Centella Sunscreen Market Size

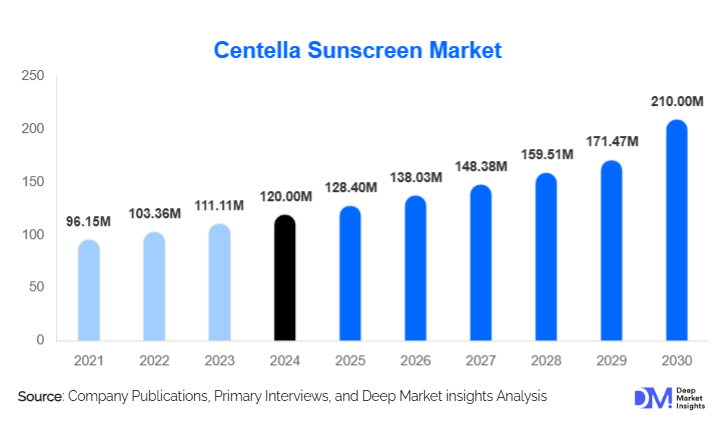

According to Deep Market Insights, the global Centella sunscreen market size was valued at USD 120 million in 2024 and is projected to grow from USD 128.4 million in 2025 to reach USD 210 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising consumer awareness of sun protection, increasing demand for natural and botanical skincare ingredients, and the adoption of multifunctional sunscreens that combine Centella Asiatica with advanced UV filters for sensitive skin.

Key Market Insights

- Centella sunscreens are increasingly favored for sensitive and acne-prone skin, due to their soothing, anti-inflammatory, and barrier-repair properties.

- APAC dominates the global market, led by countries such as South Korea, Japan, China, and India, driven by strong consumer familiarity with Centella and high sunscreen usage.

- North America is emerging as a critical growth region, fueled by rising awareness of clean, botanical, and natural skincare products among premium consumers.

- Online and e-commerce channels are becoming the leading distribution mode, enabling niche and premium Centella sunscreen brands to reach global consumers directly.

- Technological innovation in formulations, including micro-encapsulation, hybrid chemical-mineral filters, and lightweight textures, is enhancing product efficacy and consumer acceptance.

What are the latest trends in the Centella sunscreen market?

Rising Demand for Clean and Botanical Skincare

Consumers are increasingly prioritizing natural ingredients, non-irritating formulations, and environmentally sustainable products. Centella Asiatica has gained recognition for its anti-inflammatory, antioxidant, and soothing benefits, making it an ideal addition to sunscreens. Brands are responding with clean, fragrance-free, and hypoallergenic products targeting sensitive skin. Sustainability trends, such as eco-friendly packaging and ethical sourcing of Centella, are further driving consumer adoption.

Multi-Functional Sunscreen Products

Modern consumers prefer products that combine sun protection with additional skincare benefits. Centella sunscreens are being formulated with antioxidants, barrier-repair agents, hyaluronic acid, and niacinamide to address multiple skin concerns simultaneously. These multifunctional products cater to daily facial use, post-procedure skincare, and outdoor protection, offering a convenient all-in-one solution for a growing segment of consumers.

What are the key drivers in the Centella sunscreen market?

Increasing Awareness of Sun Damage and Skin Health

Growing awareness of harmful UV radiation effects, such as premature aging, pigmentation, and skin cancer, is a major driver. Consumers are more conscious of incorporating daily sunscreen into their routines. Centella’s soothing and skin-repair benefits further incentivize adoption, especially for individuals with sensitive skin or those using active skincare ingredients that increase photosensitivity.

Preference for Natural, Sensitive-Skin Friendly Products

The shift toward botanical and clean beauty products is fueling demand for Centella sunscreens. Consumers value gentle, hypoallergenic formulations free from parabens, sulfates, and harsh chemicals. This trend aligns with the growing premium skincare segment, enabling brands to command higher price points and expand market reach.

Rapid Growth of E-commerce and Direct-to-Consumer Channels

Online sales and social media marketing have significantly improved accessibility to niche botanical sunscreens. Direct-to-consumer channels allow smaller brands to showcase clinical efficacy, consumer reviews, and educational content, fostering trust and adoption. E-commerce also enables cross-border distribution, supporting export-driven growth, particularly from APAC manufacturing hubs to Europe and North America.

What are the restraints for the global market?

Regulatory Challenges and Safety Validation

Sunscreens are heavily regulated across regions, requiring SPF, UVA, and stability testing. Incorporating botanical ingredients like Centella necessitates additional safety and stability validation. Regulatory variations between the US, EU, and APAC can complicate market entry and increase development costs, slowing expansion for emerging brands.

