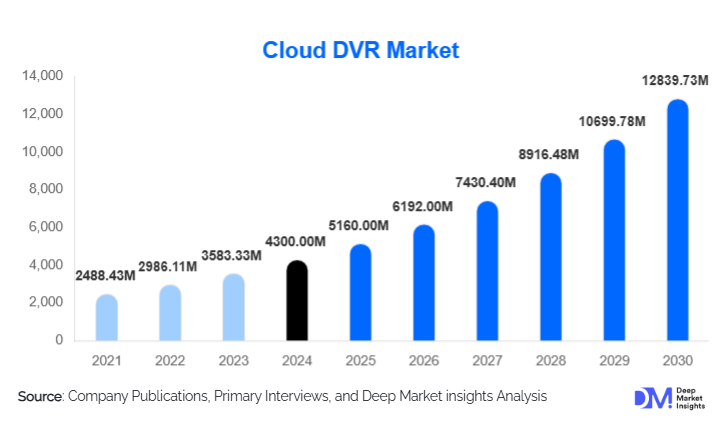

Cloud DVR Market Size

According to Deep Market Insights, the global cloud DVR market size was valued at USD 4,300.00 million in 2024 and is projected to grow from USD 5,160.00 million in 2025 to reach USD 12,839.73 million by 2030, expanding at a CAGR of 20.00% during the forecast period (2025–2030). Growth in the cloud DVR market is primarily driven by surging OTT adoption, the shift from physical DVR hardware to cloud-based storage, and the rising demand for flexible, time-shifted video viewing experiences worldwide. Increasing broadband penetration and the bundling of cloud DVR services by telecom and cable operators further strengthen overall market expansion.

Key Market Insights

- Cloud DVR adoption is accelerating globally as consumers shift from hardware DVRs to cloud-based recording and playback across devices.

- OTT platforms integrating cloud DVR functionality are driving subscription growth and boosting user retention.

- Hybrid storage architectures (HDD+SSD) are dominating deployments due to cost–performance efficiency.

- North America holds the largest market share, while Asia-Pacific remains the fastest-growing region due to rising broadband and streaming penetration.

- Telecom operators and ISPs are aggressively bundling Cloud DVR with broadband and IPTV packages to drive ARPU and reduce churn.

- AI-based content personalisation, smart recording, and cross-device sync are emerging as key differentiators among providers.

What are the latest trends in the Cloud DVR market?

AI-Enhanced Content Discovery and Smart Recording

Market-leading OTT platforms and telecom operators are integrating machine learning and AI to create smarter Cloud DVR experiences. AI-based algorithms now identify user preferences, auto-record shows, improve content discovery, and optimise storage usage. Smart metadata tagging and intelligent indexing significantly enhance the user experience by enabling faster search, better organisation, and seamless multi-device playback. As AI models improve, Cloud DVR services are evolving from simple recording tools into personalised content hubs.

Expansion of Cloud DVR Bundling in Telecom Ecosystems

A major trend shaping the industry is the increasing bundling of Cloud DVR within broadband, IPTV, and OTT subscription packages. Telecom operators in North America, Europe, and emerging Asian markets are offering Cloud DVR as a default feature to encourage long-term customer retention. This bundling model reduces hardware dependence, cuts operational costs, and delivers a more flexible viewing experience. Operators are also offering tiered DVR storage, such as 100-hour, 500-hour, or unlimited plans, creating new revenue streams and upsell opportunities.

What are the key drivers in the Cloud DVR market?

Shift Away from Physical DVR Hardware

Consumers are rapidly transitioning from traditional set-top DVR boxes toward cloud-based storage solutions that eliminate hardware limitations. Cloud DVR offers anywhere access, multiple device compatibility, and unlimited recording capacity, making physical DVR obsolete. Providers benefit from reduced hardware costs and enhanced scalability, accelerating global adoption.

Rising OTT and Streaming Consumption

The explosive growth of OTT platforms such as Netflix, Hulu, and regional streaming services is driving demand for flexible video consumption models. With binge-watching and time-shifted viewing becoming mainstream, cloud DVR enables users to record live content, skip ads, and access content offline or across devices, perfectly aligning with modern viewing behaviour.

Advancements in Cloud Storage and Network Infrastructure

The maturation of cloud computing, SSD/HDD hybrid storage, and global CDNs has enhanced the performance, speed, and reliability of cloud DVR systems. Faster broadband speeds and widespread 5G rollout are enabling seamless HD and 4K content storage and streaming, supporting long-term industry growth.

What are the restraints for the global market?

Content Licensing Restrictions and Copyright Barriers

The Cloud DVR industry faces stringent content rights regulations, especially in markets like the U.S. Providers often must create individual copies for each subscriber, increasing infrastructure and storage costs. Licensing complexities also limit cross-border content availability, slowing market expansion.

Bandwidth Limitations in Emerging Markets

Cloud DVR performance heavily relies on strong and consistent internet connectivity. In many developing regions, unstable bandwidth, high data costs, and limited broadband coverage hinder adoption. This creates quality-of-service challenges, especially for HD and 4K content playback.

