Camping Furniture Market Size

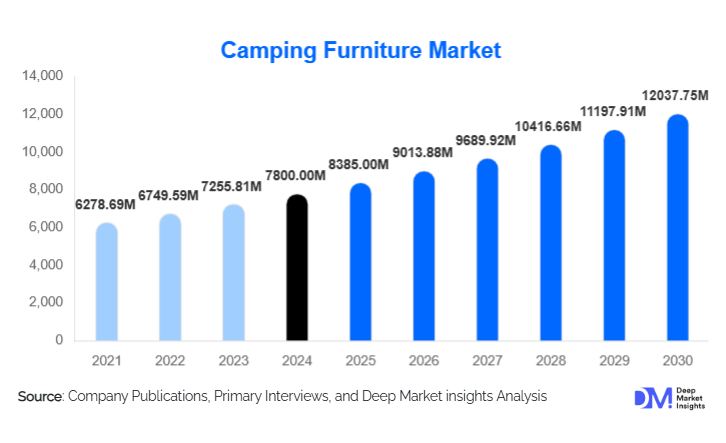

According to Deep Market Insights, the global camping furniture market size was valued at USD 7,800.00 million in 2024 and is projected to grow from USD 8,385.00 million in 2025 to reach USD 12,037.75 million by 2030, expanding at a CAGR of 7.50% during the forecast period (2025–2030). The camping furniture market growth is fueled by the rising popularity of outdoor recreation, expansion of glamping and RV-based tourism, and continuous product innovation in lightweight, modular, and sustainable furniture designed for enhanced comfort and convenience in outdoor environments.

Key Market Insights

- Foldable and ultra-lightweight camping furniture dominates global demand, driven by its portability, compact storage, and suitability for car camping and backpacking.

- Premium and glamping-grade furniture is expanding rapidly, offering designer aesthetics, sustainable materials, and hotel-level outdoor comfort.

- Europe holds the largest share of the global camping furniture market, supported by mature camping cultures and strong glamping infrastructure.

- Asia-Pacific is the fastest-growing regional market, driven by rising disposable incomes, domestic tourism, and emerging outdoor recreation trends in China and India.

- Online channels and D2C brand stores are transforming market access, offering product transparency, comparison features, and rapid delivery.

- Material innovation, aluminum alloys, composites, and advanced textiles, is pushing manufacturers toward lighter, stronger, and more durable furniture solutions.

What are the latest trends in the camping furniture market?

Premium Glamping Furniture on the Rise

The rapid expansion of glamping resorts and boutique outdoor retreats is driving a shift toward premium camping furniture. Resorts are demanding high-quality wooden and bamboo furniture, modular seating sets, and comfort-oriented cots that replicate hotel-grade experiences in natural settings. These products emphasize aesthetics, sustainability, and long life cycles, often featuring UV-resistant fabrics, corrosion-proof metal frames, and artisan design elements. Glamping operators are partnering with brands to co-develop custom furniture packages and long-term maintenance contracts. As glamping becomes a mainstream tourism category, its premiumization is pushing average selling prices upward and encouraging manufacturers to diversify into designer-grade collections.

Lightweight & Innovative Materials Transforming Product Design

Manufacturers are increasingly adopting advanced materials such as aircraft-grade aluminum, carbon-infused composites, and durable ripstop fabrics to create lighter, stronger, and more compact furniture. Ultralight folding chairs, compact roll-top tables, and modular storage units now cater to backpackers and serious outdoor enthusiasts seeking performance and portability. Inflatable seating and cots are also evolving, utilizing enhanced air-cell systems and puncture-resistant coatings. New quick-lock mechanisms, multi-use attachments, and pack-down efficiencies appeal to tech-savvy, convenience-oriented consumers. These innovations are reshaping market expectations and helping brands differentiate in a fragmented competitive landscape.

What are the key drivers in the camping furniture market?

Growing Participation in Outdoor Recreation

Global participation in camping, trekking, overlanding, and RV-based tourism has increased significantly over the past few years. Post-pandemic lifestyle shifts have reinforced demand for nature-centric activities and short weekend outdoor escapes. Consumers are now more willing to invest in comfort-enhancing accessories, making camping furniture, especially portable chairs, tables, and cots, essential gear for families, first-time campers, and adventure travelers alike. This structural shift in recreation preferences continues to anchor market growth.

