Compression Stockings Market Size

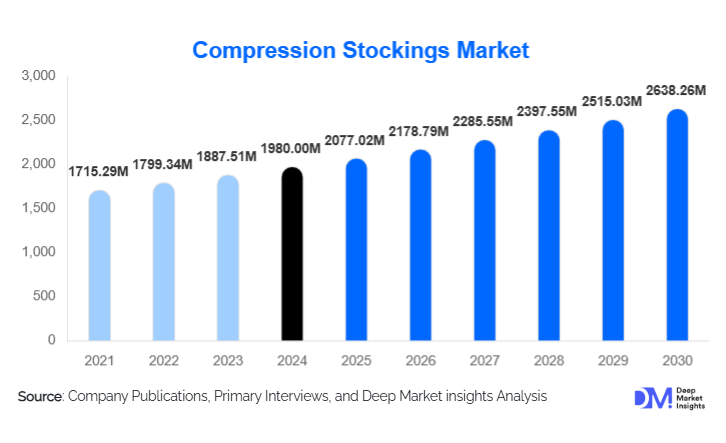

According to Deep Market Insights, the global compression stockings market size was valued at USD 1,980 million in 2024 and is projected to grow from USD 2,077.02 million in 2025 to reach USD 2,638.26 million by 2030, expanding at a CAGR of 4.9% during the forecast period (2025–2030). The market growth is primarily driven by rising incidences of venous disorders, increasing surgical procedures, expanding home care demand, and technological advancements in smart compression textiles, making these products more accessible and user-friendly.

Key Market Insights

- Graduated compression stockings dominate the product landscape, accounting for over 58% of the global market due to clinical efficacy and physician preference for treatment of chronic venous insufficiency and varicose veins.

- Moderate compression stockings (15–20 mmHg) lead the compression level segment, balancing effectiveness with comfort for both medical and preventive applications.

- Knee-high stockings are the most popular length, representing 46% of the market, favored for ease of use, affordability, and patient compliance.

- Spandex/elastane-based materials dominate the market, with 41% share, due to superior elasticity, durability, and consistent pressure delivery.

- Hospitals and surgical centers account for the largest end-user segment, capturing 44% of the market, driven by standard post-operative protocols and clinical recommendations.

- North America leads the regional market, with the U.S. representing USD 850 million in demand, while Asia-Pacific is the fastest-growing region due to urbanization, rising surgical volumes, and increasing healthcare expenditure.

What are the latest trends in the compression stockings market?

Adoption of Smart Compression Textiles

Advanced smart textiles embedded with pressure sensors, moisture-wicking fabrics, and wearable health-monitoring capabilities are gaining traction. These innovations improve patient compliance by ensuring optimal pressure delivery and comfort. Hospitals, sports medicine clinics, and preventive healthcare providers are increasingly adopting such products to enhance treatment effectiveness. Integration with mobile apps allows for real-time monitoring, replacement reminders, and personalized usage data, driving both clinical and lifestyle adoption.

Expansion into Preventive and Lifestyle Segments

Compression stockings are no longer limited to clinical use. There is growing adoption among athletes, frequent travelers, pregnant women, and individuals in sedentary professions. The trend toward wellness-driven usage has spurred new product designs focusing on aesthetics, comfort, and breathable materials. Lifestyle-oriented compression stockings are increasingly available through e-commerce platforms, enabling direct-to-consumer access and subscription-based models for long-term usage.

What are the key drivers in the compression stockings market?

Rising Prevalence of Venous Disorders

Increasing incidences of chronic venous insufficiency, varicose veins, and deep vein thrombosis are major growth drivers. Sedentary lifestyles, aging populations, and obesity contribute to a growing patient base, directly boosting demand for medical-grade compression stockings. Physician recommendations and preventive care guidelines further support market expansion.

Growth in Surgical Procedures and Hospitalizations

Orthopedic, cardiovascular, and post-operative patients frequently use anti-embolism compression stockings to prevent DVT. Rising surgical volumes globally provide a stable and recurring demand base. Hospitals and surgical centers continue to be the primary procurement channels for these products.

Increasing Awareness and Preventive Healthcare Adoption

Employers, airlines, sports professionals, and pregnant women are adopting compression stockings for prevention, creating a non-clinical market segment. Awareness campaigns highlighting the health benefits of compression therapy have expanded the consumer base significantly.

What are the restraints for the global market?

Patient Compliance and Comfort Issues

Discomfort, improper sizing, and excessive pressure discourage long-term use, particularly in hot climates. Manufacturers must continue improving ergonomic designs and breathable materials to enhance compliance.

Limited Reimbursement in Developing Economies

Compression stockings are often categorized as non-essential medical devices, leading to high out-of-pocket expenses in price-sensitive markets. This limits adoption and can slow market growth if affordability and awareness are not addressed.

What are the key opportunities in the compression stockings market?

Technological Integration and Smart Stockings

The development of wearable smart compression textiles offers premium pricing and differentiation opportunities. Integration of pressure sensors, moisture-wicking fabrics, and app-based monitoring ensures optimal use and expands adoption in clinical and lifestyle segments.

Untapped Emerging Markets

Regions such as Asia-Pacific, Latin America, and parts of the Middle East are experiencing rising demand due to urbanization, increased surgical volumes, and healthcare infrastructure expansion. Affordable localized production and partnerships with healthcare programs can accelerate market penetration.

Direct-to-Consumer and Digital Sales Models

Online platforms enable personalized sizing, subscription-based replacements, and direct engagement with consumers. D2C models improve margins for manufacturers while enhancing accessibility for chronic users and lifestyle-focused buyers.

