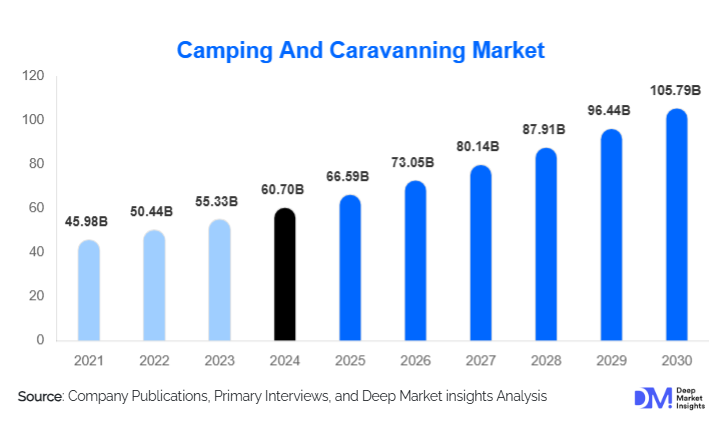

Camping and Caravanning Market Size

According to Deep Market Insights, the global camping and caravanning market size was valued at USD 60.70 billion in 2024 and is projected to grow from USD 66.59 billion in 2025 to reach USD 105.79 billion by 2030, expanding at a CAGR of 9.7% during the forecast period (2025–2030). The camping and caravanning market growth is primarily driven by the rising popularity of domestic and road-based tourism, increasing preference for nature-oriented and experiential travel, and growing adoption of recreational vehicles (RVs), camper vans, and advanced camping equipment across both developed and emerging economies.

Key Market Insights

- Camping and caravanning are transitioning from niche outdoor activities to mainstream travel choices, supported by flexible work culture, remote working trends, and longer leisure trips.

- Recreational vehicles and motorhomes represent the highest-value segment, driven by comfort, mobility, and multi-functional usage for travel and temporary living.

- North America dominates the global market, led by the United States due to high RV ownership, strong campground infrastructure, and an established camping culture.

- Europe remains a mature and innovation-driven market, with strong caravan adoption and cross-border travel demand.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, government tourism initiatives, and growing interest in outdoor leisure activities.

- Technological integration, including smart RV systems, lightweight materials, solar power solutions, and digital booking platforms, is reshaping product development and consumer adoption.

What are the latest trends in the camping and caravanning market?

Growth of Smart and Sustainable Camping Solutions

Sustainability and technology are increasingly influencing consumer preferences in the camping and caravanning market. Manufacturers are integrating solar panels, lithium-ion batteries, energy-efficient appliances, and smart climate control systems into caravans and RVs to enhance off-grid capabilities. Lightweight composite materials and modular interiors are improving fuel efficiency and usability. Environmentally conscious consumers are driving demand for recyclable camping gear, low-emission camper vans, and eco-certified campgrounds, positioning sustainability as a long-term growth trend across the industry.

Expansion of Rental and Shared Economy Models

Rental and subscription-based models are gaining traction as consumers seek access over ownership, particularly for high-value RVs and caravans. Digital platforms enabling peer-to-peer rentals, short-term leasing, and bundled camping experiences are lowering entry barriers for first-time users. This trend is especially strong among younger travelers and urban consumers who value flexibility and affordability. As a result, rental-based camping and caravanning services are emerging as one of the fastest-growing sub-segments globally.

What are the key drivers in the camping and caravanning market?

Rising Demand for Experiential and Nature-Based Travel

Consumers worldwide are prioritizing experiential travel that emphasizes outdoor engagement, wellness, and personalization. Camping and caravanning offer immersive experiences in natural environments while allowing travelers to maintain control over itineraries and costs. This shift in travel behavior has expanded the customer base beyond traditional adventure enthusiasts to include families, retirees, and first-time campers, significantly boosting market demand.

Growth of Domestic and Road-Based Tourism

Improved road infrastructure, increasing fuel efficiency, and flexible work arrangements have fueled road travel and domestic tourism. RVs and camper vans provide integrated mobility, accommodation, and workspace solutions, making them highly attractive for long-duration trips. Government initiatives promoting domestic tourism and outdoor recreation further support this driver, particularly in North America, Europe, and the Asia-Pacific.

What are the restraints for the global market?

High Upfront Costs of Caravans and RVs

The high initial investment required for purchasing caravans and motorhomes remains a key restraint, especially in price-sensitive markets. Premium RVs can be prohibitively expensive for average consumers, limiting ownership-based adoption. Although rental models partially mitigate this challenge, cost remains a barrier for widespread penetration in emerging economies.

Regulatory and Environmental Constraints

Zoning regulations, emission standards, and restrictions on campground development in environmentally sensitive areas can limit market expansion. Seasonal demand fluctuations and varying regional regulations related to vehicle standards and campsite usage further increase operational complexity for manufacturers and service providers.

What are the key opportunities in the camping and caravanning industry?

Electrification and Smart Mobility Integration

The development of electric camper vans and hybrid RVs presents a major opportunity as governments enforce stricter emission norms. Advances in battery technology, charging infrastructure, and lightweight design are enabling manufacturers to introduce low-emission mobility solutions tailored to environmentally conscious consumers. Companies investing early in electrification are expected to gain long-term competitive advantages.

Emerging Demand from Asia-Pacific and Latin America

Rapid urbanization, rising disposable incomes, and increased exposure to outdoor travel trends are driving camping and caravanning adoption in the Asia-Pacific and Latin America. Countries such as China, Australia, Japan, Brazil, and South Korea are witnessing growing interest in glamping, camper vans, and organized camping experiences. Localized product offerings and affordable entry-level models present strong opportunities for market expansion.

