Children's Entertainment Centers Market Size

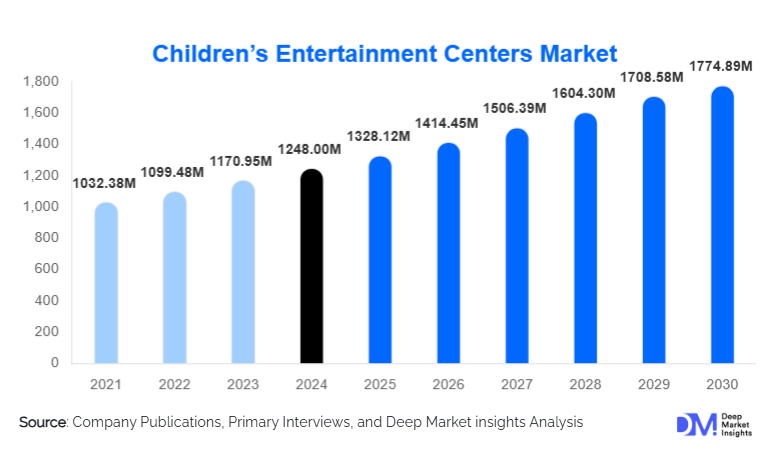

According to Deep Market Insights, the global children's entertainment centers market size was valued at USD 1,248.00 Million in 2024 and is projected to grow from USD 1,328.12 Million in 2025 to reach USD 1,774.89 Million by 2030, expanding at a CAGR of 6.50% during the forecast period (2025–2030). Growth in this market is fueled by rising family leisure spending, strong mall and retail infrastructure expansion, increased demand for safe indoor entertainment, and rapid adoption of immersive AR/VR technologies targeting children, teens, and family social groups.

Key Market Insights

- Asia-Pacific remains the largest regional market, accounting for nearly one-third of global revenue in 2024, driven by rapid urbanization, expanding malls, and high youth population density.

- Teenagers (12–18 years) dominate visitor demographics, contributing the highest revenue share due to their strong preference for arcades, VR zones, and competitive gaming activities.

- Medium-sized entertainment centers (10,001–20,000 sq. ft.) lead the facility segment, supported by their operational efficiency, balanced CAPEX, and popularity in malls and retail hubs.

- Entry ticket and attraction fee revenues account for nearly half of the total market value, making them the largest revenue stream globally.

- Soft-play and physical activity zones remain the most widely adopted offering type, especially for younger children, contributing stable year-round demand.

- Technology integration, AR/VR, motion tracking, and e-sports zones are reshaping engagement and driving premium pricing strategies in developed and emerging markets.

What are the latest trends in the children’s entertainment centers market?

Immersive & Technology-Driven Experiences Becoming Mainstream

Children’s entertainment centers are increasingly adopting interactive digital technologies such as AR/VR gaming, mixed-reality simulations, digital trampolines, motion capture games, and e-sports arenas. These offerings appeal strongly to tech-savvy children, teens, and young adults, supporting higher per-visitor spending. Many centers are also integrating mobile apps for booking, loyalty programs, real-time game scores, and team competitions. This digital layer enhances engagement and drives repeat visits, particularly in urban markets where digital-native demographics dominate.

Edutainment and STEM-Based Play Zones Rising in Popularity

Parents worldwide are increasingly prioritizing learning-enriched entertainment. Centers are responding by introducing STEM labs, robotics corners, interactive science exhibits, and problem-solving games. This hybrid model merges fun with child development, making it highly attractive to families with younger children. Schools and educational institutions are partnering with entertainment centers for field trips, skill-based programs, and after-school activities, expanding weekday utilization and diversifying revenue.

What are the key drivers in the children’s entertainment centers market?

Rising Disposable Incomes and Family Leisure Spending

Growing middle-class populations in emerging markets and increasing discretionary spending on family leisure activities are key growth drivers. Families seek safe, structured, and engaging spaces for children, especially in densely populated urban areas where outdoor recreation is limited. The shift from “material gifting” to “experience spending” is further accelerating growth.

Expansion of Urban Retail & Mall Infrastructure

Shopping malls and mixed-use developments are rapidly expanding in the Asia-Pacific, the Middle East, and Latin America. Entertainment centers have become essential anchor attractions that boost footfall and increase dwell time. Their integration into malls reduces CAPEX for operators and provides high foot-traffic environments, driving rapid global proliferation.

Technological Advancements in Gaming & Interactive Entertainment

Advances in VR, AR, motion sensors, gamification, and AI-driven entertainment platforms have transformed the CEC ecosystem. These innovations create immersive, personalized, and socially engaging experiences that traditional playgrounds cannot match. Technology allows operators to command premium pricing while appealing to a wider demographic, children, teens, and adults.

What are the restraints for the global market?

High Initial Investment and Operating Costs

Building and maintaining entertainment centers, especially those with high-tech attractions, requires significant capex. Real estate, safety compliance, equipment, staffing, and maintenance expenses limit the entry of small operators. Profitability is sensitive to footfall volatility, making investment risky in low-density regions.

Competition from Home Entertainment & Mobile Gaming

Children now have access to a wide range of digital entertainment options at home, including mobile games, VR devices, gaming consoles, and streaming platforms. These low-cost or free alternatives reduce the frequency of visits to physical entertainment centers, especially during economic downturns.

What are the key opportunities in the children’s entertainment centers industry?

