Climbing Helmet Market Size

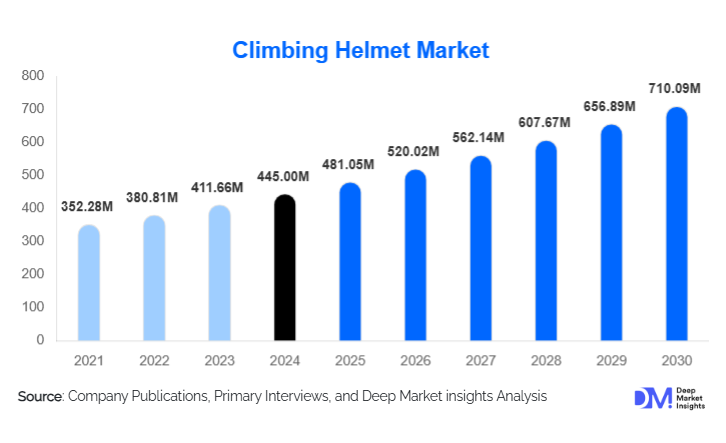

According to Deep Market Insights, the global climbing helmet market size was valued at USD 445 million in 2024 and is projected to grow from USD 481.05 million in 2025 to reach approximately USD 710.09 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The climbing helmet market growth is primarily driven by the rapid expansion of indoor climbing gyms, rising participation in recreational and competitive climbing, increasing safety awareness, and continuous product innovation focused on lightweight and high-impact protection.

Key Market Insights

- Sport and indoor climbing applications dominate demand, supported by the global rise of urban climbing gyms and Olympic-level recognition of climbing.

- Foam and hybrid helmet constructions are gaining preference due to superior comfort, reduced weight, and enhanced ventilation.

- Europe remains the largest regional market, supported by strong Alpine traditions and stringent safety compliance.

- Asia-Pacific is the fastest-growing region, driven by gym expansion, youth participation, and rising disposable incomes.

- Mid-range helmets (USD 60–120) account for the largest share, balancing safety certifications with affordability.

- E-commerce and D2C channels are rapidly expanding, especially among younger, tech-savvy climbers.

What are the latest trends in the climbing helmet market?

Lightweight and Multi-Impact Helmet Designs

Manufacturers are increasingly focused on developing lightweight helmets that provide multi-impact protection without compromising comfort. Advanced foam materials such as EPS and EPP, combined with hybrid shell constructions, are enabling helmets to absorb repeated impacts while remaining compact and breathable. This trend is particularly important for sport climbers and mountaineers who prioritize long-duration wear comfort. Reduced helmet weight has also helped improve adoption among experienced climbers who were previously resistant to helmet use.

Sustainability and Eco-Friendly Materials

Sustainability is emerging as a differentiating trend in the climbing helmet market. Leading brands are introducing recyclable plastics, bio-based foams, and low-emission manufacturing processes. Environmentally conscious consumers, particularly in Europe and North America, increasingly favor brands that align with responsible outdoor ethics. Sustainable packaging, extended product life cycles, and repair-friendly designs are also gaining traction as manufacturers align product strategies with circular economy principles.

What are the key drivers in the climbing helmet market?

Growth of Indoor Climbing Gyms

The global proliferation of indoor climbing gyms is one of the strongest growth drivers for climbing helmets. Gyms frequently mandate helmet use for beginners, youth programs, and training courses, creating consistent institutional demand. Urbanization and increasing interest in fitness-oriented adventure sports have significantly expanded the addressable consumer base beyond traditional outdoor climbers.

Rising Safety Awareness and Certification Standards

Increasing awareness of head injury risks and stricter enforcement of international safety standards have accelerated helmet adoption. Certifications such as CE and UIAA are now considered essential benchmarks, encouraging climbers to upgrade or replace older helmets. Professional guides, climbing federations, and insurance providers further reinforce helmet usage, supporting long-term market growth.

What are the restraints for the global market?

Price Sensitivity in Emerging Markets

Premium climbing helmets can be relatively expensive, limiting adoption among price-sensitive consumers in developing regions. Entry-level users often delay purchases or opt for uncertified alternatives, slowing penetration in emerging markets.

Cultural Resistance Among Experienced Climbers

In certain climbing disciplines, especially sport climbing, some experienced climbers continue to perceive helmets as unnecessary. Overcoming these ingrained perceptions requires ongoing education, regulation by gyms, and advocacy from professional athletes.

What are the key opportunities in the climbing helmet industry?

Institutional and Bulk Sales to Gyms and Training Centers

The expansion of climbing gyms, adventure training institutes, and youth sports programs presents strong opportunities for bulk helmet sales. Manufacturers offering durable, adjustable, and cost-efficient helmet models can secure long-term supply agreements and recurring revenue.

Technological Integration and Smart Safety Features

Opportunities are emerging for integrating smart features such as impact indicators, RFID tracking for gym inventory, and sensor-based damage alerts. These innovations can support premium pricing and enhance differentiation, particularly for professional and institutional users.

Product Type Insights

Foam (in-mold) helmets lead the market, accounting for approximately 48% of global demand in 2024, due to their lightweight construction and comfort. Hybrid helmets are gaining share among mountaineers and alpine climbers who require enhanced durability, while traditional hardshell helmets remain relevant in institutional and training applications where durability and cost-efficiency are prioritized.

Application Insights

Sport climbing, including indoor and outdoor applications, represents the largest application segment with around 42% market share. Mountaineering and alpine climbing follow, driven by strict safety requirements in high-altitude environments. Ice climbing and via ferrata segments, while smaller, are growing steadily due to rising adventure tourism participation.

Distribution Channel Insights

Specialty outdoor and sports retail stores dominate distribution, accounting for nearly 46% of sales, as consumers prefer professional fitting and expert advice. E-commerce and D2C platforms are the fastest-growing channels, benefiting from wider product availability, competitive pricing, and direct brand engagement.

End-User Insights

Recreational climbers constitute the largest end-user segment, representing approximately 55% of total demand. Professional climbers and mountaineers drive premium helmet sales, while climbing gyms and adventure operators generate consistent institutional demand through bulk procurement and replacement cycles.

| By Helmet Construction Type | By Application | By End User | By Distribution Channel | By Price Category |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global climbing helmet market with an estimated 32% share in 2024. Germany, France, Italy, Switzerland, and Austria are key contributors, supported by strong Alpine climbing cultures, high safety compliance, and premium product adoption.

North America

North America accounts for approximately 28% of global demand, led by the United States. The region benefits from widespread gym networks, strong adventure sports participation, and high consumer spending on certified safety equipment.

Asia-Pacific

Asia-Pacific represents about 23% of the market and is the fastest-growing region, expanding at over 9.5% CAGR. China, Japan, South Korea, and India are driving growth through gym expansion, youth participation, and government-supported sports infrastructure.

Latin America

Latin America holds roughly 9% market share, led by Chile and Argentina. Growth is supported by adventure tourism and the increasing adoption of climbing as a recreational sport.

Middle East & Africa

The Middle East & Africa account for around 8% of global demand, with growth driven by tourism initiatives in the UAE and Saudi Arabia and climbing activity in the alpine regions of Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|