Coffee Scales Market Size

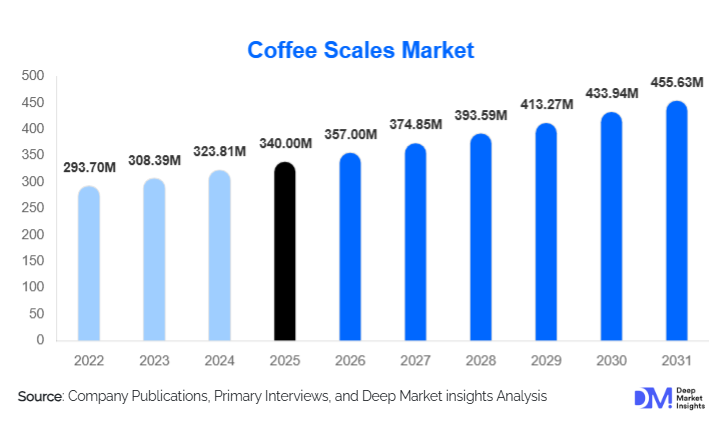

According to Deep Market Insights, the global coffee scales market size was valued at USD 340.00 million in 2025 and is projected to grow from USD 357.00 million in 2026 to reach USD 455.63 million by 2031, expanding at a CAGR of 5.0% during the forecast period (2026–2031). The coffee scales market growth is primarily driven by the rapid expansion of specialty coffee consumption, increasing adoption of precision brewing practices across cafés and home users, and the rising penetration of smart, app-enabled coffee brewing equipment globally.

Key Market Insights

- Precision brewing is becoming a global standard, with coffee scales increasingly viewed as essential equipment rather than optional accessories.

- Home brewing demand accounts for nearly half of global sales, supported by premiumization of residential coffee setups.

- Digital coffee scales dominate the market, while smart and connected models are recording the fastest growth.

- Asia-Pacific is the fastest-growing region, driven by specialty café expansion in China, South Korea, and Japan.

- Online direct-to-consumer channels lead distribution, benefiting from influencer marketing and global e-commerce reach.

- Commercial cafés and specialty roasters remain the highest-margin buyers, emphasizing accuracy, repeatability, and durability.

What are the latest trends in the coffee scales market?

Rise of Smart and Connected Coffee Scales

Smart coffee scales equipped with Bluetooth connectivity, brew-ratio tracking, and mobile app integration are gaining strong traction among advanced home brewers and professional cafés. These scales allow users to monitor extraction time, weight flow, and consistency across brews, aligning with data-driven coffee preparation trends. Integration with espresso machines and grinders is emerging as a differentiator, positioning coffee scales as part of connected brewing ecosystems rather than standalone tools. This trend is particularly strong in North America, Europe, and urban Asia-Pacific markets.

Premium Design and Compact Form Factors

Manufacturers are increasingly focusing on minimalist designs, heat-resistant materials, and compact form factors tailored for espresso machines and pour-over stations. Consumers are prioritizing aesthetics alongside functionality, especially in residential kitchens and specialty cafés where equipment visibility influences brand perception. Slim-profile scales with fast response times and waterproof coatings are becoming industry benchmarks, reinforcing the shift toward premium positioning.

What are the key drivers in the coffee scales market?

Expansion of Specialty Coffee Culture

The global specialty coffee segment continues to expand at a steady pace, driving demand for precision tools that ensure consistency and quality. Coffee scales play a critical role in manual brewing methods such as pour-over, AeroPress, and espresso, where small weight deviations can impact flavor profiles. As cafés compete on quality differentiation, investment in professional-grade scales has increased significantly.

Growth of Home Brewing and Prosumer Demand

Home consumers are increasingly adopting café-style brewing techniques, supported by higher disposable incomes and growing exposure to coffee education through digital platforms. This shift has expanded the addressable market for mid-range and premium coffee scales, particularly models with integrated timers and smart features. Prosumer demand is now a major growth engine for the global market.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

Advanced coffee scales remain relatively expensive in developing regions, limiting adoption beyond premium urban consumers. Entry-level users often substitute dedicated coffee scales with general kitchen scales, reducing penetration in price-sensitive markets. This remains a key challenge for broader global expansion.

Limited Replacement Cycles

Coffee scales typically have long usage lifespans, especially in residential settings, resulting in slower replacement demand. Unlike consumable brewing accessories, scales rely heavily on new user acquisition and feature upgrades to sustain growth momentum.

What are the key opportunities in the coffee scales industry?

