Cat Litter Products Market Size

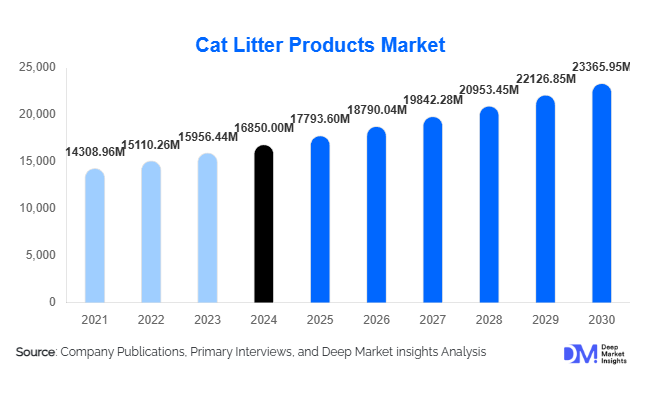

According to Deep Market Insights, the global cat litter products market size was valued at USD 16,850.00 million in 2024 and is projected to grow from USD 17,793.60 million in 2025 to reach USD 23,365.95 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). The market growth is primarily driven by rising pet ownership, increasing humanisation of cats, growing awareness about pet hygiene, and the rapid expansion of e-commerce and subscription-based distribution channels for pet products.

Key Market Insights

- Eco-friendly and biodegradable cat litter formulations are gaining traction globally as consumers increasingly prefer sustainable and low-impact products for their pets.

- Clumping clay-based litter dominates due to its superior convenience and odor control, while plant-based and silica litters are emerging rapidly in premium and eco-conscious segments.

- North America remains the largest market, driven by high cat ownership rates, premiumization, and strong retail infrastructure.

- Asia-Pacific is the fastest-growing region, led by urbanization, rising disposable incomes, and increasing adoption of cats as household pets in China, India, and Japan.

- Online and subscription-based sales channels are transforming distribution, providing convenience and access to premium/luxury cat litter products.

- Technological innovations, including odor-control formulas, dust-free litters, and health-monitoring crystal litters, are reshaping consumer preferences.

What are the latest trends in the cat litter products market?

Shift Toward Eco-Friendly and Sustainable Products

Manufacturers are increasingly launching plant-based, biodegradable, and compostable litter to cater to environmentally conscious consumers. Eco-litters made from corn, wheat, wood pulp, or recycled paper are positioned as premium alternatives to traditional clay-based products. Governments in regions such as the EU and North America are promoting sustainable packaging and waste management practices, further incentivizing the adoption of eco-friendly litter solutions. Brands that emphasize low environmental impact, compostable packaging, and renewable raw materials are seeing higher growth in urban and younger consumer segments.

Premiumization and Innovation in Product Formulation

Premium and functional litter products, such as silica gel crystals, dust-free formulations, and odor-controlling clumping litters, are witnessing strong adoption. Innovations like health-monitoring crystal litters, lightweight packaging, and multi-cat performance formulas enhance convenience and justify higher pricing. This trend appeals to consumers willing to invest in high-quality products that offer better hygiene and ease of use. Manufacturers are also experimenting with scents, texture, and granule size to meet diverse customer preferences, further driving premium segment growth.

What are the key drivers in the cat litter products market?

Increasing Pet Ownership and Humanisation of Cats

Globally, the number of households owning cats is rising, fueled by urbanization, smaller family sizes, and single-person households. Cats are increasingly treated as family members, creating higher demand for hygienic, convenient, and premium litter products. Multi-cat households especially prefer high-performance litters with odor control and dust reduction, driving both volume and value growth.

Expansion of E-commerce and Subscription Models

The rapid growth of online sales platforms and subscription-based delivery is transforming the market. Pet owners appreciate the convenience of auto-replenishment and direct access to premium or niche products. Manufacturers can reach new markets and build customer loyalty through digital channels, while subscription models enable consistent revenue streams and higher repeat purchases.

Premiumization and Product Differentiation

Consumers increasingly prefer high-quality and specialized cat litters, including clumping, low-dust, scented, and eco-friendly options. Manufacturers are introducing innovative formulations to meet these demands, which allows them to capture higher profit margins and create brand differentiation in a competitive market.

What are the restraints for the global market?

Price Sensitivity and Raw Material Volatility

Many consumers remain price-conscious, particularly in the mass-market clay litter segment. Fluctuating costs of bentonite clay, silica gel, and plant-based raw materials, as well as shipping costs for heavy products, limit pricing flexibility and may slow growth in premium and value segments.

Environmental and Regulatory Challenges

Traditional clay litter is environmentally taxing due to mining requirements and disposal concerns. Additionally, dust levels, crystalline silica exposure, and packaging regulations in some regions create compliance costs for manufacturers. Meeting sustainability standards while maintaining performance and cost-effectiveness is a persistent challenge.

What are the key opportunities in the cat litter products industry?

Growth in Eco-Friendly and Biodegradable Products

Increasing consumer awareness of environmental sustainability is creating opportunities for plant-based, biodegradable, and compostable litter. Manufacturers investing in R&D and marketing these products can capture premium segments and position themselves as environmentally responsible brands.

Expansion into Emerging Markets

Urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East are driving first-time cat ownership. These emerging regions represent untapped potential for both conventional and premium litter products, offering long-term revenue growth for market entrants and established players.

Direct-to-Consumer and Subscription Models

Online platforms and subscription services enable manufacturers to directly engage with consumers, enhance convenience, and create loyal customer bases. Subscription models also allow incremental revenue from premium products and cross-selling opportunities with related pet-care items.

