Card Printers Market Size

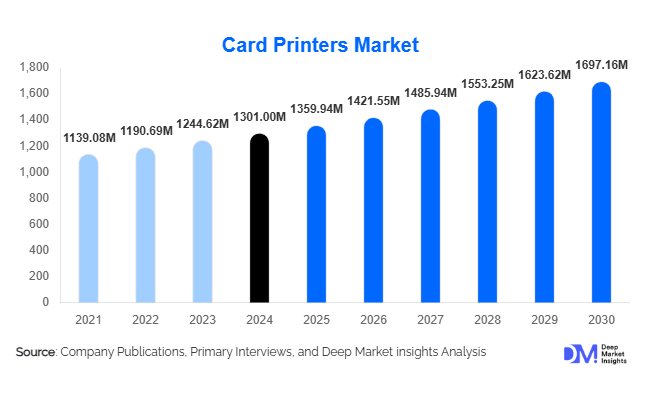

According to Deep Market Insights, the global card printers market size was valued at USD 1,301 million in 2024 and is projected to grow from USD 1,359.94 million in 2025 to reach USD 1,697.16 million by 2030, expanding at a CAGR of approximately 4.53% during the forecast period (2025–2030). The replacement of legacy issuance hardware primarily drives market growth, the rising demand for secure printed credentials (including contactless and smart cards) in government and enterprise sectors, and the expansion of high-durability printing technologies tailored for centralized issuance and transit applications.

Key Market Insights

- Direct-to-card (DTC) printers dominate unit volumes, catering to decentralized issuance and SMB deployments where cost efficiency is critical.

- Retransfer and HDP printing technologies are growing fastest, offering edge-to-edge image quality and durability required for secure credentials and smart cards.

- Consumables (ribbons, overlays, blank cards) and embedded encoding modules are becoming strategic revenue streams, enabling vendors to lock in recurring revenues beyond hardware sales.

- North America remains the largest regional market, driven by strong enterprise, government, and financial services spending on printed credential issuance.

- Asia-Pacific (APAC) is the fastest-growing region, bolstered by national ID programs, transit smart-card roll-outs, and growth in local manufacturing/consumption of printers and consumables.

- Technological convergence and managed-print services integration are reshaping the market: cloud-based issuance, remote device management, and software-enabled printing platforms are gaining traction across large deployments.

What are the latest trends in the card printers market?

Premiumization of Printing Technology

Vendors are increasingly offering retransfer and high-definition printing (HDP) technologies to meet the demand for high-quality, edge-to-edge printed cards with durable overlays. Governments and transit authorities require cards with extended lifecycles and tamper-resistance, which drives preference for the higher-end printing capabilities. As a result, premium hardware units (and associated consumables) are commanding higher ASPs and margin profiles compared to legacy desktop models.

Integration of Smart-Card Encoding and Contactless Capabilities

The shift toward contactless credentials, multi-application cards (EMV + transit + access control), and mobile-wallet convergence is pushing the card-printers market to embed encoding modules (magstripe, chip, NFC/RFID) and connectivity options (USB, network). Printers that support smart-card personalization and secure encoding are becoming more attractive to large issuers, driving incremental value per printer and increased consumables/encoder module sales over time.

What are the key drivers in the card printers market?

Modernization of Government & Enterprise Credential Programs

Governments worldwide are upgrading national ID programs, voter registration cards, secure workplace badges, and transit passes, all requiring issuance hardware, consumables, and service contracts. Enterprises are similarly upgrading corporate access and staff-credentialing systems. These large-scale programs drive hardware refresh cycles, increased consumable consumption, and service-based revenue streams, making this one of the strongest growth levers in the market.

Recurring Revenue from Consumables & Service Models

Once hardware is installed, the ongoing requirement for blank cards, ribbons, overlays, cleaning kits, and service support creates high-margin recurring business. Vendors are increasingly bundling software and managed-print services (remote device monitoring, cloud issuance, help-desk) to lock in customers for longer lifecycles. This shift from one-time hardware sales to lifecycle revenue is enhancing profitability and investment attractiveness.

Expansion of Contactless and Multi-Application Card Use Cases

Transit systems, campuses, corporate access, loyalty programs, and smart cities are adopting cards that combine payment, identity, access, and transit in a single form factor. This diversification of applications increases the per-card value and the complexity of issuance systems (requiring higher-capability printers, encoding module, and secure consumables). As a result, the market is benefiting from higher average selling prices and increased consumable utilization.

What are the restraints for the global market?

Shift Toward Digital Credentials and Mobile Authentication

In some end-use segments (notably loyalty, membership, and access control), mobile/virtual credentials are substituting for physical cards, thereby reducing demand for new card printers and traditional blank-card inventory. Organizations delaying physical reissue or shifting to smartphone-based credentialing may slow card-printer hardware growth.

Price Pressure and Fragmentation in the Entry-Level Hardware Segment

The desktop card-printer segment faces aggressive price competition from low-cost OEMs and regional suppliers, compressing hardware margins. As buyers increasingly demand integrated encoding and cloud features, smaller OEMs struggle to differentiate. Vendors must thus shift focus toward higher-margin segments (industrial, retransfer, software) to maintain profitability.