Integration with Connected Brewing Platforms

There is strong opportunity to embed coffee scales into broader smart kitchen and coffee brewing ecosystems. Scales that seamlessly integrate with grinders, espresso machines, and mobile applications can unlock recurring revenue through software features, data analytics, and subscription-based brewing insights.

Rising Institutional and Training Demand

The global expansion of barista training institutes, coffee labs, and certification programs is creating stable B2B demand for high-accuracy coffee scales. These institutions prioritize calibration reliability and durability, offering manufacturers opportunities for bulk sales and long-term partnerships.

Product Type Insights

Digital coffee scales dominate the market, accounting for approximately 62% of global revenue in 2025, driven by their affordability, reliable accuracy, and broad availability across online and offline retail channels. These scales are widely used by both home brewers and commercial operators due to ease of calibration, compact form factors, and compatibility with modern brewing methods. Smart and connected coffee scales represent around 24% of the market and are the fastest-growing segment, expanding at double-digit rates as consumers increasingly adopt app-enabled brewing workflows, recipe tracking, and real-time extraction control. Mechanical coffee scales hold a smaller share, largely confined to niche users and traditional setups, with declining relevance in professional environments due to limited precision and lack of digital functionality.

End-Use Insights

Residential users account for nearly 46% of global demand, supported by rising home brewing adoption, growing interest in specialty coffee, and increased spending on premium brewing equipment. The segment benefits from consumer awareness of brewing consistency and the influence of online coffee education. Commercial cafés represent approximately 32% of the market, driven by café chain expansion, standardized brewing protocols, and the need for repeatable extraction across multiple locations. Specialty roasters, HoReCa operators, and coffee training institutes collectively account for the remaining share, with institutional demand growing steadily as coffee education, barista certification programs, and professional training facilities continue to expand globally.

Distribution Channel Insights

Online direct-to-consumer channels lead the market with around 41% share, benefiting from global shipping reach, influencer-driven marketing, detailed product comparisons, and strong penetration of brand-owned e-commerce platforms. Specialty coffee equipment stores remain critical for premium product positioning, offering hands-on demonstrations, expert guidance, and bundled brewing solutions. Mass retail channels primarily serve entry-level digital scale buyers, focusing on price-sensitive consumers and casual users. Meanwhile, B2B institutional sales are gaining importance, particularly among cafés, roasters, and training institutes that require bulk procurement, standardized equipment, and long-term supplier relationships.

| By Product Type | By Capacity Range | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global coffee scales market in 2025, led by the United States and Canada. A well-established specialty coffee culture, high per-capita spending on brewing equipment, and widespread adoption of home espresso and pour-over methods support sustained demand. Smart and app-connected scales show particularly strong traction among prosumer and enthusiast users, driven by data-focused brewing habits and strong penetration of premium coffee brands.

Europe

Europe holds around 28% market share, driven by steady demand from Germany, the United Kingdom, Italy, and Nordic countries. Consumer emphasis on precision brewing, product durability, and design quality supports the adoption of premium digital and smart scales. Sustainability considerations and preference for long-lasting equipment further reinforce replacement demand across both café operators and home users.

Asia-Pacific

Asia-Pacific represents about 26% of global demand and is the fastest-growing regional market, expanding at over 10% CAGR. China, Japan, and South Korea are key growth markets, supported by rapid café expansion, rising disposable incomes, and strong consumer acceptance of smart and connected coffee devices. Increasing participation in specialty coffee competitions and education also contributes to professional equipment adoption.

Latin America

Latin America accounts for nearly 7% of the market, with Brazil and Colombia leading regional demand. Growth is supported by café modernization initiatives and increased investment by export-oriented coffee producers in quality control and brewing consistency. Adoption remains concentrated in urban centers and specialty-focused establishments.

Middle East & Africa

The Middle East & Africa region contributes approximately 5% of global revenue, driven primarily by premium café expansion in the UAE and Saudi Arabia. Demand is centered on high-end commercial outlets and specialty coffee chains, with adoption largely limited to urban, tourism-driven, and high-income consumer segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The coffee scales market is moderately fragmented, with the top five manufacturers collectively accounting for approximately 48–52% of global revenue. Market leaders compete primarily on product accuracy, design, smart features, and brand credibility rather than price alone.

Key Players in the Coffee Scales Market

- Acaia

- Hario

- Timemore

- Brewista

- Felicita

- OXO

- Escali

- Rhino Coffee Gear

- MyWeigh

- Bonavita