Expansion of Glamping, RV Parks, and Outdoor Hospitality

The professionalization of outdoor lodging through glamping resorts, luxury campsites, and RV rental fleets is creating a strong B2B demand base for durable, premium, and aesthetically appealing furniture. These operators require consistent quality, longer product lifespans, and seasonal replacement cycles, which significantly boost procurement volumes. Institutional buyers also seek sustainable materials and repair-friendly designs, encouraging manufacturers to innovate in both design and supply-chain transparency.

Innovation in Portability, Modularity & Materials

Rapid advancements in aluminum framing, anti-tear textile engineering, and compact foldable architecture have enabled manufacturers to offer lighter, more functional products with higher perceived value. Portability, ease of assembly, and compact pack size are now core buying criteria. The market also benefits from innovations such as multi-function furniture (e.g., tables with integrated storage or modular racks) and ergonomically enhanced seating that elevates user comfort during both short and extended outdoor stays.

What are the restraints for the global market?

Price Sensitivity Across Mass-Market Consumers

While premium camping furniture is expanding, the mass consumer base remains highly price-sensitive. Economic buyers prefer low-cost, basic folding furniture, limiting the ability of manufacturers to fully pass on increases in material, labor, or logistics costs. Intense competition among small regional manufacturers also contributes to margin pressure. This restricts the widespread adoption of higher-end products, especially in developing markets.

Supply Chain & Raw Material Volatility

Fluctuating prices of aluminum, steel, plastics, and technical fabrics create recurring cost pressures for manufacturers. Additionally, the seasonality of demand often results in inventory imbalances, higher warehousing expenses, and increased logistical complexity. Delays in shipment cycles, particularly for manufacturers in Asia supplying to North America and Europe, can further challenge profitability and delivery commitments.

What are the key opportunities in the camping furniture industry?

Glamping & Hospitality Partnerships

The booming global glamping market opens lucrative opportunities for furniture manufacturers to supply high-value, durability-focused furniture packages to resorts and luxury camps. This includes wooden lounge sets, ergonomic cots, and modular dining arrangements. Long-term service contracts, refurbishment plans, and customization options provide additional revenue potential. As glamping becomes a mainstream upscale experience, brands that can deliver premium, visually appealing, and sustainable collections will benefit most.

Technology-Integrated & Sustainable Furniture Solutions

The rise of tech-enabled outdoor lifestyles offers space for innovation, solar-integrated tables, USB-equipped armrests, LED-lit furniture modules, and IoT-based comfort adjustments. Coupled with growing sustainability expectations, brands adopting recycled materials, biodegradable fabrics, and circular lifecycle programs (repair centers, take-back schemes) can differentiate themselves and tap into environmentally conscious consumers and institutional buyers.

Expansion in Rental & Event-Based Outdoor Segments

Festival organizers, outdoor events, and rental equipment companies require large quantities of weather-resistant, durable furniture. Manufacturers that design heavy-duty, quick-deploy furniture tailored for repeated high-volume use can secure stable institutional contracts. Additionally, the rising popularity of outdoor weddings, corporate retreats, and pop-up events strengthens long-term B2B revenue streams beyond peak camping seasons.

Product Type Insights

Chairs and stools dominate the camping furniture category, accounting for over 52% of the 2024 market. Their versatility, low cost, and essential role in outdoor comfort make them the most frequently purchased items across recreational, trekking, and RV-based camping. Tables represent a significant secondary category, particularly as travelers prioritize organized outdoor cooking and dining experiences. Cots and portable beds are witnessing steady growth due to rising demand from glamping resorts and travelers seeking enhanced sleep comfort outdoors. Premium lounges, benches, and inflatable sofas continue to gain traction among luxury campsites and long-stay outdoor travelers, supporting overall market diversification.

