Can Openers Market Size

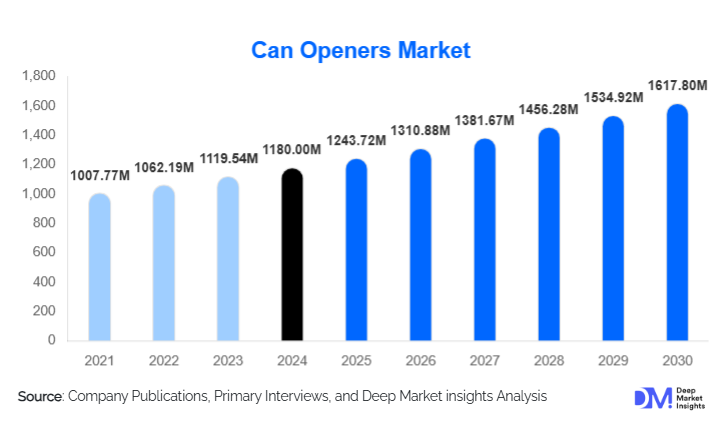

According to Deep Market Insights, the global can openers market size was valued at USD 1,180 million in 2024 and is projected to grow from USD 1,243.72 million in 2025 to reach USD 1,617.80 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The can openers market growth is primarily driven by rising household consumption, increasing adoption of electric and multifunctional kitchen appliances, and growing demand from foodservice and industrial end-users seeking operational efficiency and safety in can handling.

Key Market Insights

- Manual can openers remain the dominant product type, favored for their affordability, simplicity, and durability, particularly in Asia-Pacific and Latin America.

- Electric and multifunctional can openers are gaining traction in developed regions due to convenience, ergonomic designs, and smart kitchen integration.

- Stainless steel is the preferred material globally, offering corrosion resistance, longevity, and premium kitchen appeal.

- Offline retail continues to dominate distribution, though e-commerce adoption is growing rapidly, enabling reach to tier-2 and tier-3 cities and niche customer segments.

- Household kitchens lead end-use demand, but industrial and foodservice sectors are increasingly adopting advanced can openers to improve operational safety and efficiency.

- Technological innovations, including automatic lid-lifting, battery-powered operation, and safety-focused designs, are driving product differentiation and premium pricing.

What are the latest trends in the can openers market?

Smart and Automatic Can Openers Gaining Popularity

Consumers are increasingly seeking convenience-oriented appliances, leading to the rising adoption of electric and automatic can openers. Features such as one-touch operation, safety edges, and battery-powered mechanisms are driving interest in developed regions such as North America and Europe. Multifunctional can openers that combine bottle opening, jar handling, and ergonomic grips are emerging as lifestyle-focused kitchen tools. Brands are also exploring IoT-enabled products that can connect with smart kitchen systems for automated operation and notifications.

Integration of Ergonomics and Premium Materials

Ergonomic handles, lightweight construction, and stainless steel blades are shaping consumer preference. Safety-oriented designs, such as side-cutting mechanisms and edge-free openers, are becoming standard features in premium products. These innovations cater to aging populations and consumers with limited hand strength, while premium materials ensure long-lasting performance. Market leaders are leveraging design aesthetics to appeal to modern kitchens, driving both usability and aspirational value.

What are the key drivers in the can openers market?

Urbanization and Rising Household Consumption

Urban households, particularly in Asia-Pacific and Latin America, are increasingly adopting modern kitchen tools. Nuclear families and dual-income households prioritize time-saving devices, boosting demand for electric and multifunctional can openers. The growing number of households with higher disposable incomes further reinforces market expansion in emerging economies.

Technological Innovation and Product Differentiation

Manufacturers are investing in safety-oriented, automatic, and multifunctional can openers, which enhance convenience and reduce risk during use. Side-cutting and top-cutting mechanisms, battery-powered operation, and ergonomic designs are gaining prominence. Continuous innovation enables manufacturers to differentiate products and capture premium market segments, particularly in North America and Europe.

E-commerce and Organized Retail Expansion

The proliferation of e-commerce platforms allows manufacturers to reach urban and semi-urban consumers efficiently. Online marketplaces, subscription-based spare parts sales, and digital marketing campaigns are expanding market accessibility. This trend is particularly strong in Asia-Pacific, where online penetration is driving rapid adoption of both mid-range and premium products.

What are the restraints for the global market?

