Bookends Market Size

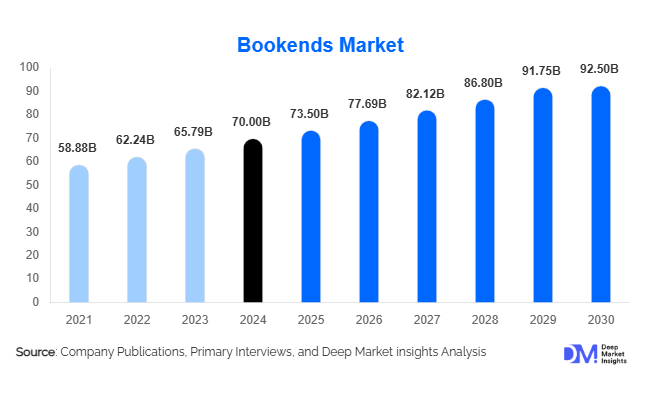

According to Deep Market Insights, the global bookends market size was valued at USD 70 billion in 2024 and is projected to grow from USD 73.5 billion in 2025 to reach USD 92.5 billion by 2030, expanding at a CAGR of 5.7% during the forecast period (2025–2030). The bookends market growth is primarily driven by increasing home décor and organizational trends, rising demand for aesthetic and multifunctional accessories, and the expansion of e-commerce and global distribution channels offering diverse designs and materials.

Key Market Insights

- Consumers increasingly prefer multifunctional and designer bookends, combining utility with aesthetic appeal for residential, commercial, and institutional use.

- Wood and modern/contemporary designs dominate globally, driven by versatility, durability, and alignment with interior décor trends.

- Asia-Pacific is emerging as the largest and fastest-growing market, led by rising middle-class income, urbanization, and increasing investments in education and home furnishings.

- Online retail channels are accelerating market growth, allowing niche and artisanal designs to reach global consumers efficiently.

- Sustainability trends are shaping production, with demand for eco-friendly, recycled, and certified materials gaining traction.

- Technological adoption, including CNC machining, 3D printing, and AR-based visualization for consumer previews, is transforming product customization and manufacturing efficiency.

What are the latest trends in the bookends market?

Sustainability and Eco-Friendly Materials

Bookend manufacturers are increasingly incorporating recycled wood, metal, and plastics, as well as sustainably sourced hardwoods, to appeal to environmentally conscious consumers. Certifications such as FSC for wood and low-VOC finishes for painted products are becoming important purchase considerations. This trend not only enhances brand differentiation but also aligns with government regulations and global sustainability goals. Companies leveraging eco-friendly materials are positioned to capture higher price premiums and foster long-term customer loyalty.

Designer and Customization Trends

Customization is gaining prominence, with consumers seeking limited-edition, themed, and artist-collaborated bookends. Novelty, luxury, and personalized products are driving higher margins, while mass-market players focus on mid-range designs. Online platforms have facilitated this trend, allowing consumers to choose bespoke shapes, engravings, and finishes. This shift is enhancing the role of bookends as decorative and statement pieces, beyond their functional use of supporting books.

What are the key drivers in the bookends market?

Growing Home Décor and Interior Aesthetic Demand

Consumers worldwide are increasingly investing in home decoration, leading to higher demand for stylish and functional accessories such as bookends. Open shelving, home libraries, and display-oriented bookshelves are contributing to sustained market growth. Wood and contemporary designs are particularly popular due to their ability to complement diverse interiors.

Remote Work and Hybrid Education

The rise of remote work and hybrid learning has resulted in an increase in home office setups and personal study spaces, boosting the demand for organizational accessories, including bookends. These products are now being perceived as essential for both functionality and visual appeal in modern homes.

E-Commerce and Global Accessibility

Digital retail channels have expanded market reach, enabling smaller brands and artisans to sell directly to global consumers. Enhanced online visibility and social media marketing are increasing awareness and adoption of diverse bookend designs. E-commerce also facilitates faster product innovation and customer feedback integration, further accelerating growth.

What are the restraints for the global market?

