Comté Cheese Market Size

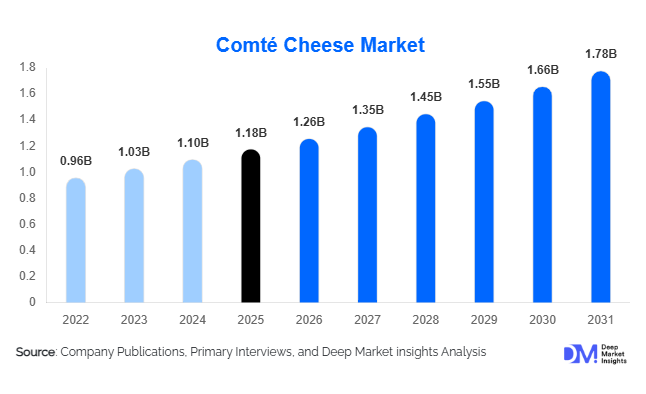

According to Deep Market Insights, the global Comté cheese market size was valued at USD 1.18 billion in 2025 and is projected to grow from USD 1.26 billion in 2026 to reach USD 1.78 billion by 2031, expanding at a CAGR of 7.1% during the forecast period (2026–2031). The Comté cheese market growth is primarily driven by rising global demand for premium and artisanal cheeses, strong export demand from North America and Asia-Pacific, and increasing consumer preference for origin-certified and sustainably produced dairy products.

Key Market Insights

- Comté cheese remains one of the most valuable PDO cheeses globally, supported by strict production regulations and premium pricing.

- Europe dominates global consumption, accounting for approximately 60% of total market value, led by France, Germany, and Switzerland.

- North America is the second-largest market, driven by gourmet retail expansion and strong foodservice demand in the U.S.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes and premium food adoption in China, Japan, and South Korea.

- Aged Comté (12–24 months) leads product demand, owing to its complex flavor profile and culinary versatility.

- Supermarkets and hypermarkets remain the dominant distribution channel, while online and D2C channels are growing rapidly.

What are the latest trends in the Comté cheese market?

Premiumization and Aging Led Differentiation

One of the most prominent trends in the Comté cheese market is the increasing consumer preference for aged and extra-aged variants. Comté aged between 12 and 24 months is gaining popularity due to its nutty, caramelized flavor profile and enhanced texture, making it suitable for both table consumption and gourmet cooking. Producers are emphasizing cellar-aging techniques, terroir storytelling, and flavor notes to differentiate products in premium retail environments. As consumers become more educated about cheese maturation, demand is shifting toward longer-aged Comté, supporting higher average selling prices and margins.

Digital and Direct-to-Consumer Expansion

The adoption of online gourmet food platforms and direct-to-consumer sales is reshaping market access for Comté producers. Specialty e-commerce platforms, subscription-based cheese clubs, and branded producer websites are enabling direct engagement with consumers globally. These channels provide transparency around sourcing, aging, and sustainability while allowing producers to retain higher margins. Digital storytelling and traceability tools are increasingly being used to communicate authenticity and quality, particularly to younger and urban consumers.

What are the key drivers in the Comté cheese market?

Rising Demand for Artisanal and Origin-Certified Dairy

Global consumers are increasingly shifting toward artisanal, minimally processed, and geographically certified dairy products. Comté cheese benefits significantly from its Protected Designation of Origin (PDO) status, which guarantees strict quality standards, traceable sourcing, and traditional production methods. This driver is particularly strong in Europe and North America, where consumers are willing to pay premium prices for authenticity and provenance.

Growth of Gourmet Foodservice and Culinary Tourism

High-end restaurants, premium bakeries, and gourmet fast-casual dining establishments are increasingly incorporating Comté cheese into menus. Its melting properties and complex flavor make it ideal for fondues, sauces, pastries, and premium sandwiches. Culinary tourism and chef-led endorsements further enhance brand visibility and consumption, especially in export markets.

What are the restraints for the global market?

Supply Constraints Due to PDO Regulations

Comté cheese production is strictly regulated, including limits on milk yield, herd size, and aging requirements. While these controls preserve quality, they also restrict scalability and limit the ability of producers to rapidly respond to rising global demand. Supply rigidity remains a structural restraint for market expansion.

High Price Sensitivity Outside Premium Segments

Comté cheese is significantly more expensive than mass-market cheeses. In emerging economies and price-sensitive consumer segments, this limits adoption to affluent households, gourmet retailers, and high-end foodservice establishments, constraining volume growth.

What are the key opportunities in the Comté cheese industry?

Expansion into High-Growth Export Markets

Asia-Pacific and the Middle East present strong growth opportunities due to rising middle-class wealth, expanding gourmet retail, and increasing Western culinary influence. Strategic investments in cold-chain logistics, export partnerships, and localized marketing can unlock substantial incremental demand.

Product Innovation and Convenient Formats

The development of pre-sliced, grated, and portion-controlled Comté formats offers opportunities to expand household usage and foodservice penetration. These innovations improve convenience while preserving premium positioning, particularly in urban markets.

