Canvas Products Market Size

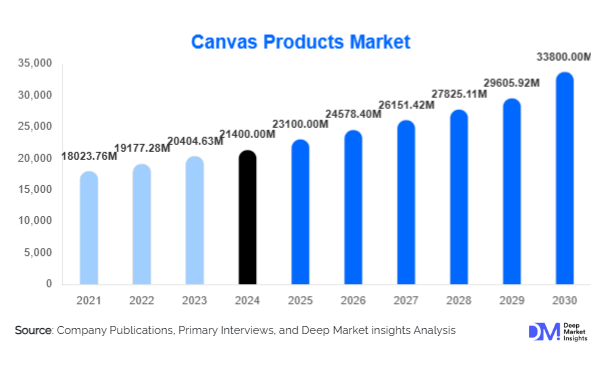

According to Deep Market Insights, the global canvas products market size was valued at USD 21,400 million in 2024 and is projected to grow from USD 23,100 million in 2025 to reach USD 33,800 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025-2030). The canvas products market growth is primarily driven by the rising demand for durable and eco-friendly materials in industries such as outdoor recreation, defense, logistics, fashion, and home furnishings. Increasing adoption of sustainable and recycled fabrics, coupled with the growing popularity of canvas in lifestyle products, is further accelerating market expansion worldwide.

Key Market Insights

- Eco-friendly and recycled canvas materials are rapidly gaining traction, appealing to sustainability-conscious consumers and industries.

- Canvas bags and backpacks dominate the consumer goods segment, supported by fashion trends and bans on single-use plastics in many countries.

- Defense and military applications remain a critical market driver, with consistent procurement of canvas tents, covers, and gear across regions.

- Asia-Pacific leads global production and consumption, with China and India serving as manufacturing hubs, while North America drives premium and specialty demand.

- E-commerce and direct-to-consumer (D2C) channels are expanding canvas product accessibility, boosting SME participation in the global market.

- Technological integration in textile manufacturing, including water-repellent treatments and digital printing, is expanding the functional and aesthetic appeal of canvas products.

What are the latest trends in the canvas products market?

Shift Toward Sustainable Canvas Materials

With global emphasis on sustainability, manufacturers are increasingly using organic cotton, hemp, and recycled polyester blends for canvas production. Eco-conscious consumers are driving the demand for biodegradable and low-impact materials in bags, footwear, and industrial covers. Governments and global brands are promoting sustainable textile certifications, further encouraging adoption. This shift is especially visible in Europe and North America, where strict environmental regulations are fostering demand for greener alternatives.

Canvas in Lifestyle and Fashion

Canvas has become a staple in the fashion and lifestyle industry, particularly in the production of backpacks, handbags, and footwear. The material’s durability, affordability, and ability to be customized with prints and designs make it highly popular among younger demographics. Leading brands are blending functionality with style, incorporating water-resistant coatings and premium finishing techniques. This trend is significantly boosting canvas demand in consumer markets, especially in urban centers across APAC, Europe, and North America.

What are the key drivers in the canvas products market?

Rising Outdoor Recreation and Camping Activities

The surge in outdoor activities such as trekking, camping, and adventure tourism has amplified demand for canvas tents, tarpaulins, and backpacks. Canvas is preferred for its strength and weather resistance, making it the material of choice for heavy-duty outdoor gear. The global adventure tourism industry, projected to grow above 9% annually, is directly contributing to the canvas market expansion.

Military and Defense Procurement

Defense and security agencies across the globe rely on canvas-based tents, vehicle covers, and protective gear. With governments increasing defense spending, consistent procurement contracts ensure steady demand. Canvas remains critical for temporary shelters, camouflage equipment, and load-bearing accessories used in military operations worldwide.

Consumer Preference for Durable and Affordable Goods

In consumer goods, particularly bags and footwear, canvas continues to outperform alternatives due to its cost-effectiveness, versatility, and strength. With fashion brands integrating canvas into premium collections, the perception of canvas products has shifted from purely functional to fashionable, broadening consumer adoption across age groups.

What are the restraints for the global market?

Competition from Synthetic Alternatives

The increasing use of lightweight synthetic fabrics such as nylon and polyester poses a challenge to the canvas market. While these materials offer water resistance and flexibility, they often undercut canvas on weight and cost. This competition is particularly strong in luggage, footwear, and tent applications.

