Colored Gemstones Market Size

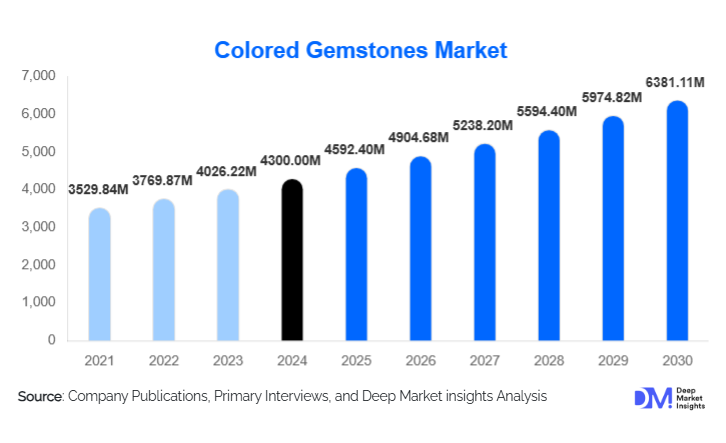

According to Deep Market Insights, the global colored gemstones market size was valued at USD 4,300 million in 2024 and is projected to grow from USD 4,592.40 million in 2025 to reach USD 6,381.11 million by 2030, expanding at a CAGR of around 6.8% during the forecast period (2025–2030). This growth trajectory reflects the rising adoption of colored gemstones in bridal and fine jewelry, increasing consumer preference for personalized and symbolic designs, and the gradual formalization of historically fragmented gemstone supply chains.

Key Market Insights

- The global colored gemstones market is on track to grow from USD 4.3 billion in 2024 to about USD 6.4 billion by 2030, supported by robust demand in fine jewelry and high jewelry.

- Sapphires lead the gemstone type segment, accounting for roughly 28% of global colored gemstone value in 2024, ahead of rubies and emeralds.

- Natural, mined gemstones dominate with around 70–75% of market value, while lab-grown colored stones rapidly gain share in fashion and entry segments.

- Rings, particularly engagement and bridal rings, represent the largest application, contributing about 35% of colored gemstone jewelry value.

- Asia-Pacific is the largest and fastest-growing regional market, followed by North America and Europe, driven by rising disposable incomes and evolving fashion preferences.

- Top organized miners and luxury houses together account for roughly 20–25% of global market value, but a large informal and artisanal sector keeps the industry structurally fragmented.

What are the latest trends in the colored gemstones market?

Ethical, Traceable, and Certified Colored Gemstones

One of the most prominent trends reshaping the colored gemstones market is the rapid shift toward ethical sourcing and traceability. Buyers increasingly demand transparency on origin, environmental impact, and labor practices, pushing miners, traders, and brands to formalize supply chains. Certification from reputable laboratories and origin reports are becoming essential for mid- to high-value stones, particularly emeralds, rubies, and sapphires. Mine-to-market traceability programs, blockchain-based tracking, and laser inscription are being adopted to reassure both retailers and end consumers. This trend supports price premiums for responsibly sourced gemstones and encourages governments in producing countries to tighten regulatory frameworks, formalize artisanal mining, and invest in local beneficiation.

Color-Forward Bridal and Fashion Jewelry

Another key trend is the growing dominance of color-forward designs in both bridal and fashion jewelry. Younger consumers are actively seeking alternatives to traditional diamond-only engagement rings, opting instead for sapphire, emerald, spinel, and tourmaline center stones that communicate individuality and emotional symbolism. Social media, celebrity weddings, and influencer campaigns have significantly normalized colored gemstone engagement rings, halo designs, and multi-stone bands. Beyond bridal, colored gems are central to contemporary high jewelry, stacking rings, gender-neutral signet rings, and statement earrings. This aesthetic evolution increases overall gemstone usage per piece and drives up the value of mid- to high-grade stones in popular hues such as teal, peach, and vivid green.

What are the key drivers in the colored gemstones market?

