Car Refrigerator Market Size

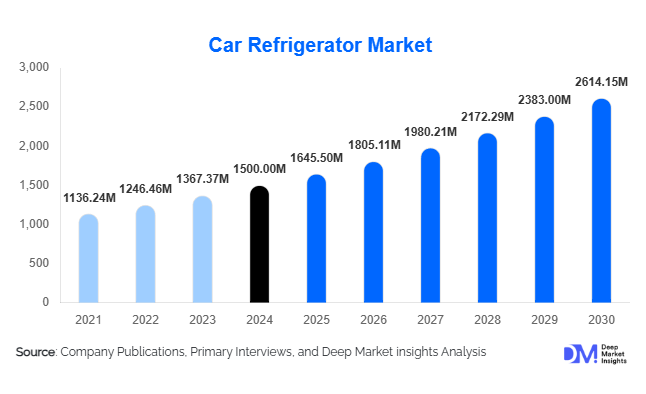

According to Deep Market Insights, the global car refrigerator market size was valued at USD 1,500.00 million in 2024 and is projected to grow from USD 1,645.50 million in 2025 to reach USD 2,614.15 million by 2030, expanding at a CAGR of 9.7% during the forecast period (2025–2030). Market growth is primarily driven by increasing vehicle ownership worldwide, rising demand for in-car convenience, and technological innovations in portable and built-in cooling systems. Adoption of energy-efficient compressors, hybrid refrigeration units, and IoT-enabled monitoring solutions is further fueling the market, alongside growing recreational travel and logistics applications requiring temperature-controlled storage.

Key Market Insights

- Portable car refrigerators dominate consumer preference due to compact designs, ease of installation, and suitability for SUVs, passenger cars, and vans.

- Compressor-based cooling technology is leading, particularly in tropical climates, due to superior cooling performance and reliability.

- North America and Europe hold the largest market shares, driven by high disposable incomes, vehicle penetration, and recreational vehicle adoption.

- Asia-Pacific is the fastest-growing region, with rising disposable incomes, increasing SUV sales, and government initiatives supporting automotive upgrades.

- Integration with electric vehicles and hybrid power sources is emerging as a key differentiator, offering energy-efficient solutions without impacting battery performance.

- Export-driven demand is increasing, especially in the Middle East and Africa, where durable and heat-resistant portable refrigerators are in high demand.

What are the emerging trends in the car refrigerator market?

Smart and Hybrid Refrigerators

Market participants are increasingly developing hybrid and dual-power car refrigerators capable of operating on both 12V and 24V systems, as well as directly on electric vehicle batteries. IoT-enabled models with app-based temperature control, predictive cooling, and battery monitoring are gaining traction. These innovations appeal to tech-savvy consumers seeking convenience, real-time monitoring, and energy efficiency.

Rising Popularity of Portable Units

Portable car refrigerators are expanding rapidly, supported by rising road trips, outdoor recreation, and family travel. Compact and medium-capacity refrigerators (20–40 liters) are particularly popular as they balance storage space with portability. Manufacturers are focusing on lightweight, thermoelectric, and solar-powered designs to meet evolving consumer expectations.

Integration in Commercial and Specialized Vehicles

Car refrigerators are increasingly integrated into commercial vehicles, such as refrigerated delivery vans and ambulances, to maintain temperature-sensitive goods. Specialized applications in luxury buses and recreational vehicles are also rising, contributing to a broader B2B adoption trend.

What factors are driving growth in the global car refrigerator market?

Rising Vehicle Ownership and Recreational Travel

Increasing vehicle sales globally, particularly SUVs, vans, and electric vehicles, are directly boosting demand for in-car refrigerators. Road trips, family vacations, and camping are creating a strong consumer preference for portable and medium-capacity units that maintain food and beverage freshness during transit.

Technological Advancements

Innovations such as compressor-based cooling, thermoelectric units, hybrid power sources, and smart IoT integration have enhanced product efficiency and convenience. These technologies improve reliability, reduce energy consumption, and appeal to premium consumers, driving overall market growth.

Growing Logistics and Pharmaceutical Applications

Demand for temperature-controlled transport of perishable goods and medicines is increasing globally. Commercial vehicles equipped with car refrigerators are becoming essential in food delivery, healthcare logistics, and cold-chain operations, supporting B2B adoption and incremental market expansion.

What challenges or restraints are affecting the car refrigerator market worldwide?

