Chicken & Meat Shredder Market Size

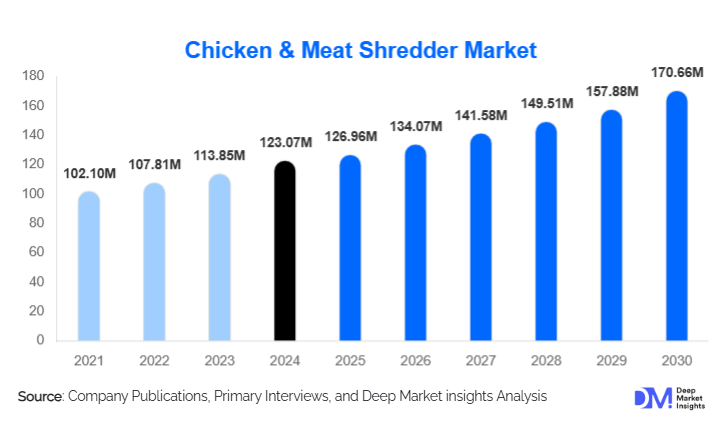

According to Deep Market Insights, the global chicken & meat shredder market size was valued at USD 123.07 million in 2024 and is projected to grow from USD 129.96 million in 2025 to reach USD 170.66 million by 2030, expanding at a CAGR of 5.60% during the forecast period (2025–2030). The growth of the chicken & meat shredder market is primarily driven by increasing demand from industrial meat processing units, rising adoption of automated shredding technologies, and growing emphasis on hygienic and standardized meat processing in both developed and emerging regions.

Key Market Insights

- Automation and mechanization are transforming meat processing, driving the adoption of high-capacity shredders in industrial facilities to improve efficiency and output quality.

- Emerging markets, particularly in APAC and LATAM, are witnessing rapid growth due to rising meat consumption, urbanization, and expanding retail and food service sectors.

- North America dominates the high-end shredder segment, with large-scale industrial users preferring fully automatic shredders for consistent performance and compliance with hygiene standards.

- Europe is among the fastest-growing regions, driven by stringent food safety regulations and increasing demand for export-quality processed meat products.

- Technological advancements, such as IoT-integrated shredders, hybrid slicer-shredder units, and stainless steel corrosion-resistant blades, are improving operational efficiency and reducing labor dependency.

- Online and direct sales channels are expanding, offering manufacturers a platform to reach SMEs, large food processors, and export-oriented customers efficiently.

What are the latest trends in the chicken & meat shredder market?

Adoption of Fully Automated Shredders

Industrial meat processing units are increasingly investing in fully automated shredders to optimize throughput, reduce labor costs, and maintain consistent output quality. Automation trends include features like programmable shredding speeds, blade-wear monitoring, and sanitation alerts to comply with hygiene standards. These advancements are particularly relevant for large-scale operations in North America and Europe, where regulatory compliance and efficiency are critical for profitability and export competitiveness.

Integration of Smart Technologies

Smart shredders equipped with IoT and sensor technology allow real-time performance monitoring, predictive maintenance, and energy efficiency tracking. Manufacturers are leveraging these features to differentiate products, reduce operational downtime, and provide higher ROI to end-users. IoT integration is gaining traction in Europe, North America, and parts of APAC, especially in meat processing units that export to markets with strict hygiene requirements.

What are the key drivers in the chicken & meat shredder market?

Rising Industrial Meat Processing

The increasing consumption of processed and packaged meat globally is a major growth driver. Industrial meat processing facilities, ready-to-eat meat manufacturers, and export-oriented plants require high-capacity shredders to meet demand efficiently. Growth in organized retail and supermarket chains, especially in APAC and LATAM, further fuels this trend by ensuring consistent product supply.

Technological Advancements and Efficiency

Innovations in shredder design, such as hybrid slicer-shredder machines, stainless steel blades, and energy-efficient motors, are enhancing operational efficiency and reliability. This trend reduces labor dependence, ensures hygienic processing, and supports compliance with international food safety standards, driving adoption across industrial, retail, and restaurant segments.

Growing Regulatory Compliance

Governments and food safety authorities in Europe, North America, and APAC are enforcing stringent standards for meat processing and hygiene. Compliance with these regulations necessitates the adoption of modern shredders that meet sanitation and traceability requirements, providing a stable demand base for high-quality equipment.

What are the restraints for the global market?

