Combat Sports Products Market Size

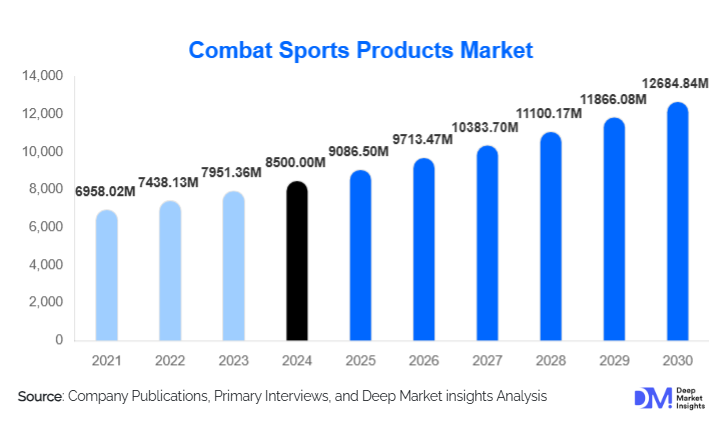

According to Deep Market Insights, the global combat sports products market size was valued at USD 8,500.00 million in 2024 and is projected to grow from USD 9,086.50 million in 2025 to reach USD 12,684.84 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). The market’s growth is driven by the rising popularity of combat sports such as boxing, mixed martial arts (MMA), wrestling, and Brazilian jiu-jitsu, along with increasing adoption of combat-based fitness programs and the growing professionalization of training academies worldwide.

Key Market Insights

- Protective gear remains the largest revenue-generating product category, supported by mandatory safety requirements across professional, amateur, and training environments.

- MMA continues to be the fastest-growing combat sport segment, benefiting from global media exposure, pay-per-view events, and strong youth engagement.

- North America dominates global demand, led by the United States due to high consumer spending, organized leagues, and strong brand penetration.

- Asia-Pacific is the fastest-growing region, supported by government-backed sports initiatives, rising disposable incomes, and expanding gym infrastructure.

- Online direct-to-consumer channels are gaining share rapidly, driven by influencer marketing, customization options, and convenience.

- Product innovation and smart training equipment are reshaping purchasing behavior among professional athletes and serious fitness enthusiasts.

What are the latest trends in the combat sports products market?

Technology-Integrated Training Equipment

The combat sports products market is witnessing rapid adoption of technology-enabled equipment such as sensor-based gloves, smart punching bags, and app-connected training systems. These innovations allow athletes to track punch force, speed, accuracy, and endurance in real time. Gyms and professional training centers are increasingly investing in connected equipment to enhance athlete performance, reduce injury risk, and differentiate their service offerings. This trend is particularly strong in North America and Europe, where data-driven training is becoming standard practice.

Growth of Combat-Based Fitness Programs

Combat sports are increasingly being adopted as mainstream fitness solutions rather than purely competitive disciplines. Boxing-inspired fitness classes, MMA conditioning programs, and martial arts-based workouts are gaining popularity among recreational users. This shift is driving demand for entry-level gloves, pads, and protective gear, expanding the customer base beyond professional athletes to include home users and fitness enthusiasts.

What are the key drivers in the combat sports products market?

Rising Global Participation in Combat Sports

Participation in combat sports has increased significantly across age groups and skill levels. Amateur leagues, local tournaments, and gym-based training programs are expanding rapidly, particularly in urban areas. This has resulted in consistent demand for training equipment, protective gear, and apparel, with frequent replacement cycles supporting recurring revenue for manufacturers.

Commercialization and Media Exposure of Combat Sports

High-profile boxing and MMA events, athlete endorsements, and social media visibility have elevated combat sports into mainstream entertainment. This exposure directly influences consumer purchasing behavior, as fans seek professional-grade equipment endorsed by elite athletes. Sponsorship deals between leagues and equipment manufacturers further reinforce brand visibility and demand.

What are the restraints for the global market?

