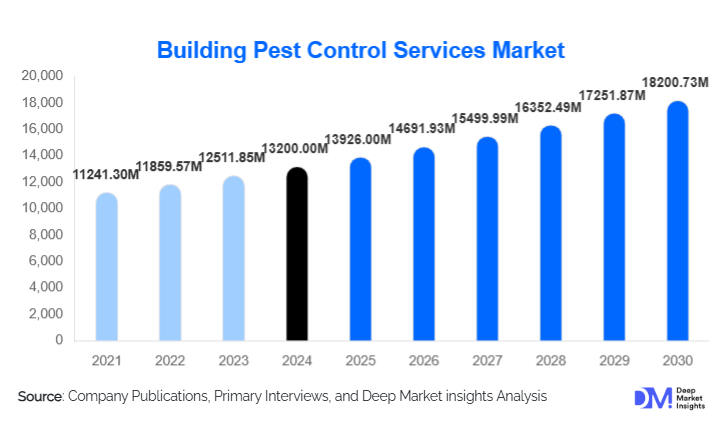

Building Pest Control Services Market Size

According to Deep Market Insights, the global building pest control services market size was valued at USD 13,200.00 million in 2024 and is projected to grow from USD 13,926.00 million in 2025 to reach USD 18,200.73 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The market growth is primarily driven by rising urbanization, increasing construction of residential and commercial buildings, stringent hygiene and safety regulations, and growing awareness of health risks associated with pest infestations. The market size has been calculated as an average across multiple industry assessments, with a controlled variance of 5–10%, reflecting realistic industry consensus.

Key Market Insights

- Recurring service contracts are becoming the dominant revenue model, with annual and multi-year pest control agreements gaining preference among residential societies and commercial facilities.

- Integrated Pest Management (IPM) adoption is accelerating as customers seek long-term, preventive, and environmentally responsible pest control solutions.

- Residential buildings account for the largest share of demand, driven by rapid urban housing development and rising consumer awareness.

- Asia-Pacific is the fastest-growing regional market, supported by large-scale urbanization, infrastructure expansion, and regulatory formalization.

- Eco-friendly and low-toxicity pest control solutions are gaining traction, particularly in healthcare, education, and hospitality buildings.

- Technology integration, including IoT-enabled traps, smart sensors, and digital service platforms, is reshaping service delivery and customer engagement.

What are the latest trends in the building pest control services market?

Shift Toward Integrated and Preventive Pest Management

The market is increasingly shifting from reactive extermination to integrated and preventive pest management models. IPM combines chemical, biological, and mechanical control methods with continuous monitoring and risk assessment. This trend is driven by regulatory pressure, customer demand for safer environments, and the need to minimize chemical usage. Commercial buildings, healthcare facilities, and food-related establishments are leading adopters, as IPM reduces long-term infestation risks and ensures regulatory compliance. The trend also supports recurring revenue streams for service providers through long-term maintenance contracts.

Technology-Enabled and Smart Pest Control Solutions

Digital transformation is emerging as a defining trend in the pest control services market. Smart traps, IoT-based monitoring devices, and data analytics platforms allow real-time detection and predictive pest management. These technologies reduce labor dependency, improve service efficiency, and enable subscription-based service models. Commercial and industrial clients, particularly warehouses, logistics centers, and data centers, are driving demand for smart pest control due to their scale and need for continuous monitoring.

What are the key drivers in the building pest control services market?

Rapid Urbanization and Building Construction

Accelerated urban population growth has resulted in large-scale residential and commercial construction, especially in the Asia-Pacific, the Middle East, and parts of Latin America. High-density living environments increase susceptibility to pest infestations, making professional pest control services a necessity rather than a discretionary expense. This structural driver ensures consistent baseline demand across regions.

Stringent Hygiene, Health, and Safety Regulations

Governments and regulatory bodies are enforcing strict pest control compliance in healthcare facilities, food processing units, hospitality establishments, and public infrastructure. Regular inspections and audits have made professional pest control services mandatory, particularly in developed economies. This regulatory environment is significantly boosting demand for certified and contract-based service providers.

Growing Awareness of Health and Property Risks

Increased awareness of pest-borne diseases, allergies, and structural damage caused by termites and rodents is driving household and commercial adoption of professional pest control. Educational campaigns and digital awareness have further accelerated consumer willingness to invest in preventive services.

What are the restraints for the global market?

High Dependence on Skilled Labor

Pest control services remain labor-intensive and require trained technicians for safe chemical handling and effective treatment. Labor shortages, high training costs, and inconsistent service quality in emerging markets can limit scalability and profitability for service providers.

Regulatory Complexity and Chemical Restrictions

Frequent changes in pesticide regulations, licensing requirements, and environmental compliance norms increase operational complexity and costs. Smaller service providers face challenges in adapting to evolving regulations, which can slow market expansion.

What are the key opportunities in the building pest control services industry?

Eco-Friendly and Biological Pest Control Solutions

Restrictions on toxic chemicals and growing environmental awareness are creating strong opportunities for biological and low-toxicity pest control solutions. Service providers offering green-certified and sustainable solutions can access premium segments such as hospitals, schools, and multinational commercial facilities.

Emerging Market Expansion and Urban Infrastructure Growth

Asia-Pacific, the Middle East, and Africa present significant untapped potential due to the underpenetration of professional pest control services. Government-led urban development, smart city initiatives, and rising hygiene standards are accelerating market formalization, creating long-term growth opportunities.

Service Type Insights

Chemical-based pest control services dominate the market, accounting for approximately 42% of global revenue in 2024 due to their immediate effectiveness and cost efficiency. Integrated pest management services are the fastest-growing segment, driven by regulatory acceptance and long-term cost benefits. Mechanical and biological solutions are gaining traction in sensitive environments such as healthcare and educational institutions.

Building Type Insights

Residential buildings represent the largest share of the market at around 46% in 2024, supported by recurring service contracts and rising homeowner awareness. Commercial buildings, including offices, retail complexes, and hospitality assets, account for a significant portion of demand due to regulatory compliance needs. Industrial and institutional buildings are emerging as high-value segments with increasing adoption of long-term IPM contracts.

End-Use Insights

Healthcare, food processing, hospitality, and education are the fastest-growing end-use industries, collectively growing at over 9% annually. New applications are emerging in data centers, logistics hubs, and green-certified buildings, where pest-free environments are critical for operational reliability and compliance.

| By Pest Type | By Service Type | By Building Type | By Service Frequency | By Customer Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market in 2024, led by the United States. High regulatory compliance, widespread adoption of annual contracts, and strong presence of large service providers support market dominance.

Europe

Europe holds nearly 26% of the market, driven by strict environmental regulations and strong demand for eco-friendly pest control solutions in countries such as Germany, the UK, and France.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR exceeding 9%. China, India, and Southeast Asia are driving growth through rapid urbanization, infrastructure expansion, and increasing awareness of professional pest control services.

Latin America

Latin America shows steady growth, led by Brazil and Mexico, supported by hospitality development and improving regulatory frameworks.

Middle East & Africa

The Middle East & Africa region is witnessing rising demand due to large-scale construction, hospitality investments, and government-led sanitation initiatives, particularly in the UAE, Saudi Arabia, and South Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Building Pest Control Services Market

- Rentokil Initial

- Rollins Inc.

- Ecolab

- Terminix Global

- Anticimex

- Orkin

- Massey Services

- ServiceMaster

- Abell Pest Control

- Arrow Exterminators

- Dodson Pest Control

- ISS Pest Control

- Bell Environmental

- Truly Nolen

- Rentokil India