High Initial Cost

Premium and hybrid car refrigerators remain expensive, limiting adoption among middle-income consumers in emerging markets. Cost-sensitive buyers may opt for lower-capacity or basic thermoelectric units, which can restrict growth in certain regions.

Energy and Power Constraints

Continuous operation of refrigerators in vehicles can strain battery systems, especially in electric vehicles or vehicles with smaller alternators. Limited access to energy-efficient designs or advanced cooling technologies may restrain adoption, particularly in developing countries.

What are the key opportunities for growth in the car refrigerator market industry?

Integration with Electric Vehicles

With the growing adoption of EVs, manufacturers have an opportunity to develop low-power, high-efficiency car refrigerators integrated with vehicle battery management systems. This allows continuous operation without excessive battery drain, creating a niche for energy-conscious consumers and OEM collaborations.

Expansion in Emerging Economies

Regions such as India, China, Brazil, and Southeast Asia are witnessing rising vehicle ownership, tourism, and disposable incomes. Localized designs, cost-effective models, and region-specific marketing strategies offer substantial growth opportunities for both domestic and global players.

Technology-Driven Differentiation

Advanced features such as IoT monitoring, app-based temperature control, solar-powered options, and hybrid cooling units provide a clear competitive advantage. Companies investing in R&D can capture the premium segment, offering products that combine convenience, efficiency, and smart functionalities.

Product Type Insights

Portable car refrigerators dominate the market with a 2024 share of 45%, driven by high adoption in SUVs, passenger cars, and family vehicles. Built-in or integrated refrigerators are preferred in luxury cars, while hybrid units appeal to consumers seeking flexibility across vehicle types. Overall, portable models remain the preferred choice due to convenience, ease of installation, and cost-effectiveness.

Application Insights

Passenger vehicles account for 60% of demand in 2024, fueled by road trips, camping, and long-distance travel. Commercial vehicles, particularly refrigerated delivery vans and logistics fleets, are a growing segment. Recreational vehicles (RVs) and specialized applications such as ambulances are emerging markets, supporting expansion in North America and Europe. Export-driven demand from regions such as the Middle East and Africa emphasizes durable and high-performance models.

Distribution Channel Insights

Online retail platforms, direct OEM partnerships, and specialty automotive accessory stores dominate distribution. Online channels offer comparison, reviews, and transparent pricing, while direct collaborations with vehicle manufacturers support integrated and premium product adoption. Emerging subscription-based and membership sales models are also enhancing consumer engagement in select regions.

| Installation Type | Cooling Technology | Power Source |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 30% of the 2024 market, with high SUV and recreational vehicle ownership driving growth. U.S. and Canadian consumers prioritize convenience, premium features, and energy-efficient designs. The region’s strong logistics and healthcare segments further support commercial adoption.

Europe

Europe accounts for 28% of the 2024 market, led by Germany, France, and the U.K. The market benefits from high disposable incomes, recreational travel culture, and integration in luxury and commercial vehicles. Eco-conscious consumers are increasingly adopting energy-efficient and smart refrigerator models.

Asia-Pacific

Asia-Pacific is the fastest-growing region (CAGR ~9.5%), with China, India, Japan, and Australia driving demand. Rising disposable incomes, SUV sales, tourism, and government support for automotive accessories are key factors. China leads the region in manufacturing and exports.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is increasingly adopting portable and hybrid refrigerators due to luxury vehicle usage and long-distance travel. Intra-African travel also contributes to growing demand for durable, heat-resistant models.

Latin America

Brazil and Mexico are the major markets in Latin America, showing gradual growth in portable and compressor-based refrigerators. Rising road travel, urbanization, and logistics applications are supporting adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Car Refrigerator Market

- Dometic Group

- ARB Corporation Ltd

- Whynter LLC

- Indel B S.p.A

- Alpicool

- Engel Australia

- Mobicool

- Waeco (Dometic)

- Black+Decker

- CF Auto

- KingCamp

- Chefman

- Coleman

- Cooluli

- Mobicool

Recent Developments

- In March 2025, Dometic Group launched a new range of energy-efficient, dual-voltage car refrigerators with IoT monitoring for European and North American markets.

- In January 2025, ARB Corporation introduced hybrid portable refrigerators with solar charging capability in the Asia-Pacific region, targeting SUV owners and outdoor enthusiasts.

- In December 2024, Whynter LLC expanded its medium-capacity compressor-based refrigerator portfolio for commercial vehicle applications in North America and LATAM.