Premiumization and Resilient Luxury Jewelry Demand

The global expansion of affluent consumer segments and the resilience of luxury jewelry spending form a fundamental demand driver. High-net-worth and aspirational consumers view fine jewelry, especially pieces featuring rare colored gemstones, as a blend of adornment, emotional value, and wealth preservation. High jewelry collections centered on exceptional rubies, emeralds, sapphires, and Paraíba-type tourmalines routinely attract global attention and set new price benchmarks. As luxury groups expand boutiques and high jewelry events in key cities across Asia, the Middle East, Europe, and North America, colored gemstones benefit from curated storytelling, heritage branding, and limited-edition collections that justify premium pricing and strong margins.

Personalization, Symbolism, and Design-Led Purchases

Consumer preference is shifting from generic, status-driven jewelry to pieces that express personal narratives, symbolism, and lifestyle. Birthstones, zodiac themes, and color psychology are frequently used by designers to position colored gemstones as deeply personal choices rather than mere accessories. Custom and semi-custom platforms allow customers to choose gem type, color, cut, and setting, aided by digital visualization tools. As a result, colored gemstones capture a disproportionate share of incremental demand in customized and bespoke jewelry. This driver is particularly strong among millennials and Gen Z, who prioritize uniqueness and emotional resonance over traditional brand hierarchy alone.

Expansion of Organized and Online Jewelry Retail

The rapid growth of organized jewelry chains and digital sales channels is structurally expanding the addressable market for colored gemstones. In Asia, large chains are rolling out color-centric sub-brands and curated gemstone lines within malls and high streets. In the U.S. and Europe, specialty retailers and major chains are integrating colored stones into bridal, fashion, and men’s collections, backed by in-store gemologists and certification. E-commerce and omni-channel models enable long-distance sales of certified colored stones, supported by 3D visualization, AR try-ons, and virtual consultations. Together, these developments reduce information asymmetry, build trust, and make colored gemstones accessible to a broader global customer base.

What are the restraints for the global market?

Supply Volatility and Geopolitical Risk in Producing Regions

Colored gemstone supply is geographically concentrated, with emeralds dominated by Zambia and Colombia, rubies by Mozambique and select Asian regions, and sapphires by deposits in Africa and Asia. Many of these producing countries face political instability, regulatory uncertainty, infrastructure gaps, and artisanal mining safety challenges. Periodic disruptions, such as license changes, export restrictions, strikes, or security incidents, can interrupt production and create pronounced volatility in both availability and prices. For downstream brands and retailers, this makes planning collections, inventory management, and long-term sourcing agreements more complex, particularly for consistent color and quality grades.

Fragmented, Informal Trade and Trust Deficits

A large portion of colored gemstone extraction and trade remains informal, involving small-scale miners and multi-layered brokerage networks. This fragmentation results in inconsistent grading, limited documentation, and variable disclosure of treatments and synthetics. Many retail buyers, particularly in emerging markets, still encounter stones with unclear provenance or ambiguous treatment histories, eroding trust and discouraging higher-ticket purchases. For global brands and new entrants, building robust sourcing frameworks, quality-control processes, and vendor due diligence adds cost and complexity. Unless industry-wide standards and transparency improve, this structural opacity will continue to restrain full-scale adoption of colored gemstones in mainstream, mass-premium jewelry lines.

What are the key opportunities in the colored gemstones industry?

Scaling Ethical, Certified, and Origin-Branded Gemstones

There is significant headroom for companies that can deliver certified, ethically sourced colored gemstones with robust origin stories. By integrating responsible mining practices, community development, and environmental stewardship with third-party verification, miners and brands can capture price premiums and preferential shelf space at top retailers. Origin-branded lines, such as Zambian emeralds or Mozambican rubies, offer clear differentiation, marketing narratives, and long-term franchise potential. Digital passports, blockchain traceability, and QR-linked storytelling can further enhance customer engagement at the point of sale, positioning ethical colored gemstones as a cornerstone of ESG-aligned luxury.

