecosystem, high device production volumes, and presence of major OEMs and sensor manufacturers. China’s large domestic consumer base, combined with its role as a global manufacturing hub, drives substantial sensor demand. South Korea and Japan contribute through advanced R&D capabilities and innovation in image and motion sensors, while Taiwan plays a critical role in semiconductor fabrication and packaging. Government-backed initiatives to strengthen local semiconductor supply chains further reinforce regional growth.

North America

North America accounts for approximately 23% of the global market, driven by high adoption of premium consumer electronics, strong innovation ecosystems, and early deployment of advanced sensing technologies. The United States leads regional demand due to high consumer spending on smartphones, wearables, smart home devices, and AR/VR platforms. Robust R&D investments, a strong startup ecosystem, and government support for domestic semiconductor manufacturing under initiatives such as the CHIPS Act are key growth drivers. Demand is further supported by the rapid adoption of AI-enabled and health-focused consumer electronics.

Europe

Europe represents nearly 18% of global demand, supported by strong consumer demand for smart devices, regulatory emphasis on energy efficiency, and high adoption of connected home technologies. Countries such as Germany, the U.K., and France are major contributors, driven by demand for high-quality consumer electronics and strong integration of sensors in smart appliances and security systems. Europe’s focus on sustainability, data privacy, and safety standards also drives demand for advanced, high-precision sensors that comply with stringent regulatory requirements.

Latin America and the Middle East & Africa

Latin America and the Middle East & Africa collectively account for approximately 11% of the global market, with growth driven by rising smartphone penetration, improving digital connectivity, and expanding middle-class populations. In Latin America, countries such as Brazil and Mexico are witnessing increased adoption of smartphones and smart home devices, supporting steady sensor demand growth. In the Middle East & Africa, demand is supported by high smartphone usage, growing interest in smart home security solutions, and increasing investments in digital infrastructure, particularly in Gulf countries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Consumer Electronics Sensors Market

- Sony Corporation

- Samsung Electronics

- Bosch Sensortec

- STMicroelectronics

- Texas Instruments

- TDK Corporation

- Analog Devices

- NXP Semiconductors

- Infineon Technologies

- ON Semiconductor

- Broadcom

- ROHM Semiconductor

- Microchip Technology

- OmniVision Technologies

- Murata Manufacturing