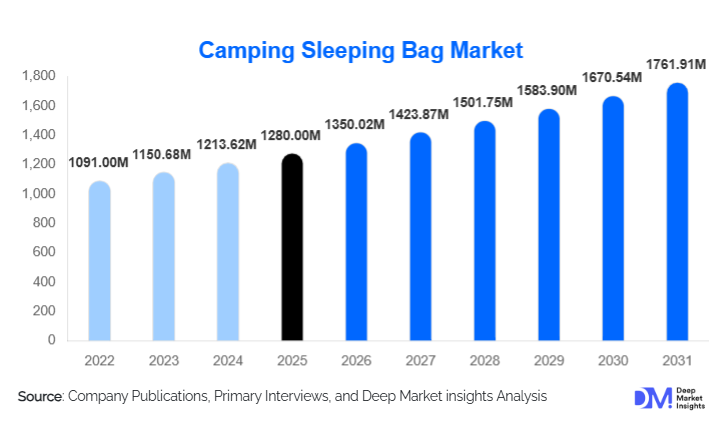

Camping Sleeping Bag Market Size

According to Deep Market Insights, the global camping sleeping bag market size was valued at USD 1,280.00 million in 2024 and is projected to grow from USD 1,350.02 million in 2025 to reach USD 1,761.91 million by 2030, expanding at a CAGR of 5.47% during the forecast period (2025–2030). The camping sleeping bag market growth is primarily driven by the rising popularity of outdoor recreation, increasing participation in camping and adventure tourism, and continuous innovation in insulation materials and lightweight product design.

Key Market Insights

- Camping and outdoor recreation participation continues to rise globally, supporting steady demand for sleeping bags across recreational, trekking, and expedition use cases.

- Synthetic insulation sleeping bags dominate volume sales, owing to affordability, ease of maintenance, and reliable performance in wet conditions.

- North America leads global demand, supported by a mature camping culture, high per-capita spending on outdoor gear, and extensive national park infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rising domestic tourism, expanding middle-class incomes, and government-backed outdoor recreation initiatives.

- E-commerce and direct-to-consumer channels are reshaping purchasing behavior, improving accessibility and price transparency for consumers worldwide.

- Sustainability-focused product development, including recycled fabrics and ethically sourced down, is becoming a key differentiator among leading brands.

What are the latest trends in the camping sleeping bag market?

Lightweight and High-Performance Material Innovation

Manufacturers are increasingly focusing on improving warmth-to-weight ratios through advanced insulation technologies. Developments in hollow-fiber synthetics, hydrophobic down treatments, and hybrid insulation systems are enabling sleeping bags to deliver higher thermal efficiency while remaining compact and lightweight. These innovations are particularly appealing to backpackers, trekkers, and mountaineers who prioritize portability and performance. Compressibility, moisture resistance, and durability have become central design parameters, driving premiumization within the market.

Sustainability and Eco-Friendly Product Design

Sustainability has emerged as a defining trend in the camping sleeping bag market. Brands are incorporating recycled polyester shells, PFC-free water repellents, and responsibly sourced down certified by ethical standards. Environmentally conscious consumers are increasingly willing to pay premium prices for products aligned with sustainability values. In addition, packaging reduction, repair services, and product longevity guarantees are being adopted to strengthen brand loyalty and reduce environmental impact.

What are the key drivers in the camping sleeping bag market?

Growth in Outdoor Recreation and Adventure Tourism

The global surge in outdoor recreational activities is a primary driver of market growth. Camping, hiking, backpacking, and overlanding have gained mainstream acceptance, particularly among millennials and younger demographics seeking experiential and wellness-oriented travel. National park expansions, adventure tourism promotion, and post-pandemic preference for nature-based activities continue to support long-term demand for camping sleeping bags.

Product Innovation and Premiumization

Continuous innovation in materials, ergonomic design, and temperature regulation is driving replacement demand and encouraging consumers to upgrade to higher-performance products. Premium sleeping bags offering extreme cold protection, ultralight construction, and modular layering systems are gaining traction among serious outdoor enthusiasts. This trend supports higher average selling prices and improved profit margins for manufacturers.

What are the restraints for the global market?

