Cheek Makeup Market Size

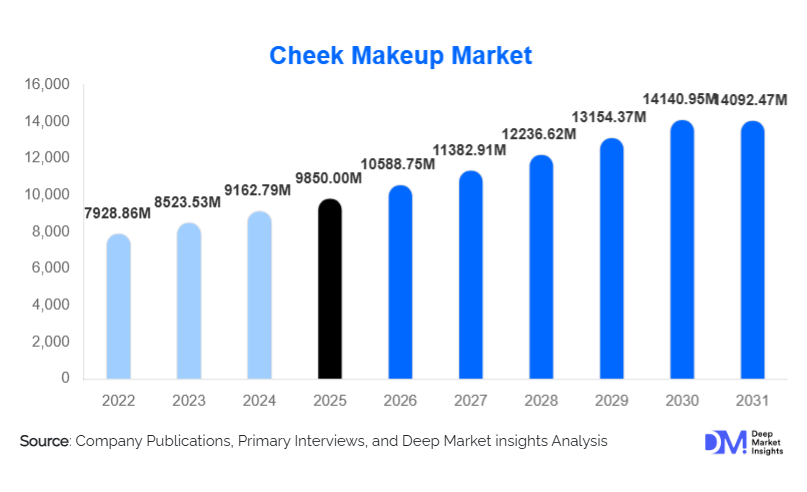

According to Deep Market Insights, the global cheek makeup market size was valued at USD 9850 million in 2025 and is projected to grow from USD 10,588.75 million in 2026 to reach USD 14,092.47 million by 2031, expanding at a CAGR of 7.5% during the forecast period (2026–2031). The cheek makeup market growth is primarily driven by rising daily-use cosmetics adoption, strong influence of social media-driven beauty trends, increasing premiumization of color cosmetics, and rapid expansion of online and direct-to-consumer beauty platforms globally.

Key Market Insights

- Blush products dominate the cheek makeup category, driven by their daily-use appeal and expanding shade inclusivity across skin tones.

- Powder-based formulations remain the most widely consumed, while cream and liquid formats are the fastest growing due to demand for natural finishes.

- North America leads the global market by value, supported by high per-capita cosmetic spending and strong brand presence.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, youthful demographics, and K-beauty and J-beauty influence.

- Mid-premium products account for the largest revenue share, balancing affordability, quality, and brand perception.

- Digital channels and influencer-led marketing are reshaping product discovery, trial, and purchase behavior globally.

What are the latest trends in the cheek makeup market?

Shift Toward Skin-First and Clean Beauty Formulations

Cheek makeup products are increasingly being positioned as hybrid cosmetics that combine color with skincare benefits. Brands are incorporating ingredients such as hyaluronic acid, niacinamide, vitamin E, SPF, and botanical extracts into blushes, bronzers, and highlighters. Clean-label claims such as vegan, cruelty-free, paraben-free, and dermatologist-tested are gaining prominence, particularly among millennial and Gen Z consumers. This trend is reinforcing premium pricing and driving repeat purchases as consumers seek products that enhance both appearance and skin health.

Rise of Cream, Liquid, and Stick-Based Cheek Products

Consumer preference is shifting away from traditional heavy powders toward cream, liquid, and stick formats that offer blendability, buildable coverage, and a natural skin-like finish. These formats are particularly popular in Asia-Pacific and among younger demographics influenced by social media tutorials and “no-makeup makeup” aesthetics. Multi-use cheek sticks that function as blush, lip tint, and eyeshadow are also gaining traction, supporting minimalist beauty routines and portability.

What are the key drivers in the cheek makeup market?

Social Media and Influencer-Led Beauty Consumption

Short-form video platforms and beauty influencers have transformed cheek makeup into a trend-sensitive category. Viral blush shades, contouring techniques, and glow-enhancing products drive rapid demand spikes and product sell-outs. User-generated content, tutorials, and real-time reviews significantly reduce consumer hesitation, accelerating purchasing decisions and shortening product life cycles.

Premiumization and Brand Differentiation

Consumers are increasingly willing to pay higher prices for superior formulations, luxury packaging, and brand storytelling. Prestige and mid-premium brands are introducing advanced pigment technologies, long-wear formulations, and sustainable packaging to differentiate themselves. This trend is especially visible in North America and Europe, where brand loyalty and product performance strongly influence repeat purchases.

What are the restraints for the global market?

High Market Saturation and Intense Competition

The cheek makeup market is highly saturated, with frequent product launches creating shelf congestion and high customer acquisition costs. New entrants face challenges in gaining visibility without substantial marketing investments, particularly in mature markets where brand loyalty is strong.

Raw Material Price Volatility and Regulatory Pressures

Fluctuations in prices of pigments, mica alternatives, oils, and sustainable packaging materials impact production costs and margins. Additionally, stricter regulations related to ingredient safety, ethical sourcing, and environmental compliance increase operational complexity, particularly for global manufacturers.

What are the key opportunities in the cheek makeup industry?

Digital-First and Direct-to-Consumer Expansion

Brands leveraging DTC models, AI-based shade matching, and virtual try-on tools can significantly improve conversion rates and customer engagement. Digital platforms enable better data collection, personalized marketing, and higher margins, creating strong opportunities for both new entrants and established brands.

Emerging Market Penetration and Localized Product Development

Rapid urbanization, growing middle-class populations, and rising beauty awareness in India, Southeast Asia, Latin America, and the Middle East present strong growth opportunities. Brands offering localized shade ranges, climate-adapted formulations, and culturally relevant branding are well-positioned to capture untapped demand.

