Children’s Books Market Size

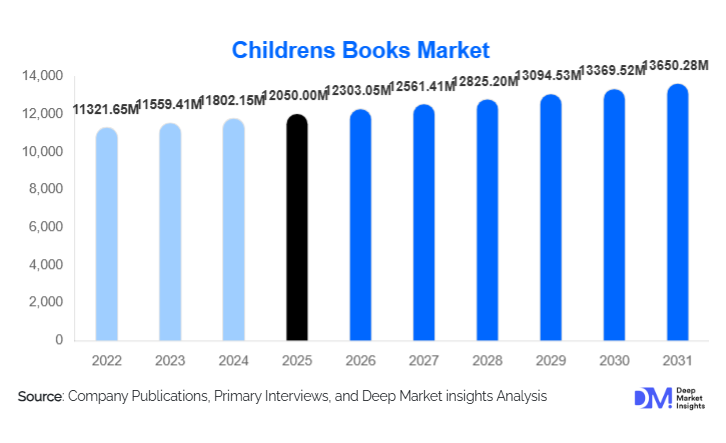

According to Deep Market Insights, the global children's books market size was valued at USD 12,050.00 million in 2025 and is projected to grow from USD 12,303.05 million in 2026 to reach USD 13,650.28 million by 2031, expanding at a CAGR of 2.1% during the forecast period (2026–2031). The children’s books market growth is primarily driven by rising awareness of early-age literacy, increasing parental spending on educational content, expanding school enrollment in emerging economies, and continuous innovation in storytelling formats, including interactive and digital books.

Key Market Insights

- Early childhood education remains the strongest demand driver, with preschool and early-reader books accounting for the largest revenue share globally.

- Print books continue to dominate the market, supported by gifting culture, school curricula requirements, and tactile learning preferences.

- Asia-Pacific is the fastest-growing regional market, driven by large child populations, education reforms, and rising middle-class income levels.

- English-language books lead global demand, but regional-language publishing is gaining rapid traction in emerging economies.

- Digital and audio children’s books are expanding steadily, particularly in developed markets with high digital adoption.

- Intellectual property-based franchises are increasingly shaping market competitiveness through cross-media monetization.

What are the latest trends in the children’s books market?

Growth of Educational and STEM-Focused Content

Educational children’s books, particularly those focused on STEM learning, problem-solving, and critical thinking, are gaining significant traction. Parents and educators are increasingly seeking books that combine storytelling with measurable learning outcomes. This trend is particularly strong in North America, Europe, and urban Asia-Pacific markets, where curriculum alignment and skill development are key purchasing criteria. Publishers are expanding titles focused on coding basics, environmental science, mathematics, and general knowledge to cater to this demand.

Rising Popularity of Interactive and Digital Formats

Interactive children’s books, including app-based e-books, augmented reality-enabled titles, and audiobooks, are witnessing steady adoption. These formats enhance engagement by integrating sound, animation, and read-along features, making them particularly attractive for early learners. While digital formats still represent a smaller share of total revenues, they are growing at a faster pace than traditional print, supported by increased tablet and smartphone penetration among households.

What are the key drivers in the children’s books market?

Increasing Global Focus on Early Literacy

Governments and educational institutions worldwide are prioritizing early literacy as a foundation for long-term academic success. Public investments in preschool education, national reading campaigns, and school library expansions are driving institutional demand for children’s books. These initiatives create stable, long-term procurement opportunities for publishers and content developers.

Rising Parental Spending on Child Development

Parents are increasingly investing in educational resources that support cognitive and emotional development. Children’s books are viewed as essential, affordable tools for learning, leading to repeat purchases across age groups. This trend is particularly strong among urban households and middle-income families in emerging markets.

What are the restraints for the global market?

Competition from Digital Entertainment

Rising screen time from video streaming, mobile games, and social media platforms competes directly with traditional reading habits. Older children, in particular, are increasingly shifting toward digital entertainment, posing a challenge for sustained engagement with books.

Volatility in Printing and Raw Material Costs

Fluctuations in paper prices, printing costs, and logistics expenses can pressure publisher margins, especially in price-sensitive markets. These cost challenges limit pricing flexibility and can slow expansion in emerging regions.

What are the key opportunities in the children’s books industry?

Expansion of Regional and Local Language Publishing

Demand for children’s books in regional and native languages is rising rapidly, particularly in Asia-Pacific, Africa, and Latin America. Publishers that invest in local authors, illustrators, and culturally relevant narratives can unlock high-growth, underpenetrated markets and build strong regional brand loyalty.

Integration of Digital Learning Technologies

The integration of AI-driven personalization, adaptive reading tools, and gamified learning features presents significant growth opportunities. These innovations enhance engagement, track learning progress, and differentiate offerings in a competitive market.

Product Type Insights

Fiction books continue to dominate the children’s books market, accounting for over 50% of global revenues. This dominance is primarily driven by strong demand for fantasy, adventure, and contemporary storytelling, which appeal to a broad age range and often serve as the first entry point for young readers. Franchises and popular series with cross-media adaptations (films, TV shows, and digital content) further reinforce fiction’s leading position by creating brand loyalty and repeat readership.