Product Type Insights

Clumping cat litter dominates the market, accounting for approximately 70% of global market value in 2024. Its popularity is primarily driven by convenience, ease of cleaning, and superior odor control, making it the preferred choice for multi-cat households and premium segments. Busy pet owners favor clumping litter as it supports easy scooping, aligns with subscription delivery models, and provides perceived hygiene benefits. Non-clumping litter, although less popular, retains a strong user base due to lower cost and suitability for multi-pet or high-traffic environments. Silica gel/crystal litters are gaining traction in premium segments for their superior moisture and odor control and longer life per fill. Biodegradable, plant-based litters are expanding steadily, propelled by the global sustainability trend, compostability appeal, and marketing focus on environmentally conscious buyers. Other synthetic or compound blends are leveraged for engineered properties, including low dust, fragrance delivery, and antimicrobial additives, targeting niche requirements.

Distribution Channel Insights

Offline retail channels, including supermarkets, hypermarkets, and pet specialty stores, continue to dominate, representing ~65% of global market value in 2024. These channels benefit from immediate availability, impulse buying, and private-label ranges. Online and subscription-based platforms are rapidly growing, particularly for premium, functional, and eco-friendly litters, as consumers value convenience, home delivery, and loyalty programs. Direct-to-consumer channels allow manufacturers to foster stronger brand relationships and provide recurring revenue streams. Wholesale and B2B channels support commercial and institutional buyers, offering bulk discounts, procurement efficiency, and consistent supply for veterinary clinics, catteries, and pet hotels.

End-Use Insights

Residential households represent the largest end-use segment, driven by multi-cat households, demand for odor control, and willingness to invest in premium performance litters. Convenience, low tracking, and dust-free properties are key purchase drivers for indoor cat owners. Commercial and institutional users, such as veterinary clinics, catteries, and pet hotels, prefer durable, cost-efficient, and bulk-priced options, often favoring non-clumping or heavy clay litters. Export-driven demand is growing, particularly to emerging markets with rising pet ownership, urbanization, and disposable incomes, where premium and eco-friendly litters are becoming increasingly popular.

| By Product Type | By Material / Composition | By Form / Format | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 38% of the global cat litter market in 2024. The region’s growth is driven by high cat ownership, strong pet humanization trends, and robust premiumization. Consumers prefer clumping, low-dust, and silica-based litters, supported by a high penetration of subscription delivery models. Strong spending power allows buyers to prioritize convenience, hygiene, and premium product features. The U.S. remains the largest national market, while Canada contributes through both premium and value segments.

Europe

Europe accounts for around 32% of the global market, with key contributors including Germany, the UK, and France. Regional growth is propelled by consumer awareness and regulatory push toward sustainable, eco-friendly products. Eco-certified litter, biodegradable formulations, and recyclable packaging are increasingly preferred. High disposable incomes, coupled with strong pet humanization trends, further support demand for premium and functional litter types. Sustainability and environmental compliance continue to drive innovation and brand differentiation in European markets.

Asia-Pacific

APAC is the fastest-growing region, with a CAGR of 6–8%, contributing significantly to global market expansion. China, India, Japan, and South Korea lead growth, fueled by rapid urbanization, rising disposable incomes, and expanding first-time cat ownership. Regional drivers include e-commerce proliferation, smaller living spaces requiring compact, dust-free, and low-odor litter solutions, and a high preference for imported premium brands. The rising middle-class urban population is increasingly willing to invest in convenience-oriented and hygienic litter options, driving both volume and value growth.

Latin America

Latin America holds 10–12% of the global market, with Brazil and Argentina as the key contributors. Regional growth is driven by increasing urban middle-class pet ownership, coupled with a price-sensitive consumer base. Value and mass-market litter segments dominate, while branded, affordable clumping litters present a significant opportunity. Improvements in distribution networks, including supermarket penetration and online sales, are enabling wider access to quality products and supporting market expansion.

Middle East & Africa

MEA contributes 5–8% of the global market, with urban centers in GCC countries showing the highest growth potential. Regional drivers include nascent but expanding pet ownership, high urbanization rates, and climatic conditions, such as elevated temperatures, which increase the demand for strong odor control and moisture-resistant formulations. South Africa represents a growing market for both conventional and premium litters. Adoption is concentrated in higher-income urban households, and there is increasing interest in eco-friendly and functional litter types, aligning with premiumization trends observed globally.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Cat Litter Products Market

- Nestlé Purina PetCare

- The Clorox Company

- Church & Dwight Co.

- Mars Petcare

- Oil-Dri Corporation of America

- Dr. Elsey’s Cat Products

- Kent Corporation (World’s Best Cat Litter)

- Pettex Limited

- Rettenmaier & Söhne GmbH + Co KG (JRS)

- Ökocat (Healthy Pet)

- Eco-Shell (Naturally Fresh)

- von Gimborn GmbH

- Jingzhou Lovepet Pet Products

- Sinochem Silica Gel Co., Ltd

- Blue Buffalo (Spectrum Brands)

Recent Developments

- In May 2025, Nestlé Purina PetCare expanded its plant-based litter product line in North America, focusing on eco-friendly, biodegradable options with subscription delivery models.

- In March 2025, Oil-Dri Corporation of America launched a new low-dust, multi-cat litter formulation in the U.S. and Europe to address customer concerns over dust and tracking.

- In January 2025, Church & Dwight introduced a silica gel-based litter with health-indicating crystals, enhancing odor control and user convenience, targeting premium segments globally.