Bluetooth Speaker Market Size

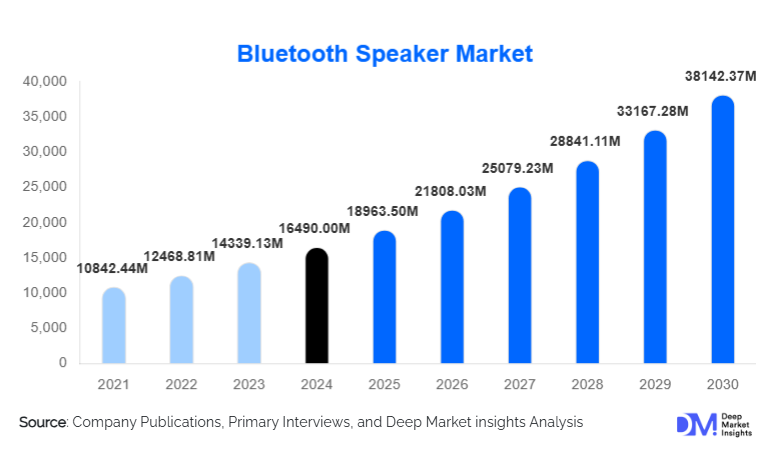

According to Deep Market Insights, the global Bluetooth speaker market size was valued at USD 16,490.00 million in 2024 and is projected to grow from USD 18,963.50 million in 2025 to reach USD 38,142.37 million by 2030, expanding at a CAGR of 15.00% during the forecast period (2025–2030). The Bluetooth speaker market growth is primarily driven by rising consumer demand for wireless audio solutions, expanding smart-home ecosystems, increasing smartphone and streaming usage, and rapid adoption of portable lifestyle electronics across both developed and emerging regions.

Key Market Insights

- Portable Bluetooth speakers dominate global demand, supported by lifestyle shifts toward mobility, outdoor recreation, and convenience-first audio consumption.

- Conventional Bluetooth speakers remain the largest product category, fueled by affordability and widespread adoption in emerging markets.

- Smart Bluetooth speakers are the fastest-growing segment, driven by IoT integration, voice assistants, and home-automation compatibility.

- Asia-Pacific leads the global market, accounting for the highest volume share due to strong manufacturing bases and rapidly expanding consumer electronics adoption.

- North America is the highest-value market, with strong uptake of premium and smart Bluetooth speakers.

- Technological advancements, including Bluetooth 5.x, extended battery life, waterproofing, and high-fidelity audio, are redefining product differentiation and pricing.

What are the latest trends in the Bluetooth speaker market?

Smart-Home & IoT Integration Accelerating

Bluetooth speakers are rapidly evolving from standalone audio devices into multifunctional smart-home accessories. Integration with voice assistants, home-automation systems, and IoT networks is enabling users to control lighting, appliances, and smart devices through a single speaker interface. Manufacturers are embedding AI-driven features, multi-room audio capabilities, and enhanced connectivity options to meet rising consumer expectations for seamless smart living. This shift is especially pronounced in North America and Europe, where smart-home penetration is highest. The rise of hybrid Bluetooth-Wi-Fi speakers further enhances product utility, enabling cloud-connected audio, voice commands, and synchronized home entertainment systems.

Outdoor & Rugged Speaker Demand Surging

As social, travel, and recreational activities expand globally, demand for rugged, waterproof, and long-battery-life Bluetooth speakers is increasing sharply. IP67/IP68-certified speakers, designed for beach trips, hiking, camping, and outdoor events, are becoming mainstream. Brands are launching compact yet high-output models tailored for portability without sacrificing sound quality. This trend aligns with the growing popularity of outdoor lifestyles among millennials and Gen Z consumers, particularly in APAC and LATAM.

What are the key drivers in the Bluetooth speaker market?

Explosion in Smartphone & Streaming Media Consumption

With billions of smartphone users worldwide and the rise of music, podcast, and video-streaming platforms, Bluetooth speakers have become essential accessories. Consumers increasingly prefer wireless audio solutions that offer effortless connectivity, portability, and superior sound versus built-in device speakers. This ecosystem-driven demand remains a primary market accelerator.

Demand for Portability, Convenience & Wireless Living

Consumers are shifting decisively toward wireless, cable-free devices for home entertainment, travel, fitness, and outdoor recreation. Portable Bluetooth speakers fulfill this need by offering mobility, ease of use, and compatibility with a wide range of devices. Their lightweight, battery-powered design and falling price points make them attractive to mass-market consumers, particularly in emerging economies.

Technological Advancements in Audio & Battery Systems

Continuous innovation, including longer battery life, faster charging, superior sound engineering, enhanced Bluetooth standards, and durable waterproof designs, is significantly improving product performance. These advancements help manufacturers differentiate their offerings and stimulate replacement purchases from existing users seeking upgrades.

What are the restraints for the global market?

Competition from Substitute Audio Devices

Despite strong demand, Bluetooth speakers face competition from soundbars, smart speakers, wired systems, and high-quality headphones/earbuds. Audiophiles often prefer alternatives that deliver superior bass performance or immersive surround sound. This limits the adoption of high-end Bluetooth speakers in certain market segments.

