Brow Gel Market Size

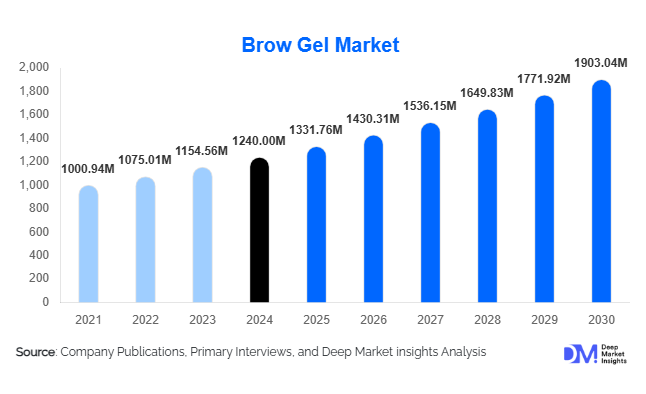

According to Deep Market Insights, the global brow gel market size was valued at USD 1,240.00 million in 2024 and is projected to grow from USD 1,331.76 million in 2025 to reach USD 1,903.04 million by 2030, expanding at a CAGR of 7.4% during the forecast period (2025–2030). The brow gel market growth is primarily driven by rising global beauty consciousness, increasing adoption of brow-enhancing routines, and strong demand for tinted, multifunctional, and clean-label formulations across both retail and professional beauty ecosystems.

Key Market Insights

- Tinted brow gels dominate global demand owing to their multifunctional capabilities, tinting, volumizing, and shaping, aligned with minimalistic beauty routines.

- Clean, vegan, and cruelty-free brow gel formulations are rapidly gaining traction, fuelled by growing consumer preference for ethical and skin-friendly cosmetics.

- Offline retail remains the largest distribution channel due to strong beauty store penetration, though online D2C channels are the fastest-growing.

- Asia-Pacific emerges as the fastest-growing regional market, driven by expanding middle-class consumer bases in India, China, and Southeast Asia.

- North America continues to hold a leading share due to premium beauty consumption, influencer-led marketing, and strong cosmetic brand presence.

- Hybrid brow gel innovations, such as gel-serum blends with hair-nourishing ingredients, represent a major area of product differentiation.

What are the latest trends in the Brow Gel Market?

Clean-Beauty & Ethical Brow Gels Rising Rapidly

The brow gel category is witnessing a distinct shift toward clean, vegan, and cruelty-free formulations. Consumers increasingly prefer products free from parabens, synthetic fragrances, and harsh fixatives. Brands are developing gels infused with botanical extracts, natural pigments, and low-irritation polymers that ensure long-lasting hold without compromising skin safety. Eco-friendly packaging, recyclable tubes, biodegradable applicators, and refill-friendly formats are further reinforcing brand differentiation. This trend is particularly strong in North America and Europe, where ethical and transparent cosmetic production is becoming non-negotiable for younger buyers.

Technology-Driven Beauty Retail & Virtual Try-Ons

AR-powered shade matching, virtual try-on tools, and AI-driven personalisation are reshaping how consumers discover and purchase brow gel products. Online platforms now allow users to preview brow tint shades, test styling effects, and receive automated product recommendations based on face shape, brow density, and skin tone. Beauty brands increasingly deploy influencer-led campaigns and AI-based content personalisation to enhance conversion rates. E-commerce integrations with sustainability ratings and ingredient transparency modules further empower informed purchasing decisions, supporting the market’s digital transformation.

What are the key drivers in the Brow Gel Market?

Rising Global Demand for Brow Grooming & Facial Aesthetics

Eyebrows have become a central focus of modern beauty routines, significantly influenced by social media trends, makeup tutorials, and celebrity aesthetics. Consumers increasingly seek well-defined, fuller, and long-lasting brow styles, driving the adoption of both tinted and clear gels. This aesthetic shift has normalised brow products as daily-use essentials rather than occasional cosmetic items, expanding the addressable consumer base worldwide.