Raw Material Price Volatility

Fluctuations in the prices of down feathers, synthetic fibers, and technical fabrics pose challenges to cost stability. Volatile input costs can compress margins and complicate pricing strategies, particularly for mass-market products where price sensitivity is high. Manufacturers must balance cost pressures with consumer expectations for affordability and quality.

Seasonal and Weather-Dependent Demand

Camping sleeping bag sales are inherently seasonal and highly influenced by weather patterns. Unfavorable climatic conditions, such as extended winters, wildfires, or extreme rainfall, can suppress outdoor activity and delay purchases. This seasonality creates inventory management challenges and revenue fluctuations for both manufacturers and retailers.

What are the key opportunities in the camping sleeping bag industry?

Expansion in Emerging Outdoor Recreation Markets

Asia-Pacific, Latin America, and parts of the Middle East present strong growth opportunities as outdoor recreation gains popularity. Government investments in eco-tourism infrastructure, trekking routes, and national parks are expanding the consumer base for camping equipment. Brands offering region-specific products designed for diverse climates can capture early-mover advantages in these markets.

Institutional and Government Procurement

Military, defense, and disaster-relief agencies represent an underpenetrated opportunity. High-performance sleeping bags are increasingly procured for emergency shelters, humanitarian aid, and defense operations. Long-term government contracts offer stable revenue streams and reduce reliance on seasonal consumer demand.

Product Type Insights

Mummy sleeping bags dominate the global market, accounting for approximately 42% of total revenue in 2024. Their tapered design enhances thermal efficiency and reduces weight, making them the preferred choice for backpacking and cold-weather applications. Rectangular sleeping bags remain popular among recreational campers due to comfort and affordability, while semi-rectangular designs bridge the gap between performance and comfort. Double sleeping bags serve a niche, but a growing segment focused on family camping and leisure travel.

Insulation Type Insights

Synthetic insulation sleeping bags lead the market with nearly 58% share, driven by cost-effectiveness, durability, and reliable performance in damp conditions. Down insulation bags, while premium-priced, are favored for superior warmth-to-weight ratios and compressibility, particularly in cold-weather and expedition use. Hybrid insulation systems are emerging as a fast-growing niche, combining the strengths of both materials.

Distribution Channel Insights

Offline specialty outdoor retail stores account for the largest share of sales, supported by consumer preference for hands-on product evaluation and expert guidance. However, e-commerce is the fastest-growing channel, expanding at over 9% CAGR, driven by convenience, wider product selection, and competitive pricing. Direct-to-consumer platforms are gaining importance as brands invest in digital engagement and personalized marketing strategies.

End-Use Insights

Recreational camping represents the largest end-use segment, contributing nearly 48% of global demand in 2024. Backpacking and trekking applications are growing the fastest, supported by adventure tourism and fitness-oriented lifestyles. Military, defense, and emergency relief applications provide stable institutional demand, while mountaineering and expedition use drives premium product sales.

| By Product Type | By Insulation Type | By Temperature Rating | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global camping sleeping bag market, led by the United States and Canada. High participation in camping, strong purchasing power, and a well-developed outdoor retail ecosystem support sustained demand. The U.S. alone accounts for nearly 26% of global revenue, driven by both recreational and institutional buyers.

Europe

Europe represents around 28% of the market, with strong demand from Germany, France, the U.K., and Nordic countries. Sustainability-driven purchasing behavior and cold-climate camping traditions support premium sleeping bag sales. Outdoor festivals and adventure tourism continue to stimulate regional growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with growth exceeding 8% CAGR. China, Japan, South Korea, and Australia are key contributors, supported by rising disposable incomes, domestic tourism expansion, and increasing interest in outdoor lifestyles.

Latin America

Latin America accounts for a smaller but growing share of demand, led by Brazil, Chile, and Argentina. Adventure tourism and trekking activities are gradually expanding the market, particularly for mid-range and affordable sleeping bags.

Middle East & Africa

The Middle East & Africa region shows steady growth driven by eco-tourism, desert camping, and government-backed outdoor initiatives. South Africa and the UAE are key demand centers, while institutional procurement supports baseline consumption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camping Sleeping Bag Market

- The North Face

- Columbia Sportswear

- Marmot

- Big Agnes

- Deuter

- Mountain Hardwear

- Kelty

- Sierra Designs

- Rab

- Montbell

- Sea to Summit

- NEMO Equipment

- Western Mountaineering

- ALPS Mountaineering

- Coleman