Body Firming Creams Market Size

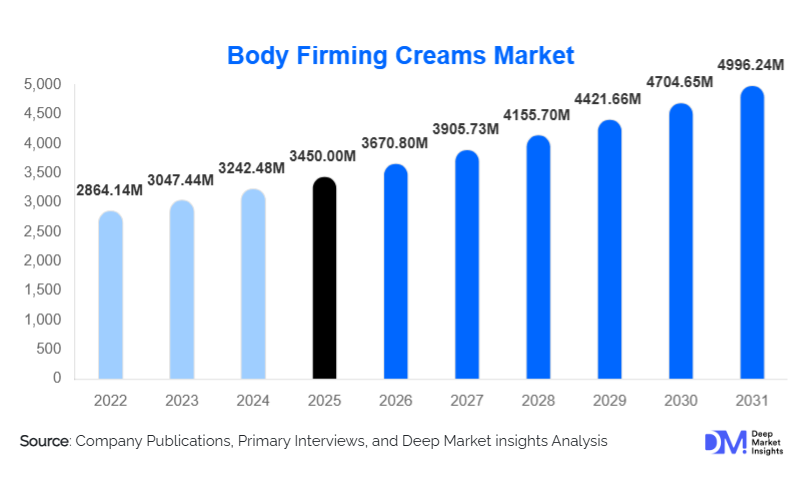

According to Deep Market Insights, the global body firming creams market size was valued at USD 3450 million in 2025 and is projected to grow from USD 3670.8 million in 2026 to reach USD 4996.24 million by 2031, expanding at a CAGR of 6.4% during the forecast period (2026–2031). The body firming creams market growth is primarily driven by increasing consumer focus on body aesthetics, rising demand for non-invasive skin tightening solutions, and the growing penetration of premium and clinically backed body care products across both developed and emerging economies.

Key Market Insights

- Body care routines are increasingly mirroring facial skincare regimens, with consumers seeking targeted firming, toning, and anti-aging solutions for multiple body areas.

- Hybrid formulations combining natural botanicals and synthetic actives dominate, as consumers demand both safety and visible efficacy.

- North America leads global demand, supported by high per-capita spending on personal care and strong adoption of premium body care products.

- Asia-Pacific is the fastest-growing regional market, driven by rising middle-class income, urbanization, and beauty consciousness in China and India.

- Online retail channels are growing at double-digit rates, supported by influencer marketing, subscription models, and D2C brand strategies.

- Mid-premium price segments account for the largest revenue share, balancing affordability with perceived clinical effectiveness.

What are the latest trends in the body firming creams market?

Shift Toward Clean-Label and Natural Formulations

Consumers are increasingly gravitating toward clean-label body firming creams that exclude parabens, sulfates, and artificial fragrances. Plant-derived actives such as caffeine, green tea, algae extracts, shea butter, and essential oils are gaining prominence as brands respond to growing concerns over long-term skin health. This trend is particularly strong in Europe and North America, where regulatory scrutiny and consumer awareness are higher. Brands are also highlighting vegan, cruelty-free, and dermatologically tested claims to strengthen product credibility and command premium pricing.

Clinical Positioning and Performance-Backed Claims

Body firming creams are increasingly marketed as cosmeceutical-grade products, supported by clinical trials and visible performance metrics. Innovations in peptide complexes, retinol derivatives, hyaluronic acid delivery systems, and micro-encapsulation technologies are improving skin penetration and efficacy. Brands are investing in before-and-after studies and dermatologist endorsements to address consumer skepticism and improve trust. This science-led positioning is transforming body firming creams from cosmetic add-ons into essential body treatment products.

What are the key drivers in the body firming creams market?

Rising Demand for Non-Invasive Body Aesthetic Solutions

Consumers are increasingly opting for topical solutions over surgical or device-based cosmetic procedures due to cost, safety, and convenience considerations. Body firming creams offer an accessible alternative for addressing skin laxity, cellulite appearance, and post-weight-loss sagging. This trend is reinforced by post-pandemic wellness priorities, where home-based self-care routines have become mainstream across age groups.

Aging Population and Post-Pregnancy Skin Care Demand

The expanding global population aged 30–55 years is a key growth driver, as this demographic actively seeks anti-aging and skin-firming solutions. Additionally, rising awareness around post-pregnancy body care has significantly boosted demand for abdomen, thigh, and waist firming creams. Brands targeting these use cases through specialized formulations and messaging are seeing higher adoption and repeat purchase rates.

