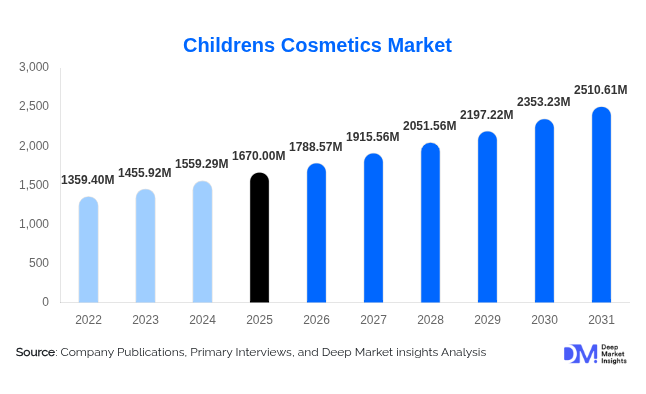

Children’s Cosmetics Market Size

According to Deep Market Insights, the global children's cosmetics market size was valued at USD 1670 million in 2025 and is projected to grow from USD 1788.57 million in 2026 to reach USD 2510.61 million by 2031, expanding at a CAGR of 7.1% during the forecast period (2026–2031). The children’s cosmetics market growth is primarily driven by rising parental awareness around age-appropriate personal care, increasing demand for non-toxic and dermatologically tested formulations, and the growing influence of licensed characters and social media on children’s grooming habits.

Key Market Insights

- Natural and organic children’s cosmetics are gaining strong traction, driven by heightened concerns around chemical exposure and skin sensitivity.

- Color cosmetics, particularly nail products and lip care, dominate demand due to their playful, non-invasive nature and ease of use.

- Offline retail remains the largest distribution channel, supported by parental preference for physical product evaluation and impulse gifting.

- Asia-Pacific is the fastest-growing regional market, fueled by rising middle-class income, urbanization, and expanding e-commerce penetration.

- Licensed and character-based product packaging continues to influence purchase decisions, especially in the 7–12 age group.

- E-commerce and DTC platforms are reshaping brand engagement through subscriptions, personalization, and influencer-led marketing.

What are the latest trends in the children’s cosmetics market?

Clean-Label and Dermatologically Tested Formulations

The shift toward clean-label children’s cosmetics is one of the most prominent trends shaping the market. Parents are increasingly prioritizing products that are free from parabens, sulfates, phthalates, and artificial fragrances. This has accelerated demand for hypoallergenic, dermatologist-tested, and pediatrician-approved cosmetics, particularly in skincare and bath products. Brands are investing heavily in transparent labeling, third-party safety certifications, and plant-based ingredients to build trust and justify premium pricing. This trend is especially strong in North America and Europe, where regulatory scrutiny and consumer awareness are high.

Rise of Character-Licensed and Gift-Oriented Products

Licensed cosmetics featuring popular cartoons, movies, and digital characters are gaining widespread popularity. These products combine emotional appeal with functionality, making them highly attractive for gifting occasions such as birthdays and holidays. Kits and bundled gift sets now account for a significant share of sales, as they offer higher perceived value and convenience. The integration of sustainable and reusable packaging within these licensed kits is also emerging as a differentiating factor.

What are the key drivers in the children’s cosmetics market?

Growing Parental Awareness of Child-Specific Grooming

Parents are increasingly aware that children’s skin and hair require specialized care distinct from adult products. This awareness is driving demand for age-appropriate cosmetics that are gentle, safe, and formulated for sensitive skin. Pediatric endorsements and dermatologist recommendations are further reinforcing this driver, particularly for skincare and hair care products.

Influence of Social Media and Digital Content

Exposure to social media, online videos, and children’s entertainment content has significantly influenced grooming and self-expression behaviors among younger age groups. Children increasingly seek playful cosmetics inspired by influencers and characters, while parents rely on online reviews and educational content before purchasing. This dynamic is accelerating product discovery and brand engagement.

What are the restraints for the global market?

Regulatory and Compliance Complexity

Children’s cosmetics are subject to stricter safety and compliance standards compared to adult cosmetics. Regulatory requirements related to ingredient safety, allergen testing, and labeling increase product development timelines and costs. Smaller brands often face challenges in scaling operations due to these compliance burdens.

Price Sensitivity in Emerging Markets

While demand is rising globally, affordability remains a constraint in developing economies. Premium organic and imported products often face limited penetration unless supported by localized manufacturing or tiered pricing strategies. This price sensitivity can slow adoption in high-growth regions.

What are the key opportunities in the children’s cosmetics industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and the Middle East present strong growth opportunities due to rising disposable incomes and expanding urban populations. Localized product offerings, culturally relevant packaging, and affordable pricing models can unlock significant untapped demand in these regions.