High Initial Capital Investment

High-capacity and fully automated shredders require significant upfront investment, limiting adoption among small and medium-sized meat processing units. SMEs often rely on manual or semi-automatic shredders, which have lower efficiency and hygiene standards, potentially slowing overall market growth.

Maintenance and Operational Complexity

Advanced shredders require regular maintenance and skilled operators to ensure optimal performance. Operational downtime due to technical issues, blade wear, or sanitation requirements can increase costs and reduce efficiency. Manufacturers must address these challenges through user-friendly designs and after-sales service networks.

What are the key opportunities in the chicken & meat shredder industry?

Emerging Market Expansion

Rising meat consumption, urbanization, and the expansion of organized retail and food service in APAC and LATAM create new opportunities for shredder manufacturers. Governments promoting food processing industrialization, cold chain infrastructure, and export-driven meat production further support market growth in these regions.

Integration with IoT and Smart Manufacturing

Manufacturers can capitalize on the growing demand for smart, IoT-enabled shredders that monitor performance, predict maintenance needs, and optimize energy use. Smart technologies also support compliance with international hygiene standards, attracting industrial and export-oriented meat processors.

Export-Oriented Meat Processing Growth

Countries such as Brazil, the USA, and China are expanding meat exports, increasing demand for high-quality shredders that meet international standards. Customized solutions for export-oriented processing units present opportunities for equipment differentiation and higher-value product offerings.

Product Type Insights

Automatic shredders dominate the market, accounting for approximately 45% of global market share in 2024. Their high efficiency, consistency, and compliance with hygiene regulations make them essential for industrial meat processing units. Semi-automatic shredders, contributing roughly 30% of the market, are popular among medium-scale processing units, balancing affordability with efficiency. Manual shredders hold about 25% of the market, catering to small butcheries, restaurants, and household use where demand volumes are lower.

Application / End-Use Insights

Food processing units remain the largest end-use segment, representing 50% of the market in 2024. Restaurants and catering contribute around 20%, while retail and supermarkets account for 15%. Household and small-scale users make up the remaining 15%. The fastest-growing applications are export-oriented meat processing and ready-to-eat meat production due to rising demand for hygienic, pre-processed products. Emerging industries such as plant-based meat analog processing are also exploring shredder adoption for hybrid meat products.

| By Product Type | By Shredding Capacity | By Application / End-Use Industry | By Technology | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the market with a 28% share in 2024, driven by strong industrial meat processing infrastructure, regulatory compliance, and demand for fully automated shredders. The U.S. dominates the region, accounting for nearly 70% of North America’s market, followed by Canada with 20%. High-capacity industrial shredders are increasingly deployed in meat export facilities.

Europe

Europe holds 25% of the global market in 2024, with Germany, France, and the U.K. as key contributors. Europe’s growth is supported by stringent hygiene regulations, high consumption of processed meat, and the adoption of automated shredding solutions. The region is expected to remain a high-value market, with Germany projected as the fastest-growing country due to rising demand for export-compliant meat products.

Asia-Pacific

APAC is the fastest-growing region, led by China, India, and Southeast Asian countries. Rising disposable incomes, urbanization, and the industrialization of meat processing facilities are driving growth. China dominates the APAC market, with India showing the highest CAGR of approximately 9% from 2025 to 2030 due to increasing meat consumption and retail expansion.

Latin America

Brazil, Argentina, and Mexico are key markets. Growth is driven by export-oriented meat processing facilities, particularly in Brazil. Demand for medium- and high-capacity shredders is increasing as exporters comply with international meat standards.

Middle East & Africa

South Africa leads demand in Africa, primarily for domestic and export-oriented meat processing units. The Middle East, led by the UAE and Saudi Arabia, is a growing market for high-quality industrial shredders in hotels, catering, and meat processing facilities, driven by urbanization and higher disposable incomes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Chicken & Meat Shredder Market

- GEA Group

- JBT Corporation

- Marel

- Vemag Maschinenbau GmbH

- Treif Maschinenbau GmbH

- Wenger Manufacturing

- Risco S.r.l.

- FAM Equipment

- HOBART

- Provisur Technologies

- Talsa

- BAADER

- Sirman

- Handtmann

- Skyfood

Recent Developments

- In March 2025, Marel launched a high-capacity automated shredder with IoT integration for European and North American meat processors.

- In January 2025, GEA Group expanded its industrial shredder production facility in Brazil to support export-oriented meat processing units.

- In December 2024, JBT Corporation introduced hybrid slicer-shredder machines in APAC, combining slicing and shredding in a single automated unit for industrial meat processing.