Product Type Insights

Caravans and recreational vehicles (RVs) dominate the global camping and caravanning market, accounting for approximately 42% of total market value in 2024. This segment leads primarily due to its high average selling prices and increasing adoption for long-distance travel, extended vacations, and multi-purpose use, including mobile living and remote working. The growing preference for self-contained travel solutions that combine transportation, accommodation, and comfort has significantly strengthened demand for motorhomes, camper vans, and towable caravans, particularly in North America and Europe. Technological advancements such as smart interiors, energy-efficient systems, and enhanced safety features have further accelerated adoption in premium and mid-range RV categories.

Camping equipment, including tents, sleeping gear, camping furniture, and portable cooking systems, represents a substantial share of the market, driven by its affordability, ease of access, and mass-market appeal. This segment benefits from a low entry barrier, making it especially popular among first-time campers, younger travelers, and budget-conscious consumers. Seasonal usage, frequent replacement cycles, and rising participation in outdoor recreation activities support steady volume-driven growth for this segment.

Application Insights

Leisure and recreational travel remains the dominant application segment, contributing over 55% of global demand. Camping and caravanning are widely adopted for family vacations, weekend getaways, and domestic tourism due to their cost-effectiveness, flexibility, and ability to offer immersive nature-based experiences. This segment continues to benefit from increasing work-life balance awareness and a shift away from crowded urban travel destinations.

Adventure tourism and eco-tourism applications represent the fastest-growing segments within the market. Rising consumer awareness around sustainability, wellness, and experiential travel is driving demand for camping formats that enable deeper engagement with natural environments. Activities such as trekking, wildlife tourism, and national park visits are increasingly paired with camping and caravanning solutions, particularly in Europe, Asia-Pacific, and parts of Latin America.

Distribution Channel Insights

Offline retail channels, including specialty outdoor equipment stores, brand-owned outlets, and RV dealerships, dominate the camping and caravanning market with approximately 58% share. The need for physical inspection, customization, financing options, and after-sales service makes offline channels particularly critical for high-value purchases such as caravans and motorhomes. Dealer networks also play a key role in maintenance, upgrades, and customer education, reinforcing their importance in mature markets.

Online distribution channels are expanding rapidly, supported by direct-to-consumer (D2C) platforms, digital configuration tools, and rental marketplaces. Consumers increasingly rely on online platforms for product research, price comparison, and booking of rental equipment. While large purchases still tend to close offline, digital channels are significantly influencing purchase decisions.

End-User Insights

Families represent the largest end-user segment, accounting for approximately 34% of global demand. Camping and caravanning offer families a cost-effective alternative to traditional vacations, along with flexibility, privacy, and child-friendly experiences. The availability of family-oriented campgrounds, safety-focused equipment, and educational outdoor activities continues to support strong demand from this segment.

Couples and solo travelers form a high-growth segment, particularly within camper van usage and rental-based models. This group values flexibility, short-term travel options, and experiential journeys, making them key adopters of compact camper vans and shared-economy platforms. Senior travelers aged 55 and above contribute significantly to premium RV demand. This segment prioritizes comfort, safety, and extended travel durations, often undertaking long road trips or seasonal travel. Higher disposable incomes and retirement-driven leisure time make senior travelers a critical customer base for high-end motorhomes and luxury caravans.

| By Product Type | By Application | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global camping and caravanning market with approximately 39% share in 2024. The United States alone accounts for nearly 32% of global demand, driven by high RV ownership rates, an extensive and well-developed campground network, and strong consumer spending on outdoor recreation. Favorable government policies supporting national parks, widespread road-trip culture, and high adoption of large motorhomes further reinforce regional dominance. The growing popularity of remote work and long-distance domestic travel continues to support sustained demand.

Europe

Europe holds around 31% of the global market, led by Germany, France, and the United Kingdom. A deeply rooted caravan culture, compact travel distances, and strong cross-border tourism support steady demand. The region’s emphasis on sustainability, fuel efficiency, and lightweight caravan designs has driven innovation and adoption. Additionally, supportive infrastructure such as caravan parks, camper-friendly highways, and standardized regulations across countries enhances ease of travel and market stability.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 10% CAGR. China, Australia, Japan, and South Korea are key contributors, supported by rising disposable incomes, expanding middle-class populations, and government-led tourism development programs. Increased exposure to outdoor lifestyles through social media, along with the growth of glamping and organized camping experiences, is accelerating adoption. Australia’s established camper van culture and China’s rapidly developing domestic tourism infrastructure are particularly strong growth drivers.

Latin America

Latin America represents an emerging market, with Brazil, Argentina, and Mexico showing increasing adoption of camping and caravanning. Growth in this region is primarily driven by adventure tourism, expanding domestic travel, and rising interest in cost-effective vacation alternatives. Rental-based models and guided camping experiences are gaining popularity, helping overcome affordability and infrastructure constraints.

Middle East & Africa

The Middle East & Africa region shows niche but steadily growing demand, led by the UAE and South Africa. In the Middle East, luxury desert camping, high-end caravanning, and off-road recreational activities are key growth drivers, supported by high disposable incomes and tourism diversification initiatives. In Africa, eco-tourism, wildlife travel, and national park tourism are driving demand for both camping equipment and specialized caravanning solutions, particularly in South Africa and select East African markets.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Camping and Caravanning Market

- Thor Industries

- Forest River

- Winnebago Industries

- Trigano Group

- Knaus Tabbert

- Hymer Group

- Swift Group

- Jayco

- Adria Mobil

- Dethleffs

- Bailey of Bristol

- Bürstner

- Coachmen RV

- Auto-Trail

- Lunar Caravans