What are the restraints for the global market?

Delayed Visible Results and Consumer Skepticism

Unlike aesthetic procedures, body firming creams require consistent long-term use to deliver noticeable results. This often leads to consumer dissatisfaction or discontinuation, particularly among first-time users. The challenge of managing expectations and communicating realistic outcomes remains a key restraint for market growth.

Price Sensitivity in Emerging Markets

Premium and clinically positioned body firming creams remain inaccessible to a large segment of consumers in emerging economies. High formulation costs, imported actives, and branding expenses result in elevated retail prices, limiting penetration unless mass-market variants are introduced.

What are the key opportunities in the body firming creams industry?

Expansion in Emerging Asian and Middle Eastern Markets

Asia-Pacific and the Middle East present significant growth opportunities due to increasing disposable income, beauty awareness, and Western-influenced skincare routines. Localized formulations tailored to climate, skin tone, and cultural preferences can unlock strong demand in China, India, Indonesia, Saudi Arabia, and the UAE. E-commerce expansion further supports rapid market penetration in these regions.

Personalization and Technology-Driven Skincare

Digital skin diagnostics, AI-powered personalization tools, and subscription-based replenishment models are creating new engagement pathways. Brands offering customized firming solutions based on skin type, age, and lifestyle factors are improving consumer loyalty and lifetime value. Advances in formulation technology also enable more targeted and efficient active delivery.

Product Type Insights

Cream-based body firming products dominate the market, accounting for approximately 42% of global revenue in 2024, due to superior texture, hydration benefits, and consumer familiarity. Lotion-based formulations appeal to daily-use consumers seeking lighter textures, while gels are gaining traction in warmer climates for their fast-absorbing properties. Oil and balm-based firming products remain niche but are growing steadily within the premium and spa-grade segments, particularly in wellness-focused markets.

Ingredient Type Insights

Hybrid formulations combining synthetic actives with natural ingredients lead the market with nearly 38% share, reflecting consumer demand for both safety and efficacy. Fully natural formulations are the fastest-growing sub-segment, driven by clean beauty trends, while synthetic-only formulations maintain relevance due to proven performance and cost efficiency in mass-market products.

Distribution Channel Insights

Offline retail channels, including pharmacies, supermarkets, and specialty beauty stores, account for approximately 55% of total sales, benefiting from consumer trust and in-store product trials. However, online channels are growing at over 11% CAGR, driven by direct-to-consumer platforms, influencer marketing, and subscription models. Professional channels such as spas and dermatology clinics support premium positioning and higher-margin sales.

End-Use Insights

Home-based personal skincare remains the dominant end-use segment, driven by convenience and affordability. Professional spa and dermatology usage is growing steadily, particularly in urban centers, where body firming creams are used as complementary treatments to aesthetic procedures. Export-driven demand from Asia-Pacific and the Middle East is further supporting manufacturing growth.

| By Product Formulation | By Ingredient Type | By Application Area | By Consumer Demographics | By Price Category |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global body firming creams market, led by the United States. High consumer spending on personal care, strong preference for premium products, and widespread awareness of body aesthetics drive demand. Clean-label and dermatologist-recommended products perform particularly well in this region.

Europe

Europe represents around 28% of the global market, with strong demand in Germany, France, the U.K., and Italy. The region is highly receptive to natural, organic, and sustainably packaged body firming products, supported by stringent regulatory standards and eco-conscious consumers.

Asia-Pacific

Asia-Pacific holds approximately 25% market share and is the fastest-growing region. China and India are key contributors, supported by rising disposable income, expanding e-commerce penetration, and growing beauty awareness. South Korea and Japan continue to influence formulation innovation and premium product trends.

Latin America

Latin America is witnessing steady growth, led by Brazil and Mexico. Increasing beauty consciousness and expanding middle-class populations are driving demand for mid-premium and mass-market firming creams.

Middle East & Africa

The Middle East & Africa region is growing gradually, supported by premium demand in the UAE and Saudi Arabia, along with rising urbanization and beauty adoption across African economies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Body Firming Creams Market

- L’Oréal Group

- Unilever

- Beiersdorf AG

- Estée Lauder Companies

- Procter & Gamble

- Shiseido Company

- Kao Corporation

- Amorepacific Corporation

- Clarins Group

- Johnson & Johnson

- Coty Inc.

- Henkel AG

- Natura & Co

- Pierre Fabre Group

- Avon Products