Cognitive Media Market Size

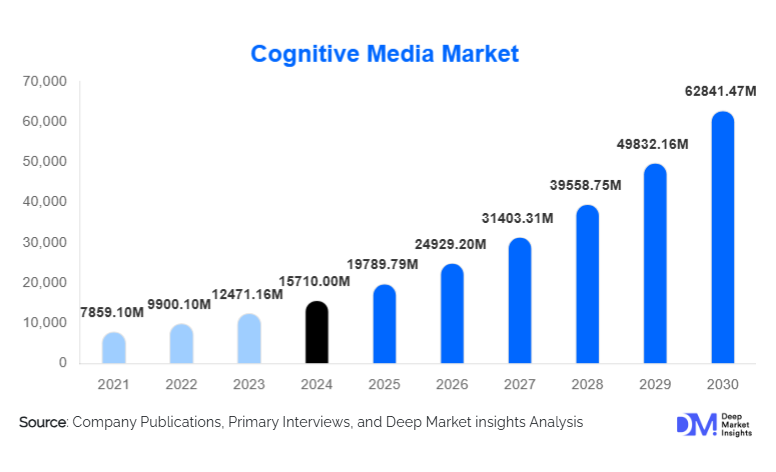

According to Deep Market Insights, the global cognitive media market size was valued at USD 15,710.00 million in 2024 and is projected to grow from USD 19,789.79 million in 2025 to reach USD 62,841.47 million by 2030, expanding at a CAGR of 25.97% during the forecast period (2025–2030). The cognitive media market growth is primarily driven by the rapid adoption of artificial intelligence across media creation, content personalization, advertising optimization, and audience analytics, alongside the explosive growth of OTT platforms and digital media consumption globally.

Key Market Insights

- Generative AI and machine learning are transforming content creation and monetization, enabling automation, scalability, and hyper-personalized media experiences.

- Cloud-based cognitive media platforms dominate deployments, accounting for over 60% of total market share due to scalability and cost efficiency.

- North America leads the global market, driven by advanced adtech ecosystems, OTT platform investments, and strong AI infrastructure.

- Asia-Pacific is the fastest-growing region, supported by mobile-first media consumption, regional language content, and government-backed AI initiatives.

- Video-based cognitive media applications account for the largest revenue share, fueled by streaming, sports analytics, and AI-powered advertising.

- Rising regulatory focus on ethical AI and data privacy is reshaping product design and deployment strategies across the industry.

What are the latest trends in the cognitive media market?

Rapid Adoption of Generative AI in Media Workflows

Generative AI has emerged as the most disruptive trend in the cognitive media market. Media companies are increasingly deploying AI-powered tools for automated video generation, scriptwriting, dubbing, subtitling, and synthetic content creation. These capabilities are significantly reducing production costs and turnaround times while enabling large-scale content localization for global audiences. Streaming platforms and digital publishers are leveraging generative AI to personalize trailers, previews, and promotional creatives in real time, enhancing viewer engagement and conversion rates.

Shift Toward Contextual and Emotion-Aware Media Intelligence

Advanced natural language processing and emotional AI are being integrated into cognitive media platforms to analyze sentiment, tone, and contextual relevance. This trend is particularly strong in advertising and news media, where understanding audience emotions is critical for engagement and brand safety. Contextual targeting solutions are gaining traction as alternatives to cookie-based advertising, helping platforms comply with evolving data privacy regulations while maintaining monetization efficiency.

What are the key drivers in the cognitive media market?

Explosion of Digital Content and OTT Platforms

The rapid growth of OTT streaming services and digital-first media platforms has led to an unprecedented volume of unstructured content. Cognitive media technologies enable automated tagging, indexing, and intelligent content discovery, making them indispensable for managing large-scale media libraries. This driver continues to accelerate adoption across entertainment, sports, and news publishing segments.

Rising Demand for Hyper-Personalized Media Experiences

Consumers increasingly expect personalized recommendations, targeted advertisements, and tailored content experiences. AI-driven personalization engines are improving viewer retention, engagement, and lifetime value, making them a core investment area for media companies globally.

What are the restraints for the global market?

High Implementation and Integration Costs

Deploying cognitive media platforms requires significant upfront investment in AI infrastructure, data pipelines, and skilled talent. Smaller media firms and regional publishers often face budget and expertise constraints, limiting adoption despite strong long-term benefits.

Regulatory and Ethical Challenges

Concerns related to data privacy, algorithmic bias, intellectual property rights, and deepfake content are creating regulatory uncertainty. Compliance with evolving AI governance frameworks can slow deployment and increase operational complexity for market participants.

What are the key opportunities in the cognitive media industry?

Expansion in Emerging Digital Media Markets

Asia-Pacific, Latin America, and the Middle East present significant growth opportunities due to rising internet penetration, mobile media consumption, and expanding regional OTT platforms. Cognitive media solutions tailored for vernacular content and low-bandwidth environments are expected to see strong adoption.

Cognitive Advertising and Revenue Intelligence

The shift toward privacy-centric advertising is creating opportunities for AI-powered contextual targeting and revenue optimization platforms. Solutions that deliver real-time ad performance analytics and predictive monetization insights are increasingly востребованы by advertisers and publishers.

Technology Type Insights

Generative AI leads the cognitive media market, accounting for approximately 32% of total revenue in 2024, driven by its ability to automate content creation and personalization. Machine learning–based analytics follow closely, enabling audience behavior prediction and content performance optimization. Natural language processing and computer vision technologies are gaining traction in news automation, metadata management, and video intelligence applications.

Deployment Model Insights

Cloud-based deployment dominates the market with nearly 61% share in 2024, supported by scalability, lower capital expenditure, and seamless AI model updates. On-premise deployments remain relevant for organizations with strict data sovereignty requirements, while hybrid models are increasingly adopted by large media enterprises seeking flexibility.

End-Use Industry Insights

Media and entertainment represent the largest end-use segment, contributing approximately 39% of the global cognitive media market in 2024. Advertising and marketing is the fastest-growing segment, driven by AI-powered targeting, campaign optimization, and real-time performance analytics. Emerging applications in education, e-learning, and government communications are further expanding the market scope.

| By Technology Type | By Media Functionality | By Deployment Model | By Media Format | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global cognitive media market in 2024, led by the United States. Strong investments in AI infrastructure, advanced advertising ecosystems, and early adoption of generative AI technologies support regional dominance.

Europe

Europe holds around 21% market share, with the U.K., Germany, and France leading adoption. Regulatory emphasis on ethical AI and data privacy is shaping product innovation and deployment strategies.

Asia-Pacific

Asia-Pacific represents nearly 29% of the global market and is the fastest-growing region, expanding at an estimated CAGR of over 25%. China, India, Japan, and South Korea are key contributors, driven by mobile-first consumption and regional content demand.

Latin America

Latin America accounts for about 7% of global demand, with Brazil and Mexico leading adoption as OTT penetration and digital advertising investments increase.

Middle East & Africa

The Middle East & Africa region holds roughly 9% market share, supported by smart city initiatives, digital transformation programs, and rising investments in media infrastructure, particularly in the UAE and Saudi Arabia.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cognitive Media Market

- Google (Alphabet)

- Microsoft

- IBM

- Amazon (AWS)

- Adobe

- Meta Platforms

- NVIDIA

- OpenAI

- Oracle

- SAP

- Tencent

- Baidu

- Netflix

- Sony Group

- Apple