High Cost of Premium and Certified Equipment

Professional-grade and competition-certified equipment carries a significant price premium, which can restrict adoption in price-sensitive regions. Smaller gyms and beginners often opt for lower-cost alternatives, limiting penetration of premium brands in emerging markets.

Lack of Uniform Global Standards

Inconsistent enforcement of safety and certification standards across regions poses challenges for manufacturers. While professional competitions mandate strict compliance, amateur and recreational markets often lack oversight, allowing uncertified low-cost products to compete with high-quality branded equipment.

What are the key opportunities in the combat sports products industry?

Expansion in Emerging Economies

Asia-Pacific, Latin America, and the Middle East present significant growth opportunities due to rising interest in combat sports and increasing government support for sports development. Establishing localized manufacturing and distribution networks can help companies capture cost-sensitive demand while improving market penetration.

Women and Youth-Focused Product Lines

Female and youth participation in combat sports is increasing rapidly, yet product offerings remain limited. Developing gender-specific and age-appropriate protective gear and apparel offers manufacturers an opportunity to tap into underserved but fast-growing segments.

Product Type Insights

Protective gear dominates the combat sports products market, accounting for approximately 32% of total revenue in 2024. Mandatory safety regulations across training and competition environments drive sustained demand for headgear, shin guards, and mouthguards. Training equipment follows closely, supported by gym expansion and home fitness adoption. Apparel and accessories benefit from frequent replacement cycles and strong brand-driven purchasing behavior.

Sport Type Insights

Mixed martial arts represents the largest sport-based segment, contributing nearly 28% of the global market in 2024. Boxing remains a mature but stable segment, while Brazilian jiu-jitsu and kickboxing are gaining traction due to growing academy networks and international tournaments.

Distribution Channel Insights

Online direct-to-consumer platforms account for around 30% of global sales and represent the fastest-growing channel. Specialty sports retailers continue to play a key role in professional and premium segments, while institutional procurement dominates bulk purchases by gyms, academies, and educational institutions.

End-Use Insights

Training academies and gyms are the largest end-use segment, contributing approximately 35% of total demand. Professional athletes drive premium product sales, while home fitness enthusiasts represent the fastest-growing user group, supported by digital coaching platforms and hybrid training models.

| By Product Type | By Combat Sport Type | By End User | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market in 2024, led by the United States. High consumer spending on fitness and combat sports equipment, the presence of well-established professional leagues, and a dense network of commercial gyms and training centers support sustained demand. Product replacement cycles and strong participation in boxing, MMA, and fitness-oriented combat training further reinforce market stability.

Europe

Europe represents about 22% of global demand, driven by structured amateur sports ecosystems and stringent safety and equipment standards. The U.K., Germany, and France are key markets, supported by organized boxing clubs, martial arts academies, and school-level programs. Growing participation in MMA and combat fitness formats is contributing to steady, long-term demand.

Asia-Pacific

Asia-Pacific holds nearly 29% market share and is the fastest-growing region, with growth exceeding a 10% CAGR. China, India, Japan, South Korea, and Thailand are major contributors, supported by government-led sports development initiatives and a strong cultural connection to martial arts disciplines. Rising urbanization, expanding gym chains, and increasing youth participation are accelerating regional adoption.

Latin America

Latin America accounts for around 8% of the market, led by Brazil and Mexico. Strong regional interest in MMA, boxing, and mixed combat disciplines continues to drive equipment demand. The expansion of local gyms, training academies, and regional tournaments is supporting gradual but consistent market growth.

Middle East & Africa

The Middle East and Africa region is witnessing increasing adoption, particularly in the UAE and Saudi Arabia. Growth is supported by sports tourism, international combat sports events, and government-backed athletic development programs. Rising investment in fitness infrastructure and youth sports initiatives is further strengthening demand across key urban centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Combat Sports Products Market

- Adidas

- Nike

- Everlast Worldwide

- Venum

- Hayabusa Fightwear

- Title Boxing

- Ringside

- Fairtex

- Century Martial Arts

- Twins Special

- Cleto Reyes

- RDX Sports

- Under Armour

- Fuji Sports

- Revgear