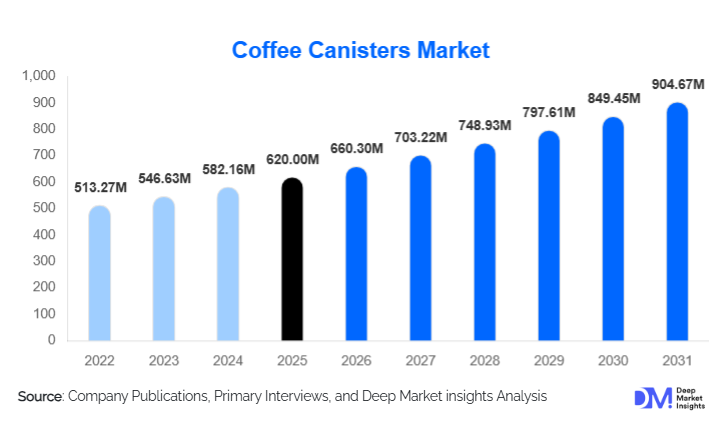

Coffee Canisters Market Size

According to Deep Market Insights, the global coffee canisters market size was valued at USD 620.00 million in 2025 and is projected to grow from USD 660.30 million in 2026 to reach USD 904.67 million by 2031, expanding at a CAGR of 6.5% during the forecast period (2026–2031). The coffee canisters market growth is primarily driven by the rising global consumption of specialty coffee, increasing adoption of home brewing equipment, and growing awareness of proper coffee storage to preserve freshness, aroma, and flavor integrity.

Key Market Insights

- Demand for airtight and freshness-preserving coffee storage solutions is increasing, supported by rising consumer awareness around oxidation and moisture control.

- Home brewing culture continues to expand globally, directly driving residential demand for premium coffee canisters.

- North America leads global demand, supported by high per-capita coffee consumption and widespread adoption of specialty coffee practices.

- Asia-Pacific is the fastest-growing region, driven by café expansion, rising disposable incomes, and urban lifestyle shifts.

- Stainless steel canisters dominate product adoption due to durability, premium appeal, and superior preservation properties.

- Online direct-to-consumer channels are reshaping market access, enabling brands to scale globally and educate consumers.

What are the latest trends in the coffee canisters market?

Premiumization of Coffee Storage Solutions

Coffee canisters are increasingly positioned as premium kitchen accessories rather than basic storage containers. Consumers investing in high-quality coffee beans are showing strong willingness to purchase stainless steel, ceramic, and valve-enabled canisters designed to maintain bean integrity. Design aesthetics, minimalistic finishes, and countertop-friendly formats are influencing purchasing decisions, particularly in urban households. This premiumization trend has allowed manufacturers to command higher average selling prices while improving brand differentiation.

Adoption of Advanced Preservation Technologies

Manufacturers are integrating CO₂ release valves, vacuum-seal mechanisms, and humidity-control features into coffee canisters to extend shelf life. These innovations are gaining traction among specialty coffee enthusiasts and professional users. While still representing a niche segment, smart and functional canisters with freshness indicators are witnessing growing adoption, particularly in developed markets where consumers value precision and product transparency.

What are the key drivers in the coffee canisters market?

Growth of Home Coffee Brewing

The rapid expansion of home espresso machines, grinders, and manual brewing methods has significantly increased the need for proper coffee storage. Consumers are increasingly aware that exposure to air, light, and moisture degrades coffee quality, driving sustained demand for airtight and valve-based canisters. This trend is especially strong in North America and Europe, where home brewing has become a daily ritual.

Expansion of Specialty Cafés and Coffee Chains

Global expansion of specialty cafés and branded coffee chains has boosted commercial demand for standardized coffee storage solutions. Cafés and roasters require reliable canisters to maintain consistency across multiple locations, leading to recurring bulk purchases. Emerging café cultures in Asia-Pacific and the Middle East are further strengthening this driver.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

In developing markets, a significant portion of consumers continue to use generic containers for coffee storage, limiting penetration of premium canisters. Higher price points for stainless steel and valve-enabled products restrict adoption among cost-conscious buyers, particularly in rural and semi-urban areas.

Risk of Product Commoditization

Basic plastic and conventional lid canisters face intense competition due to low entry barriers and widespread availability. Without strong branding or functional differentiation, manufacturers in this segment face margin pressure and limited pricing power.