Product Type Insights

Graduated compression stockings dominate the global compression stockings market, accounting for over 58% of total market share in 2024. Their leadership is primarily driven by strong clinical endorsement for the treatment and management of chronic venous insufficiency (CVI), varicose veins, and post-thrombotic syndrome. Physicians and vascular specialists consistently recommend graduated compression due to its ability to apply the highest pressure at the ankle and gradually reduce pressure upward, ensuring effective venous blood return and symptom relief. This evidence-backed efficacy, combined with widespread inclusion in clinical guidelines, continues to reinforce adoption across hospitals, clinics, and home care settings.

Anti-embolism compression stockings represent a critical segment within acute care environments, particularly in post-surgical and immobilized patients. Their usage is driven by standardized hospital protocols aimed at preventing deep vein thrombosis (DVT) and pulmonary embolism, especially following orthopedic, cardiovascular, and abdominal surgeries. Meanwhile, non-medical or support compression stockings are witnessing accelerated growth within lifestyle and wellness applications. Rising awareness around preventive care, prolonged sitting, frequent air travel, pregnancy-related swelling, and sports recovery has expanded demand beyond traditional medical use.

Application Insights

Chronic venous insufficiency remains the largest application segment globally, accounting for the highest share of compression stocking demand due to its long-term nature and high recurrence rate. The growing prevalence of sedentary lifestyles, obesity, and aging populations has significantly expanded the CVI patient base, making compression therapy a first-line, non-invasive treatment option. Varicose veins represent the second-largest application, supported by increasing cosmetic awareness and early-stage intervention trends.

DVT prevention continues to be a major application within hospitals and surgical centers, driven by increasing global surgical volumes and mandatory thromboprophylaxis protocols. At the same time, emerging applications are reshaping the market landscape. Lifestyle and sports usage are gaining traction among athletes, frequent travelers, and professionals with prolonged standing or sitting hours. Pregnancy-related venous disorders are also contributing to the rising demand, particularly for moderate compression products.

Distribution Channel Insights

Retail pharmacies remain the leading distribution channel, accounting for approximately 38% of global market revenue. Their dominance is supported by high accessibility, strong physician-pharmacist linkage, and consumer trust in pharmacist-recommended products. Retail pharmacies serve as a critical bridge between clinical prescriptions and over-the-counter preventive usage.

Online pharmacies and direct-to-consumer (D2C) platforms are the fastest-growing channels, driven by digital healthcare adoption, personalized sizing tools, subscription-based replenishment models, and competitive pricing. These platforms are particularly attractive to chronic users, lifestyle consumers, and younger demographics seeking convenience and discreet purchasing.

End-User Insights

Hospitals and surgical centers dominate the compression stockings market, capturing approximately 44% of total demand in 2024. This dominance is driven by standardized post-operative protocols, high patient turnover, and routine use of anti-embolism stockings for thrombosis prevention. Clinics and ambulatory care centers follow, supported by increasing outpatient treatments and early diagnosis of venous conditions.

Homecare settings represent the fastest-growing end-user segment, benefiting from aging populations, rising chronic venous disease prevalence, and the global shift toward home-based healthcare. Improved patient education and availability of easy-to-use products have accelerated adoption in this segment.

| By Product Type | By Compression Level | By Length | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global compression stockings market, accounting for approximately 38% of total demand. The United States is the primary growth engine, with a market size of nearly USD 850 million in 2024. Regional growth is driven by high diagnosis rates of venous disorders, strong reimbursement coverage, widespread physician awareness, and advanced healthcare infrastructure. Preventive usage among frequent travelers, pregnant women, and aging populations further supports demand. Canada contributes steadily through increasing adoption in both clinical and homecare settings, supported by public healthcare access and rising elderly demographics.

Europe

Europe holds approximately 29% of the global market, led by Germany, the United Kingdom, and France. Growth in the region is driven by a rapidly aging population, high awareness of venous health, and well-established reimbursement systems for compression therapy. Germany remains a key manufacturing and export hub, while the UK and France demonstrate strong demand through hospital and retail pharmacy channels. Emerging demand in Eastern Europe is supported by improving healthcare infrastructure, rising surgical volumes, and increasing access to preventive care.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at a CAGR exceeding 10%. China, Japan, and India are the primary contributors, driven by rising surgical volumes, urbanization, expanding middle-class healthcare expenditure, and increasing awareness of venous disorders. Japan’s aging population significantly boosts long-term compression therapy demand, while China and India benefit from rapid hospital infrastructure development and local manufacturing expansion. The growing availability of affordable products and increasing online healthcare adoption further accelerate regional growth.

Latin America

Latin America represents a steadily growing market, led by Brazil, Mexico, and Argentina. Growth is driven by expanding private healthcare facilities, rising awareness of venous disorders, and increasing adoption of post-surgical care protocols. Urban centers account for the majority of demand, while limited reimbursement coverage and price sensitivity continue to moderate growth rates across the region.

Middle East & Africa

The Middle East is witnessing rising demand, particularly in the UAE and Saudi Arabia, supported by high-income populations, preventive healthcare adoption, and strong private hospital networks. Increasing lifestyle-related venous conditions and medical tourism also contribute to growth. In Africa, demand remains primarily clinical, concentrated in hospitals and surgical centers within South Africa and select North African countries. Gradual healthcare infrastructure development and rising awareness are expected to support long-term market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Compression Stockings Market

- Essity AB

- Medi GmbH & Co. KG

- Sigvaris Group

- Bauerfeind AG

- 3M Company

- Juzo (Julius Zorn GmbH)

- Thuasne Group

- DJO Global

- BSN Medical

- Leonisa

- Arjo AB

- Zensah

- Cizeta Medicali

- Knit-Rite

- Medline Industries