Bread Makers Market Size

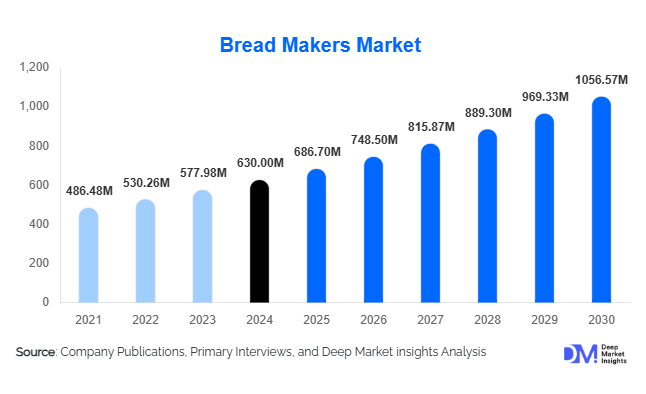

According to Deep Market Insights, the global bread makers market size was valued at USD 630 million in 2024 and is projected to grow to USD 686.70 million in 2025 to reach USD 1056.57 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). The bread makers market growth is primarily driven by rising consumer preference for fresh, healthy, and customizable homemade bread, coupled with advancements in smart kitchen appliances and the rapid expansion of online retail channels across emerging economies.

Key Market Insights

- Automatic bread makers dominate the market, accounting for nearly 60% of total revenue in 2024, owing to the growing adoption of fully automated and user-friendly appliances.

- Medium-capacity bread makers lead demand among households, representing 55% of global sales, due to their suitability for small and mid-sized families.

- Household applications remain the primary revenue source, comprising around 70% of market value in 2024.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class incomes, growing online sales, and increasing awareness of home-baking culture.

- Smart and connected bread makers are emerging as a premium sub-segment, integrating IoT-enabled control, recipe customization, and app connectivity.

- The top five manufacturers hold approximately 45–50% of the global market share, highlighting moderate concentration and increasing competition from regional players.

Latest Market Trends

Smart Kitchen Connectivity and IoT Integration

Modern bread makers are increasingly being integrated into the connected home ecosystem. Manufacturers are launching WiFi and Bluetooth-enabled models that allow users to control baking programs through mobile apps, customize recipes, and receive real-time alerts. Integration with smart assistants such as Alexa and Google Home is improving user convenience and appeal among tech-savvy consumers. This trend aligns with the broader smart kitchen revolution, where consumers seek automation, energy efficiency, and digital control in daily cooking routines.

Health-Conscious and Specialty Baking Demand

The surge in demand for gluten-free, organic, and whole-grain products is reshaping consumer preferences in the bread makers market. Manufacturers are adding preset functions for gluten-free and vegan recipes, allowing health-conscious users to control ingredients and nutritional value. The growing popularity of artisanal baking and sourdough preparation at home has further driven innovation in programmable settings and ingredient dispensers, supporting consumer interest in clean-label, additive-free breads.

Bread Makers Market Drivers

Rising Preference for Fresh and Customizable Home-Baked Bread

Consumers increasingly prioritize fresh, preservative-free bread that aligns with dietary preferences. Bread makers enable users to customize recipes, control ingredients, and bake healthier loaves. The shift toward convenience and quality in home-cooked meals has fueled global adoption, especially among urban middle-income families seeking a balance between health and convenience.

Technological Innovation and Product Diversification

Advances in smart sensors, automatic ingredient dispensers, and programmable baking cycles have elevated bread makers from simple appliances to multi-functional devices. The addition of features such as gluten-free modes, artisan loaf settings, and mobile app integration has expanded consumer segments. Leading brands such as Panasonic, Breville, and Zojirushi continue to invest in R&D, launching innovative designs that combine performance with energy efficiency and digital connectivity.

Growth of E-Commerce and Digital Distribution

The proliferation of online retail platforms has revolutionized appliance distribution, making bread makers accessible to a wider audience. Consumers can now compare models, access peer reviews, and benefit from discounts and direct delivery. Online sales have surged, accounting for nearly 40% of 2024 global bread maker sales. This trend particularly benefits emerging markets such as India, Brazil, and Southeast Asia, where traditional retail infrastructure is still developing.

Market Restraints

High Initial Cost and Price Sensitivity

Despite rising popularity, bread makers remain non-essential purchases for many households in price-sensitive markets. The high upfront cost of quality appliances, coupled with limited replacement cycles, can hinder repeat purchases. Manufacturers are addressing this through cost-efficient production and localized assembly, yet affordability remains a key challenge in emerging economies.

Competition from Alternative Baking Solutions

Consumers often substitute bread makers with conventional ovens, multifunctional air fryers, or readily available bakery products. In regions where traditional bread styles dominate, cultural preferences for manual baking reduce adoption rates. Overcoming these behavioral barriers requires education on the convenience and cost-efficiency benefits of modern bread makers.