Growth of E-Commerce & Omnichannel Beauty Experiences

The ubiquity of online shopping, combined with influencer endorsements and social-commerce integration, has dramatically expanded brow gel visibility. D2C beauty brands in particular benefit from low entry barriers and strong digital marketing reach. Subscription beauty boxes, online-exclusive product bundles, and social-media-driven launches further accelerate e-commerce sales. Offline retail remains important, but omnichannel models, try in-store, buy online, are increasingly common.

What are the restraints for the global market?

Raw Material Price Volatility & Regulatory Compliance

Brow gels rely on specialised ingredients such as cosmetic-grade pigments, long-wear polymers, creamy gel bases, and safe preservatives. Price fluctuations in raw materials, coupled with strict regulations on allergen disclosures and banned substances, raise manufacturing costs and complicate product development. For small and mid-tier brands, meeting EU, U.S., and APAC cosmetic safety standards can impose resource-intensive compliance requirements.

Market Saturation in Mature Cosmetic Regions

While demand is strong, markets such as North America and Western Europe face increasing saturation, with numerous brands offering similar tinted and styling gels. This intensifies price competition and compresses margins, especially in the mass-market segment. Differentiation now requires innovation in formulation, sustainability, packaging, and brand storytelling, elements that demand higher investment and strategic marketing.

What are the key opportunities in the Brow Gel Industry?

Hybrid Brow Gels with Skincare & Haircare Benefits

The next wave of product innovation lies in hybrid brow gels that combine pigmentation and styling with eyebrow nourishment. Ingredients like peptides, castor oil, panthenol, and plant proteins can promote brow density, reduce breakage, and enhance hair health, appealing to consumers seeking both cosmetic and care benefits. Multi-functional products also align with minimalistic beauty routines, offering superior value and performance.

Digital-First D2C Brand Expansion

New entrants can leverage digital channels to penetrate the market at lower costs, utilising influencer partnerships, TikTok virality, and AI-led personalisation tools. D2C brands can scale globally without traditional retail barriers, enabling rapid market penetration. Subscription models, loyalty ecosystems, and data-driven product launches further strengthen brand-consumer engagement and improve lifetime customer value.

Product Type Insights

Tinted brow gels remain the dominant product category globally, capturing approximately 60% of total revenue in 2024. Their leadership is driven by strong consumer preference for multifunctional cosmetics that combine color, volumizing effects, shaping, and long-wear hold in a single step. This aligns well with the global shift toward minimalistic makeup routines, especially among young consumers seeking quick, natural-looking definition without multi-step brow kits. Tinted gels also benefit from heavy promotion by beauty influencers and makeup artists, particularly through social media tutorials that highlight effortless “full brow” transformations.

Clear brow gels, holding around 25% market share, continue to serve consumers seeking subtle, natural grooming. Their appeal is strongest among users preferring a “no-makeup” aesthetic, clean-beauty buyers, and professional environments where bold brow pigments may not be desired. The category also sees strong penetration in male grooming segments and among first-time brow product users.

Hybrid and serum-infused brow gels are the fastest-growing segment, expanding at a high double-digit pace. This surge is fueled by rising interest in brow care + cosmetic hybrids, products infused with peptides, biotin, vitamin E, panthenol, or botanical extracts that support brow density and hair strength. Consumers increasingly favor products that deliver both visible cosmetic enhancement and long-term care benefits, driving strong adoption of this category across premium and mid-range brands.

Application Insights

Styling and setting applications remain the largest application segment, accounting for nearly 45% of the global market. Brow gels that offer long-lasting hold and shape retention are widely used across all age groups due to their ease of use and compatibility with diverse brow types, from naturally thick brows to sparse or irregularly shaped ones. Demand for high-hold and smudge-resistant formulas is rising, especially among working professionals and active lifestyle consumers.

