Camera Straps Market Size

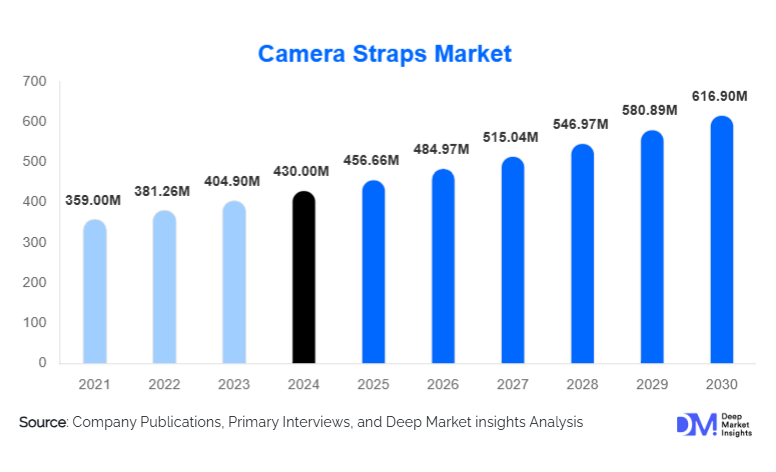

According to Deep Market Insights, the global camera straps market size was valued at USD 430 million in 2024 and is projected to grow from USD 456.66 million in 2025 to reach approximately USD 616.90 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The camera straps market growth is primarily driven by the sustained adoption of DSLR and mirrorless cameras, the rapid expansion of content creation and travel photography, and increasing consumer preference for ergonomic, durable, and premium camera accessories. Despite smartphone substitution pressures, the market continues to show resilience due to premiumization trends and the growing installed base of interchangeable-lens cameras globally.

Key Market Insights

- Neck and sling camera straps dominate global demand due to their versatility and comfort for long-duration photography.

- Mid-range priced camera straps (USD 15–50) account for the largest revenue share, balancing affordability and quality.

- North America remains the largest regional market, supported by professional photography adoption and premium accessory demand.

- Asia-Pacific is the fastest-growing region, driven by rising mirrorless camera adoption and creator economy growth.

- Online marketplaces and D2C channels now represent nearly half of global camera strap sales.

- Material innovation and ergonomic design are key differentiators among leading brands.

What are the latest trends in the camera straps market?

Premiumization and Custom Design Adoption

The camera straps market is witnessing a strong shift toward premium and customized products. Professional photographers and serious enthusiasts increasingly favor leather, hybrid-material, and handcrafted straps that combine aesthetics with durability. Custom engraving, limited-edition designs, and brand collaborations are gaining traction, allowing manufacturers to command higher margins while strengthening brand loyalty. Premium camera straps are increasingly positioned as lifestyle accessories rather than purely functional products.

Integration with Creator and Vlogging Ecosystems

Growth in content creation and vlogging has significantly influenced camera strap design and functionality. Lightweight sling straps, wrist straps with quick-release mechanisms, and modular attachment systems are increasingly preferred by hybrid photo-video creators. Brands are designing straps compatible with tripods, gimbals, and action cameras, enabling seamless transitions between shooting modes. This trend is particularly strong among younger, tech-savvy users who prioritize flexibility and speed.

What are the key drivers in the camera straps market?

Rising Adoption of Mirrorless Cameras

The global shift from DSLRs to mirrorless cameras has emerged as a key growth driver. Mirrorless cameras, while lighter, remain premium-priced and require reliable accessories for protection and comfort. This has increased demand for ergonomically optimized camera straps that reduce strain during prolonged use. Strong mirrorless adoption in Japan, China, Europe, and North America continues to support steady accessory sales.

Growth of Travel, Adventure, and Outdoor Photography

Post-pandemic growth in travel and adventure tourism has significantly boosted demand for durable, weather-resistant camera straps. Adventure photographers increasingly prefer harness and sling systems that distribute weight evenly and secure equipment during outdoor activities. This trend is reinforcing demand for reinforced nylon, neoprene, and hybrid-material straps designed for rugged environments.

What are the restraints for the global market?

Smartphone Camera Substitution

Improving smartphone camera capabilities continues to limit entry-level camera sales, indirectly impacting demand for low-cost camera straps. Casual users increasingly rely on smartphones for everyday photography, reducing volume demand in the economy price segment.

Raw Material Price Volatility

Fluctuating prices of leather, synthetic fabrics, and metal hardware components pose margin pressure for manufacturers. Premium brands are particularly exposed to cost volatility, requiring careful pricing strategies to maintain profitability without dampening demand.

What are the key opportunities in the camera straps industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and the Middle East offer strong growth opportunities as disposable incomes rise and camera adoption increases. Localized designs, competitive pricing, and regional e-commerce partnerships can help manufacturers penetrate these markets effectively.

Sustainable and Vegan Material Innovation

Growing consumer awareness around sustainability is creating demand for vegan leather, recycled fabrics, and eco-friendly manufacturing processes. Brands investing in sustainable materials are likely to gain a competitive advantage, particularly among younger and environmentally conscious consumers.