Bread Makers Market Opportunities

Smart Appliance Integration and AI-Based Recipe Customization

Integration of artificial intelligence and smart-home technology presents major opportunities for manufacturers. Future bread makers are expected to feature adaptive learning algorithms that adjust baking cycles based on user behavior and environmental factors such as temperature or humidity. Partnerships with recipe platforms and mobile apps can generate new recurring revenue through subscription-based services and ingredient kits.

Emerging Market Expansion

Asia-Pacific, Latin America, and the Middle East represent untapped markets with low bread maker penetration. Rising disposable incomes, growing urbanization, and increasing access to e-commerce channels create lucrative entry points. Localized product design, compact models, voltage customization, and competitive pricing will be key for success in these regions.

Health and Lifestyle Positioning

The global focus on wellness and clean eating is opening opportunities for brands to market bread makers as health-oriented appliances. Marketing strategies highlighting preservative-free, gluten-free, and nutrient-controlled recipes can position bread makers as lifestyle enhancers rather than mere kitchen devices, strengthening brand loyalty and premium positioning.

Product Type Insights

Automatic bread makers lead the global market with around 60% share in 2024, owing to their ease of use, fully automated cycles, and increasing incorporation of digital controls. Semi-automatic and manual models cater to niche consumers who prefer traditional hands-on baking. The multi-function and smart bread maker category is the fastest-growing sub-segment, projected to expand at over 11% CAGR through 2030, supported by growing demand for IoT-enabled appliances and customizable programs.

Capacity Insights

Medium-capacity bread makers, suitable for 500g–1kg loaves, dominate with 55% of global market share in 2024. They are favored for family households, offering the right balance of output and space efficiency. Large-capacity models serve small commercial users and bakeries, while compact mini bread makers are gaining popularity among single professionals and urban apartments where counter space is limited.

Application Insights

Household applications account for about 70% of total market value, driven by the surge in home cooking and baking hobbies. The commercial segment, though smaller, is growing at an estimated 10% CAGR, with adoption in cafés, boutique bakeries, and hotels offering in-house artisan bread. The increasing use of bread makers in culinary schools and small restaurants is also boosting demand in this segment.

Distribution Channel Insights

Offline retail continues to account for a slight majority of global revenue, but online sales are the fastest-growing channel, contributing around 40% of total market value in 2024. Leading e-commerce platforms, brand-owned websites, and digital marketing campaigns have improved global reach. Subscription-based e-commerce for kitchen appliances and direct-to-consumer models are expected to further strengthen online dominance by 2030.

| By Product Type | By Application | By Technology | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global bread makers market with an estimated 32% share in 2024 (USD 202 million). The U.S. remains the largest market, supported by high disposable income, modern kitchen infrastructure, and a growing culture of home baking. Canada also shows steady growth, driven by demand for smart and energy-efficient appliances. Product innovation and online distribution continue to strengthen regional performance.

Europe

Europe represents approximately 25% of the global market share (USD 158 million in 2024). Countries such as Germany, the U.K., France, and Italy exhibit strong adoption due to a cultural preference for baking and premium kitchenware. Sustainable designs and energy-efficient appliances resonate with environmentally conscious European consumers, making it a stable yet mature market.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for 20% of 2024 revenue (USD 126 million) but expected to surpass Europe by 2030. Rapid urbanization, rising middle-class income, and the expansion of e-commerce platforms are driving sales in China, Japan, South Korea, and India. Local manufacturing under initiatives like “Make in India” and “Made in China 2025” is also reducing product costs and improving accessibility.

Latin America

Latin America holds around 10% of the market (USD 63 million). Brazil and Mexico lead demand, supported by a growing middle-class population and increasing awareness of home appliance benefits. The region is expected to see robust growth through online imports of affordable bread makers and the emergence of local distribution networks.

Middle East & Africa

MEA contributes approximately 8% of the global share (USD 50 million). The UAE, Saudi Arabia, and South Africa are emerging as high-potential markets, driven by modern kitchen adoption and high-income households. However, limited local manufacturing and high import costs remain challenges. Expanding e-commerce and premium appliance stores are expected to enhance regional growth prospects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bread Makers Market

- Panasonic Corporation

- Breville Group Limited

- Koninklijke Philips N.V.

- Midea Group

- Hamilton Beach Brands Holding Company

- BLACK+DECKER

- Cuisinart (Conair Corporation)

- Zojirushi Corporation

- Oster (Sunbeam Products, Inc.)

- Kenwood Limited

- Morphy Richards

- Tefal (Groupe SEB)

- Smeg S.p.A.

- Domo

- Russell Hobbs

Recent Developments

- In March 2025, Panasonic introduced a new AI-powered smart bread maker series in Japan with adaptive learning programs that adjust baking cycles based on ambient temperature and ingredients.

- In January 2025, Breville launched its “Smart Loaf Pro” model across North America and Europe, integrating app control, recipe sharing, and gluten-free baking modes.

- In December 2024, Philips announced the expansion of its appliance manufacturing facility in India under the “Make in India” initiative to meet regional demand for mid-range bread makers.