Price Sensitivity and Competition from Conventional Sunscreens

Centella-infused sunscreens generally command premium pricing, which may limit adoption in price-sensitive markets. Conventional chemical and mineral sunscreens continue to dominate due to affordability. Ensuring perceived value, effective marketing, and quality differentiation is critical for broader market penetration.

What are the key opportunities in the Centella sunscreen market?

Innovative Formulations for Sensitive and Specialized Skin Types

There is a substantial opportunity to develop lightweight, non-greasy, multifunctional Centella sunscreens suitable for daily facial use, post-procedure skin, and children’s skin. Advanced formulations using micro-encapsulation or hybrid chemical-mineral filters can enhance efficacy and reduce irritation, appealing to sensitive skin users globally.

Expansion into Emerging Markets

Regions such as South Asia, Southeast Asia, Latin America, and MENA present high growth potential due to rising disposable income, increasing sun exposure, and growing awareness of skincare. Tailored marketing and localized e-commerce strategies can accelerate the adoption of premium Centella sunscreen products in these regions.

Leveraging Regulatory Trends and Clean Beauty Initiatives

Governments and consumers are increasingly favoring natural, cruelty-free, and environmentally safe products. Centella sunscreen brands that comply with eco-certifications and clinical testing standards can capitalize on this trend, differentiate themselves, and command higher margins, especially in premium segments across North America and Europe.

Product Type Insights

Creams and lotions dominate the market, accounting for approximately 40% of the 2024 market share. These formulations provide ease of use, better skin coverage, and compatibility with Centella extracts, making them preferred for daily facial and body application. Serums, gels, and fluid textures are emerging trends, particularly among consumers seeking lightweight and multifunctional solutions.

Application Insights

Facial daily-use sunscreens are the most prominent application, driven by urban consumers and younger demographics. Multi-use products (face and body combined) and post-procedure skincare segments are gaining traction, supported by dermatologists recommending Centella for barrier repair and soothing. Children's and men’s skincare represent emerging niches, with increasing premium adoption across these categories.

Distribution Channel Insights

E-commerce and online D2C platforms are leading distribution channels, facilitating global reach, product education, and consumer trust. Pharmacies and specialty beauty stores remain key for offline sales, particularly in APAC and North America. Social media marketing, influencer collaborations, and subscription models are shaping consumer purchase decisions and enabling smaller brands to compete with established players.

End-Use Insights

Daily facial protection represents the fastest-growing end-use segment, driven by the need for multifunctional skincare. Outdoor/sport-specific sunscreens and multi-use formulations are expanding, with increasing demand from fitness-conscious and active lifestyle consumers. Dermatology clinics are also recommending Centella sunscreens for post-procedure care, presenting a growing professional end-use segment.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for roughly 25% of the Centella sunscreen market in 2024. U.S. and Canadian consumers are increasingly adopting botanical and sensitive-skin formulations, with premium brands driving growth. High disposable income and strong online sales channels are facilitating market expansion.

Europe

Europe held approximately 18% of the global market in 2024. Countries such as Germany, France, and the U.K. are witnessing growth in clean and botanical skincare adoption, especially among younger and environmentally conscious consumers. Southern Europe shows higher SPF adoption due to higher sun exposure.

Asia-Pacific

Asia-Pacific is the largest market, with a 45–50% share in 2024. South Korea, Japan, China, and India drive demand due to cultural familiarity with Centella, strong skincare routines, and high SPF awareness. Emerging Southeast Asian markets are witnessing rapid adoption, supported by e-commerce and social media awareness.

Latin America

Latin America accounts for 7% of the market, with Brazil, Mexico, and Argentina showing increasing interest in botanical sunscreen products. Growth is fueled by rising incomes and a shift toward premium skincare.

Middle East & Africa

The region represents 5% of the global market. High UV exposure and growing awareness in the UAE, Saudi Arabia, and South Africa are driving premium Centella sunscreen adoption. Luxury consumer segments are increasingly targeted via specialized marketing and online distribution.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Centella Sunscreen Market

- Estée Lauder

- L’Oréal

- Shiseido

- AMOREPACIFIC

- Unilever

- SKIN1004

- Purito

- Benton

- SkinRx Lab

- Innisfree

- Etude House

- Dr. Jart+

- Cosrx

- Missha

- Klairs

Recent Developments

- In March 2025, SKIN1004 expanded its Centella sunscreen line with a water-based SPF serum targeting sensitive skin, featuring lightweight and non-greasy formulations.

- In April 2025, L’Oréal launched a multi-functional Centella sunscreen in Europe with antioxidant and barrier-repair claims to appeal to the clean beauty segment.

- In June 2025, AMOREPACIFIC introduced a hybrid chemical-mineral Centella sunscreen in South Korea, optimized for non-white-cast, everyday facial use, capturing growing online demand.