What are the key opportunities in the Cloud DVR industry?

Integration with OTT & Telecom Bundles

Bundling Cloud DVR with streaming, broadband, and IPTV packages opens significant revenue potential. Operators can expand ARPU, reduce subscriber churn, and offer differentiated service tiers. This bundle-driven model is especially promising in emerging markets that are experiencing rapid digital transformation.

Emerging Market Expansion with Growing Broadband Penetration

Countries across Asia, the Middle East, Africa, and Latin America are witnessing rapid internet infrastructure growth. As streaming adoption accelerates, first-time digital TV users represent a large, untapped market for Cloud DVR services. Localised content offerings, affordable tiered plans, and multi-language support can help providers capture early mover advantage.

Leveraging Cloud-Native Innovations & AI

AI-driven recommendations, automated recording, compression optimisation, and smart storage management create tremendous differentiation opportunities. Cloud-native video processing, such as HEVC encoding and adaptive bitrate streaming, enhances user experience while reducing costs. Providers integrating these technologies can gain competitive leadership.

Product Type Insights

Subscription-based Cloud DVR services dominate the market, accounting for nearly 60% of total 2024 revenue. These plans offer predictable pricing, unlimited or tiered storage, multi-device access, and integration with OTT and cable services. Pay-per-use models, while smaller in share, appeal to price-sensitive users and specific markets with variable viewing habits. Hybrid storage (HDD+SSD) continues to grow as the preferred architecture among providers due to cost efficiency and scalability.

Application Insights

Residential usage is the core application segment, contributing nearly 70% of global Cloud DVR demand in 2024. Consumer demand for flexible, time-shifted video viewing drives this segment’s dominance. In commercial applications, hotels, MDUs, and hospitality chains are increasingly integrating Cloud DVR into in-room entertainment systems, creating new revenue streams. Media companies and broadcasters also leverage cloud DVR infrastructure for catch-up TV and hybrid OTT offerings.

Distribution Channel Insights

OTT platforms and telecom operators serve as the leading distribution channels for Cloud DVR, responsible for over half of global installations. Direct-to-consumer (D2C) streaming services with integrated DVR functionality are gaining traction. Telecom ISPs increasingly rely on bundled models to retain customers, offering Cloud DVR as a value-added component alongside broadband and IPTV subscriptions.

User Type Insights

Household subscribers represent the largest user demographic for Cloud DVR services, driven by cross-device streaming trends and multi-user families requiring flexible content access. Younger consumers (18–35), who favour mobile streaming and binge-watching, are the fastest-growing user base. Professionals aged 30–55 drive premium DVR plan adoption due to higher disposable incomes and a preference for on-demand viewing.

| By Service Type | By Storage / Technology Type | By Platform / Provider Type | By End-Use / Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest Cloud DVR market, representing approximately 35–40% of global 2024 revenue. High broadband speeds, advanced OTT ecosystems, and strong consumer preference for on-demand viewing drive adoption. The U.S. leads the region, with telecom giants and streaming companies aggressively bundling cloud DVR into service packages.

Europe

Europe accounts for 15–20% of global demand, supported by widespread IPTV and digital TV usage. Western Europe, particularly the U.K., Germany, and France, shows strong adoption of DVR-enabled streaming services. Regulatory fragmentation poses challenges but does not hinder overall growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, capturing 25–30% of the 2024 market and projected to expand rapidly by 2030. Rising middle-class incomes, surging OTT adoption in India and Southeast Asia, and local telecom bundling strategies strengthen regional demand. China and India lead with high mobile-first consumption patterns.

Latin America

Latin America accounts for 8–10% of global Cloud DVR revenue. Brazil, Mexico, and Argentina are the primary growth engines, aided by improving broadband access and expanding streaming subscriptions. Telecom operators are increasingly offering DVR-inclusive packages to attract new users.

Middle East & Africa

MEA represents 5–7% of the global market but shows strong growth potential. The Middle East, particularly the UAE and Saudi Arabia, is adopting Cloud DVR rapidly due to high-income households and premium OTT uptake. Africa’s growth is tied to improving internet infrastructure and mobile streaming habits.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cloud DVR Market

- Amazon Web Services (AWS)

- Google Cloud

- Comcast Corporation

- Hulu (Disney Streaming)

- Roku Inc.

- Dish Network

- AT&T / DirecTV

- Verizon Communications

- NetApp

- Harmonic Inc.

- Akamai Technologies

- SeaChange International

- Telefonica

- Charter Communications

- Sky Group

Recent Developments

- In 2024, several OTT providers expanded their Cloud DVR storage tiers, offering unlimited recording plans to increase subscription value.

- In 2025, telecom operators in APAC and LATAM introduced AI-enhanced DVR services bundled with fibre broadband packages.

- Cloud infrastructure companies invested heavily in CDN and hybrid storage upgrades to support global 4K recording demand.