Cannabis Cosmetics Market Size

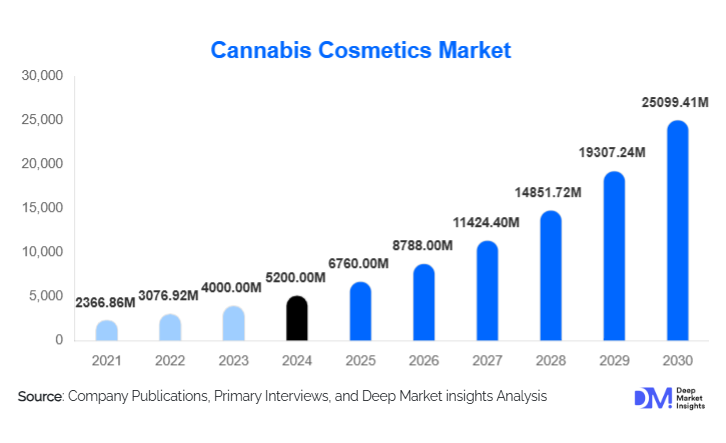

According to Deep Market Insights, the global cannabis cosmetics market size was valued at USD 5,200.00 million in 2024 and is projected to grow from USD 6,760.00 million in 2025 to reach USD 25,099.41 million by 2030, expanding at a CAGR of 30.0% during the forecast period (2025–2030). The cannabis cosmetics market growth is driven by rising consumer preference for plant-based and clean-label beauty products, expanding legalization of hemp-derived ingredients, and increasing scientific validation of cannabidiol (CBD) for skin and hair health applications.

Key Market Insights

- CBD-based skincare dominates the market, accounting for over 60% of total demand due to its anti-inflammatory, antioxidant, and anti-aging properties.

- North America leads global consumption, supported by regulatory clarity, advanced cannabis supply chains, and high per-capita spending on premium cosmetics.

- Asia-Pacific is the fastest-growing region, driven by K-beauty innovation, rising disposable income, and rapid e-commerce adoption.

- Online distribution channels are gaining share rapidly, supported by D2C brand strategies and cross-border digital commerce.

- Premiumization is a key trend, with consumers willing to pay higher prices for clinically backed, sustainable, and cruelty-free cannabis cosmetic products.

- Professional dermatology and spa adoption is strengthening credibility and accelerating institutional demand.

What are the latest trends in the cannabis cosmetics market?

Premium CBD-Infused Skincare and Haircare

The market is witnessing strong premiumization, particularly in CBD-infused face serums, anti-aging creams, and scalp treatment products. Consumers increasingly associate cannabis-derived ingredients with therapeutic efficacy, positioning these products within the dermocosmetic and cosmeceutical segments. High-end brands are launching clinically tested formulations with enhanced bioavailability using nano-emulsion and liposomal delivery technologies. This trend is driving higher average selling prices while improving consumer trust and repeat purchases.

Technology-Driven Formulation and Extraction Innovation

Advancements in cannabinoid extraction, purification, and stabilization technologies are reshaping product development. Manufacturers are adopting supercritical CO₂ extraction, nano-encapsulation, and bio-fermentation to improve ingredient consistency and shelf life. These innovations enable wider application of cannabinoids across color cosmetics and sensitive-skin products while complying with strict THC-free regulations. Technology integration is also improving traceability and transparency, key factors influencing purchasing decisions among informed consumers.

What are the key drivers in the cannabis cosmetics market?

Rising Demand for Natural and Clean-Label Beauty Products

Consumers globally are shifting away from synthetic chemicals toward botanical and functional ingredients. Cannabis-derived components such as CBD and hemp seed oil align strongly with clean beauty, vegan, and cruelty-free trends. This shift is particularly pronounced among millennials and Gen Z consumers, who prioritize ingredient transparency, sustainability, and ethical sourcing. As a result, cannabis cosmetics are increasingly positioned as premium yet responsible beauty solutions.

Scientific Validation and Dermatological Acceptance

Growing clinical evidence supporting the anti-inflammatory, sebum-regulating, and antioxidant benefits of cannabinoids is driving dermatological acceptance. CBD-based topical formulations are increasingly recommended for acne, eczema, rosacea, and post-procedure skin recovery. This medical endorsement is expanding the market beyond lifestyle beauty into professional and therapeutic skincare, significantly strengthening long-term demand.