Price Sensitivity & Margin Pressure in Emerging Markets

Intense competition among branded and unbranded manufacturers in markets such as India, Southeast Asia, and Africa compresses margins. Budget-friendly alternatives often undercut established brands, making it difficult to maintain price premiums. Raw material fluctuations, particularly in lithium batteries and electronic components, also impact profitability.

What are the key opportunities in the Bluetooth speaker industry?

Smart-Home Ecosystem Expansion

The rise of smart homes creates significant potential for Bluetooth speakers integrated with voice assistants, home hubs, and IoT systems. As consumers seek multi-room control, smart entertainment systems, and hands-free digital assistance, manufacturers can expand offerings through hybrid Bluetooth-Wi-Fi designs, AI-enhanced sound processing, and seamless cross-device connectivity.

Emerging Market Penetration

Rising disposable incomes in India, China, Southeast Asia, Brazil, and Africa are fueling demand for affordable wireless audio devices. Brands that localize features, such as extended battery life, rugged builds, or region-specific content integration, will capture high-volume growth. E-commerce expansion further accelerates adoption by enabling easy access to mid-range and budget speakers.

Outdoor Lifestyle & Recreational Use Expansion

The global shift toward outdoor leisure, fitness, camping, beach travel, and social gatherings drives demand for rugged, waterproof, and high-performance portable speakers. Manufacturers can capitalize on lightweight designs, shockproof materials, and high-capacity battery systems tailored for long outdoor sessions.

Product Type Insights

Conventional Bluetooth speakers dominate the global market, accounting for nearly 60% of total value, supported by affordability, simple functionality, and widespread accessibility across retail and online channels. Smart Bluetooth speakers are the fastest-growing category, driven by voice assistant adoption and smart-home connectivity. Waterproof and outdoor-grade speakers continue to gain traction among youth and lifestyle consumers, while mini and compact speakers appeal to travelers seeking ultra-portable audio solutions.

Application Insights

Personal and residential use remains the largest application, representing over 60% of market demand. Consumers use Bluetooth speakers for indoor entertainment, remote work, social gatherings, and everyday audio needs. Outdoor and recreational applications are expanding rapidly as rugged speakers become mainstream. The hospitality and tourism sectors, including hotels, cafes, and resorts, are increasingly adopting Bluetooth speakers for ambiance and guest entertainment. Smart-home integration represents an emerging high-value application, driven by rising IoT adoption.

Distribution Channel Insights

Offline retail dominates global sales, accounting for nearly 55–60% of all transactions. Electronics outlets, hypermarkets, and brand-exclusive stores allow customers to test sound quality, influencing purchase behavior. Online sales are growing rapidly, with e-commerce channels offering broader product variety, competitive pricing, and direct-to-consumer (D2C) access. Flash sales, influencer marketing, and brand-owned online stores are boosting adoption among younger consumers.

End-Use Insights

The residential consumer segment represents the core of global demand, driven by growing usage in home entertainment, mobile streaming, and personal audio environments. Commercial applications, including retail stores, gyms, restaurants, and hospitality venues, are expanding due to the increasing need for portable audio solutions. Export-led demand is strong in APAC, particularly China and Southeast Asia, where manufacturers supply North American and European markets. Smart-home users are emerging as a high-value end-use group as integrated audio ecosystems gain traction.

| By Product Type | By Portability / Form Factor | By Price Range | By Distribution Channel | By Application / End-Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 20–25% of global revenue, driven by high adoption of premium audio devices and smart-home technologies. The U.S. leads regional demand, supported by strong consumer spending power, streaming media usage, and replacement purchase cycles. Multi-room and smart Bluetooth speakers are particularly popular among tech-savvy households.

Europe

Europe represents 15–20% of global market share, with strong demand from the U.K., Germany, France, and the Nordics. European consumers prioritize sustainability, durability, and premium sound quality. Growing smart-home installations and rising outdoor leisure culture contribute significantly to regional demand.

Asia-Pacific

APAC is the largest and fastest-growing region, holding 35–40% of global market share. China and India dominate consumption due to large populations, rapid digitization, and expanding middle-class purchasing power. Southeast Asian markets such as Indonesia, Thailand, and Vietnam exhibit rising traction in the mid-range and budget speaker categories.

Latin America

LATAM holds approximately 5–8% of the market. Brazil and Mexico lead regional demand, driven by youth-oriented consumption, music culture, and expanding online retail. Price-sensitive consumers primarily prefer budget and mid-tier Bluetooth speakers.

Middle East & Africa

MEA contributes around 5–7% of the global market value. Urban centers in the UAE, Saudi Arabia, and South Africa exhibit robust demand for premium and rugged outdoor speakers. Tourism and hospitality sectors also drive the adoption of portable audio solutions in resorts and event venues.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bluetooth Speaker Market

- Apple Inc.

- Bose Corporation

- Sony Corporation

- Samsung Electronics

- LG Electronics

- Logitech International

- JBL / Harman International

- Marshall Group

- Sennheiser

- Sonos

- Panasonic Corporation

- Philips

- Edifier

- Creative Technology

- Altec Lansing

Recent Developments

- In March 2025, Sony introduced a new series of waterproof outdoor Bluetooth speakers with extended 30-hour battery life and enhanced bass architecture.

- In January 2025, JBL expanded its smart speaker lineup featuring hybrid Bluetooth-Wi-Fi connectivity and improved integration with AI assistants.

- In April 2025, Bose announced upgrades to its premium portable speaker category, incorporating spatial audio technology and sustainable materials.