Tinting and filling applications hold approximately 35% of the global share. This segment is increasingly shaped by global beauty trends showcasing fuller, sculpted brows, fuelled by TikTok, Instagram, and K-beauty influences. Tinted gels that allow precise color deposition, fiber-enhanced volumizing, and quick brow enhancement have become daily essentials for many consumers, reflecting the shift toward expressive and well-defined facial aesthetics.

Distribution Channel Insights

Offline retail, including beauty specialty stores, drugstores, and supermarkets, continues to dominate with 55–60% of global sales. Consumers often prefer in-store testing to match tint shades and evaluate brush applicators or hold levels. Strong merchandising presence and point-of-sale promotions by leading cosmetic brands further sustain offline strength.

However, online retail and D2C channels are rapidly expanding at double-digit growth rates. E-commerce benefits from AR try-on technology, influencer-driven discovery, social commerce, and subscription models. Direct-to-consumer websites are particularly influential in the premium, clean beauty, and indie brand segments, where storytelling, ingredient transparency, and sustainability messaging drive stronger engagement.

End-User Insights

Individual consumers make up nearly 80% of total brow gel usage, driven by daily grooming routines, social-media-influenced beauty trends, and the increasing popularity of compact, travel-friendly brow products. Recurring usage, often multiple times per week, creates a strong replacement cycle and contributes to stable retail demand. Professional makeup artists and beauty salons constitute a smaller yet high-value segment, seeking long-wear, sweat-proof, and film-forming brow gels suitable for events, photography, and bridal makeup. Their product usage drives premium brand visibility and often influences consumer purchasing behavior through advocacy and recommendations.

Beauty influencers and content creators, though not a formal end-user category, act as powerful demand amplifiers. Their tutorials and product trials significantly influence brand discovery, especially for tinted and hybrid formulations.

| By Product Type | By Application | By Distribution Channel | By End User | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global brow gel market in 2024, driven by strong cosmetic consumption, high influencer activity, and robust demand for premium clean beauty products. The U.S. shows strong adoption of tinted and hybrid formulations, while Canada displays rising interest in vegan and ethically sourced products.

Europe

Europe represents 23% of global demand, with Germany, the U.K., and France leading consumption. The region strongly favors eco-labeled, sustainable beauty offerings. European consumers show a higher willingness to pay for cruelty-free formulations and recyclable packaging.

Asia-Pacific

Asia-Pacific accounts for a 30–35% share and is the fastest-growing region globally. China and India dominate volume growth, supported by rising disposable incomes and booming online beauty ecosystems. South Korea and Japan exhibit high demand for precision brow grooming and innovation-led formulations.

Latin America

Latin America contributes 6% of market share, with Brazil, Mexico, and Argentina leading adoption. Growth is driven by increased urbanization and rising beauty spending among young consumers. Mass-market brow gels dominate due to price sensitivity.

Middle East & Africa

MEA holds a 5–7% share, with the UAE and Saudi Arabia showing a strong preference for premium brow products. Africa’s growing beauty retail infrastructure and rising youth population present long-term opportunities, though affordability remains a key consideration.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Brow Gel Market

- L’Oréal

- The Estée Lauder Companies

- Shiseido

- Coty Inc.

- Kao Corporation

- Amorepacific

- Revlon

- KOSÉ Corporation

- e.l.f. Beauty

- Missha

- Glossier Inc.

- Anastasia Beverly Hills

- Benefit Cosmetics

- Huda Beauty

- Charlotte Tilbury Beauty

Recent Developments

- In March 2025, L’Oréal introduced a new vegan, refillable brow gel line targeting environmentally conscious consumers.

- In January 2025, e.l.f. Beauty expanded its brow portfolio with hybrid peptide-infused gels aimed at brow growth and nourishment.

- In September 2024, Benefit Cosmetics launched long-wear tinted gels tailored for high-humidity regions in Asia and Latin America.