Volatility in Raw Material Prices

Fluctuations in cotton and polyester prices directly impact the production costs of canvas products. Supply chain disruptions and regional trade imbalances can create significant price instability, making it difficult for manufacturers to maintain stable margins in a highly competitive environment.

What are the key opportunities in the canvas products industry?

Adoption of Smart and Treated Canvas

The integration of technologies such as waterproof coatings, UV resistance, and fire-retardant treatments presents opportunities for expanding canvas applications in industrial, defense, and outdoor markets. Smart coatings enable canvas products to perform better in extreme environments, opening new avenues in high-performance sectors.

Growing Demand in Emerging Economies

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and Africa are driving demand for affordable consumer products such as bags, shoes, and home furnishings made from canvas. Local manufacturing initiatives and trade liberalization policies are boosting exports and strengthening domestic markets.

E-commerce Expansion and Direct-to-Consumer Sales

Digital platforms are enabling manufacturers and SMEs to directly reach consumers across the globe. The growing popularity of canvas backpacks, tote bags, and customized art products on online platforms provides lucrative opportunities for market players to scale globally without significant overhead costs.

Product Type Insights

Canvas bags and backpacks hold the largest market share at 28% in 2024, driven by the ban on single-use plastics and rising demand for eco-friendly, stylish alternatives. Canvas footwear follows closely, holding 22% of the market, propelled by its affordability and versatility. Industrial and defense applications collectively contribute nearly 30%, underscoring the material’s importance in heavy-duty use cases. Art and decorative products, while smaller in share, are gaining popularity with the growing global demand for DIY and home décor markets.

Application Insights

Consumer lifestyle and fashion account for 35% of the market in 2024, making it the largest application segment. Outdoor recreation and defense follow, with combined shares of around 30%. Industrial uses such as tarpaulins, aprons, and machinery covers represent a growing segment, especially in APAC and the Middle East, as industrialization accelerates. Household applications, including upholstery and wall décor, are witnessing renewed interest in developed regions where canvas is valued for its rustic and sustainable appeal.

Distribution Channel Insights

Retail and e-commerce channels dominate sales with a combined share of over 60% in 2024. Online platforms are experiencing the fastest growth, particularly for fashion and decorative products. B2B distribution, including defense procurement and logistics, holds a significant share of 35%, ensuring long-term contracts and stable demand streams. The direct-to-consumer trend is reshaping the competitive landscape, allowing emerging brands to compete directly with established players through digital storefronts.

| By Product Type | By Material | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 27% of the global market in 2024, led by strong consumer demand for fashion, outdoor recreation, and military supplies. The U.S. remains the largest market, driven by high defense spending and a robust retail sector for consumer products.

Europe

Europe holds 23% of the global share in 2024, with Germany, the U.K., and France leading demand. Strict sustainability regulations and consumer preference for eco-friendly materials are driving the adoption of recycled canvas in fashion and home furnishings.

Asia-Pacific

APAC dominates production and is the fastest-growing market, projected to expand at a CAGR above 7.5% through 2030. China and India are the primary manufacturing hubs, while Japan and South Korea drive premium product demand. Rising disposable incomes across Southeast Asia are further boosting consumer sales.

Latin America

Latin America is emerging as a growing market, particularly in Brazil and Mexico, where demand is driven by industrial tarpaulins, footwear, and affordable fashion goods. Government incentives for local manufacturing are expected to support steady growth.

Middle East & Africa

The MEA region is witnessing growing adoption of canvas in defense, construction, and industrial sectors. South Africa and the UAE are leading markets, with rising imports of canvas bags, tents, and tarpaulins. Defense contracts in Saudi Arabia are further contributing to regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Canvas Products Market

- VF Corporation

- Converse Inc. (Nike)

- Samsonite International S.A.

- Tiger Canvas Company

- Martexin Original Wax

- Hanesbrands Inc.

- New Balance Athletics, Inc.

- Eastpak (part of VF Corporation, but listed separately in some datasets)

- Duluth Trading Company

- JanSport

- Topdeal Canvas Products

- Coleman Company

- Filson

- TentSmiths

- Carhartt, Inc.

Recent Developments

- In July 2025, Samsonite expanded its eco-friendly product line with recycled canvas travel bags targeting European and North American consumers.

- In May 2025, VF Corporation announced sustainability initiatives, including increased use of organic and recycled canvas across its footwear and apparel lines.

- In March 2025, Coleman Company introduced a new series of water-resistant canvas tents for the adventure tourism market in North America and Europe.