Price Sensitivity in Emerging Economies

High-cost electric and automatic can openers face adoption challenges in price-sensitive markets such as Africa, Latin America, and parts of Asia. While manual variants remain affordable, premium products require targeted pricing strategies and value communication to drive penetration.

Competition from Multi-Purpose Kitchen Tools

The growing popularity of multifunctional kitchen gadgets and food packaging innovations reduces reliance on traditional can openers. Companies must continuously innovate and expand product portfolios to maintain relevance in a crowded appliance market. Failure to adapt could slow growth, particularly in competitive and mature markets.

What are the key opportunities in the can openers market?

Expansion in Emerging Regions

Urbanization, rising disposable incomes, and lifestyle shifts in India, China, Brazil, and Mexico are creating significant demand for convenience-oriented kitchen tools. Electric and multifunctional can openers offer higher value and efficiency, appealing to middle-class households and small foodservice establishments. Emerging markets represent untapped revenue potential for both domestic and international players.

Technological Integration and Smart Kitchen Adoption

The integration of IoT-enabled, automatic, and ergonomic designs provides manufacturers with opportunities to target premium consumer segments. Smart kitchen appliances enhance safety and convenience, enabling differentiation in developed markets such as North America and Europe. Partnerships with kitchen appliance ecosystems can further expand reach and consumer engagement.

E-commerce and Direct-to-Consumer Growth

Online retail platforms are reshaping market dynamics by providing direct access to consumers. Manufacturers can launch niche products, offer subscription-based spare part sales, and leverage digital marketing to boost brand visibility. This channel also enables penetration into smaller cities, expanding the market beyond traditional retail networks.

Product Type Insights

Manual can openers dominate with approximately 52% share of the 2024 market due to affordability and simplicity. Electric and multifunctional can openers are growing in popularity in developed regions, driven by convenience and time-saving features. Side-cutting mechanisms are increasingly preferred for safety, representing 55% of the mechanism segment. Stainless steel material leads with 48% market share, offering durability and premium kitchen appeal.

Application Insights

The household/kitchen segment accounts for 65% of global demand, driven by urban households and nuclear families seeking convenience. Foodservice and industrial sectors are adopting electric and automatic can openers to improve operational efficiency, safety, and hygiene. Emerging industrial applications include canning units and institutional kitchens, where automated devices are preferred for high-volume operations.

Distribution Channel Insights

Offline retail dominates with a 60% market share, including supermarkets, hypermarkets, and specialty stores. Online platforms are growing rapidly, especially in the Asia-Pacific, enabling direct-to-consumer sales, subscription-based spare part offerings, and niche product launches. E-commerce adoption allows manufacturers to penetrate tier-2 and tier-3 cities and target specific demographic segments efficiently.

| By Product Type | By Material | By Mechanism Type | By Distribution Channel | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market with a 32% share in 2024, driven by high adoption of electric and automatic can openers. The U.S. and Canada lead demand due to premium kitchen appliance preferences, safety-focused designs, and rising urban household consumption.

Europe

Europe accounts for 28% market share, with Germany, France, and the U.K. driving growth. Safety, ergonomics, and quality materials are the key purchase drivers. E-commerce penetration and growing interest in smart kitchen appliances further bolster market expansion.

Asia-Pacific

Asia-Pacific is the fastest-growing region at 8% CAGR, led by China and India. Rising disposable incomes, urbanization, and increased awareness of convenient kitchen tools are fueling adoption. Mid-range and electric variants are gaining popularity in urban households.

Latin America

Brazil and Mexico are key markets, showing growing adoption of electric and multifunctional can openers. Outbound influence from North America and changing consumer lifestyles are driving growth, particularly in urban areas.

Middle East & Africa

While smaller in market size, regions like South Africa and the UAE are witnessing gradual adoption due to rising modern kitchen trends, higher disposable incomes, and premium product preference.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Can Openers Market

- OXO

- Kuhn Rikon

- Hamilton Beach

- Cuisinart

- Swing-A-Way

- Zyliss

- KitchenAid

- Farberware

- Chef’n

- Brabantia

- Progressive International

- Tramontina

- WMF

- Tupperware

- Leifheit

Recent Developments

- In January 2025, OXO launched a new automatic can opener with ergonomic design and edge-free technology for enhanced safety.

- In March 2025, Kuhn Rikon introduced a multifunctional electric can opener combining jar opening and ergonomic grip for kitchen convenience.

- In April 2025, Hamilton Beach upgraded its product line with battery-powered automatic openers targeting aging populations and users with limited hand strength.