Technology-Enhanced Hybrid Entertainment Centers

The integration of VR gaming, AR-based treasure hunts, digital sports tournaments, mixed-reality experiences, and e-sports arenas presents a lucrative opportunity. These immersive zones attract teens and young adults, segments with high per-visit spending, and support premium pricing, memberships, and recurring revenue models.

Expansion into Emerging Markets

Asia-Pacific, Middle East & Africa, and Latin America present strong expansion opportunities due to rising urban populations, growing retail infrastructure, and underpenetrated entertainment markets. Secondary cities in India, China, Indonesia, and the Gulf region offer substantial untapped demand, enabling new entrants to scale rapidly with mid-sized center formats.

New Revenue Models: Memberships, Events & Edutainment

Operators are increasingly diversifying revenue beyond ticket sales through birthday events, school collaborations, merchandise, loyalty programs, STEM workshops, and subscription packages. Edutainment-based offerings appeal strongly to parents seeking developmental value, creating sustained weekday demand and higher occupancy during non-peak hours.

Product Type Insights

Soft-play and physical activity zones dominate the market, driven by consistent demand from children aged 3–12 and parents prioritizing safety and physical engagement. Arcade gaming and redemption zones remain a strong revenue generator, particularly among teenagers. VR and AR attractions are the fastest-growing product category, supported by their immersive nature and repeat-visit potential. Hybrid centers that combine physical play, digital experiences, and F&B areas are emerging as the preferred format for malls and mixed-use developments.

Application Insights

Family leisure remains the core application segment, supported by birthday parties, weekend outings, and school field trips. Teen-focused applications such as competitive gaming, e-sports, and social hangout zones are growing rapidly. Edutainment applications, STEM learning, robotics, and interactive science zones are gaining importance, particularly in markets with strong parental emphasis on child development. Corporate events, youth competitions, and group-based recreational programs are emerging as niche but high-value applications.

Distribution Channel Insights

Online booking platforms, D2C websites, and mobile apps dominate booking channels, enabling customers to reserve slots, purchase memberships, and manage event bookings. Walk-in bookings remain important for small- and mid-sized centers located in malls. Social media marketing, influencer promotions, and digital loyalty programs are increasingly critical to attracting teens and young families. Franchise operators also use centralized digital platforms for pricing, customer analytics, and targeted promotions.

Visitor Type Insights

Group visitors, family groups, school groups, and teen friend circles represent the largest share of center footfall. Teen groups drive high revenue through arcades and VR experiences. Families with children under 12 contribute strong weekend demand, with a focus on physical play and edutainment. Young adult visitors (18–24 years) are an emerging growth segment, primarily attracted to VR and competitive gaming zones. Birthday parties and event groups remain one of the most profitable visitor categories.

Age Group Insights

Children aged 6–12 years and teenagers aged 12–18 represent the dominant age groups in the market. Teens account for approximately 30–35% of total revenue due to their spending on arcades, VR, and competitive gaming experiences. Younger children (0–5 years) drive consistent demand for soft-play zones, attracting parents seeking safe developmental play environments. Adults accompanying children represent a secondary revenue channel, especially through F&B and merchandise purchases.

| By Visitor Demographics | By Facility Size | By Activity / Offering Type | By Revenue Model |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is a mature market with strong spending power, established entertainment brands, and high penetration of mall-integrated centers. U.S. demand is driven by teens and families seeking immersive digital experiences and multi-activity centers. Refurbishment of older centers with VR and mixed-reality zones is a key trend supporting market retention.

Europe

Europe shows stable demand for indoor playgrounds, trampoline parks, and soft-play cafés. The region prioritizes safety, hygiene, and structured play environments. Western Europe dominates market activity, while Eastern Europe is emerging with new mall developments and rising family leisure spending.

Asia-Pacific

Asia-Pacific accounts for the largest share (33–35%) of global revenue. India, China, Indonesia, and Southeast Asian nations drive demand due to young demographics, rapid urbanization, and strong mall expansion. India alone generated approximately USD 1.2 billion in CEC revenue in 2024, driven by growing middle-class families and retail developments.

Latin America

Demand is gradually rising, especially in Brazil, Mexico, and Argentina. Economic fluctuations limit rapid growth, but urban centers with expanding malls are boosting the adoption of indoor entertainment formats.

Middle East & Africa

The Middle East, particularly the UAE, Saudi Arabia, and Qatar, is experiencing fast growth powered by high-income populations, robust mall infrastructure, and a preference for premium indoor recreation due to climate conditions. Africa shows moderate growth, with South Africa and Egypt leading the adoption of mall-integrated centers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Children’s Entertainment Centers Market

- Dave & Buster’s

- Sky Zone

- LEGOLAND Discovery Center

- KidZania

- Round1

- Urban Air Adventure Parks

- Main Event Entertainment

- Bowlero Corp.

- Punch Bowl Social

- Altitude Trampoline Park

- Boomers! Parks

- Scene75 Entertainment Center

- Great Wolf Lodge (Entertainment Division)

- Chuck E. Cheese (CEC Entertainment)

- Timezone Group

Recent Developments

- In March 2025, KidZania announced expansion into Southeast Asia with two new centers integrating STEM-based edutainment and digital play experiences.

- In February 2025, Sky Zone launched a next-generation trampoline and VR-integrated park format targeting teens and young adults.

- In January 2025, Urban Air Adventure Park introduced a hybrid entertainment arena combining AR-based obstacle courses and interactive climbing zones.