Outdoor Cat House and Furniture Market Size

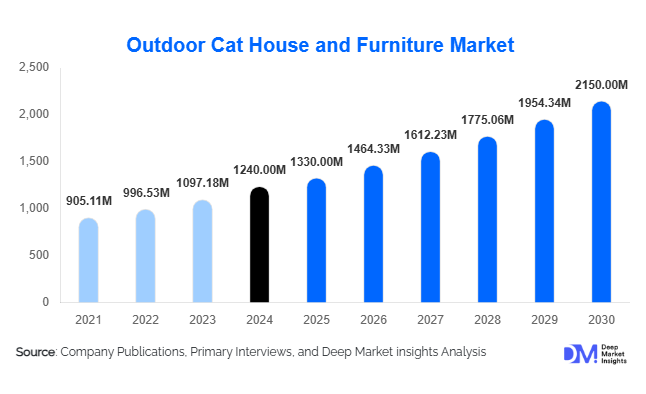

According to Deep Market Insights, the global outdoor cat house and furniture market size was valued at USD 1,240 million in 2024 and is projected to grow from USD 1,330 million in 2025 to reach USD 2,150 million by 2030, expanding at a CAGR of 10.1% during the forecast period (2025–2030). The market growth is primarily driven by the rising trend of pet humanization, increasing demand for durable and weather-resistant outdoor cat enclosures, and growing consumer expenditure on premium and sustainable pet furniture.

Key Market Insights

- Rising pet adoption rates worldwide are significantly driving demand for outdoor cat houses and furniture designed for comfort, safety, and enrichment.

- Eco-friendly and sustainable materials such as recycled plastics, FSC-certified wood, and bamboo are increasingly preferred by environmentally conscious consumers.

- North America dominates the market due to high pet ownership rates and robust spending on premium outdoor pet accessories.

- Europe is the fastest-growing region, driven by strong demand for design-focused, customizable, and weatherproof cat housing solutions.

- Asia-Pacific’s rapid urbanization and rising disposable incomes are fueling a surge in pet furniture adoption, particularly in China, Japan, and South Korea.

- Technological integration, including smart heating systems, motion sensors, and app-enabled monitoring for outdoor cat shelters, is enhancing product functionality and appeal.

What are the latest trends in the outdoor cat house and furniture market?

Sustainability and Eco-Conscious Designs

Manufacturers are increasingly focusing on sustainable production, offering cat houses made from recyclable and biodegradable materials. Brands are highlighting eco-friendly designs that minimize environmental impact while maintaining durability and style. This aligns with growing consumer awareness around sustainability and climate-conscious purchasing behavior. Companies are also investing in modular designs that extend product life cycles by allowing owners to replace individual parts rather than entire units.

Smart and Functional Outdoor Cat Housing

The integration of smart technologies such as solar-powered heating, motion detection, and temperature control systems is transforming outdoor cat houses. Connected features like app-based monitoring, automated doors, and weather sensors are becoming popular, especially among tech-savvy pet owners. This trend caters to pet parents seeking convenience, safety, and real-time oversight of their pets’ well-being in outdoor environments.

What are the key drivers in the outdoor cat house and furniture market?

Increasing Pet Humanization

Pet owners are increasingly treating cats as family members, driving demand for high-quality and aesthetically pleasing outdoor furniture that blends with home exteriors. The desire to offer pets comfort, safety, and outdoor enrichment is encouraging investment in premium, weather-resistant structures. This emotional connection continues to shape purchasing behavior and fuels innovation across the pet accessories sector.

Rising Demand for Weatherproof and Durable Products

Consumers are prioritizing materials that can withstand diverse climates, such as insulated wood, UV-resistant resin, and waterproof fabrics. Outdoor cat houses with thermal protection and modular roofing are gaining traction in both cold and tropical regions. Brands focusing on longevity and easy maintenance are capturing greater market share as buyers seek value-added durability.

What are the restraints for the global market?