Product Type Insights

Aged Comté cheese (12–24 months) dominates the global Comté market, accounting for approximately 42% of total market value in 2024. This leadership is primarily driven by its complex nutty flavor profile, crystalline texture, and high culinary versatility, making it the preferred choice among gourmet consumers, professional chefs, and premium foodservice operators. The segment benefits from strong demand in fine dining, specialty retail, and export-oriented markets where flavor depth and provenance are key purchasing criteria.

Medium-aged Comté (6–12 months) represents the second-largest segment, supported by its balanced taste, smoother texture, and broader affordability. This segment is widely favored for everyday household consumption, sandwiches, and cooking applications, particularly in Europe and North America. Extra-aged Comté (over 24 months), while niche in volume, commands premium pricing due to its rarity, extended maturation process, and appeal among connoisseurs, contributing disproportionately to revenue growth in specialty channels.

Application Insights

Household consumption remains the largest application segment, accounting for nearly 50% of global demand. Growth in this segment is driven by premium home dining trends, increased consumer experimentation with artisanal cheeses, and the rising popularity of cheese boards, wine pairings, and gourmet home cooking. Aged Comté is the leading product type within this segment due to its versatility and perceived quality.

Foodservice applications are expanding at a faster pace, supported by upscale restaurants, hotels, and catering services incorporating Comté into signature dishes, sauces, fondues, and gratins. Industrial food processing is an emerging application area, with growing use of Comté in premium ready meals, bakery fillings, and specialty sauces, particularly in export-focused markets seeking differentiation through authentic European ingredients.

Distribution Channel Insights

Supermarkets and hypermarkets dominate the global distribution landscape, contributing approximately 45% of total sales, particularly across Europe and North America. Their dominance is supported by strong cold-chain infrastructure, private-label gourmet sections, and wide consumer accessibility.

Specialty cheese stores and delicatessens play a critical role in premium positioning, consumer education, and product storytelling, especially for aged and extra-aged variants. Meanwhile, online retail and direct-to-consumer channels are witnessing rapid expansion, driven by gourmet e-commerce platforms, subscription-based cheese services, and growing consumer preference for curated, home-delivered specialty foods.

End-Use Insights

Household consumers remain the primary end-use segment, supported by rising disposable incomes and increasing appreciation for artisanal and origin-certified cheeses. Foodservice operators constitute the second-largest end-use segment, with premium foodservice emerging as the fastest-growing category due to fine dining expansion and luxury hospitality growth.

Industrial end users, though currently limited in share, are gradually increasing adoption as Comté is incorporated into high-end packaged foods and export-oriented premium product lines, particularly in North America and Asia-Pacific.

| By Product Type | By Form | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Europe

Europe accounts for approximately 60% of the global Comté cheese market in 2024. France dominates both production and consumption, followed by Germany, Switzerland, Italy, and the United Kingdom. Strong culinary heritage, high per-capita cheese consumption, and strict Protected Designation of Origin (PDO) regulations ensure consistent quality and brand equity.

Key growth drivers include sustained domestic consumption, premiumization within mature markets, tourism-driven foodservice demand, and continued export growth within the EU. The popularity of aged Comté in traditional and modern European cuisine remains a core driver of regional stability.

North America

North America represents around 20% of global market share, led by the United States. Demand is driven by expanding gourmet retail networks, rising imports of European specialty cheeses, and strong adoption in premium foodservice establishments.

Key growth drivers include increasing consumer awareness of origin-certified cheeses, growth in specialty and organic food retail, and menu innovation in upscale restaurants. The region is expected to grow at a CAGR of approximately 8% through 2030, with aged Comté leading demand due to its versatility in both retail and foodservice applications.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, with China, Japan, South Korea, and Australia driving demand. Although per-capita cheese consumption remains lower than Western markets, rapid urbanization and premium food adoption are accelerating growth.

Key growth drivers include rising disposable incomes, Western dining influence, expansion of luxury hotels and international restaurant chains, and increasing availability of imported gourmet cheeses through modern retail and e-commerce platforms. The region is projected to register a CAGR exceeding 10%, with foodservice and online retail acting as primary growth engines.

Latin America

Latin America represents a smaller but steadily expanding market, led by Brazil, Mexico, and Chile. Demand is concentrated among affluent urban consumers, expatriate communities, and high-end restaurants.

Key growth drivers include premiumization of food consumption, expansion of fine dining in major cities, and growing interest in European culinary experiences. Imports remain the primary supply source, with aged Comté favored for specialty menus and gourmet retail.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is emerging as a premium import hub for Comté cheese. Growth is supported by luxury hospitality, international tourism, and a large expatriate population with strong preference for European cheeses.

Key growth drivers include high-end hotel and restaurant expansion, premium grocery retail growth, and increasing demand for authentic European food products. Africa remains a niche market, primarily supported by upscale hospitality and limited gourmet retail presence.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

ey Players in the Comté Cheese Market

- Lactalis Group

- Sodiaal Group

- Fromageries Marcel Petite

- Fromageries Arnaud

- Juraflore (Monts & Terroirs)

- Fromagerie Badoz

- Fromagerie Rivoire-Jacquemin

- Fromagerie Vagne

- Fromagerie de la Haute Comté

- Fromagerie Pochat & Fils