Canopy Market Size

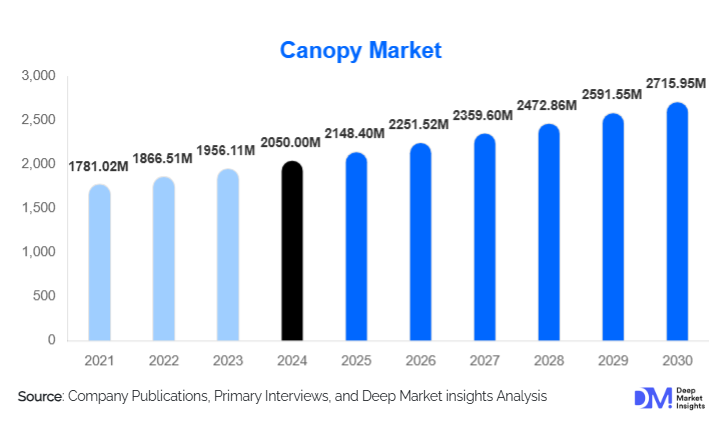

According to Deep Market Insights, the global canopy market size was valued at USD 2,050.00 million in 2024 and is projected to grow from USD 2,148.40 million in 2025 to reach USD 2,715.95 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). Growth is fueled by rising adoption of outdoor living spaces, strong demand from commercial and hospitality sectors, and increasing use of advanced materials such as PTFE, ETFE, and modular metal-frame systems for long-term architectural durability. The market continues to expand as canopies become integral to residential landscaping, urban development, and public infrastructure enhancement.

Key Market Insights

- PTFE and advanced membrane canopies dominate material demand, supported by long service life and architectural versatility.

- Shade canopies lead application share globally, driven by residential patios, hospitality outdoor seating, and commercial shading requirements.

- Europe holds the largest regional market share owing to robust infrastructure renovation and demand for sustainable outdoor structures.

- Asia-Pacific is the fastest-growing region, propelled by rapid urbanization, hospitality expansion, and rising middle-class home improvement spending.

- Technological integration is reshaping canopy design, including retractable systems, modular structures, and solar-integrated canopy roofs.

- Commercial, hospitality, and event sectors are key demand accelerators, driving adoption of both temporary and permanent canopy solutions.

What are the latest trends in the canopy market?

Growth of Sustainable, Long-Life Membrane Canopies

The canopy industry is witnessing increasing adoption of eco-friendly, highly durable materials such as PTFE and ETFE membranes. These advanced polymers offer exceptional weather resistance, UV protection, low maintenance, and architectural appeal. Their growing use in stadiums, public plazas, airports, walkways, and commercial buildings aligns with global sustainability drives and lower life-cycle costs. Many governments and developers are specifying membrane canopies as part of green-building certification requirements, reinforcing demand for long-life, recyclable, and energy-efficient canopy structures.

Rise of Modular, Smart & Retractable Canopy Systems

Technological innovation is transforming canopy functionality. Smart retractable systems equipped with motorization, weather sensors, and automated controls are becoming increasingly common in premium residential and commercial settings. Modular canopies, designed for rapid assembly, portability, and customization, are gaining traction in events, logistics, and hospitality sectors. Solar-integrated canopies that serve as both shade and renewable-power generators are emerging as a promising niche, particularly in high-sunlight regions. These innovations are expanding use cases and enabling canopy manufacturers to differentiate through advanced functionality.

What are the key drivers in the canopy market?

Global Expansion of Residential Outdoor-Living Spaces

The shift toward lifestyle-driven home improvement is propelling canopy installations in patios, balconies, gardens, and terraces. Homeowners increasingly seek shade, weather protection, and aesthetic value additions to outdoor areas. Canopies play a central role in creating usable outdoor spaces for leisure, dining, and vehicle protection, supporting sustained residential demand. Rapid urbanization in the Asia-Pacific and rising disposable incomes strengthen this segment even further.

Commercial Infrastructure Growth & Hospitality Investments

Restaurants, hotels, resorts, malls, cafés, and entertainment venues rely heavily on canopies for sheltered outdoor seating, walkways, entrances, and event areas. Growing tourism and hospitality construction, especially in Europe, the Middle East, and Southeast Asia, continues to elevate demand. Public infrastructure such as airports, stadiums, and educational campuses also uses architectural canopies for durability and aesthetics. These multi-sector investments collectively reinforce canopy market expansion.

Advancements in Material Engineering & Structural Design

Improvements in polymer membranes, tensile fabric technology, metal framing, corrosion-resistant coatings, and lightweight modular systems enhance canopy performance and broaden applications. The ability to create sweeping architectural forms, reduce maintenance, and extend operational life makes advanced canopies attractive for both public and private developers. Innovation also reduces the long-term cost of ownership, a key driver for government projects and commercial real estate stakeholders.

What are the restraints for the global market?

High Installation & Maintenance Costs for Permanent Structures

Architectural canopies built with PTFE membranes, glass panels, or metal structures require significant upfront investment and skilled installation. Maintenance costs, such as cleaning membranes, servicing retractable systems, and structural inspections, restrict adoption among budget-sensitive customers. These financial barriers are particularly impactful in developing regions where construction spending remains conservative.

Market Fragmentation & Price Competition

The presence of numerous regional manufacturers and generic canopy suppliers intensifies price competition. Fabric-based canopies face significant commoditization, reducing profit margins for smaller businesses. Limited product differentiation in low-cost segments challenges companies to innovate while maintaining competitive pricing, slowing revenue growth potential in the broader industry.