What are the key opportunities in the coffee canisters industry?

Smart and Connected Coffee Canisters

The integration of freshness indicators, humidity sensors, and app-based monitoring presents a long-term opportunity for product differentiation. As smart kitchens gain popularity, connected coffee canisters can appeal to tech-savvy consumers and professional users seeking precision storage solutions.

Rising Demand from Emerging Coffee Markets

Countries such as India, China, Brazil, and Indonesia are witnessing rapid growth in café density and specialty coffee consumption. Localized manufacturing and private-label partnerships with café chains present scalable growth opportunities for market participants.

Product Material Insights

Stainless steel coffee canisters dominate the market, accounting for approximately 38% of global revenue in 2025, driven by durability, corrosion resistance, and premium positioning. Glass and ceramic canisters appeal to design-focused consumers, while plastic canisters remain relevant in entry-level price segments. Hybrid and composite materials are gaining traction as manufacturers seek to balance cost, aesthetics, and performance.

Closure & Preservation Technology Insights

Airtight lid canisters represent the largest segment with around 42% market share, owing to affordability and widespread household adoption. CO₂ valve-enabled and vacuum-seal canisters are growing rapidly, particularly among specialty coffee users who prioritize freshness preservation. Conventional lid canisters are gradually losing relevance in premium markets.

Capacity Insights

The 250–500 gram capacity segment leads global demand, accounting for nearly 36% of total sales, as it aligns with typical household consumption cycles. Smaller canisters below 250 grams are popular among single-origin coffee users, while capacities above 1 kg are primarily used in commercial and institutional settings.

End-Use Insights

Residential users account for approximately 49% of global demand, supported by home brewing adoption and premium kitchen investments. Commercial cafés and specialty roasters represent the fastest-growing end-use segment, expanding at close to 8% annually, driven by café expansion and quality standardization.

Distribution Channel Insights

Online direct-to-consumer channels lead the market with roughly 44% share, benefiting from global shipping, influencer marketing, and brand-owned websites. Specialty kitchenware stores remain important for premium positioning, while B2B and HoReCa channels support recurring commercial demand.

| By Product Material | By Closure & Preservation Technology | By Capacity | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of global market revenue, led primarily by the United States. High per-capita coffee consumption, a mature specialty coffee ecosystem, and widespread adoption of premium kitchenware continue to support regional leadership. Growth is further reinforced by home brewing trends, strong e-commerce penetration, and consistent demand from professional cafés and roasters.

Europe

Europe represents around 23% of the global market, with Germany, the U.K., and France driving regional demand. Consumers show a strong preference for durable, design-focused, and sustainable products, supporting steady replacement and upgrade cycles. Established café culture and growing interest in home espresso and manual brewing methods also contribute to stable market performance.

Asia-Pacific

Asia-Pacific holds nearly 29% of global market share and is the fastest-growing region. Rapid café expansion, rising disposable incomes, and increasing urbanization across China, India, Japan, and South Korea are key growth drivers. The region benefits from a growing middle class, expanding specialty coffee chains, and increasing adoption of premium home coffee equipment among younger consumers.

Latin America

Latin America accounts for approximately 8% of global demand, led by coffee-producing countries such as Brazil and Colombia. Rising domestic consumption, growing specialty coffee awareness, and increasing café density are supporting market expansion. Demand is also influenced by a gradual shift toward higher-quality brewing tools among urban consumers.

Middle East & Africa

The Middle East & Africa region contributes around 6% of global revenue, with demand concentrated in the UAE, Saudi Arabia, and South Africa. Premium café culture, hospitality sector investments, and strong demand for high-end coffee experiences support regional growth. Urban lifestyle shifts and international café brand expansion continue to strengthen market adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The coffee canisters market is moderately fragmented, with the top five manufacturers accounting for approximately 33% of global revenue. Brand strength, product design, and functional differentiation remain key competitive factors.

Key Players in the Coffee Canisters Market

- Fellow Products

- OXO International

- Planetary Design

- Hario Co., Ltd.

- Brabantia

- Le Creuset

- Joseph Joseph

- Tupperware Brands

- Kinto Co., Ltd.

- Zwilling J.A. Henckels