What are the restraints for the global market?

Regulatory Fragmentation Across Regions

Despite growing acceptance, regulatory frameworks for cannabis-derived cosmetic ingredients vary widely across countries. Differences in allowable THC thresholds, labeling requirements, and ingredient approvals complicate international expansion and increase compliance costs. These regulatory inconsistencies act as a barrier for small and mid-sized brands seeking global scale.

Premium Pricing and Cost Sensitivity

Cannabis cosmetics typically command premium prices due to higher raw material costs, specialized extraction processes, and compliance expenses. While this supports strong margins, it limits penetration in price-sensitive markets. Brands must balance innovation and affordability to expand beyond niche consumer segments.

What are the key opportunities in the cannabis cosmetics industry?

Expansion into Emerging Asia-Pacific and Latin American Markets

Rapid growth in beauty consumption across Asia-Pacific and Latin America presents significant expansion opportunities. Markets such as South Korea, Japan, Brazil, and Mexico are showing strong interest in functional skincare and botanical ingredients. Localized formulations, influencer-led marketing, and cross-border e-commerce are enabling faster market entry with lower capital intensity.

Professional Dermatology and Spa-Based Applications

Institutional adoption of cannabis cosmetics by dermatology clinics, medical spas, and wellness centers is emerging as a high-growth opportunity. Professional endorsements enhance brand credibility and drive higher-value recurring demand. This channel also supports product innovation targeted at post-treatment recovery, inflammation control, and sensitive skin care.

Product Type Insights

Skin care products dominate the cannabis cosmetics market, accounting for approximately 52% of global revenue in 2024. Face creams, serums, and anti-aging formulations lead demand due to strong consumer awareness of CBD’s skin health benefits. Hair care products represent a fast-growing segment, driven by the rising incidence of scalp sensitivity and hair loss concerns. Personal care products such as soaps and deodorants are gaining traction, while color cosmetics remain an emerging but promising category.

Ingredient Type Insights

CBD-based cosmetics lead the market with nearly 61% share, supported by superior efficacy and broad regulatory acceptance. Hemp seed oil-based products follow, benefiting from nutritional and moisturizing properties. Full-spectrum cannabis extracts are limited to regions with stricter compliance frameworks, while synthetic cannabinoids remain niche due to lower consumer preference for artificial ingredients.

Distribution Channel Insights

Offline retail channels, including pharmacies and specialty cosmetic stores, account for around 55% of total sales, driven by trust and professional recommendations. However, online channels are growing at over 22% CAGR, supported by D2C strategies, subscription models, and influencer-driven marketing. Brand-owned websites are increasingly important for education, transparency, and margin optimization.

End-User Insights

Individual consumers represent approximately 78% of total demand, driven by rising personal wellness spending and beauty consciousness. Professional and institutional users, including dermatology clinics and spas, form the fastest-growing end-user segment, expanding at over 21% CAGR, supported by medical-grade topical adoption.

| By Product Type | By Ingredient Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 41% of the global cannabis cosmetics market share in 2024. The United States dominates regional demand due to mature hemp cultivation, strong R&D capabilities, and high consumer acceptance of CBD products. Canada follows, supported by robust regulatory frameworks and export-oriented production.

Europe

Europe accounts for nearly 28% of the global market share, led by Germany, the U.K., and France. Strong demand for organic and sustainable cosmetics, combined with widespread acceptance of hemp-based ingredients, supports steady growth across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 22% CAGR. South Korea and Japan lead innovation-driven demand, while China and India contribute volume growth through rising disposable incomes and e-commerce penetration.

Latin America

Latin America is an emerging market, with Brazil and Mexico showing increasing adoption of cannabis cosmetics. Regulatory easing and growing middle-class consumption are supporting gradual expansion.

Middle East & Africa

The region remains nascent but growing, led by Israel and the UAE. Demand is driven by premium skincare consumption and increasing interest in plant-based cosmetic formulations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Leading Players in the Cannabis Cosmetics Market

- L’Oréal Group

- Estée Lauder Companies

- The Body Shop

- Kiehl’s

- Cannuka

- Josie Maran Cosmetics

- Lord Jones

- Herbivore Botanicals

- CBD For Life

- Vertly

- Endoca

- Isodiol International

- Kapu Maku

- Aphria Consumer Products

- Sephora (Private Label)