Emerging Market Affluence and New End-Use Niches

Rising middle-class and upper-middle-class wealth in Asia-Pacific, the Middle East, and Latin America is creating new demand pockets for colored gemstone jewelry, watches, and decorative objects. As consumers in China, India, the Gulf states, and Brazil move up the income curve, they are increasingly open to color-rich pieces that signal status and individuality. At the same time, new end-use niches, such as men’s jewelry, gender-neutral designs, spiritual or wellness-themed jewelry, and limited-edition timepieces, are expanding the addressable market. Companies that tailor gemstone assortments, design language, and price points to these emerging consumer segments can secure outsized growth and build defensible regional positions.

Gemstone Type Insights

Sapphires represent the single largest gemstone type by value, accounting for an estimated 28% of the global colored gemstones market in 2024. Their dominance arises from exceptionally broad color ranges (from classic royal blue to teal and pastel hues), high durability suitable for everyday wear, and deep historical associations with royalty and heritage jewelry houses. Rubies and emeralds together contribute a similar share but are more constrained by supply and clarity challenges, particularly at higher qualities. “Other” gemstones, including tourmaline, spinel, tanzanite, garnet, morganite, aquamarine, and opal, are collectively gaining ground, especially in design-led and fashion-forward collections, but individually remain smaller than the big three in value terms.

Application Insights

Jewelry is the dominant application segment, with rings, especially engagement and bridal rings, contributing roughly 35% of the 2024 colored gemstone jewelry value. Colored center stones in solitaire, halo, and three-stone designs are increasingly mainstream, particularly for younger couples seeking differentiation from traditional diamond solitaires. Necklaces, pendants, and earrings represent significant additional volume, often featuring smaller stones in pavé, cluster, and drop configurations. Watches and timepieces form a smaller but high-margin segment, where colored gemstones embellish bezels, lugs, crowns, and dials in luxury timepieces. A niche yet strategically important segment comprises loose stones for investment and collection, typically focused on large, top-quality rubies, emeralds, sapphires, and rare varieties.

Distribution Channel Insights

Organized jewelry chains and branded mono-brand boutiques account for an estimated 35–40% of colored gemstone retail value, leveraging strong brand equity, access to certified stones, and consistent quality standards. Independent jewelers remain critical as design innovators and trusted local advisors, particularly for bespoke and redesign projects. Online and omni-channel retail are expanding rapidly, enabling global consumers to research, compare, and purchase certified colored gemstones with greater confidence. Auction houses and private sales channels dominate the top end of the market, where exceptional stones and high jewelry pieces trade at significant premiums, often setting benchmark prices for the broader industry. Duty-free and travel retail contribute incremental demand, particularly for mid- to premium-tier gemstone jewelry among international travelers.

Customer Segment Insights

Branded jewelry and watch houses are the largest end-use customer segment, accounting for roughly 40% of colored gemstone consumption by value. Their influence extends beyond direct sales, as their high-profile collections and campaigns shape global aesthetics and consumer expectations. Independent designers and ateliers form another critical segment, driving experimentation with unconventional cuts, color combinations, and settings that eventually filter into mainstream designs. Online-first jewelry brands target digitally savvy consumers with education-rich content, customization options, and transparent pricing, accelerating adoption among younger demographics. Private collectors and investment buyers, though smaller in number, exert significant influence on the pricing and availability of rare, one-of-a-kind stones.