What are the key opportunities in the card printers industry?

Large-Scale Issuance Programs in Emerging Markets

Governments in APAC, LATAM, and MEA are launching large-scale national ID, smart-card, and transit card programs. These initiatives present opportunities for OEMs to supply hardware, consumables, software, and managed services. For new entrants, collaborating with local integrators or building regional manufacturing/consumable capacity can unlock niche access to long-term contracts.

Managed Cloud-Based Issuance and Lifecycle Services

As issuers move from purely hardware-centric procurement to full lifecycle solutions, vendors offering cloud issuance platforms, remote device management, analytics, secure key management, and subscription-based consumables gain a competitive edge. This model provides higher margins and recurring revenue streams, enabling vendors to deepen relationships with large enterprise and government customers.

Transit, Smart City, and Multi-Application Card Expansion

Urbanization, rising mobility services, and smart-city infrastructure are fueling demand for contactless, reloadable, and multi-purpose cards that combine transit, access, loyalty, and payment. Printers capable of high-volume issuance, embedded encoding, and durable output are in high demand. OEMs and integrators can position themselves for growth by offering complete issuance solutions tailored for transit and multi-application card programs.

Product Type Insights

The direct-to-card (DTC) printer category dominates unit volumes and value, accounting for approximately 60% of the global market share in 2024. This is driven by widespread usage in SMB, education, and enterprise badging applications, where cost-efficiency and decentralized issuance are key. Meanwhile, retransfer and HDP technologies are gaining ground rapidly due to their superior print quality and suitability for high-security and durable applications. As issuers upgrade to newer formats (smart-cards, metal cards, overlays), the premium segment expands, pushing overall average selling prices upward.

Application Insights

The largest end-use market for card printers continues to be government and large enterprise credential issuance (≈45% share of the 2024 market). Banking/financial services and transit/smart-city segments are growing strongly, with increasing personalization, contactless issuance, and regional issuance centers. Emerging applications such as corporate badging for access control, healthcare patient/staff credentials, and event/loyalty cards are gaining traction as well. Export-driven demand is significant: hardware and consumables produced in North America and Europe are shipped to APAC and LATAM for deployment in government/transit programs.

Distribution Channel Insights

Value-added resellers and system integrators account for the bulk (62%) of the global 2024 market value, particularly for large deployments involving encoding modules, software, integration, and service. Online and direct channels are dominant for lower-end desktop models in SMB/education segments, but contribute a smaller share of overall revenue. OEMs are increasingly using hybrid channel models, which combine direct enterprise sales with reseller networks and consumables marketplaces.

End-User Type Insights

Government and public-sector institutions represent the largest and highest-value customer umbrella (45% of the global 2024 market). Corporate/enterprise (badging & access) and BFSI (card issuance/personalization) follow closely. The fastest growth segments are transit/smart-city issuance and multi-application cards, where new entrants and integrators can tap expanding demand. Education and healthcare segments are stable but slower-growing, given lower per-unit ASPs and limited security requirements.

Age Group Insights

Not directly applicable to card-printers as a B2B market; however, younger end-users (enterprises deploying cloud-driven badge issuance, transit authorities targeting millennials) tend to favour newer technologies (contactless, mobile-hybrid issuance), which in turn accelerate hardware upgrading and consumables demand.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest share (34%, or USD 442 million in 2024) of the global card printer market. The U.S. and Canada lead in large government credentials, enterprise badging, and banking-card personalization. High infrastructure maturity, frequent upgrade cycles, and a strong consumables aftermarket underpin regional stability. Buyers’ focus on integrated encoding and cloud software drives ASPs upward.

Asia-Pacific

Asia-Pacific is estimated at 28% (USD 364 million in 2024) and is the fastest-growing region. Drivers include national ID/biometric programs in India and China, transit and reloadable smart-card roll-outs in Southeast Asia, and increasing local manufacturing of printers and consumables. Growth rates exceed the global average as penetration remains lower and upgrade cycles begin.

Europe

Europe accounts for 20% (USD 260 million) of the 2024 market size. Strong demand from national credential modernization, GDPR-driven security upgrades, and banking personalization is key. Germany, France, and the U.K. are among the largest national buyers.

Middle East & Africa

MEA holds 8% (USD 104 million) of the 2024 market. Government and transit credentialing projects in GCC states, workforce access control in hospitality/resorts, and regional event credentialing contribute to growth.

Latin America

Latin America registers 10% (USD 131 million) of the 2024 global market. Brazil and Mexico lead adoption through government ID programs, transit card modernization, and banking personalization. Channel fragmentation and budget sensitivity moderate growth relative to APAC.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Card Printers Market

- Entrust Corporation

- HID Global (Assa Abloy)

- Zebra Technologies Corporation

- Evolis

- Matica Technologies AG

- Magicard Ltd.

- NiSCA Corporation

- DASCOM

- NBS Technologies

- IDP Corp.

- HiTi Digital

- CIM Systems

- SwiftColor

- Pointman

- AlphaCard / Universal Smart Cards