Non-fiction books, including educational, reference, and STEM-focused titles, represent a rapidly growing segment. Growth in this segment is supported by rising parental emphasis on skill-based learning, increasing school curriculum integration, and government literacy initiatives. These books help build foundational knowledge and cater to the demand for early cognitive development. Comics and graphic novels are gaining popularity among middle-grade (9–12 years) and young-teen (13–15 years) readers due to their visual appeal and engaging storytelling formats. Meanwhile, activity and interactive books, including coloring, puzzles, sticker books, and tactile learning materials, remain strong sellers in the preschool and early-learning categories, driven by parental preference for experiential learning that combines play with education.

Format Insights

Print books continue to dominate with approximately 72% of global market share, supported by school requirements, gifting traditions, and the tactile, hands-on learning experience they provide. The strong physical book culture in schools and libraries, along with parental familiarity and comfort with print media, reinforces its dominance.

Digital books and audiobooks collectively account for the remaining share and are growing steadily, particularly in North America and Europe, where high digital penetration and subscription-based reading platforms drive adoption. Digital formats are increasingly popular among early readers and young teens, offering interactivity, read-along audio, and gamified learning experiences. Audiobooks, in particular, are capturing interest from commuting families and tech-savvy households, providing flexibility and reinforcing literacy skills in a convenient format.

Distribution Channel Insights

Offline retail channels, including bookstores, school sales, and specialty learning stores, remain the dominant distribution route globally, especially in emerging markets where digital penetration is lower. The tactile experience of browsing, coupled with in-store recommendations, continues to encourage purchases.

However, online channels are rapidly gaining share, driven by e-commerce platforms, direct-to-consumer publisher websites, and subscription-based reading services. The convenience of home delivery, global catalog access, and personalized recommendations are making online sales increasingly attractive, particularly in urban areas. Institutional sales to schools, libraries, and early-learning centers remain a stable, high-volume demand driver, reinforced by government literacy programs and curriculum-based procurement in both developed and emerging markets.

Age Group Insights

Preschool children (3–5 years) represent the largest age-group segment, accounting for approximately 26% of the global market. Growth in this segment is driven by early education emphasis, parental involvement, and government-led literacy programs promoting foundational reading skills. Interactive and activity-based books are particularly popular for this group, enabling hands-on learning experiences that encourage engagement and cognitive development.

Early readers (6–8 years) and middle-grade readers (9–12 years) follow closely, supported by both school curricula and recreational reading. Adventure and fantasy fiction, combined with educational non-fiction, dominate purchases for these groups. Graphic novels and illustrated books are also increasingly appealing to this demographic, fostering reading interest and improving literacy through visual storytelling. Young teens (13–15 years) form a smaller but growing segment, driven primarily by graphic novels, transitional young-adult fiction, and emerging digital formats. Demand is fueled by a desire for relatable narratives, interactive content, and crossover media engagement, with social media and online communities influencing reading choices.

| By Product Type | By Format | By Age Group | By Distribution Channel | By Language |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global children’s books market, led by the United States. Strong school infrastructure, high per-child spending, and widespread adoption of educational books underpin the region’s dominance. Drivers of growth include government literacy initiatives, high parental investment in early learning, and strong market penetration of digital and audio formats. Subscription-based digital reading platforms, library programs, and popular media franchises also stimulate book consumption. The U.S. market remains highly competitive, with publishers emphasizing both physical and interactive digital content to meet diverse consumer needs.

Europe

Europe holds around 26% of the global market, with strong demand in the U.K., Germany, and France. Multilingual publishing, robust library networks, and government-supported literacy programs drive growth. Regional drivers include a strong culture of early reading, comprehensive school curricula that emphasize reading proficiency, and high digital adoption in Northern and Western Europe. Additionally, a growing preference for bilingual and multicultural content, as well as interactive and STEM-oriented books, further accelerates market expansion.

Asia-Pacific

Asia-Pacific represents nearly 29% of the global market and is the fastest-growing region. China and India are the primary contributors, driven by large child populations, expanding education systems, and increasing regional-language publishing. Drivers include government initiatives promoting literacy and early education, rising middle-class income supporting discretionary educational spending, and urbanization that enhances access to bookstores and online channels. The growing digital infrastructure in urban centers facilitates the adoption of interactive e-books and audiobooks, while local content tailored to cultural and linguistic preferences drives further growth.

Latin America

Latin America accounts for approximately 7% of global demand, led by Brazil and Mexico. Market growth is supported by public education investments, expanding school enrollment, and increasing access to affordable children’s books. Drivers include government literacy campaigns, NGO-led educational programs, and rising parental awareness of the importance of early reading. Online retail expansion and digital learning initiatives are also enhancing reach, especially in urban and semi-urban areas.

Middle East & Africa

The Middle East & Africa region holds around 6% of the market. Demand is driven by literacy initiatives, school expansion, and rising imports of English-language children’s books, particularly in the UAE, Saudi Arabia, and South Africa. Key growth drivers include government funding for education, rising disposable incomes among urban families, and investments in school library infrastructure. English-language proficiency programs, digital learning adoption, and increased participation in extracurricular reading initiatives also contribute to market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Children’s Books Market

- Penguin Random House

- Scholastic Corporation

- HarperCollins Publishers

- Hachette Livre

- Macmillan Publishers

- Simon & Schuster

- Egmont Group

- Usborne Publishing

- Bloomsbury Publishing

- Walker Books