Product Type Insights

Neck camera straps represent the largest product segment, accounting for approximately 32% of the global camera straps market in 2024. Their leadership is primarily driven by universal compatibility across DSLR, mirrorless, and compact cameras, along with superior comfort during extended shooting sessions. Neck straps remain the default choice for both professional and enthusiast photographers due to even weight distribution, ease of use, and availability across all price tiers. Sling and shoulder camera straps are the fastest-growing product sub-segment, supported by rising adoption among professional photographers, travel photographers, and content creators who require quick camera access and ergonomic weight support. These straps are increasingly favored in outdoor, wedding, and documentary photography, where mobility and speed are critical.

Harness and dual-camera straps cater to niche but high-value professional use cases, particularly among sports, event, and wildlife photographers who carry multiple camera bodies simultaneously. Meanwhile, wrist straps and hand straps are gaining popularity among vloggers, street photographers, and hybrid creators seeking lightweight, minimalist solutions for short-duration shooting and portability. The diversification of shooting styles continues to expand demand across all product categories.

Material Type Insights

Nylon and polyester camera straps dominate the market with a 41% share in 2024, supported by their durability, lightweight nature, resistance to wear, and cost efficiency. These materials are widely adopted in mid-range and entry-level straps, making them the preferred choice for hobbyists and mass-market consumers. Their adaptability to padding, reinforcement, and moisture-resistant coatings further strengthens their market leadership. Leather camera straps hold a significant share of the premium segment, particularly among professional photographers and high-end enthusiasts. The appeal of leather lies in its aesthetic value, durability over time, and perceived craftsmanship, allowing manufacturers to command premium pricing. Demand for handcrafted and full-grain leather straps is especially strong in North America and Europe.

Neoprene and foam-based materials are increasingly favored in comfort-focused designs, as they provide shock absorption and reduce strain during long shoots. Hybrid materials—combining leather, nylon, metal reinforcements, and quick-release components—are gaining traction as brands seek to balance visual appeal, strength, and ergonomic performance. Sustainability-driven materials, including vegan leather and recycled fabrics, are also emerging as a differentiating factor.

Distribution Channel Insights

Online marketplaces and brand-owned direct-to-consumer (D2C) platforms collectively account for nearly 48% of global camera strap sales. This dominance is driven by ease of comparison, global accessibility, broader product assortments, and customer reviews that influence purchasing decisions. E-commerce enables niche and premium brands to reach international customers without extensive physical retail footprints. Brand-owned D2C channels are gaining importance as manufacturers focus on higher margins, customization options, and direct engagement with consumers. Many premium brands now offer personalized engraving, modular strap systems, and limited-edition products exclusively through their websites.

Offline specialty camera stores continue to play a critical role in premium and professional purchases, where tactile evaluation, expert recommendations, and bundled accessory sales influence buying behavior. Mass electronics retailers primarily serve entry-level consumers, offering standardized products at competitive prices, particularly in emerging markets and urban retail hubs.

End-Use Insights

Enthusiast and hobbyist consumers represent the largest volume-driven end-use segment, contributing approximately 44% of total market demand. Growth in this segment is fueled by travel photography, social media usage, and increased affordability of mirrorless cameras. Enthusiasts typically prefer mid-range straps that balance comfort, durability, and design. Professional photographers account for a smaller share in volume but generate the highest revenue contribution due to their preference for premium, customized, and heavy-duty strap solutions. This segment drives demand for leather, harness, and hybrid strap systems designed for long shooting hours and equipment safety.

Media, broadcasting, and adventure sports users represent smaller but fast-growing end-use segments. Demand from these users is rising for reinforced, weather-resistant, and load-distributing strap systems capable of supporting demanding field conditions. Growth in sports coverage, outdoor content creation, and digital media production is expected to further strengthen this segment.

| By Product Type | By Material Type | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 32% of the global camera straps market in 2024, led primarily by the United States. Regional dominance is driven by a large base of professional photographers, high adoption of premium camera accessories, and strong penetration of e-commerce and D2C sales channels. The region also benefits from a mature content creation ecosystem, widespread mirrorless camera usage, and consumer willingness to invest in high-quality, branded accessories.

Europe

Europe represents around 21% of the global market, with Germany, the United Kingdom, and France as key demand centers. Growth in the region is supported by strong demand for premium leather and handcrafted camera straps, reflecting Europe’s preference for craftsmanship and design-led products. Sustainability-focused purchasing behavior and interest in eco-friendly materials further support premium segment growth. A well-established photography culture and strong retail networks reinforce steady demand.

Asia-Pacific

Asia-Pacific holds nearly 29% market share and is the fastest-growing region, expanding at a CAGR of over 7.5%. China, Japan, and India are the primary growth drivers, supported by rising mirrorless camera adoption, expanding middle-class income, and rapid growth of the creator economy. Strong domestic manufacturing capabilities, increasing online retail penetration, and social media-driven photography trends continue to accelerate regional demand.

Latin America

Latin America accounts for approximately 9% of global demand, led by Brazil and Mexico. Market growth is driven by increasing social media engagement, rising travel photography, and improving access to international e-commerce platforms. While price sensitivity remains high, demand for affordable and mid-range camera straps is expanding steadily across urban centers.

Middle East & Africa

The Middle East & Africa region holds about 9% of the global market share. Growth is supported by rising tourism activity, expanding media and broadcasting investments, and a growing base of professional photographers, particularly in the UAE and Saudi Arabia. Government-led initiatives promoting tourism, digital media, and creative industries are further supporting demand for professional-grade camera accessories across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|