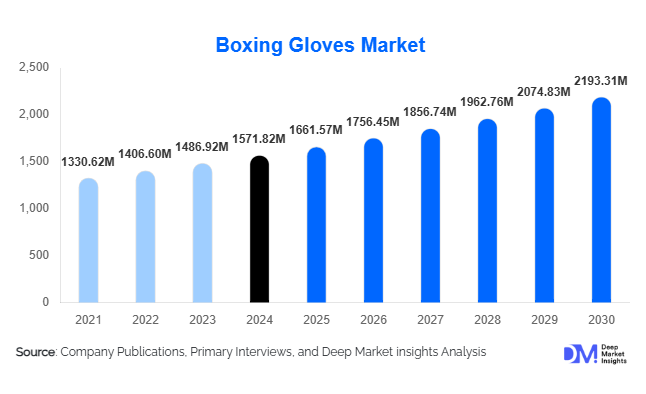

Boxing Gloves Market Size

According to Deep Market Insights, the global boxing gloves market size was valued at USD 1,571.82 million in 2024 and is projected to grow from USD 1,661.57 million in 2025 to reach USD 2,193.31 million by 2030, expanding at a CAGR of 5.71% during the forecast period (2025–2030). Growth in the boxing gloves market is primarily driven by the increasing adoption of boxing for fitness training, the expansion of combat sports such as MMA and kickboxing, rising demand for training equipment among recreational users, and the introduction of advanced glove technologies, including smart sensors and eco-friendly materials. Increasing e-commerce adoption and global health awareness trends further accelerate industry development.

Key Market Insights

- Fitness-driven boxing is rapidly replacing traditional competitive boxing as the leading demand source, with gyms and home workouts driving year-round glove purchases.

- Training gloves dominate global adoption, with multi-purpose fitness gloves gaining traction among recreational consumers.

- North America holds the largest market share due to widespread combat-sport culture and strong retail penetration.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class income, increasing gym enrollments, and expanding combat-sport viewership.

- Smart boxing gloves and connected training systems are emerging as major innovation areas, appealing to tech-savvy athletes and beginners.

- E-commerce and D2C channels are reshaping distribution, offering wider product variety, better pricing, and personalized shopping experiences.

What are the latest trends in the boxing gloves market?

Smart & Sensor-Integrated Gloves Gain Momentum

Manufacturers are rapidly integrating wearable technology into boxing gloves, incorporating sensors that track punch speed, power, technique, and training volume. These connected gloves sync with mobile apps, enabling athletes to analyze performance metrics in real time. This technology appeals strongly to younger and fitness-oriented consumers who seek data-driven workouts and digital coaching experiences. Smart gloves are also being adopted by professional trainers who use the analytics to refine athlete technique and reduce injury risks. As connected fitness ecosystems expand, smart gloves are expected to capture rising market share within premium product categories.

Eco-Friendly & Vegan Materials Become Mainstream

With increasing sustainability awareness, brands are transitioning toward eco-conscious materials such as vegan leather, recycled microfibers, and biodegradable foam padding. This trend is particularly prominent among millennial and Gen Z consumers who prioritize ethical and environmentally safe gear. Manufacturers are also adopting cleaner production techniques, low-emission processes, and recyclable packaging to appeal to sustainability-focused buyers. The result is a new premium sub-category of “green boxing gloves,” carving out distinct market positioning in the global sports equipment landscape.

What are the key drivers in the boxing gloves market?

Rising Fitness Participation & Combat-Sport Popularity

Global engagement in fitness-oriented boxing and combat sports has surged, driven by social media influence, celebrity endorsements, and increased availability of boxing fitness classes. Boxing is now widely adopted for cardio fitness, strength development, and stress relief, fueling demand for training gloves across age groups. The rise of MMA and combat-sport leagues has further strengthened global appeal, with consumers investing more in personal equipment.

Material & Design Innovations

Advanced glove technologies, such as multi-layer foam padding, ergonomic wrist supports, breathable interior linings, and impact-diffusing gel layers, have significantly enhanced glove safety and performance. These innovations encourage more frequent use and support professional-level training, driving premium product demand. eco-friendly and vegan materials also appeal to environmentally conscious users, expanding purchasing motivation across new demographic segments.

What are the restraints for the global market?

Counterfeit Products & Low-Quality Imports

Unregulated online marketplaces and low-cost manufacturing hubs have led to a spike in counterfeit and substandard gloves. These products compromise user safety and negatively impact brand trust. Although price-sensitive consumers often opt for cheaper alternatives, dissatisfaction and injury concerns hinder overall market stability and limit adoption among beginners.