High Product Costs and Limited Awareness

Premium outdoor cat houses and smart-enabled furniture come with high price tags, limiting adoption in emerging markets. Additionally, many cat owners remain unaware of the benefits of specialized outdoor furniture, leading to slow market penetration outside urban and affluent regions. The lack of affordable, locally produced options further constrains growth.

Maintenance and Space Constraints

Outdoor cat houses require regular cleaning, pest control, and weatherproofing, which can deter some consumers. Moreover, urban apartments with limited outdoor space restrict the feasibility of installing large cat enclosures, especially in densely populated cities across Asia and Europe.

What are the key opportunities in the outdoor cat house and furniture industry?

Customization and Aesthetic Integration

Consumers increasingly seek cat houses that complement home architecture and outdoor landscaping. Customizable colors, materials, and modular designs offer brands a chance to differentiate through aesthetics and personalization. Partnerships with home décor and outdoor furniture brands are emerging as viable strategies to tap into design-conscious consumers.

Expansion in E-Commerce and D2C Channels

Online platforms are transforming the pet furniture market by enabling global reach and convenient customization options. Direct-to-consumer (D2C) brands are gaining traction by offering virtual design previews, real-time order tracking, and subscription-based upgrade models. The continued expansion of e-commerce in emerging markets presents a major opportunity for scalable growth.

Product Type Insights

Wooden cat houses dominate the market due to their natural aesthetics, insulation capabilities, and durability. Plastic and resin cat houses are gaining momentum for their lightweight and weatherproof properties. The multi-level outdoor cat condos segment is rapidly growing, offering enhanced activity spaces for exercise and play. Innovations in portable and collapsible shelters are also expanding accessibility for renters and urban dwellers.

Distribution Channel Insights

Online retail remains the leading distribution channel, accounting for the majority of global sales, thanks to product variety and customer reviews influencing purchasing decisions. Offline specialty pet stores continue to perform well, particularly in North America and Europe, where personalized advice and product demonstrations influence high-value purchases. OEM and D2C channels are expected to gain market share as brands streamline supply chains and build direct relationships with consumers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America dominates the market, with the U.S. accounting for a major share due to high pet ownership rates and spending on outdoor comfort solutions. Growing awareness of pet safety and climate-adaptive shelters has led to significant adoption of insulated and smart cat houses. The trend of backyard pet spaces and luxury outdoor enclosures is especially strong in suburban areas.

Europe

Europe is witnessing strong growth, driven by sustainability-focused consumers and demand for designer pet furniture. The U.K., Germany, and France lead adoption, with increasing interest in eco-friendly, weatherproof cat houses that integrate into garden aesthetics. EU regulations promoting sustainable materials are further influencing product development in this region.

Asia-Pacific

Asia-Pacific represents the fastest-growing market, supported by rising disposable incomes, urban pet adoption, and expanding online retail infrastructure. China, Japan, and South Korea are major contributors, with consumers showing increasing preference for compact, space-efficient cat houses. Local manufacturing expansion and affordable product offerings are expected to further accelerate growth.

Latin America

The market in Latin America is developing steadily, particularly in Brazil and Mexico, where outdoor pet care products are gaining popularity. Growth is supported by increasing pet adoption and the entry of global pet brands offering affordable, weather-resistant furniture options.

Middle East & Africa

In the Middle East and Africa, the market is at an emerging stage, driven by rising urbanization and growing acceptance of pets as family members. The UAE and South Africa are key early adopters, with premium and temperature-regulated outdoor cat shelters showing strong potential in hot climates.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Outdoor Cat House and Furniture Market

- PetSafe

- K&H Pet Products

- TRIXIE Pet Products

- Prevue Pet Products

- MidWest Homes for Pets

- PawHut (Aosom LLC)

- New Age Pet (EcoFlex)

- Ware Pet Products

Recent Developments

- In August 2025, K&H Pet Products launched a new line of insulated outdoor cat houses with integrated thermostats designed for extreme weather conditions.

- In May 2025, PawHut introduced modular and stackable outdoor cat condos to promote flexible installation in urban environments.

- In February 2025, TRIXIE Pet Products unveiled an eco-friendly outdoor cat shelter range made from 100% recycled wood-plastic composite, aligning with its sustainability goals.