What are the key opportunities in the canopy industry?

Growth in Urban Development & Public Infrastructure Shading

Cities worldwide are investing in walkable infrastructure, transit hubs, airport expansions, and climate-adaptive public spaces. Canopies offer shading, shelter, and architectural enhancement, positioning them as essential elements in modern urban planning. Governments increasingly integrate tensile structures, public walkway canopies, and solar shade systems into redevelopment projects, creating a long-term opportunity for canopy suppliers and engineering firms.

Hospitality, Events & Recreation Sector Expansion

Rising global tourism and outdoor recreation are boosting demand for event canopies, modular shelters, and hospitality shading. Hotels and restaurants are upgrading outdoor spaces to accommodate year-round dining and leisure. Event organizers seek lightweight, scalable canopy solutions for festivals, exhibitions, and sports events. This sector presents strong recurring revenue potential due to frequent replacement, rental cycles, and seasonal demand.

Smart, Modular & Solar-Integrated Canopy Technologies

Integration of automation, retractable designs, energy generation (solar PV roofs), and quick-deploy modular systems creates high-value niches within the market. These advanced products appeal to commercial developers, luxury homeowners, and sustainability-focused organizations. Manufacturers that invest in R&D, modular engineering, and long-life sustainable materials stand to capture future growth and premium pricing opportunities.

Product Type Insights

Shade canopies remain the dominant product category globally, driven by broad adoption across residential patios, hospitality outdoor seating, retail storefronts, and public walkways. Event and large-format canopies contribute significantly to volume demand due to their use in festivals, exhibitions, and temporary venues. Portable and pop-up canopies are growing rapidly with widespread use in recreation, small businesses, and personal outdoor activities. Architectural and structural canopies, though smaller in volume, generate high revenue due to premium materials such as PTFE, ETFE, metal, and tempered glass, making them the most profitable segment for manufacturers.

Application Insights

Residential applications dominate in terms of installed units, with homeowners seeking solutions for carports, pergolas, decks, and gardens. Commercial applications, including hotels, cafés, malls, and office buildings, represent a value-rich segment due to large-scale installations. Institutional applications in schools, airports, hospitals, bus stations, and stadiums are expanding as part of modernization drives. Industrial uses, such as warehouse shading, loading bays, and logistics shelters, are emerging as a niche but fast-growing opportunity.

Distribution Channel Insights

Offline distribution continues to dominate, driven by contractors, builders, architects, and specialty dealers who manage installation services. However, online sales are rapidly accelerating for portable canopies, DIY pergolas, and residential shade systems, supported by e-commerce penetration and improved product visualization tools. Manufacturers are strengthening direct-to-consumer channels through digital catalogs, customization platforms, and virtual design previews. Rental companies maintain a strong presence in events and recreation, offering scalable canopy solutions for short-term applications.

End-Use Insights

Residential users account for a substantial share of canopy installations, propelled by home improvement trends and outdoor living upgrades. Hospitality and commercial sectors are the fastest-growing end-users, driven by outdoor dining expansion, architectural enhancement needs, and tourism growth. Institutional end-users, transport hubs, schools, and public spaces are increasingly adopting tensile canopies for shading, safety, and design aesthetics. Emerging applications include logistics canopies, EV charging-station shelters, and solar-integrated shade structures, expanding the industry’s addressable market.

| By Material Type | By Application Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28–30% of the global market in 2024, supported by strong residential spending, commercial real estate development, and outdoor lifestyle trends. The U.S. leads demand for patio covers, pergolas, and retractable systems, while Canada shows strong growth in commercial shade structures. Infrastructure projects and hospitality upgrades further reinforce market expansion.

Europe

Europe remains the largest regional market with a 30–35% share, driven by high architectural standards, renovation cycles, and preference for sustainable outdoor structures. Germany, the U.K., France, Italy, and the Netherlands are major contributors, with strong adoption of PTFE/ETFE membrane canopies in public and commercial projects. Outdoor dining culture and design-focused construction significantly support market maturity.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and expanding hospitality and tourism sectors. China and India lead high-volume installations across residential and commercial applications, while Japan, South Korea, and Australia adopt advanced tensile and retractable canopy systems. Infrastructure megaprojects across Southeast Asia create strong long-term demand potential.

Latin America

Latin America is gradually expanding its canopy market presence, with Brazil, Mexico, and Argentina driving residential and commercial demand. Adoption remains steady in outdoor dining, recreation, and events. Economic fluctuations limit short-term market acceleration, but long-term urban development trends remain supportive.

Middle East & Africa

Hot climates and rapid infrastructure development make MEA an important market for large-scale canopy installations. Gulf nations deploy canopies extensively in public spaces, resorts, malls, and transportation hubs. Africa shows rising demand for event canopies, hospitality shading, and commercial structures, with South Africa, Kenya, and Nigeria contributing notable growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Canopy Market

- Eide Industries, Inc.

- SUNAIR Awnings

- Shade Structures, Inc.

- Canopies UK Ltd.

- Lawrence Fabric, Inc.

- Impact Canopies USA

- KD Kanopy, Inc.

- JAY JAY Enterprise

- Tensile Fabric Ltd.

- Sunshade Specialists

- Architen Landrell

- Shade Systems Inc.

- Carport Central

- Röder HTS Höcker

- ShadeFlex International