Application Insights

Recreational camping remains the leading application, driven by families and weekend travelers seeking comfortable outdoor setups. This segment holds roughly 60% of the total demand. Backpacking and trekking applications are expanding through ultralight chairs and compact collapsible tables favored by adventure enthusiasts. RV and caravan applications represent a growing niche, as owners increasingly invest in multi-functional and ergonomic exterior furniture for extended travel. Glamping and hospitality applications are the fastest-growing, driven by premium lodges demanding durable, designer-grade pieces. Event-based usage, festivals, outdoor concerts, and corporate retreats are also growing due to bulk procurement of foldable seating and modular event furniture.

Distribution Channel Insights

Specialty outdoor retailers dominate high-value purchases, accounting for approximately 40% of the market in 2024. These stores offer product trials, expert guidance, and premium SKUs, making them critical for mid- and high-tier consumers. Online marketplaces and D2C brand websites are rapidly gaining share due to convenience, extensive product listings, and transparent reviews. Big-box retailers support the price-sensitive segment with mass-market offerings. B2B procurement through campgrounds, rental operators, and hospitality chains remains a key channel for bulk orders, especially for premium and durable furniture lines.

User Type Insights

Families and group travelers represent the bulk of consumer demand, favoring affordable, durable, and easy-to-assemble furniture. Solo travelers and backpackers are driving growth in ultralight product lines, prioritizing pack weight and size efficiency. Couples, especially those participating in glamping or RV tourism, contribute to the rising demand for premium and aesthetic-focused furniture. Institutional users, including glamping operators, national parks, event organizers, and rental companies, represent a high-growth, high-volume segment with consistent annual procurement patterns.

Material Insights

Aluminum-framed products lead the market with an estimated 35% share in 2024, driven by lightweight properties, corrosion resistance, and suitability for foldable designs. Steel-framed furniture remains popular for heavy-duty and rental applications due to its durability. Wood and bamboo furniture, often used in glamping resorts, represent a fast-growing premium niche. Inflatable and composite materials are gaining traction among travelers seeking compact, innovative, and comfort-oriented solutions.

| By Product Type | By Material Type | By Price Range | By Distribution Channel | By Application / End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds a strong share of the global market, driven by high RV ownership, a mature outdoor recreation culture, and large-scale festival events. The U.S. is the leading country within the region, supported by robust specialty retail networks and rising demand for lightweight and premium furniture. Canada contributes a steady demand driven by adventure and backcountry camping. Mexico’s emerging outdoor lifestyle scene is adding incremental growth, particularly through online channels and tourism-linked purchases.

Europe

Europe represents the largest regional market, accounting for approximately 34–35% of global demand in 2024. Countries such as Germany, France, the U.K., and the Nordics exhibit strong preferences for high-quality, sustainable, and premium camping furniture. The region’s established campsite infrastructure, extensive glamping facilities, and stringent environmental standards fuel demand for durable, eco-friendly products. European consumers are willing to pay premiums for ergonomic design and sustainability certifications.

Asia-Pacific

Asia-Pacific is the fastest-growing market, driven by rising disposable incomes, domestic tourism, and growing participation in camping among younger consumers in China, India, Japan, South Korea, and Australia. China leads in volume growth, while Japan and Australia drive demand for premium and ultralight products. India’s emerging glamping and trekking culture adds momentum to mid-market product adoption. Improved digital shopping ecosystems and influencer-driven outdoor trends are accelerating regional expansion.

Latin America

Latin America is an emerging market with growing interest in overlanding, ecotourism, and recreational camping. Brazil and Argentina lead regional demand, primarily through mid-range and budget-friendly products. E-commerce adoption and social media-driven outdoor lifestyle trends are helping expand awareness of modern camping furniture across urban populations.

Middle East & Africa

MEA hosts a unique dual market: Africa’s adventure tourism and camping culture, combined with the Middle East’s premium outdoor leisure trends. South Africa, Kenya, and Tanzania drive demand linked to local camping and outdoor tourism. GCC countries, including the UAE and Saudi Arabia, are adopting high-end outdoor furniture for desert camping, glamping resorts, and luxury event setups. Strong tourism investments and camping festivals are propelling long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Camping Furniture Market

- Coleman

- Helinox

- ALPS Mountaineering

- Johnson Outdoors

- NEMO Equipment

- Big Agnes

- GCI Outdoor

- TREKOLOGY

- Thule Group

- Outwell

- KingCamp

- Vango

- Kamp-Rite

- MountCraft

- REI Co-op