Decline in Physical Book Usage

Increasing adoption of e-books, audiobooks, and tablets in some regions reduces the demand for physical books, potentially limiting growth in the bookends market. Younger demographics are more likely to consume digital content, affecting the volume of traditional bookend purchases.

Price Sensitivity and Competitive Pressure

The bookends market is fragmented, with many small players competing primarily on price. Volatility in raw material costs (wood, metal, stone) and shipping logistics for heavy materials can constrain profitability. Manufacturers in the low- and mid-tier segments face challenges in maintaining margins while offering competitive pricing.

What are the key opportunities in the bookends market?

Integration of Smart and Multifunctional Features

Innovative bookends with integrated features such as LED lighting, USB ports, wireless speakers, or phone holders present new opportunities. Such multifunctional designs appeal to tech-savvy consumers and the home office segment, creating a differentiated product offering with higher perceived value.

Expansion in Emerging Markets

Emerging regions like India, China, and Southeast Asia are witnessing rapid urbanization, rising middle-class income, and growing interest in home décor. This creates strong demand for both mass-market and premium bookends. Online retail penetration in these regions is also expanding, allowing access to global designs and niche segments.

Customization and Luxury Collaborations

Collaboration with designers and artists to produce limited-edition, themed, or bespoke bookends offers higher margins and brand recognition. Consumers increasingly value personalization and aesthetic appeal, making this a profitable niche for both new entrants and established players.

Product Type Insights

Wood-based bookends dominate the market due to their versatility, durability, and aesthetic appeal, accounting for nearly 42% of the 2024 market. Metal and marble-based designs cater to premium segments, while plastic and acrylic designs are popular in mass-market and novelty categories. Modern and contemporary designs hold approximately 32% of the market, reflecting consumer preference for minimalistic and clean aesthetics.

Application Insights

Residential use remains the largest application, representing more than 52% of the 2024 market, driven by home décor and personal office setups. Educational institutions and commercial offices are also growing, reflecting rising investments in libraries, corporate gifting, and décor solutions. Hospitality and leisure applications are emerging as niche segments, particularly for luxury and decorative bookends.

Distribution Channel Insights

Online retail, including e-commerce marketplaces and brand-owned platforms, accounts for roughly 38% of the market, reflecting faster growth compared to offline retail. Specialty stores, furniture outlets, and department stores remain significant, particularly for premium and designer segments. Direct B2B sales to institutions and corporates contribute to steady bulk demand.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global market, led by the U.S. and Canada. High disposable income, home décor trends, and gifting culture drive demand. Premium and designer bookends are particularly popular, with strong adoption of online retail platforms.

Europe

Europe holds about 27% of the market, with Germany, the UK, France, and Nordic countries leading. Minimalist and designer bookends are in high demand, along with sustainable material preferences. Growth is steady, supported by cultural affinity for decorative home accessories.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for nearly 33% of the market, led by China, India, Japan, and South Korea. Rising urbanization, growing middle-class income, e-commerce expansion, and interest in interior décor fuel growth. Residential and educational applications are primary drivers.

Latin America

Latin America represents 6–8% of the global market, with Brazil, Mexico, and Argentina as key markets. Rising home décor interest and outbound gifting trends support gradual market expansion.

Middle East & Africa

MEA holds approximately 5% of the market. GCC countries like the UAE and Saudi Arabia, along with South Africa, drive premium and decorative bookend demand. Luxury residential and hospitality sectors are key adopters, while local manufacturing and imports influence pricing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bookends Market

- The Decor Kart

- Yamazaki Europe GmbH

- Inter IKEA Systems B.V.

- Wayfair LLC

- Knob Creek Metal Arts

- GuangBo Group

- Alessi SpA

- Jonathan Adler Enterprises LLC

- Umbra

- MUJI

- Ferm Living

- Kikkerland Design

- CB2

- West Elm

- Creative Co-Op

Recent Developments

- In March 2025, Yamazaki Europe GmbH launched a sustainable bamboo bookend collection targeting eco-conscious consumers in North America and Europe.

- In January 2025, The Decor Kart introduced customizable luxury bookends for home offices, integrating modular designs and premium materials.

- In December 2024, Wayfair LLC expanded its curated designer bookends category on its e-commerce platform, boosting online sales in the Asia-Pacific region.