Price Tier Insights

The colored gemstones market spans four broad price tiers: commercial mass-market, premium, high jewelry, and investment-grade. Commercial jewelry priced below USD 1,000 per piece focuses on smaller stones, treated material, and increasingly lab-grown alternatives, prioritizing color impact and affordability. The premium tier (USD 1,000–10,000 per piece) captures much of the growth in bridal and fine fashion jewelry, blending certified natural stones with brand-driven design. High jewelry (USD 10,000–250,000 per piece) showcases exceptional craftsmanship and high-quality stones with strong origin stories, while the investment-grade tier, pieces valued above USD 250,000 or featuring ultra-rare stones, remains highly concentrated among top collectors, high-net-worth buyers, and major auction houses.

| By Gemstone Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for roughly 23% of global colored gemstone demand in 2024, with the United States alone contributing around 18%. The region is a powerhouse for bridal jewelry, designer brands, and online jewelry retail. Colored gemstone engagement rings, anniversary bands, and custom-designed pieces are particularly popular among millennials and Gen Z. Major specialty chains and independent jewelers offer extensive colored stone assortments, supported by certification and financing options. The U.S. is also a key destination for high jewelry events and auctions, where exceptional colored gemstones set price records and influence global pricing benchmarks.

Europe

Europe holds an estimated 22% share of the global colored gemstones market, anchored by high jewelry capitals such as France, Italy, Switzerland, and the U.K. Luxury houses headquartered in these markets rely heavily on colored gemstones for high jewelry collections and gem-set watches. European consumers exhibit strong preferences for craftsmanship, heritage, and sustainability, making certified, responsibly sourced stones especially attractive. Auction hubs in Geneva, London, and other cities play a pivotal role in trading rare gemstones and estate jewelry, reinforcing Europe’s status as both a consumption and price-discovery center.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, representing about 38% of global colored gemstone value in 2024. China and India lead demand, propelled by rising disposable incomes, cultural affinity for jewelry, and a growing acceptance of colored stones in bridal and festive collections. Large jewelry chains in both countries are systematically introducing colored gemstone sub-brands, while export-oriented manufacturers in India, Thailand, and other regional hubs integrate colored stones into designs targeting North American, European, and Gulf markets. Southeast Asian markets and developed economies such as Japan and Australia contribute additional demand, particularly in premium and high jewelry segments.

Latin America

Latin America represents roughly 7% of global colored gemstone consumption but plays an outsized role in supply. Colombia is synonymous with high-quality emeralds, while Brazil is a major source of tourmaline, amethyst, topaz, and a variety of other colored stones. Much of the region’s rough output is exported to cutting centers in Asia and Europe, but domestic markets in Brazil, Mexico, and other countries are gradually expanding as middle-class consumers embrace higher-quality gemstone jewelry. There is significant potential for origin-branded colored gemstone lines that leverage Latin America’s rich geological heritage and cultural narratives.

Middle East & Africa

The Middle East & Africa region combines some of the world’s most important producing countries with dynamic consumer markets. African nations such as Zambia, Mozambique, Madagascar, and Ethiopia are key sources of emeralds, rubies, and sapphires, while Gulf states act as trading and consumption hubs. The region accounts for around 10% of global demand, but a substantially higher share of global supply. High disposable incomes and a strong culture of gifting drive robust demand for bold, gem-rich jewelry in the Gulf, while intra-African trade and regional jewelry manufacturing are gradually expanding. Government initiatives to formalize mining, encourage local cutting, and develop auction platforms are reshaping value distribution along the supply chain.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The colored gemstones market is moderately consolidated at the organised level, yet highly fragmented overall. The top five structured players are estimated to account for roughly 20–25% of total market value, with a substantially larger share of the certified, high-end segment. A long tail of small-scale miners, local traders, cutting workshops, independent designers, and regional brands controls the remainder. This structure creates intense competition at the mid- and premium tiers, but also provides opportunities for differentiated business models built around ethics, design innovation, digital engagement, and origin branding.

Key Players in the Colored Gemstones Market

- Gemfields Group Ltd.

- Fura Gems Inc.

- Compagnie Financière Richemont SA

- LVMH Moët Hennessy Louis Vuitton SE

- Chow Tai Fook Jewellery Group Ltd.

- Signet Jewellers Ltd.

- Graff

- Chopard Group

- Swarovski AG

- Pandora A/S

- Luk Fook Holdings (International) Ltd.

- Le Vian Corp.