Volatility in Raw Material Prices

Fluctuating costs of leather, microfiber, foam padding, and other raw materials directly influence production expenses. Rising costs result in price increases for consumers, squeezing margins for manufacturers and retailers. This creates a challenging environment for brands aiming to balance affordability with quality improvement.

What are the key opportunities in the boxing gloves industry?

Expansion of Fitness Boxing & Lifestyle Integration

The global fitness industry’s continued growth offers one of the strongest opportunities for boxing gloves manufacturers. Boxing-themed workouts, boutique studio classes, and home-training equipment packages are rapidly expanding. Gloves tailored for fitness users, lightweight, durable, and ergonomically designed, are gaining adoption across gyms and households. Companies introducing subscription-based digital boxing classes bundled with specialized gloves are tapping into a high-growth opportunity.

Regional Growth in Asia-Pacific & Emerging Markets

Rising disposable incomes, increasing urbanization, and expanding gym networks across China, India, Southeast Asia, and the Middle East are driving new demand. Local brands and international entrants can capitalize on this growth by offering region-specific glove designs, mid-range pricing, and localized marketing campaigns. Government sports development initiatives in APAC further strengthen opportunities for long-term market expansion.

Product Type Insights

Training gloves dominate the market, accounting for nearly 45% of global demand in 2024. Their versatility for sparring, bag work, and fitness routines makes them the preferred choice for gyms and home users. Competition gloves, professional and amateur, represent a smaller but premium segment, often priced higher due to specialized padding and regulatory design. Specialty gloves, including smart gloves and eco-friendly models, are the fastest-growing subcategory due to differentiation and strong consumer interest in next-generation sports technology.

Application Insights

Fitness applications lead global glove usage, driven by boxing-inspired cardio workouts, HIIT routines, and hybrid fitness programs. Professional and amateur boxing remains a strong revenue contributor, but fitness-based boxing now comprises more than half of overall demand. Smart training applications are expanding quickly, with app-integrated gloves used for personalized coaching and virtual training sessions. Youth programs and women-focused boxing classes are also fueling demand for specialized glove sizes and designs.

Distribution Channel Insights

Online platforms dominate the market, contributing nearly 42% of global sales as consumers increasingly rely on e-commerce for sports equipment purchases. D2C brands leverage social media advertising, influencer partnerships, and subscription models to expand reach. Specialty sports stores remain relevant for premium purchases, while hypermarkets and general retail outlets cater to entry-level buyers. The rise of digital-first brands is intensifying competition and accelerating price transparency across regions.

End-User Insights

Fitness enthusiasts form the largest end-user group, representing about 50% of total usage. Amateur athletes follow, driven by boxing club memberships and local competitions. Professional athletes, while a smaller niche, drive sales of premium gloves with high durability and superior impact absorption. Home users, especially during and post-pandemic periods, have become a strong growth segment, often purchasing gloves bundled with punching bags and online training subscriptions.

| By Product Type | By Material | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

According to Deep Market Insights, the global boxing gloves market size was valued at USD 1,571.82 million in 2024 and is projected to grow from USD 1,661.57 million in 2025 to reach USD 2,193.31 million by 2030, expanding at a CAGR of 5.71% during the forecast period (2025–2030).

Europe

Europe accounts for 28–30% of global demand, with the U.K., Germany, and France at the forefront. Fitness boxing studios, community sports programs, and growing interest in combat sports are propelling regional growth. Consumers in Europe show a strong preference for premium, eco-conscious gloves.

Asia-Pacific

APAC is the fastest-growing region, driven by expanding middle-class populations and increasing investments in sports infrastructure. China and India are major contributors, supported by fitness app usage, social media influence, and rising health awareness. Southeast Asian countries with rich combat-sport heritage (Thailand, Philippines) contribute strongly to demand.

Latin America

Brazil and Mexico lead demand in this region as boxing culture grows and fitness club memberships rise. Economic improvements and increasing youth interest in combat sports support market expansion.

Middle East & Africa

MEA shows steady demand growth, led by the UAE, Saudi Arabia, and South Africa. Rising investment in sports clubs, influencer-driven fitness trends, and national health initiatives strengthen glove purchases.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Boxing Gloves Market

- Everlast Worldwide

- Adidas AG

- Venum

- Winning Co., Ltd.

- Hayabusa Fightwear

- Cleto Reyes

- RDX Sports

- Twins Special

- Fairtex

- Top King Boxing

- Rival Boxing Gear

- Title Boxing

- Ringside Inc.

- Lonsdale

- Prolast Corporation