Digital-First and Subscription-Based Models

Direct-to-consumer platforms and subscription-based grooming kits offer opportunities to build long-term customer relationships. Personalized product recommendations, recurring deliveries, and educational content can increase customer lifetime value while reducing reliance on traditional retail channels.

Product Type Insights

Color cosmetics represent the largest product segment in the global children’s cosmetics market, accounting for approximately 42% of the market in 2025. Within this segment, nail products are the most prominent, fueled by the popularity of water-based and peel-off formulations that are safe, non-toxic, and easy for children to use. Skincare products follow closely, driven by increasing parental preference for gentle, hypoallergenic cleansers, moisturizers, and broad-spectrum sunscreens that cater specifically to sensitive child skin. Hair care and fragrance products form smaller but steadily expanding segments, supported by innovations such as tear-free shampoos, alcohol-free sprays, and eco-friendly packaging. Overall, product growth is strongly influenced by parental demand for safe, age-appropriate, and dermatologically tested formulations, which remains the leading driver across all categories.

Age Group Insights

Children aged 7–9 years account for the largest share of market demand, contributing nearly 34% of global revenue. This age group shows high engagement with self-expression products, particularly color cosmetics and playful kits, while still being under parental supervision, making them the most attractive demographic for brands. Pre-teens aged 10–12 years represent the fastest-growing segment, driven by early grooming routines, social influence, and exposure to digital media and licensed characters. Younger children, especially those aged 0–6 years, primarily drive demand for gentle skincare, bath, and hair care products, reflecting parents’ focus on safety, moisturizing, and skin protection.

Distribution Channel Insights

Offline retail dominates the global children’s cosmetics market with nearly 60% share in 2025, supported by supermarkets, hypermarkets, specialty beauty stores, and pharmacies. Parents often prefer physically inspecting products, especially for safety and ingredient verification. However, online channels are expanding rapidly, fueled by brand-owned websites, e-commerce platforms, and subscription-based offerings. These digital channels allow premium and niche brands to reach urban consumers efficiently, offer personalized product recommendations, and leverage influencer marketing and social media campaigns. The shift toward omnichannel strategies is enhancing convenience and brand visibility, particularly for parents seeking trusted, safe products for their children.

| By Product Type | By Age Group | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share of the children’s cosmetics market at approximately 32% in 2025, led by the United States. Growth is primarily driven by high disposable income, strong brand awareness, and widespread adoption of clean-label, hypoallergenic, and dermatologically tested products. Parental focus on safety, combined with robust retail infrastructure and a strong presence of global cosmetic brands, further supports demand. Additional drivers include growing interest in organic and natural formulations, and the influence of social media and online reviews, which significantly impact parental purchasing decisions.

Europe

Europe accounts for nearly 26% of global demand, with Germany, the U.K., and France as the leading markets. The region’s growth is driven by strict regulatory standards for children’s cosmetics, which increase consumer trust, and a strong preference for organic and eco-friendly products. Rising awareness among parents about chemical exposure and child skin sensitivity has accelerated the adoption of safe, hypoallergenic, and dermatologically approved formulations. The presence of well-established retail networks and growing e-commerce penetration, particularly in Western Europe, also contributes to growth.

Asia-Pacific

Asia-Pacific holds approximately 28% market share and is the fastest-growing region. Growth is driven by large population bases in China, India, Japan, and South Korea, combined with increasing middle-class incomes and rising parental awareness about child-specific grooming. Rapid expansion of e-commerce platforms enables broader access to branded and premium products. Additional growth drivers include the rising influence of character-based and licensed products, urbanization, and increasing exposure to global beauty trends through social media and entertainment channels. Government initiatives supporting domestic manufacturing and clean-label product adoption further accelerate regional market growth.

Latin America

Latin America represents approximately 8% of the global market, with Brazil and Mexico as primary contributors. Market growth is driven by urbanization, rising disposable income, and increasing exposure to international beauty brands. The popularity of gift-oriented cosmetic kits, social media influence, and the growing availability of both offline and online retail channels are key factors. Additionally, expanding awareness of safe and natural formulations among parents is encouraging adoption, particularly in urban centers.

Middle East & Africa

The Middle East & Africa accounts for about 6% of global demand, with the UAE and Saudi Arabia leading regional growth. The market is supported by high-income populations, a strong gifting culture, and the expansion of premium retail networks in major urban centers. Increased parental focus on non-toxic, age-appropriate, and luxury cosmetic products is a significant growth driver. Moreover, rising digital penetration, influencer-led marketing, and awareness campaigns about child-specific product safety are contributing to steady adoption, particularly in the UAE, Saudi Arabia, and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Children’s Cosmetics Market

- Markwins Beauty Brands

- Townley Girl

- Claire’s Brands

- Klee Naturals

- Snails Cosmetics

- Petite ’n Pretty

- Inuwet

- Suncoat Products

- Miss Nella

- No Nasties Kids