Product Type Insights

Blush products account for approximately 38% of the global cheek makeup market in 2025, making them the leading product type globally. The dominance of blush is driven by its universal daily-use appeal, ease of application, and relevance across all age groups, skin tones, and genders. Blush products are increasingly positioned as essential complexion enhancers rather than occasion-based cosmetics, reinforcing high purchase frequency and repeat consumption. Continuous innovation in shade inclusivity, buildable pigmentation, and hybrid blush formulations enriched with skincare ingredients further strengthens segment leadership.

Highlighters represent one of the fastest-growing product categories, supported by glow-centric beauty trends, social media-driven makeup aesthetics, and strong adoption among professional makeup artists. The rise of dewy and luminous finishes in fashion, entertainment, and digital content creation has elevated highlighters from niche products to mainstream essentials. Meanwhile, bronzers and contour products are gaining traction as consumers increasingly adopt face sculpting and definition techniques for everyday wear, particularly in North America and Europe. This growth is supported by increased availability of beginner-friendly contour kits and education-driven marketing through influencer tutorials.

Formulation Insights

Powder-based cheek makeup leads the global market with nearly 46% market share in 2025, driven by its ease of application, longer shelf life, superior oil control, and suitability for a wide range of climatic conditions. Powder formulations remain the preferred choice for mass-market consumers, professional makeup artists, and regions with warm and humid environments, supporting sustained demand.

However, cream and liquid formulations are witnessing significantly faster growth rates, fueled by rising consumer preference for natural, skin-like finishes and multifunctional beauty products. These formats are particularly popular among younger consumers influenced by “no-makeup makeup” trends and are gaining strong traction in Asia-Pacific and North America. Stick and balm-based cheek products are emerging as niche but high-growth categories, supported by demand for portable, multi-use, and travel-friendly formats that align with minimalist beauty routines.

Distribution Channel Insights

Offline retail channels, including specialty beauty stores, department stores, and branded retail outlets, account for approximately 55% of global cheek makeup sales in 2025. Physical retail continues to play a critical role due to in-store product trials, shade matching, and professional consultation, which remain important purchase drivers for complexion products. Established beauty chains and department stores also reinforce brand trust and enable premium product positioning.

Online distribution channels are the fastest-growing sales avenue, driven by increasing digital penetration, convenience, broader shade assortments, and aggressive influencer-led marketing strategies. Direct-to-consumer (DTC) platforms, subscription-based beauty models, and AI-powered virtual try-on tools are accelerating online adoption by reducing purchase hesitation and return rates. Social commerce and livestream shopping are further enhancing digital engagement, particularly among Gen Z and millennial consumers.

End-User Insights

Individual consumers dominate the cheek makeup market, contributing nearly 82% of total market revenue. This dominance reflects the integration of cheek makeup into daily grooming routines and the rising influence of social media on personal beauty standards. Growing acceptance of makeup across genders and age groups further expands the individual consumer base.

Professional makeup artists represent a high-value end-user segment, driving demand for premium, long-wear, and high-pigment products used in bridal, fashion, and editorial applications. Additionally, the entertainment and media industry plays a crucial role in shaping trends and accelerating product adoption, particularly for highlighters and contour products showcased in films, television, and digital content.

| By Product Type | By Formulation | By Finish Type | By Distribution Channel | By Price Positioning | By End User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 31% of the global cheek makeup market share in 2025, led primarily by the United States. Regional dominance is supported by high disposable income, strong brand penetration, and early adoption of premium and clean beauty trends. Consumers in North America demonstrate a high willingness to spend on mid-premium and luxury cheek makeup products, driven by brand loyalty and product performance. The region also benefits from advanced e-commerce infrastructure, strong influencer ecosystems, and rapid adoption of technology-driven beauty solutions such as virtual try-ons and AI shade matching.

Europe

Europe accounts for nearly 27% of the global market, with strong demand from France, the U.K., Germany, and Italy. Growth in the region is driven by clean beauty adoption, sustainability-conscious consumers, and premium formulation preferences. European consumers place strong emphasis on ethical sourcing, cruelty-free testing, and eco-friendly packaging, encouraging brands to innovate responsibly. The presence of globally influential fashion and beauty hubs further supports product visibility and trend diffusion across the region.

Asia-Pacific

Asia-Pacific represents approximately 24% of global revenue and is the fastest-growing region, expanding at over 10% CAGR. China, India, South Korea, and Japan are major demand centers, driven by rising disposable incomes, a youthful population, and the rapid expansion of digital commerce. The global influence of K-beauty and J-beauty trends, emphasis on natural finishes, and strong domestic brand ecosystems are accelerating product innovation and consumption. Increasing beauty awareness in tier-2 and tier-3 cities further supports long-term growth.

Latin America

Latin America contributes approximately 10% of global demand, led by Brazil and Mexico. Regional growth is driven by increasing beauty consciousness, social media influence, and expanding availability of mid-premium products. Consumers in Latin America show a strong preference for vibrant shades and long-wear formulations suited to warmer climates. The gradual expansion of organized beauty retail and e-commerce platforms is improving product accessibility across the region.

Middle East & Africa

The Middle East & Africa region holds about 8% market share, with demand concentrated in the UAE and Saudi Arabia. Growth is supported by high per-capita beauty spending, premium brand affinity, and rapid urbanization. The region also benefits from strong beauty retail infrastructure, rising tourism-driven cosmetics purchases, and increasing participation of women in the workforce. In Africa, expanding urban populations and improving retail access are gradually strengthening long-term market potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cheek Makeup Market

- L’Oréal

- Estée Lauder Companies

- Shiseido

- LVMH

- Coty

- Unilever

- Procter & Gamble

- Chanel

- Revlon

- Amorepacific

- Kao Corporation

- Beiersdorf

- Oriflame

- Natura &Co

- Colorbar Cosmetics